Pa State Tax Rate

Welcome to this comprehensive guide on the Pennsylvania State Tax rate, a crucial aspect of understanding the financial landscape of the Keystone State. This article aims to delve deep into the intricacies of Pennsylvania's tax system, providing you with a thorough understanding of the current tax rates, applicable exemptions, and the impact on residents and businesses alike. As an expert in state tax regulations, I aim to equip you with the knowledge needed to navigate this complex topic with confidence.

Understanding the Pennsylvania State Tax Landscape

Pennsylvania’s tax system is a dynamic and evolving framework, designed to support the state’s infrastructure, education, and various public services. With a rich history and a diverse economic landscape, the state’s tax policies reflect a careful balance between revenue generation and promoting economic growth.

The Pennsylvania Income Tax: A Progressive Approach

The state’s income tax structure follows a progressive model, meaning the tax rate increases as taxable income rises. This approach ensures that higher-income earners contribute a larger share to the state’s revenue while still providing incentives for economic growth and investment.

| Tax Bracket | Tax Rate |

|---|---|

| First $36,000 of taxable income | 3.07% |

| Taxable income over $36,000 | 3.07% to 3.805% |

The income tax rate for individuals and estates is 3.07% for the first $36,000 of taxable income. For income over this threshold, the rate increases to a range of 3.07% to 3.805%, depending on the specific income bracket. This progressive structure ensures fairness and helps maintain a stable revenue stream for the state.

Sales and Use Tax: A Significant Revenue Stream

The Sales and Use Tax is another vital component of Pennsylvania’s tax system, contributing significantly to the state’s revenue. This tax is levied on the sale of tangible personal property and certain services, with some exemptions for specific goods and services.

As of my last update, the base Sales and Use Tax rate in Pennsylvania is 6%, one of the lowest in the nation. However, it's important to be aware of local Sales and Use Tax additions, as some municipalities and counties impose additional taxes on top of the state rate, bringing the total tax rate to 7% or even higher in certain areas.

| Tax Category | Tax Rate |

|---|---|

| General Sales and Use Tax | 6% |

| Local Sales and Use Tax Additions | Up to 1% |

The Sales and Use Tax is a broad-based tax, applying to a wide range of goods and services, which makes it a significant source of revenue for the state. However, it's crucial to understand the specific tax rates in your local area, as these can vary significantly across Pennsylvania's diverse regions.

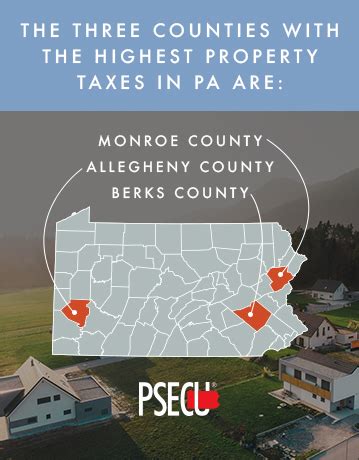

Property Tax: A Localized Approach

Property taxes in Pennsylvania are assessed and collected at the local level, primarily by counties, municipalities, and school districts. This localized approach allows for a more tailored tax structure, considering the specific needs and expenses of each community.

The state does not set a standard property tax rate, and the rates can vary significantly from one locality to another. These rates are typically expressed as millage rates, where one mill represents $1 of tax for every $1,000 of assessed property value. For instance, a property with an assessed value of $100,000 located in a district with a millage rate of 20 mills would pay $2,000 in property taxes annually.

Property taxes are a significant source of revenue for local governments, funding essential services like schools, public safety, and infrastructure maintenance. The variation in property tax rates across Pennsylvania reflects the diverse needs and economic realities of its communities.

Other Pennsylvania Taxes: A Comprehensive Overview

Pennsylvania’s tax system is not limited to income, sales, and property taxes. The state levies various other taxes to support its operations and services, including:

- Capital Stock and Franchise Tax: This tax is imposed on corporations for the privilege of doing business in Pennsylvania.

- Corporate Net Income Tax: A tax on the income of corporations, partnerships, and limited liability companies.

- Inheritance Tax: A tax on property received from a person who has died, with rates varying based on the relationship between the deceased and the recipient.

- Realty Transfer Tax: A tax on the transfer of real estate, often levied at the local level, and varying based on the property's location.

- Tax on Amusements: A tax on the admission price of various entertainment events, such as concerts, movies, and sporting events.

Each of these taxes plays a unique role in Pennsylvania's fiscal framework, contributing to the state's revenue and supporting specific services and initiatives.

