Lake County Property Taxes

Property taxes are an essential aspect of municipal finances, playing a crucial role in funding public services and infrastructure. In Lake County, Florida, the property tax system is a key revenue generator for local government, supporting vital services such as education, emergency services, and road maintenance. Understanding the workings of this system is essential for property owners and taxpayers alike, as it directly impacts their financial obligations and the quality of local services.

The Mechanics of Lake County Property Taxes

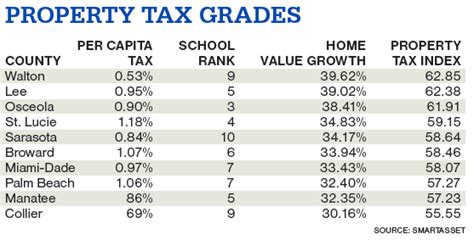

Lake County’s property tax system operates on a straightforward principle: the assessed value of a property determines the tax liability. This value is determined annually by the Lake County Property Appraiser’s Office, which evaluates each property based on factors such as location, size, improvements, and recent sales data.

Once the appraised value is established, it undergoes a series of adjustments. First, it is subjected to a homestead exemption, which reduces the taxable value for homeowners who have established permanent residence on the property. This exemption is a significant benefit for homeowners, often reducing their tax burden by thousands of dollars.

After applying the homestead exemption, the remaining value is then multiplied by the millage rate, which is set annually by the Lake County Board of County Commissioners and other local taxing authorities. The millage rate represents the number of dollars in tax owed for every $1,000 of the assessed value. This rate can vary depending on the type of property and its location within the county.

The Assessment Process

The Lake County Property Appraiser’s Office employs a systematic approach to property assessment. It involves a combination of physical inspections, sales analysis, and data verification. This process ensures that the assessed values are fair and accurate, reflecting the true market value of each property.

Property owners have the right to appeal their assessed value if they believe it is inaccurate. The process involves submitting an appeal to the Property Appraiser's Office, providing evidence to support the claim, and potentially attending a hearing before the Value Adjustment Board. This system ensures transparency and fairness in the assessment process.

Tax Rates and Revenue Distribution

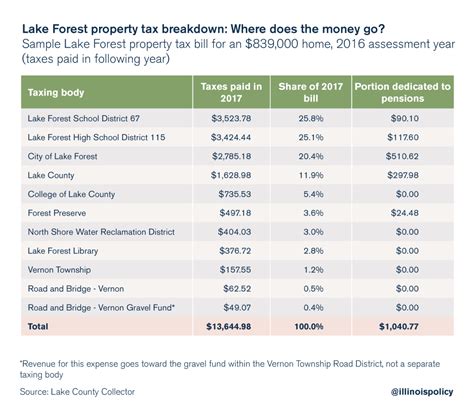

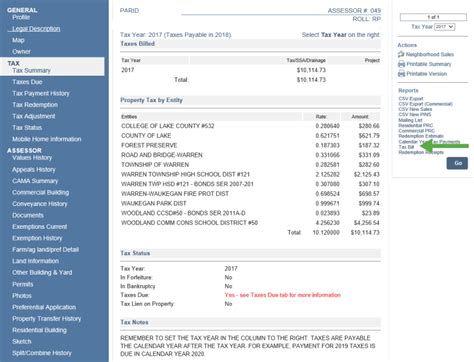

The millage rate in Lake County is composed of various components, each representing a different taxing authority. The largest portion typically goes to the school board, followed by the county government, and then other special districts and municipalities within the county. This distribution is decided annually through a budgeting process that aims to balance the needs of the community with the available revenue.

The millage rate can change from year to year, depending on the budgetary requirements and the property values within the county. Property owners can track these changes through the Property Appraiser's Office and local government websites, which provide detailed information on the proposed and final millage rates.

| Taxing Authority | Millage Rate (per $1,000 of Assessed Value) |

|---|---|

| Lake County School Board | 6.4481 |

| Lake County Government | 4.6355 |

| Lake County Special Districts | 1.7500 |

| Municipalities (City of Eustis) | 2.0000 |

| Total Millage Rate | 14.8336 |

Understanding the Tax Bill

The property tax bill is a detailed document that outlines the calculation of taxes for a specific property. It includes the assessed value, any applicable exemptions, the millage rate, and the final tax amount due. Understanding this bill is crucial for property owners to ensure accuracy and identify any potential errors or changes.

