Sales Tax Vancouver Washington

Sales tax is an essential aspect of consumer transactions, and it varies greatly depending on the jurisdiction. In Vancouver, Washington, the sales tax system is a crucial component of the city's revenue stream and affects businesses and residents alike. This article delves into the intricacies of sales tax in Vancouver, exploring its rates, applicable goods and services, exemptions, and the implications it holds for the local economy.

Understanding Sales Tax in Vancouver, Washington

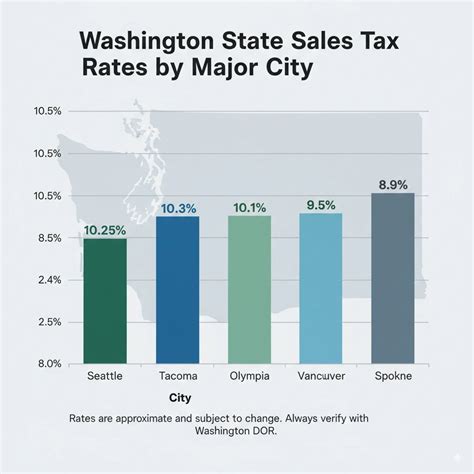

Vancouver, located in the picturesque Pacific Northwest, operates under a unique sales tax structure that combines state, county, and city tax rates. As of [most recent data available], the total sales tax rate in Vancouver stands at 9.5%, one of the highest in the state. This rate is composed of several layers, each serving a specific purpose.

The State Sales Tax

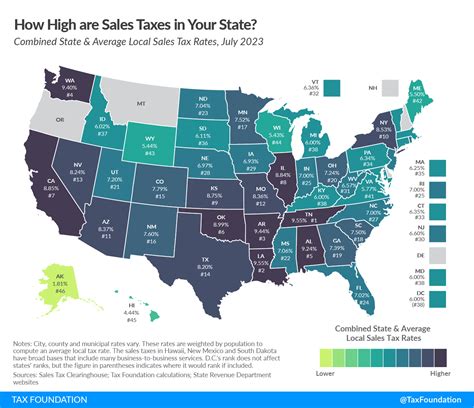

Washington State imposes a 6.5% sales tax rate on most goods and services. This base rate is a significant contributor to the state’s revenue, funding essential services and infrastructure projects. However, certain categories like groceries, prescription drugs, and manufacturing inputs are exempt from this tax.

| State Sales Tax | Rate |

|---|---|

| Standard Rate | 6.5% |

The state tax is a critical component of Washington's fiscal policy, ensuring a steady stream of revenue to support various public initiatives. It also plays a role in shaping the state's economic landscape, influencing business decisions and consumer behavior.

The County Sales Tax

Clark County, in which Vancouver is situated, adds an additional 0.5% to the state sales tax rate. This county-wide tax is specifically allocated for public safety and infrastructure improvements. It ensures that local projects and emergency services receive adequate funding, thus enhancing the quality of life for residents.

| County Sales Tax | Rate |

|---|---|

| Clark County | 0.5% |

The City Sales Tax

Vancouver, as a bustling urban center, imposes its own sales tax of 2.5%, bringing the total tax rate to 9.5%. This city-specific tax is crucial for funding local initiatives, community development projects, and maintaining essential city services. It directly impacts the daily lives of Vancouver residents and shapes the city’s future.

| City Sales Tax | Rate |

|---|---|

| Vancouver City | 2.5% |

Applicable Goods and Services

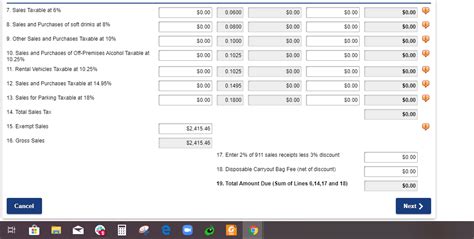

The sales tax in Vancouver applies to a broad range of goods and services, including but not limited to:

- Retail purchases of clothing, electronics, furniture, and other tangible items.

- Services such as restaurant meals, haircuts, and entertainment events.

- Vehicle purchases and rentals.

- Lodging and hotel stays.

- Admission fees for attractions and recreational activities.

However, there are notable exceptions and exemptions, which vary based on the nature of the item or service.

Exemptions and Special Considerations

While the sales tax in Vancouver covers a wide array of transactions, certain goods and services are exempt. These exemptions are designed to alleviate financial burdens on specific sectors and promote economic stability.

- Grocery Items: Food products purchased for consumption, including staple groceries and produce, are exempt from sales tax. This exemption aims to reduce the cost of living for residents.

- Prescription Drugs: Sales tax does not apply to medications prescribed by a licensed practitioner. This exemption is in place to ensure that healthcare remains accessible and affordable.

- Manufacturing Inputs: Raw materials and equipment used in manufacturing processes are exempt, encouraging industrial growth and development.

- Certain Professional Services: Legal, medical, and educational services often fall outside the scope of sales tax, depending on the specific nature of the transaction.

These exemptions are carefully crafted to balance the need for revenue generation with the desire to support specific industries and consumer needs.

Impact on the Local Economy

The sales tax in Vancouver plays a pivotal role in shaping the local economy. It serves as a significant source of revenue for the city, county, and state, funding essential services and driving economic development.

