Sales Tax Rate For Chicago Il

The sales tax rate in Chicago, Illinois, is an essential piece of information for businesses and consumers alike. Understanding the tax structure and its implications is crucial for accurate pricing, budgeting, and compliance with local regulations. This article delves into the specifics of Chicago's sales tax rate, its breakdown, and how it impacts various goods and services.

Understanding Chicago’s Sales Tax Structure

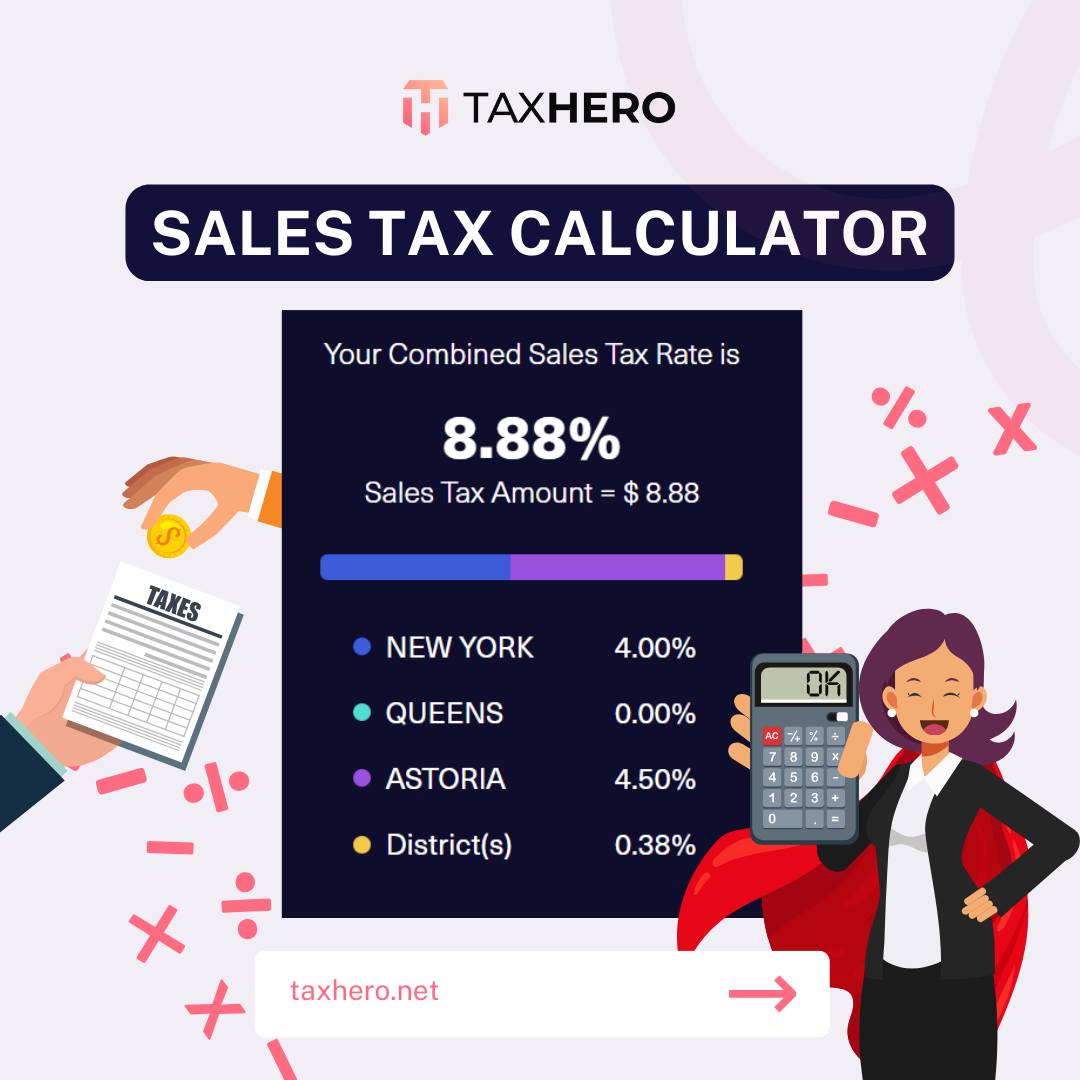

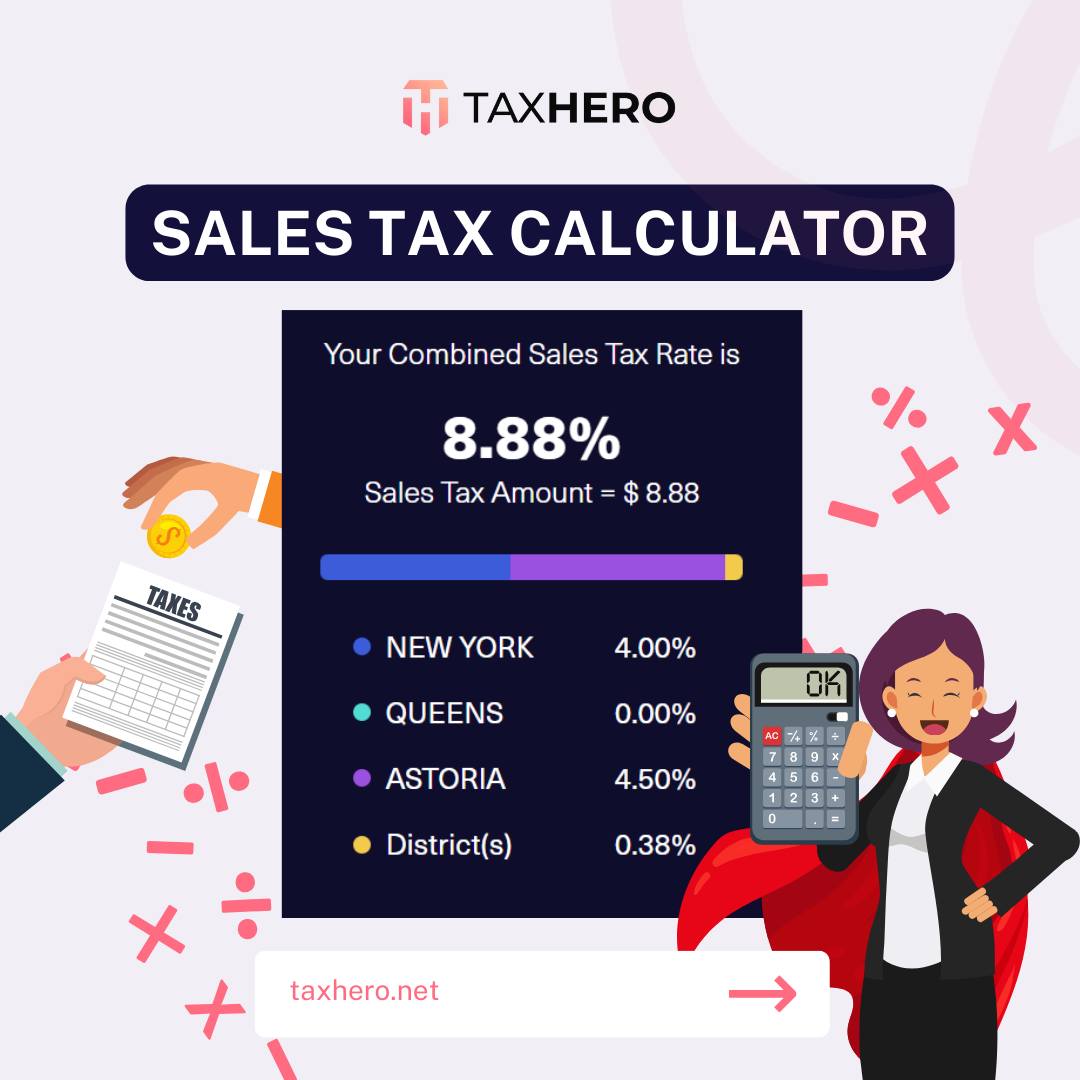

The sales tax rate in Chicago, IL, is a combination of various tax jurisdictions, each contributing a specific percentage to the total tax imposed on retail transactions. This includes the state sales tax, the municipal tax, and additional county and regional taxes. The rate can vary depending on the location of the purchase within the city, as different areas may have unique tax codes.

As of [insert up-to-date date], the total sales tax rate in Chicago is approximately 10.25%. This rate is subject to change, so it is advisable to check for the most current information before making significant purchases. The breakdown of this rate is as follows:

| Tax Jurisdiction | Tax Rate |

|---|---|

| State Sales Tax | 6.25% |

| Municipal Tax (Chicago) | 1.25% |

| Cook County Tax | 1.75% |

| Regional Transportation Authority (RTA) Tax | 1% |

It's important to note that the RTA tax is specifically allocated for transportation infrastructure and services within the Chicago region.

