Travis County Tax Appraisal

The Travis County Tax Appraisal process is a crucial aspect of property ownership and management in the vibrant region of Central Texas. This process determines the value of properties, which in turn influences the amount of property taxes that homeowners and businesses must pay annually. Understanding this appraisal process is essential for both residents and commercial entities in Travis County, as it directly impacts their financial obligations and planning.

Understanding the Travis County Tax Appraisal Process

Travis County, located in the heart of Texas, employs a comprehensive and systematic approach to tax appraisal, ensuring fairness and accuracy in the valuation of properties. The process involves several key steps, each designed to provide an up-to-date and realistic assessment of a property’s worth.

Data Collection and Analysis

The journey towards a property’s appraisal begins with a thorough collection of data. Appraisers from the Travis County Appraisal District (TCAD) gather information about the property, including its physical characteristics, such as size, age, and condition. They also consider the property’s location, taking into account factors like proximity to schools, parks, and other amenities. This data is then analyzed to determine the property’s current market value.

| Property Feature | Data Collection |

|---|---|

| Land Size | Surveyed and Recorded |

| Building Square Footage | Measured and Verified |

| Year Built | Historical Records |

| Recent Renovations | Owner-Provided Information |

During the data collection phase, TCAD appraisers often visit properties to conduct thorough inspections, ensuring the accuracy of the information gathered. This step is crucial, as it provides a comprehensive understanding of the property's true value, taking into account both its physical attributes and its context within the local real estate market.

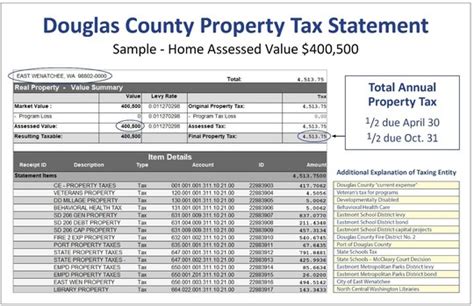

Market Value Determination

Once the data is collected and analyzed, the appraisers use various valuation methods to determine the property’s market value. The most common approach is the sales comparison method, which involves comparing the property with similar properties that have recently sold in the area. By adjusting for differences in size, location, and amenities, appraisers can estimate the fair market value of the subject property.

Another method used is the cost approach, which estimates the replacement cost of the property, minus depreciation. This approach is particularly useful for unique properties or those with specialized features. Additionally, the income approach is applicable for commercial properties, where the potential income generated by the property is a key factor in determining its value.

Appraisal Review and Appeal Process

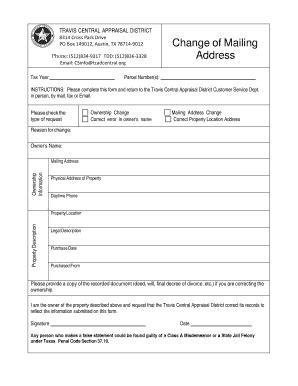

After the initial appraisal, property owners in Travis County have the right to review the appraised value of their property. TCAD provides an online platform where property owners can access their appraisal information, including detailed data and the methodology used in the valuation process. This transparency allows owners to understand how their property’s value was determined.

If a property owner disagrees with the appraised value, they have the option to file an appeal. The appeal process in Travis County is designed to be fair and accessible. Property owners can present their case to the Appraisal Review Board (ARB), an independent body that reviews and adjusts appraisals. The ARB considers new evidence, such as recent sales data or unique property features, to ensure an accurate and fair valuation.

Impact of Travis County Tax Appraisals

The Travis County Tax Appraisal process has significant implications for property owners and the local community. Accurate appraisals ensure that property taxes are fairly distributed, reflecting the true value of each property. This, in turn, supports essential public services, such as education, infrastructure development, and public safety, which are funded by property taxes.

Financial Planning and Budgeting

For individual homeowners, understanding the tax appraisal process is crucial for financial planning. The property tax bill, which is based on the appraised value, is a significant expense for many. By being aware of the appraisal process and staying informed about their property’s value, homeowners can budget effectively and plan for any potential increases in property taxes.

Business Operations and Investment Decisions

The tax appraisal process also affects businesses operating in Travis County. Commercial properties are appraised differently, considering factors like rental income and potential for development. Accurate appraisals provide businesses with valuable insights into the local real estate market, helping them make informed decisions about expansion, relocation, or investment strategies.

Community Development and Equity

Beyond individual financial considerations, the tax appraisal process plays a role in community development and equity. Accurate appraisals ensure that property taxes are distributed fairly across the county, supporting the development of schools, roads, and other public amenities. This, in turn, contributes to the overall well-being and prosperity of the community.

Travis County’s Commitment to Transparency

Travis County is dedicated to maintaining a transparent and accessible tax appraisal process. The Travis County Appraisal District provides extensive resources and information on its website, including detailed explanations of the appraisal process, online tools for property owners, and guidelines for the appeal process. This commitment to transparency fosters trust and understanding among property owners and the community.

TCAD also hosts public meetings and workshops, providing opportunities for residents and businesses to engage with appraisers and learn more about the process. These initiatives ensure that property owners are well-informed and can actively participate in the appraisal process, leading to more accurate valuations and a sense of community involvement.

Future Outlook and Innovations

As technology advances and data becomes more accessible, the Travis County Tax Appraisal process is evolving to incorporate new tools and methods. TCAD is exploring the use of advanced data analytics and artificial intelligence to enhance the accuracy and efficiency of appraisals. By leveraging these technologies, the district aims to provide even more precise valuations, ensuring fairness and equity for all property owners.

Furthermore, TCAD is committed to continuous improvement and seeks feedback from property owners and the community. This feedback loop allows the district to identify areas for enhancement and implement changes that better serve the needs of the community. By staying adaptable and responsive, Travis County aims to maintain a leading position in tax appraisal practices, setting a standard for other counties to follow.

FAQs

When is the Travis County Tax Appraisal conducted annually?

+The Travis County Tax Appraisal is typically conducted annually, with a set timeline for data collection, analysis, and notification. The specific dates may vary slightly each year, but generally, the appraisal process begins in January and continues through the spring. Property owners are notified of their appraised value by May, allowing them time to review and appeal if necessary.

How can I access my property’s appraisal information in Travis County?

+Property owners in Travis County can access their appraisal information online through the Travis County Appraisal District’s website. By creating an account, owners can view detailed appraisal reports, including the methodology used, comparable sales data, and any adjustments made. This transparency allows for a better understanding of the appraisal process and facilitates informed decision-making.

What factors influence the appraised value of my property in Travis County?

+The appraised value of a property in Travis County is influenced by various factors, including its physical characteristics (size, age, condition), location (proximity to amenities), recent sales data of similar properties, and potential income (for commercial properties). Appraisers consider these factors to determine a fair market value, ensuring accuracy and equity in the appraisal process.

Can I appeal my property’s appraised value in Travis County, and what is the process?

+Yes, property owners in Travis County have the right to appeal their property’s appraised value if they believe it is inaccurate or unfair. The appeal process involves submitting an application to the Appraisal Review Board (ARB) within a specified timeframe. The ARB reviews the appeal, considers new evidence, and makes a decision to either uphold or adjust the appraised value. It is important to provide detailed and supportive documentation during the appeal process.

How does the Travis County Tax Appraisal process contribute to community development and equity?

+The Travis County Tax Appraisal process plays a crucial role in community development and equity by ensuring that property taxes are distributed fairly across the county. Accurate appraisals support the funding of essential public services, such as education, infrastructure, and public safety. This, in turn, contributes to the overall well-being and prosperity of the community, fostering a sense of fairness and shared responsibility.