Cfp Tax Tables

CFP Tax Tables: Unlocking Financial Strategies for Effective Tax Planning

In the world of financial planning, understanding the intricacies of the tax system is crucial. Certified Financial Planners (CFPs) are well-equipped to guide individuals and businesses through the complex landscape of taxation, ensuring optimal strategies for wealth management and long-term financial goals. This article delves into the significance of CFP tax tables, exploring how they serve as powerful tools for tax optimization and financial planning.

The CFP designation is a prestigious certification that represents a high level of competence and ethical standards in financial planning. CFPs are trained to offer comprehensive financial advice, taking into account various aspects such as investment management, retirement planning, estate planning, and, of course, tax strategies. By leveraging the knowledge of tax laws and regulations, CFPs can help clients navigate the complex tax landscape and make informed decisions to minimize their tax liabilities.

The Role of CFP Tax Tables

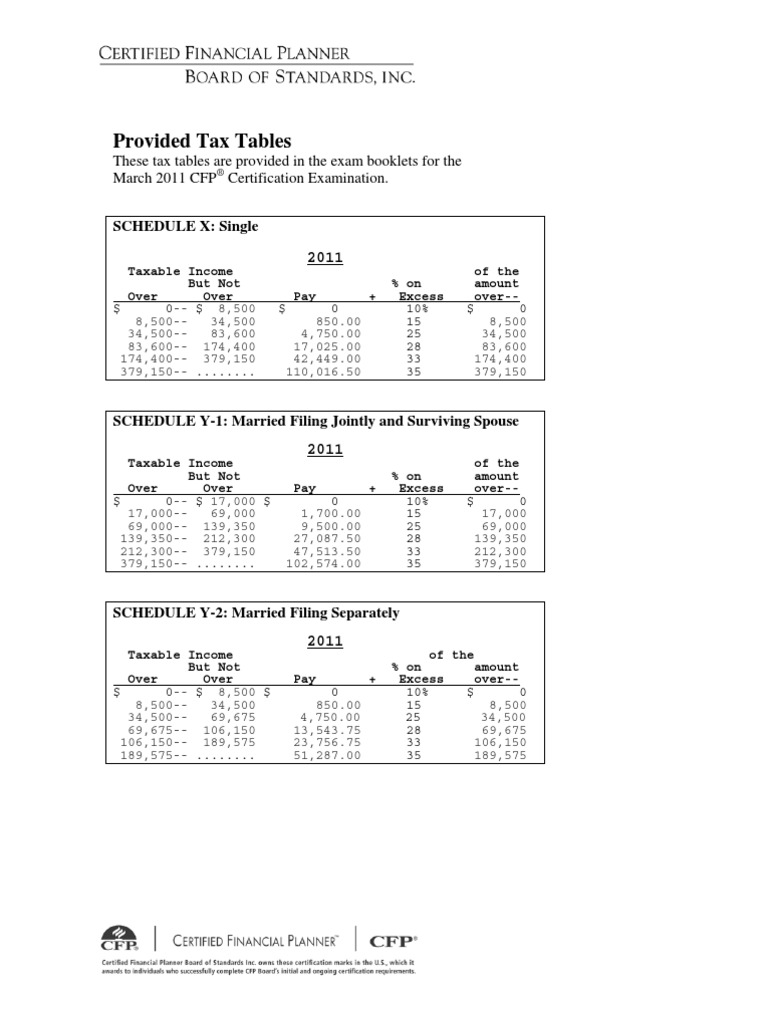

CFP tax tables are a fundamental resource for financial planners and their clients. These tables provide a detailed breakdown of tax rates, brackets, and thresholds, offering a comprehensive view of the current tax landscape. By analyzing these tables, CFPs can assess the tax implications of different financial scenarios and develop tailored strategies to optimize their clients' tax positions.

One of the key advantages of CFP tax tables is their dynamic nature. As tax laws evolve and new regulations come into effect, these tables are updated to reflect the most current information. This ensures that financial planners have access to accurate and up-to-date data when crafting tax-efficient plans. By staying abreast of the latest tax changes, CFPs can provide their clients with timely advice, helping them make informed decisions that align with the evolving tax environment.

Key Features of CFP Tax Tables

CFP tax tables offer a wealth of information, including:

- Marginal Tax Rates: These tables provide a clear overview of the tax rates applicable to different income levels. Understanding marginal tax rates is crucial for financial planners as it allows them to assess the impact of income changes on tax liabilities.

- Tax Brackets: Tax brackets indicate the income ranges associated with specific tax rates. CFP tax tables display these brackets, enabling planners to determine the appropriate tax rate for different income levels.

- Phaseout Ranges: Certain tax benefits, such as deductions or credits, may have phaseout ranges. CFP tax tables highlight these ranges, helping planners identify potential limitations on tax benefits for high-income earners.

- Alternative Minimum Tax (AMT) Information: CFP tax tables often include details on the AMT, a parallel tax system that can impact individuals with certain types of income or tax preferences. Understanding the AMT is essential for accurate tax planning.

By referencing these tables, CFPs can make informed recommendations regarding income tax planning, tax-efficient investment strategies, and retirement planning. For instance, they can advise clients on when to realize capital gains, maximize deductions, or utilize tax-advantaged retirement accounts to minimize their overall tax burden.

Maximizing Tax Efficiency with CFP Strategies

CFP tax tables serve as a foundation for developing comprehensive tax strategies. Here are some key strategies that CFPs employ to optimize their clients' tax positions:

Income Tax Planning

CFPs work with clients to develop strategies that minimize their income tax liabilities. This may involve timing the realization of income or capital gains, optimizing retirement account contributions, or utilizing tax-efficient investment vehicles. By understanding the tax implications of different income sources and investment options, CFPs can guide clients toward tax-efficient choices.