Tax Exemptions and Incentives: A Strategic Approach

Pennsylvania employs a strategic approach to tax exemptions and incentives, aiming to stimulate economic growth, attract businesses, and support specific industries. These exemptions and incentives are designed to provide relief to taxpayers while also promoting targeted economic development.

Income Tax Exemptions: Simplifying Tax Liability

Pennsylvania offers several income tax exemptions, which can significantly reduce an individual’s or business’s tax liability. These exemptions include:

- Pension Exemption: Certain pension income, including Social Security benefits, is exempt from state income tax.

- Military Exemption: Military pensions and retirement pay are exempt from state income tax, providing a benefit to Pennsylvania's veterans.

- Veterans Exemption: Veterans with a service-connected disability may be eligible for a partial or full exemption on their income tax.

- Unemployment Compensation Exemption: Unemployment compensation is exempt from state income tax, providing support to those between jobs.

These exemptions simplify the tax filing process and provide much-needed relief to specific segments of the population, aligning with the state's commitment to supporting its residents.

Sales and Use Tax Exemptions: A Strategic Advantage

The Sales and Use Tax exemptions in Pennsylvania are designed to encourage economic activity and support specific industries. Some notable exemptions include:

- Food and Drugs: Most unprepared foods, including dairy products, bakery goods, and fresh produce, are exempt from the Sales and Use Tax.

- Clothing and Footwear: Certain clothing and footwear items, including shoes, hats, and coats, are exempt from the tax, providing a benefit to consumers.

- Manufacturing Machinery and Equipment: Machinery and equipment used directly in manufacturing processes are exempt from the tax, supporting Pennsylvania's manufacturing sector.

- Farm Equipment: Machinery and equipment used directly in farming operations are exempt, promoting the state's agricultural industry.

These exemptions not only reduce the tax burden on specific industries but also make Pennsylvania an attractive location for businesses, fostering economic growth and job creation.

Incentives for Businesses: A Competitive Edge

Pennsylvania offers a range of tax incentives to attract and support businesses, especially those in targeted industries. These incentives can significantly reduce a business’s tax liability and provide a competitive advantage in the market.

The state's Business Tax Incentive Program includes initiatives like the Research and Development Tax Credit, which provides a credit against the Corporate Net Income Tax for eligible research expenses. This credit encourages innovation and technological advancement in Pennsylvania.

Additionally, the state offers a Film Production Tax Credit, designed to attract film and television productions to Pennsylvania. This credit can offset a significant portion of a production's eligible expenses, making the state an attractive location for filmmakers.

These business incentives, along with the state's strategic tax exemptions, demonstrate Pennsylvania's commitment to fostering a business-friendly environment and promoting economic growth.

Conclusion: Navigating Pennsylvania’s Tax Landscape

Pennsylvania’s tax system is a complex yet carefully crafted framework, designed to support the state’s diverse economy and its residents. With a progressive income tax structure, a competitive Sales and Use Tax rate, and a localized approach to property taxes, the state balances revenue generation with economic growth and fairness.

The state's strategic use of tax exemptions and incentives further enhances its appeal, providing relief to taxpayers and stimulating economic activity. Whether you're a resident, a business owner, or an investor, understanding Pennsylvania's tax landscape is crucial for making informed financial decisions.

As an expert in state tax regulations, I hope this guide has provided you with valuable insights into Pennsylvania's tax system. Remember, staying informed and seeking professional advice when needed can make all the difference in navigating the complexities of state taxes.

What is the income tax rate in Pennsylvania for 2024?

+The income tax rate in Pennsylvania for 2024 remains at 3.07% for the first $36,000 of taxable income, with a range of 3.07% to 3.805% for income above this threshold.

Are there any local income taxes in Pennsylvania?

+No, Pennsylvania does not impose local income taxes, which simplifies the tax structure for residents and businesses.

What is the base Sales and Use Tax rate in Pennsylvania?

+The base Sales and Use Tax rate in Pennsylvania is 6%, but local additions can increase this rate up to 7% or higher in certain areas.

How are property taxes determined in Pennsylvania?

+Property taxes in Pennsylvania are assessed and collected at the local level, with rates expressed as millage rates, which can vary significantly from one locality to another.

What are some notable tax exemptions in Pennsylvania?

+Notable tax exemptions in Pennsylvania include pension income, military pensions, veterans’ benefits, unemployment compensation, unprepared food, clothing, manufacturing machinery, and farm equipment.