Horry County Tax Payments

Horry County, located in the vibrant state of South Carolina, is a bustling region known for its diverse communities, vibrant tourism, and thriving businesses. With a rich history dating back to the early 18th century, Horry County has evolved into a dynamic hub, offering a unique blend of coastal charm and modern development. The county's efficient tax system plays a crucial role in its economic stability and growth.

Understanding the tax landscape of Horry County is essential for residents, business owners, and anyone interested in the financial health of this vibrant region. This comprehensive guide aims to delve into the intricacies of Horry County tax payments, shedding light on the processes, benefits, and implications for the community.

Unraveling the Tax Structure of Horry County

The tax system in Horry County is a well-organized framework designed to support the county's financial needs while promoting economic growth. It comprises various tax types, each serving a specific purpose and benefiting different segments of the community.

Property Taxes: A Pillar of Local Funding

Property taxes are a significant source of revenue for Horry County. These taxes are assessed on both real estate and personal property owned within the county. The county's tax assessor's office is responsible for evaluating properties annually to ensure fair and accurate assessments.

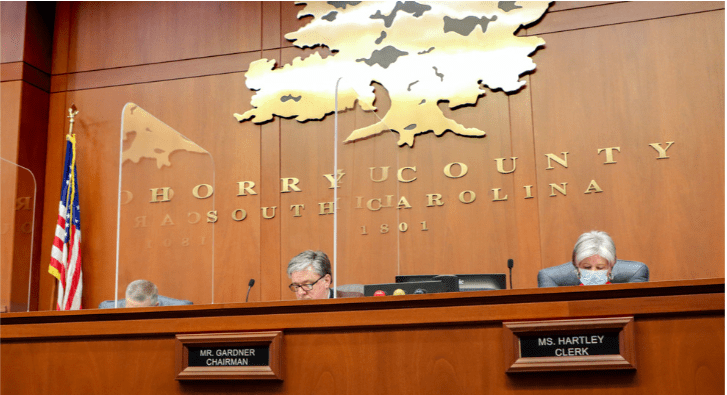

The tax rate in Horry County is determined by the millage rate, which is set by the county council. The millage rate is expressed in mills, where one mill equals $1 for every $1,000 of assessed property value. This rate can vary depending on the specific tax district within the county.

For instance, consider a residential property in the Myrtle Beach area with an assessed value of $250,000. With a millage rate of 120 mills, the annual property tax would amount to $3,000. This tax contributes to funding essential services such as education, public safety, and infrastructure development.

| Property Type | Assessment Value | Millage Rate | Estimated Annual Tax |

|---|---|---|---|

| Residential | $250,000 | 120 mills | $3,000 |

| Commercial | $500,000 | 135 mills | $6,750 |

| Vacant Land | $150,000 | 110 mills | $1,650 |

Sales and Use Taxes: Supporting Local Commerce

Horry County also relies on sales and use taxes to generate revenue. These taxes are imposed on the sale of goods and services within the county, as well as on the use, storage, or consumption of tangible personal property.

The sales tax rate in Horry County is comprised of a state tax rate, a county tax rate, and optional local tax rates. As of [current date], the total sales tax rate in Horry County is [current sales tax rate]%, which includes a state rate of [state tax rate]%, a county rate of [county tax rate]%, and optional local rates of [local tax rates]%.

For example, a purchase of a new laptop in a retail store in Horry County with a sales price of $1,000 would incur a sales tax of approximately [sales tax calculation], depending on the specific tax rates in effect at the time of purchase.

| Tax Type | Rate |

|---|---|

| State Sales Tax | [state tax rate]% |

| County Sales Tax | [county tax rate]% |

| Optional Local Taxes | [local tax rates]% |

Other Taxes and Fees: A Comprehensive Overview

In addition to property and sales taxes, Horry County collects various other taxes and fees to support specific initiatives and services. These include:

- Accommodation Taxes: A tax levied on the rental of hotel rooms, motels, and other lodging facilities. The revenue generated is often used to promote tourism and support local attractions.

- Vehicle Registration Fees: Fees paid when registering a vehicle in Horry County. These fees contribute to road maintenance and infrastructure projects.

- Business License Taxes: Taxes paid by businesses operating within the county. The revenue collected helps fund economic development initiatives and supports local businesses.

- Special Assessment Fees: Fees assessed on properties within specific districts to fund improvements or maintenance of shared infrastructure, such as roads, sewers, or parks.

Each of these taxes and fees plays a crucial role in the financial stability and growth of Horry County, ensuring that the community receives the necessary resources for its development and well-being.