Applying Sales Tax to Different Goods and Services

The sales tax in Chicago is generally applicable to a wide range of retail transactions, including tangible personal property, certain services, and digital products. However, there are exceptions and exemptions that can make the tax landscape more complex. For instance, certain food items, prescription drugs, and select services may be exempt from sales tax, while others may be subject to a reduced rate.

Let's take a closer look at how sales tax is applied to different categories of goods and services in Chicago:

Tangible Personal Property

Tangible personal property refers to physical goods that are bought and sold. This includes items like clothing, electronics, furniture, and vehicles. The full sales tax rate of 10.25% typically applies to these purchases. For example, if you buy a laptop for 1000, the sales tax would amount to 102.50, making the total cost $1102.50.

Services

Certain services are also subject to sales tax in Chicago. This can include services like repairs, maintenance, installation, and professional services. However, the taxability of services can be complex, and it often depends on the specific nature of the service and the industry it falls under. For instance, some legal and accounting services may be exempt from sales tax, while others, like consulting services, may be taxable.

Digital Products and Services

With the rise of digital transactions, Chicago’s sales tax regulations have evolved to encompass digital products and services. This includes downloads of music, movies, and software, as well as streaming services and cloud storage. The tax rate applied to these transactions is generally the same as for tangible goods, which means a 10.25% tax is added to the purchase price.

Exemptions and Reduced Rates

As mentioned earlier, there are certain goods and services that are exempt from sales tax or have reduced rates. These exemptions can vary depending on the jurisdiction and the nature of the item or service. For instance, groceries, prescription medications, and some medical devices are often exempt from sales tax. Additionally, certain nonprofit organizations and government entities may be exempt from paying sales tax on their purchases.

Impact of Sales Tax on Consumers and Businesses

The sales tax rate in Chicago has significant implications for both consumers and businesses. For consumers, it directly affects their purchasing power and the overall cost of living. A higher sales tax rate can make everyday purchases more expensive, potentially impacting household budgets and spending habits. On the other hand, businesses must factor in the sales tax when pricing their goods and services to remain competitive while also ensuring they comply with tax regulations.

From a business perspective, understanding and managing sales tax is crucial for accurate financial planning and tax compliance. Businesses must ensure they collect the correct tax rate from customers and remit it to the appropriate tax authorities. This process can be complex, especially for businesses with multiple locations or those selling both taxable and exempt items. Mismanagement of sales tax can lead to significant financial penalties and legal repercussions.

To navigate the complexities of sales tax, many businesses in Chicago utilize specialized software and tax consultants. These tools and experts help ensure accurate tax calculations, proper tax remittance, and compliance with ever-changing tax regulations. By staying informed and utilizing these resources, businesses can mitigate the risks associated with sales tax and focus on their core operations.

Conclusion: Navigating Chicago’s Sales Tax Landscape

Chicago’s sales tax rate of 10.25% is a significant consideration for both consumers and businesses operating within the city. Understanding the breakdown of this rate and its applicability to various goods and services is essential for accurate pricing, budgeting, and tax compliance. As the tax landscape continues to evolve, staying informed and utilizing specialized resources can help individuals and businesses navigate the complexities of sales tax with confidence.

How often does Chicago’s sales tax rate change?

+

Sales tax rates can change periodically, often as a result of legislative actions or budgetary decisions. In Chicago, the sales tax rate has undergone changes in recent years, with adjustments made to various tax jurisdictions. It is important to stay informed and check for updates regularly to ensure accurate tax calculations.

Are there any online resources to check the current sales tax rate in Chicago?

+

Yes, several online resources provide up-to-date information on Chicago’s sales tax rate. The official website of the Illinois Department of Revenue is a reliable source for current tax rates and regulations. Additionally, various tax service providers and business associations offer tools and resources to help businesses stay informed about sales tax changes.

How do I calculate sales tax for my business in Chicago?

+

Calculating sales tax accurately is crucial for businesses. The process involves applying the appropriate tax rate to the total sale amount. You can use online calculators or tax software to simplify the calculation process. Ensure that you have the most current tax rates and understand the specific rules for your industry and location.