Tax-Efficient Investing

CFPs are well-versed in the tax implications of various investment vehicles. They can advise clients on the most tax-efficient ways to invest, taking into account factors such as capital gains taxes, dividend taxes, and tax-deferred investment options. By selecting the right investment strategies, CFPs can help clients grow their wealth while minimizing the tax impact.

Retirement Planning

Retirement planning is a critical aspect of financial planning, and CFPs use tax tables to develop tax-efficient retirement strategies. This includes recommending the most suitable retirement accounts, such as Traditional IRAs, Roth IRAs, or 401(k) plans, based on the client's financial goals and tax situation. By maximizing tax-advantaged retirement savings, CFPs can help clients achieve their retirement objectives while minimizing tax liabilities.

Tax-Efficient Estate Planning

CFPs also play a role in estate planning, ensuring that clients' assets are transferred efficiently to their heirs. By utilizing tax tables, CFPs can advise on strategies to minimize estate taxes and gift taxes, helping clients preserve their wealth for future generations.

Real-World Examples of CFP Tax Table Applications

To illustrate the practical application of CFP tax tables, let's consider a few scenarios:

Scenario 1: Income Tax Planning for High-Earning Professionals

Imagine a successful entrepreneur with a high income. By analyzing the CFP tax tables, their financial planner can identify the marginal tax rate applicable to their income level. The planner then recommends strategies such as maximizing tax-deductible expenses, deferring income through retirement account contributions, or utilizing tax-loss harvesting to offset capital gains. These strategies can significantly reduce the entrepreneur's tax liability, allowing them to retain more of their hard-earned wealth.

Scenario 2: Tax-Efficient Investing for Retirement

Consider a young professional planning for their retirement. Their CFP can use tax tables to assess the tax implications of different investment options. For instance, the planner might recommend a mix of tax-efficient mutual funds and ETFs that offer capital appreciation potential while minimizing dividend and capital gains taxes. By focusing on tax-efficient investments, the professional can maximize the growth of their retirement savings over time.

Scenario 3: Estate Planning for Wealth Preservation

A wealthy individual with a substantial estate may engage a CFP to ensure their assets are transferred efficiently to their heirs. The CFP utilizes tax tables to understand the potential estate tax implications. By implementing strategies such as gifting, establishing trusts, or utilizing life insurance policies, the CFP can help the individual minimize estate taxes, ensuring that more of their wealth is passed on to their beneficiaries.

The Future of CFP Tax Tables and Financial Planning

As the tax landscape continues to evolve, the role of CFP tax tables in financial planning remains indispensable. The dynamic nature of these tables ensures that financial planners have the most up-to-date information to guide their clients effectively. With ongoing changes in tax laws, CFPs must stay abreast of these developments to provide accurate and timely advice.

In the future, we can expect to see continued innovation in tax planning strategies. CFPs will leverage technology and data analytics to develop even more sophisticated tax optimization models. Additionally, the integration of tax planning with other financial planning aspects, such as risk management and investment strategies, will become increasingly seamless. This holistic approach will allow CFPs to provide comprehensive financial guidance that considers all facets of a client's financial life.

| Tax Year | Tax Rate | Income Range |

|---|---|---|

| 2023 | 10% | $0 - $10,275 |

| 2023 | 12% | $10,276 - $41,775 |

| 2023 | 22% | $41,776 - $89,075 |

| 2023 | 24% | $89,076 - $170,050 |

| 2023 | 32% | $170,051 - $215,950 |

| 2023 | 35% | $215,951 - $539,900 |

| 2023 | 37% | $539,901 and above |

Frequently Asked Questions

How often are CFP tax tables updated, and where can I find the latest versions?

+

CFP tax tables are typically updated annually to reflect the latest tax laws and regulations. You can find the most recent versions on the official websites of CFP certification boards or financial planning associations. Additionally, reputable financial planning resources and software providers often offer up-to-date tax tables as part of their services.

Are CFP tax tables applicable to all income levels and tax situations?

+

Yes, CFP tax tables are designed to be comprehensive and cover a wide range of income levels and tax scenarios. They provide a detailed breakdown of tax rates, brackets, and thresholds, making them applicable to individuals and businesses across various financial situations.

How can I use CFP tax tables to estimate my tax liability for the current year?

+

To estimate your tax liability, locate your taxable income within the appropriate tax bracket on the CFP tax table. The corresponding tax rate will give you an idea of your potential tax liability. However, it’s important to note that this is a simplified estimate, and actual tax calculations may involve additional factors and deductions. Consulting with a CFP or tax professional is recommended for a more accurate assessment.

Can CFP tax tables help with retirement planning strategies?

+

Absolutely! CFP tax tables are a valuable tool for retirement planning. They help financial planners and individuals understand the tax implications of different retirement accounts, such as Traditional IRAs, Roth IRAs, and 401(k) plans. By considering tax rates and potential tax benefits, CFPs can guide clients toward tax-efficient retirement strategies that maximize their savings and minimize tax liabilities.

Are there any limitations to using CFP tax tables for tax planning?

+

While CFP tax tables provide a comprehensive overview of tax rates and brackets, they should be used as a starting point for tax planning. Tax laws can be complex, and individual circumstances may vary. It’s essential to consult with a CFP or tax professional who can provide personalized advice based on your specific financial situation and tax goals. They can help navigate any unique considerations or potential tax advantages that may apply to your circumstances.