Tax Payment Processes: A Step-by-Step Guide

Understanding the tax payment process is essential for residents and business owners in Horry County. Here's a comprehensive guide to navigate the various tax payment options available:

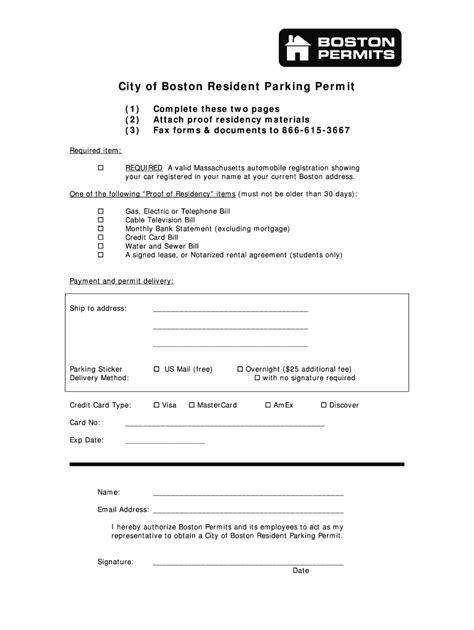

Property Tax Payments: A Convenient Online Experience

Horry County offers a user-friendly online platform for property tax payments. Taxpayers can access their account through the county's official website, where they can view their tax bills, make payments, and manage their property tax-related information.

To make a property tax payment online, taxpayers will need their account number and the amount due. The county's website provides a secure payment gateway, accepting major credit cards and electronic checks. This convenient option allows taxpayers to pay their property taxes from the comfort of their homes.

Additionally, Horry County offers a convenient installment plan for property taxes. Taxpayers can choose to pay their taxes in equal installments over a specified period, making it easier to manage their financial obligations.

For those who prefer traditional methods, in-person payments can be made at the Horry County Treasurer's Office. Taxpayers can visit the office during regular business hours and make payments by cash, check, or money order.

Sales and Use Tax Payments: A Streamlined Process

Businesses operating in Horry County are responsible for collecting and remitting sales and use taxes to the South Carolina Department of Revenue. The department provides a user-friendly online portal for businesses to register, file tax returns, and make payments.

To ensure compliance, businesses should maintain accurate records of sales transactions, including the tax amounts collected. These records are essential for accurate tax reporting and can be used to reconcile tax payments with the Department of Revenue.

The Department of Revenue offers various payment methods, including electronic funds transfer, credit card payments, and check or money order payments. Businesses can choose the method that best suits their needs and preferences.

Other Tax and Fee Payments: A Comprehensive Approach

Horry County provides a range of payment options for other taxes and fees, ensuring convenience and accessibility for taxpayers.

- Accommodation Taxes: Businesses in the hospitality industry can pay accommodation taxes online through the county's official website or by submitting payments to the designated tax authority.

- Vehicle Registration Fees: Vehicle registration fees can be paid online, in-person at the Horry County Treasurer's Office, or at designated DMV offices. The county's website provides a step-by-step guide for vehicle registration, making the process straightforward.

- Business License Taxes: Business license taxes can be paid online, by mail, or in-person at the Horry County Treasurer's Office. The county offers a simplified business license application process, ensuring a smooth experience for new and existing businesses.

- Special Assessment Fees: Special assessment fees are typically paid through the property tax payment process. Taxpayers can make these payments online, by mail, or in-person, ensuring a seamless integration with their property tax obligations.

Horry County's commitment to providing a diverse range of payment options demonstrates its dedication to meeting the needs of its diverse taxpayer base, ensuring a positive and efficient tax payment experience.

Tax Incentives and Exemptions: Unlocking Benefits

Horry County offers a range of tax incentives and exemptions to encourage economic growth, support local businesses, and promote community development. These initiatives provide financial benefits to taxpayers and contribute to the overall prosperity of the region.

Property Tax Exemptions: Supporting Homeownership

Horry County recognizes the importance of homeownership and offers several property tax exemptions to eligible residents. These exemptions reduce the tax burden on homeowners, making property ownership more affordable.

- Homestead Exemption: Horry County provides a homestead exemption for primary residences. This exemption reduces the assessed value of the property, resulting in lower property taxes. To qualify, homeowners must meet specific residency and ownership criteria.

- Senior Citizen Exemption: Elderly residents of Horry County may be eligible for a property tax exemption. This exemption provides relief to seniors who meet certain age and income requirements, ensuring that they can continue to afford their homes as they age.

- Veteran's Exemption: Horry County honors its veterans by offering a property tax exemption. Veterans who meet the eligibility criteria can receive a reduction in their property taxes, recognizing their service and sacrifice.

These property tax exemptions not only provide financial benefits to eligible residents but also contribute to the stability and vitality of the community by encouraging homeownership and supporting those who have served our nation.

Sales and Use Tax Incentives: Attracting Investment

Horry County understands the importance of attracting new businesses and encouraging economic development. To achieve this, the county offers a range of sales and use tax incentives to eligible businesses.

- Job Tax Credits: Businesses that create new jobs in Horry County may be eligible for job tax credits. These credits provide a reduction in sales and use taxes, incentivizing businesses to expand their workforce and invest in the local economy.

