Flat Tax Pros And Cons

The concept of a flat tax has been a topic of intense debate in economic and political circles for decades. A flat tax system proposes a single, uniform tax rate for all taxpayers, regardless of their income level. Proponents argue that it simplifies the tax code, promotes fairness, and stimulates economic growth. However, critics raise concerns about its potential impact on social equity and revenue generation. In this comprehensive analysis, we will delve into the pros and cons of a flat tax system, exploring its implications and shedding light on this controversial economic policy.

Understanding the Flat Tax System

A flat tax, also known as a proportional tax, is a taxation system where all taxpayers pay the same tax rate on their taxable income. Unlike progressive tax systems, where higher income earners pay a higher percentage of their income as tax, a flat tax treats everyone equally. This means that regardless of whether you earn $20,000 or $200,000, the tax rate applied to your taxable income remains the same.

The idea behind a flat tax is to create a simpler and more transparent tax system. Proponents argue that the current progressive tax structure, with its multiple brackets and complexities, leads to confusion, compliance issues, and inefficiencies. A flat tax, they say, would eliminate these problems and make tax filing and administration more straightforward.

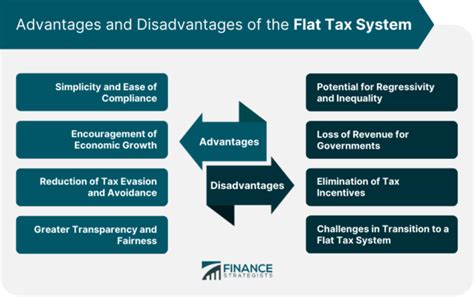

Pros of a Flat Tax

Simplicity and Efficiency

One of the most touted advantages of a flat tax is its simplicity. With a single tax rate, taxpayers no longer need to navigate through complex tax brackets and calculations. This can significantly reduce the time and resources spent on tax preparation, benefiting both individuals and businesses. Additionally, a simplified tax system could lead to more efficient tax administration, reducing the burden on government agencies.

Furthermore, a flat tax can minimize tax avoidance strategies and loopholes. With a uniform rate, taxpayers have fewer incentives to engage in complex financial maneuvers solely for tax purposes. This could enhance tax compliance and ensure a more equitable distribution of tax obligations.

Economic Growth and Investment

Proponents of a flat tax argue that it can stimulate economic growth by encouraging investment and entrepreneurship. A lower, uniform tax rate can provide a more predictable and stable tax environment, making it easier for businesses to plan and expand. This, in turn, could lead to increased investment, job creation, and overall economic prosperity.

Additionally, a flat tax may attract foreign investment. Countries with simpler tax systems often become more attractive destinations for international businesses, as they offer a clearer and more straightforward tax regime. This influx of foreign capital can further boost the domestic economy.

Fairness and Transparency

A flat tax is often promoted as a fairer alternative to progressive taxation. With everyone paying the same rate, there is no perception of discrimination based on income level. This can help alleviate concerns about income inequality and promote a sense of fairness within society.

Moreover, a flat tax can enhance transparency in the tax system. Taxpayers can easily understand how their tax obligations are calculated, as the process is straightforward and consistent. This transparency can build trust between taxpayers and the government, leading to better tax compliance.

Cons of a Flat Tax

Regressive Nature and Social Equity

One of the primary criticisms of a flat tax is its regressive nature. While it treats all taxpayers equally in terms of the tax rate, it fails to consider the differing abilities of individuals to pay taxes. Those with lower incomes may find it harder to meet their tax obligations under a flat tax, as a larger proportion of their income goes towards taxes.

This regressive effect can have significant social implications. It may exacerbate income inequality, as lower-income earners have less disposable income to spend on necessities and savings. Additionally, a flat tax can reduce the government's ability to fund social safety nets and public services that are crucial for supporting vulnerable populations.

Revenue Generation and Budgetary Concerns

A flat tax system can potentially lead to a reduction in government revenue, especially if the tax rate is set too low. This can create budgetary challenges, as the government may struggle to fund essential services and infrastructure projects. To maintain revenue levels, a flat tax would require a higher tax rate than a progressive system, which could counteract the perceived benefits of simplicity and fairness.

Moreover, a flat tax may disproportionately affect certain sectors or industries. For instance, industries with high profit margins may see a significant decrease in their tax burden, while sectors with thinner profit margins may struggle to remain competitive.

Impact on Public Services and Redistribution

The adoption of a flat tax could have far-reaching consequences for public services and social welfare programs. With a potential decrease in tax revenue, the government may need to reduce spending on healthcare, education, and other vital services. This could lead to a decline in the quality and accessibility of these services, particularly for those who rely on them the most.

Additionally, a flat tax system may limit the government's ability to redistribute wealth and address income inequality. Progressive tax systems often serve as a tool for wealth redistribution, ensuring that higher-income earners contribute more to support public goods and services. A flat tax, on the other hand, may hinder this redistribution process, further widening the wealth gap.

Real-World Examples and Performance Analysis

Several countries have implemented flat tax systems, providing real-world examples to analyze. For instance, Estonia adopted a flat tax of 21% in 1994, which was later reduced to 20%. This move was part of a broader economic reform aimed at attracting foreign investment and stimulating economic growth. Estonia’s flat tax system has been credited with contributing to its economic success and attracting businesses.

On the other hand, some countries, like Russia, have experienced mixed results with their flat tax. Russia implemented a flat tax rate of 13% in 2001, which initially boosted economic growth. However, over time, concerns arose about the system's regressive nature and its impact on social equity. Russia eventually moved away from a pure flat tax, introducing a 15% rate for higher incomes in 2015.

| Country | Flat Tax Rate | Implementation Year | Impact |

|---|---|---|---|

| Estonia | 20% | 1994 | Economic growth, investment attraction |

| Russia | 13% (15% for higher incomes) | 2001 | Initial growth, concerns about social equity |

| Lithuania | 15% | 2003 | Stable tax system, revenue concerns |

Future Implications and Policy Considerations

The debate surrounding flat tax systems is far from over, and its future implications are multifaceted. As societies become more diverse and income inequality persists, the question of tax fairness remains crucial. A flat tax may simplify the tax code, but it may also perpetuate or exacerbate existing social and economic disparities.

Looking ahead, policymakers must carefully consider the trade-offs between simplicity, fairness, and revenue generation. While a flat tax can offer certain advantages, it may also require careful design and implementation to address potential drawbacks. This could involve exploring hybrid tax systems that combine elements of both flat and progressive taxation, aiming to strike a balance between simplicity and social equity.

Additionally, the international tax landscape is evolving, with discussions around global minimum tax rates and tax harmonization. The future of flat tax systems may be influenced by these global trends, as countries strive to find a balance between competitiveness and fairness in the international tax arena.

How does a flat tax system affect the distribution of tax burden?

+A flat tax system distributes the tax burden evenly across all income levels, as everyone pays the same tax rate. This contrasts with progressive tax systems, where higher income earners pay a larger proportion of their income as tax.

What are the potential benefits of a flat tax for businesses?

+A flat tax can provide businesses with a stable and predictable tax environment, making it easier to plan and invest. It may also reduce compliance costs and administrative burdens associated with complex tax systems.

How might a flat tax impact government revenue and spending?

+A flat tax could lead to a reduction in government revenue, especially if the tax rate is set too low. This may result in budgetary constraints and potential cuts to public services and social programs.

Are there any countries that have successfully implemented a flat tax system?

+Yes, several countries have implemented flat tax systems, including Estonia and Lithuania. These countries have experienced economic growth and increased investment, but they have also faced challenges related to social equity and revenue generation.