Revenue Generation and Allocation

The 9.5% sales tax rate in Vancouver generates substantial revenue, contributing to the city’s budget. This revenue is allocated to various sectors, including public safety, education, infrastructure, and community development projects. It ensures that Vancouver remains a thriving, well-maintained city with a high quality of life.

The breakdown of revenue allocation is as follows:

- City of Vancouver: 2.5% of the sales tax revenue is allocated to the city, supporting local initiatives and services.

- Clark County: 0.5% goes towards county-wide projects and public safety enhancements.

- Washington State: The remaining 6.5% funds state-wide services and infrastructure, contributing to the overall economic health of the region.

Attracting Businesses and Consumers

The sales tax structure in Vancouver is a factor that influences business decisions and consumer behavior. While a higher tax rate might deter some businesses, Vancouver’s vibrant economy, strong infrastructure, and attractive lifestyle often outweigh the tax considerations.

For consumers, the sales tax is a visible reminder of the city's commitment to providing quality services and maintaining a thriving community. It encourages responsible spending and supports the local economy through every transaction.

Economic Growth and Development

The revenue generated from sales tax plays a crucial role in driving economic growth and development in Vancouver. It funds infrastructure projects, such as road improvements, public transportation enhancements, and the development of recreational spaces. These initiatives attract businesses and residents, fostering a dynamic and prosperous community.

Additionally, the sales tax revenue supports local businesses through various programs and incentives, helping them thrive and contribute to the city's economic vitality.

Compliance and Enforcement

Ensuring compliance with sales tax regulations is essential for the integrity of Vancouver’s tax system. The city, county, and state have implemented measures to enforce tax laws and ensure fair and accurate tax collection.

Tax Registration and Reporting

Businesses operating in Vancouver are required to register for a sales tax permit and collect the appropriate tax rate from customers. They must then remit the collected tax to the respective tax authorities on a regular basis. This process ensures that businesses contribute their fair share to the local economy.

Audit and Enforcement Procedures

The tax authorities in Vancouver have the authority to conduct audits and investigations to ensure compliance. These procedures involve examining business records, reviewing sales transactions, and verifying tax payments. Non-compliance can result in penalties, fines, and legal consequences.

By enforcing tax regulations, the city, county, and state aim to create a level playing field for businesses and ensure that tax revenue is utilized effectively for the benefit of the community.

Future Implications and Considerations

As Vancouver continues to grow and evolve, the sales tax system will play a pivotal role in shaping its future. Here are some key considerations and potential implications:

Economic Development Initiatives

The revenue generated from sales tax can be leveraged to support innovative economic development initiatives. This could include attracting high-tech industries, fostering entrepreneurship, and investing in sustainable practices. By strategically utilizing tax revenue, Vancouver can position itself as a leader in economic growth and environmental stewardship.

Community Engagement and Transparency

Ensuring that the community understands the purpose and impact of sales tax is essential for building trust and support. The city can enhance transparency by regularly communicating how tax revenue is allocated and the positive outcomes it achieves. This engagement fosters a sense of ownership and involvement in the community’s development.

Tax Reform and Equity

As Vancouver’s economy evolves, there may be opportunities to review and reform the sales tax system to ensure fairness and efficiency. This could involve exploring alternatives, such as broadening the tax base or implementing progressive tax structures. By staying adaptable and responsive, Vancouver can maintain a competitive and equitable tax environment.

Regional Cooperation and Alignment

Sales tax rates and regulations can vary across neighboring jurisdictions. To avoid tax competition and promote regional cooperation, Vancouver could explore alignment with nearby cities and counties. This collaborative approach can lead to more efficient tax administration and a unified economic vision.

Conclusion

Sales tax in Vancouver, Washington, is a multifaceted system that shapes the city’s economic landscape. From funding essential services to driving development, it plays a vital role in the community’s prosperity. By understanding the rates, exemptions, and implications, businesses and residents can navigate the tax system effectively and contribute to Vancouver’s vibrant future.

How often are sales tax rates reviewed and adjusted in Vancouver, Washington?

+

Sales tax rates in Vancouver are subject to periodic reviews and adjustments by the city council. These reviews typically occur annually or biennially, allowing for adjustments based on economic conditions and the city’s budgetary needs.

Are there any ongoing initiatives to simplify the sales tax system in Vancouver?

+

Yes, there are ongoing efforts to streamline and simplify the sales tax system in Vancouver. This includes initiatives to enhance digital tax filing and payment processes, making it more convenient for businesses to comply with tax regulations.

How does Vancouver’s sales tax compare to other major cities in Washington state?

+

Vancouver’s sales tax rate of 9.5% is among the highest in Washington state. Other major cities like Seattle and Tacoma have lower rates, ranging from 8.8% to 9.3%. This variation is influenced by local tax policies and revenue needs.

Are there any plans to introduce new sales tax exemptions in Vancouver?

+

While there are no immediate plans for new sales tax exemptions, Vancouver’s city council regularly evaluates the tax system to ensure it aligns with the community’s needs. Any changes or additions to exemptions would be subject to public consultation and legislative approval.

How can businesses stay informed about sales tax regulations and updates in Vancouver?

+

Businesses can stay informed about sales tax regulations and updates in Vancouver by regularly checking the city’s official website, which provides detailed information on tax rates, exemptions, and compliance requirements. Additionally, businesses can subscribe to tax newsletters and alerts from the city’s tax department to receive timely updates.