Raleigh Nc Sales Tax

When discussing the topic of sales tax, it's important to understand the specific regulations and rates that apply to different regions. Raleigh, North Carolina, is a vibrant city known for its thriving businesses and dynamic economic landscape. The sales tax structure in Raleigh plays a crucial role in the city's economic growth and has a significant impact on both businesses and consumers.

Understanding Raleigh’s Sales Tax Structure

Raleigh, like many other cities in North Carolina, operates under a combined sales tax system, which includes both state and local sales taxes. This means that when you make a purchase in Raleigh, you’re paying a combined rate that consists of the state sales tax and any additional local taxes.

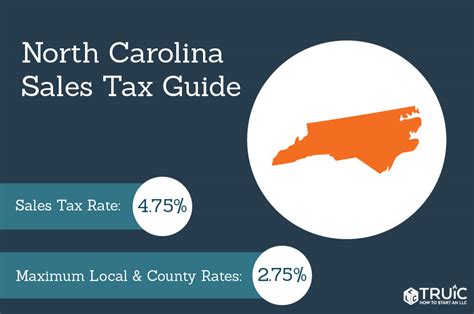

As of [current year], the state sales tax rate in North Carolina is 4.75%. This rate is applicable across the state and is a significant source of revenue for the state government. However, the sales tax doesn't stop there. Raleigh, being a thriving city, also imposes its own local sales tax, which is added to the state rate to create the total sales tax burden for consumers.

The Local Sales Tax in Raleigh

The local sales tax rate in Raleigh is 2.00%, which brings the combined sales tax rate in Raleigh to 6.75%. This local tax is used to fund various city initiatives, infrastructure development, and essential services. It’s an important revenue stream for the city, allowing it to maintain and improve the quality of life for its residents and businesses.

| Sales Tax Component | Rate |

|---|---|

| State Sales Tax | 4.75% |

| Raleigh Local Sales Tax | 2.00% |

| Total Sales Tax in Raleigh | 6.75% |

It's worth noting that the local sales tax rate in Raleigh is consistent across the city, regardless of the specific neighborhood or business district. This uniformity ensures fairness and simplicity for both businesses and consumers, as the tax rate remains the same no matter where you make your purchases within Raleigh's city limits.

Impact of Sales Tax on Businesses and Consumers

The sales tax structure in Raleigh has a direct impact on both businesses and consumers. For businesses, it can influence pricing strategies, profitability, and competitive positioning. On the consumer side, it affects purchasing power and overall spending habits.

Businesses: Navigating the Sales Tax Landscape

Businesses operating in Raleigh must carefully consider the sales tax rate when setting their prices. They need to ensure that their pricing strategies remain competitive while also covering the cost of the sales tax. This can be particularly challenging for small businesses, as they often have thinner profit margins compared to larger corporations.

To mitigate the impact of sales tax, businesses may employ various strategies. Some businesses choose to absorb the sales tax into their pricing, ensuring that the customer pays the same amount regardless of the tax. Others may pass the tax directly to the consumer, listing the tax separately on the invoice or receipt. This approach can be more transparent but may also affect customer perception and loyalty.

Consumers: Understanding the Impact

For consumers, the sales tax in Raleigh can influence their purchasing decisions and overall spending behavior. A higher sales tax rate can make certain purchases more expensive, potentially discouraging some consumers from making non-essential purchases. On the other hand, it can also encourage consumers to seek out tax-free alternatives or shop online, where sales tax may not be applicable.

However, it's important to note that the sales tax is just one factor among many that influence consumer behavior. Other factors, such as product quality, pricing, and convenience, also play significant roles. Additionally, some consumers may view the sales tax as a necessary contribution to the city's development and services, fostering a sense of civic responsibility.

Sales Tax Exemptions and Special Considerations

While the general sales tax rate applies to most goods and services, there are certain exemptions and special considerations in Raleigh’s sales tax structure.

Exemptions and Special Cases

Certain items are exempt from sales tax in North Carolina, including most unprepared food items, prescription drugs, and select non-prescription medicines. Additionally, certain services, such as legal and medical services, are also exempt from sales tax. These exemptions aim to reduce the tax burden on essential goods and services, making them more accessible to consumers.

Moreover, there are specific sales tax holidays in North Carolina, during which certain items are exempt from sales tax for a limited time. These holidays often coincide with back-to-school shopping periods or other significant events, providing consumers with an opportunity to save on essential purchases.

Remote Sellers and Online Sales

With the rise of e-commerce, the sales tax landscape has become more complex. In Raleigh, as in many other cities, remote sellers (businesses selling goods online or through catalogs) are required to collect and remit sales tax if they have a certain level of economic presence in the state. This ensures that online sales contribute to the city’s revenue stream, just like traditional brick-and-mortar stores.

Future Implications and Potential Changes

The sales tax structure in Raleigh, like any tax system, is subject to potential changes and reforms. As the city’s economic landscape evolves, so too may the sales tax rates and regulations.

Potential Sales Tax Reform

Discussions surrounding sales tax reform are ongoing, with some advocating for a simplification of the tax structure. One proposed idea is to eliminate the local sales tax and instead increase the state sales tax rate, providing a more uniform tax system across the state. Such a reform could have significant implications for both businesses and consumers in Raleigh, impacting pricing strategies and purchasing behavior.

Economic Impact and Growth

The sales tax revenue collected in Raleigh contributes to the city’s economic growth and development. It funds essential services, infrastructure projects, and initiatives that enhance the city’s competitiveness and quality of life. As such, any changes to the sales tax structure could have far-reaching effects on the city’s economic trajectory.

In conclusion, the sales tax structure in Raleigh, North Carolina, is a crucial component of the city's economic framework. It influences business strategies, consumer behavior, and the overall economic landscape. As we navigate the evolving tax landscape, staying informed about these regulations is essential for both businesses and consumers alike.

How often are sales tax rates updated in Raleigh, NC?

+Sales tax rates in Raleigh, NC, can be subject to periodic updates and changes. While the state sales tax rate is typically adjusted less frequently, local sales tax rates may undergo modifications more regularly. It’s advisable to check with the North Carolina Department of Revenue for the most current rates and any recent updates.

Are there any online resources to help calculate sales tax in Raleigh?

+Yes, there are various online tools and calculators available to assist with sales tax calculations in Raleigh. Websites like Sales Tax Calculator and AvaTax provide convenient options for estimating sales tax based on the specific location and item details.

How does Raleigh’s sales tax compare to other major cities in North Carolina?

+Raleigh’s combined sales tax rate of 6.75% is higher than the rates in some other major cities in North Carolina. For instance, Charlotte has a combined sales tax rate of 6.50%, while Greensboro and Winston-Salem have rates of 6.55%. These variations in sales tax rates can impact consumers’ purchasing decisions when comparing different cities.