Lake County offers an online tax estimator tool on its website, allowing property owners to estimate their tax liability based on their property's characteristics. This tool is a valuable resource for taxpayers, providing transparency and enabling them to plan their finances effectively.

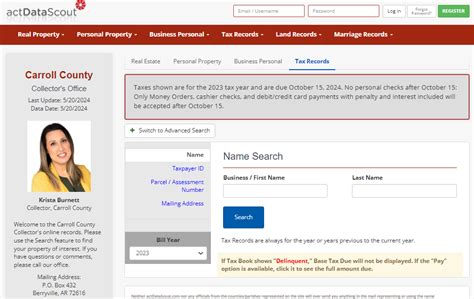

Payment Options and Due Dates

Property taxes in Lake County are due in two installments, with the first installment typically due by November 1 and the second by March 31. However, taxpayers have the option to pay their entire tax bill by November 30 to receive a small discount. Late payments are subject to interest and penalties, which accumulate over time.

Lake County offers a variety of payment methods, including online payment through its website, payment by phone, and traditional payment methods such as mail or in-person at the Tax Collector's Office. Taxpayers can choose the method that best suits their preferences and needs.

Challenges and Opportunities

While property taxes are a necessary component of local government funding, they can present challenges for property owners, particularly during times of economic hardship or when property values fluctuate significantly. However, Lake County has implemented various measures to support taxpayers and ensure the sustainability of its property tax system.

Assistance Programs

Lake County offers several assistance programs to help eligible taxpayers manage their property tax obligations. These include the Senior Citizen Exemption, which provides a discount on taxes for senior citizens, and the Disability Exemption, which offers a similar benefit for disabled individuals. Additionally, the county has a Deferred Payment Program that allows eligible taxpayers to defer their property tax payments under certain conditions.

Tax Relief Initiatives

In response to economic challenges, Lake County has initiated various tax relief measures. For instance, the county has implemented a Temporary Tax Amnesty Program, which offers reduced penalties for taxpayers with outstanding property tax debts. This initiative encourages taxpayers to settle their debts and provides a financial boost to the county’s revenue stream.

Future Outlook

The future of Lake County’s property tax system is closely tied to the county’s economic growth and development. As the county continues to attract new residents and businesses, property values are likely to increase, providing a stable revenue stream for local government. However, managing this growth sustainably and equitably will be a key challenge for county officials.

Lake County's commitment to transparency and taxpayer support is evident in its initiatives and resources. By staying informed and engaged with the county's property tax system, taxpayers can ensure they are paying their fair share while also benefiting from the essential services funded by these taxes.

How can I appeal my property’s assessed value in Lake County?

+To appeal your property’s assessed value, you must first submit a written request to the Lake County Property Appraiser’s Office. You’ll need to provide evidence supporting your claim, such as recent sales data or an appraisal. If your appeal is accepted, you’ll be scheduled for a hearing before the Value Adjustment Board, where you can present your case.

What happens if I don’t pay my property taxes on time in Lake County?

+Late payment of property taxes in Lake County incurs interest and penalties. The interest rate is set annually by the State of Florida and compounds daily. If taxes remain unpaid after a certain period, the property may be subject to a tax certificate sale, where investors can purchase the right to collect the outstanding taxes with additional fees and interest.

Are there any tax exemptions or discounts available for homeowners in Lake County?

+Yes, Lake County offers several tax exemptions and discounts for homeowners. The most common is the homestead exemption, which reduces the taxable value of your property if it’s your permanent residence. Other exemptions include the senior citizen exemption and the disability exemption. Additionally, paying your taxes in full by the early payment deadline can result in a small discount.

How can I estimate my property taxes in Lake County before receiving my tax bill?

+Lake County provides an online tax estimator tool on its website. You can use this tool to estimate your property taxes based on your property’s characteristics, including its location, size, and improvements. This tool is a valuable resource for budgeting and financial planning.