- Investment Tax Credits: Businesses that make significant capital investments in Horry County may qualify for investment tax credits. These credits reduce the sales and use tax burden on businesses, encouraging them to invest in new equipment, facilities, and infrastructure.

- Research and Development Credits: Horry County supports innovation and research by offering tax credits to businesses engaged in research and development activities. These credits provide a financial incentive for businesses to invest in cutting-edge technologies and advancements.

By offering these sales and use tax incentives, Horry County positions itself as an attractive destination for businesses, fostering economic growth and creating job opportunities for its residents.

Other Tax Relief Programs: Supporting Community Development

In addition to property and sales tax incentives, Horry County implements various other tax relief programs to support community development and specific initiatives.

- Historic Preservation Tax Credits: Horry County encourages the preservation of historic properties by offering tax credits to property owners who undertake approved rehabilitation projects. These credits provide a financial incentive for the restoration and preservation of historic buildings, contributing to the county's rich cultural heritage.

- Agricultural Tax Relief: The county recognizes the importance of agriculture and offers tax relief programs to support farmers and agricultural businesses. These programs can include reduced tax rates or exemptions for agricultural land, promoting the sustainability and growth of the local farming industry.

- Brownfield Tax Incentives: Horry County aims to rejuvenate and develop brownfield sites by offering tax incentives to businesses and developers. These incentives provide financial benefits for the remediation and redevelopment of contaminated properties, transforming them into productive assets for the community.

Through these targeted tax relief programs, Horry County demonstrates its commitment to community development, historic preservation, and sustainable economic growth, ensuring a bright future for its residents and businesses.

Future Outlook: Shaping a Sustainable Tax Landscape

As Horry County continues to thrive and evolve, its tax landscape is expected to adapt and transform to meet the changing needs of the community. Here's a glimpse into the future of Horry County's tax system and its potential implications.

Technological Advancements: Streamlining Tax Processes

Horry County is embracing technological advancements to enhance its tax processes, making them more efficient and accessible to taxpayers. The county is investing in digital platforms and online tools to improve the user experience for tax payments, filings, and interactions with tax authorities.

By leveraging technology, Horry County aims to reduce administrative burdens, minimize errors, and provide real-time updates and notifications to taxpayers. This digital transformation will not only streamline tax processes but also enhance transparency and accountability, fostering trust between taxpayers and the county.

Economic Growth and Tax Revenue

The future of Horry County's tax revenue is closely tied to its economic growth and development. As the county continues to attract businesses, expand its tourism industry, and invest in infrastructure, its tax base is expected to expand, generating increased revenue.

With a larger tax base, Horry County will have the resources to invest in critical infrastructure projects, enhance public services, and support community initiatives. This positive feedback loop of economic growth and tax revenue will contribute to the county's overall prosperity and well-being.

Tax Policy Reforms: Adapting to Changing Needs

Horry County recognizes the importance of staying agile and responsive to the changing needs of its residents and businesses. As such, the county is committed to reviewing and updating its tax policies to ensure fairness, equity, and competitiveness.

Tax policy reforms may include adjustments to tax rates, incentives, and exemptions to encourage economic development, support small businesses, and promote social equity. By staying attuned to the evolving landscape, Horry County can ensure that its tax system remains a catalyst for growth and a source of stability for the community.

Community Engagement and Tax Awareness

Engaging with the community and fostering tax awareness is a priority for Horry County. The county aims to educate residents and businesses about their tax obligations, rights, and the impact of taxes on the community's well-being.

Through community outreach programs, workshops, and online resources, Horry County strives to empower taxpayers with the knowledge and tools to navigate the tax system effectively. By fostering a culture of tax awareness and compliance, the county can build trust and strengthen the relationship between taxpayers and tax authorities.

Collaborative Governance: Working Together for a Brighter Future

Horry County recognizes the value of collaboration and partnership in shaping its tax landscape. The county works closely with local businesses, community organizations, and government agencies to develop tax policies and initiatives that benefit all stakeholders.

By fostering open dialogue and seeking input from diverse perspectives, Horry County can create tax policies that are inclusive, equitable, and responsive to the needs of its residents and businesses. This collaborative approach ensures that the tax system remains a tool for positive change, driving economic growth and social progress.

Frequently Asked Questions

How can I check my Horry County property tax bill online?

+

To access your Horry County property tax bill online, visit the official Horry County website and navigate to the “Property Tax Payment” section. You will need your account number to log in and view your tax information. The online platform provides a convenient way to manage your property tax payments and stay updated on your account status.

What are the due dates for Horry County property taxes?

+

Horry County property taxes are typically due in two installments. The first installment is due by January 15th, and the second installment is due by July 15th. However, it’s important to note that these due dates may vary depending on the specific tax year and any changes made by the county. It’s recommended to check the official Horry County website or contact the Treasurer’s Office for the most accurate and up-to-date information.