Greenburgh Taxes

Greenburgh is a town located in Westchester County, New York, known for its diverse neighborhoods, vibrant communities, and beautiful natural surroundings. One aspect that often interests residents and prospective homeowners is the tax structure and its implications. In this comprehensive guide, we will delve into the world of Greenburgh taxes, exploring the various aspects that contribute to the overall tax landscape of this charming town.

Understanding Greenburgh’s Tax System

Greenburgh operates under a municipal tax system, which plays a crucial role in funding essential services and maintaining the town’s infrastructure. The tax structure is designed to support the local government’s operations, including education, public safety, road maintenance, and various community initiatives.

Property Taxes: The Backbone of Greenburgh’s Revenue

Property taxes are a significant component of the tax system in Greenburgh. The town assesses the value of each property within its boundaries and determines the tax rate accordingly. This tax revenue is vital for funding local schools, fire departments, and other essential services.

Here’s a breakdown of the key factors influencing property taxes in Greenburgh:

- Assessment Process: Greenburgh employs a professional assessment team to evaluate properties annually. This process ensures fairness and accuracy in determining tax obligations.

- Tax Rate: The tax rate is set by the town’s governing body, taking into consideration the budget requirements and the need to provide quality services to residents.

- Exemptions: Greenburgh offers certain tax exemptions to eligible homeowners, such as the Senior Citizen Tax Relief Program, which provides tax relief to senior residents based on income and property value.

- Tax Bills: Property owners receive detailed tax bills outlining the assessed value, applicable taxes, and payment due dates. These bills are typically sent out twice a year.

| Property Tax Statistics | Greenburgh Data |

|---|---|

| Average Property Tax Rate | 1.8% - 2.0% (based on 2023 assessments) |

| Median Property Value | $520,000 (as of 2022) |

| Number of Exemptions Granted | 1,250 (Senior Citizen Tax Relief Program, 2022) |

Sales and Use Taxes: Supporting Local Commerce

In addition to property taxes, Greenburgh imposes sales and use taxes on certain goods and services. These taxes contribute to the town’s overall revenue and help fund local projects and initiatives.

Key aspects of Greenburgh’s sales and use tax system include:

- Sales Tax Rate: The sales tax rate in Greenburgh is aligned with the state’s sales tax rate, which is currently 8.875%. This rate applies to most retail sales, including clothing, electronics, and other taxable items.

- Use Tax: Greenburgh also imposes a use tax on certain goods purchased outside the town but brought into it for use. This ensures fairness and prevents tax evasion.

- Exemptions: Certain items are exempt from sales tax, such as groceries, prescription drugs, and some clothing items. These exemptions are in place to reduce the tax burden on essential goods.

Income Taxes: A Local Perspective

While income taxes are primarily collected at the federal and state levels, Greenburgh residents also contribute to the town’s revenue through income-related taxes.

Here’s an overview of income taxes in Greenburgh:

- Local Income Tax: Greenburgh does not impose a local income tax on residents. However, residents are subject to New York State income tax, which varies based on income brackets.

- Payroll Taxes: Employers in Greenburgh are responsible for paying payroll taxes, including federal and state income tax withholdings, Social Security, and Medicare taxes. These contributions support various social programs and services.

The Impact of Greenburgh Taxes

Greenburgh’s tax system plays a vital role in shaping the town’s economic landscape and the overall well-being of its residents. Let’s explore some of the key impacts of the town’s tax structure.

Funding Essential Services

The primary purpose of Greenburgh’s tax revenue is to fund essential services that enhance the quality of life for residents. Here’s a glimpse of how tax revenue is allocated:

- Education: A significant portion of tax revenue goes towards supporting the local school district, ensuring quality education for students.

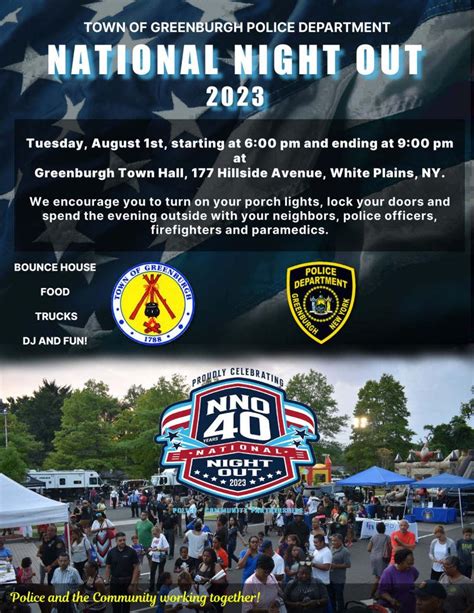

- Public Safety: Taxes contribute to maintaining a robust police force, fire department, and emergency response teams, ensuring the safety and security of the community.

- Infrastructure: Tax dollars are invested in road maintenance, public works projects, and the development of recreational facilities, creating a well-maintained and enjoyable living environment.

- Community Programs: Greenburgh’s tax revenue also funds various community initiatives, such as youth programs, senior services, and cultural events, fostering a strong sense of community.

Economic Development and Business Growth

Greenburgh’s tax structure, including sales and use taxes, plays a crucial role in supporting local businesses and promoting economic growth. Here’s how:

- Business Incentives: The town offers various tax incentives and programs to attract and retain businesses, fostering a vibrant local economy.

- Infrastructure Investment: Tax revenue is utilized to improve infrastructure, making Greenburgh an attractive location for businesses and enhancing the overall economic landscape.

- Job Creation: A thriving business environment leads to increased job opportunities, benefiting residents and contributing to the town’s economic prosperity.

Resident Satisfaction and Quality of Life

The efficient management of tax revenue in Greenburgh directly impacts the satisfaction and well-being of its residents. Here are some key aspects:

- Efficient Services: Well-funded essential services, such as education, public safety, and infrastructure, contribute to a high quality of life for residents.

- Community Initiatives: Tax-supported community programs and events create a sense of belonging and enhance the overall resident experience.

- Exemptions and Relief: Programs like the Senior Citizen Tax Relief Program demonstrate Greenburgh’s commitment to supporting its residents, especially those in need.

Conclusion: Navigating Greenburgh’s Tax Landscape

Understanding Greenburgh’s tax system is crucial for both residents and prospective homeowners. The town’s commitment to transparency, fair assessments, and efficient revenue allocation ensures that tax dollars are put to good use, supporting a thriving community and high-quality services.

Whether you’re a long-time resident or considering a move to Greenburgh, navigating the tax landscape is an essential part of your financial planning. By comprehending the various tax components and their impacts, you can make informed decisions and actively contribute to the vibrant and prosperous town of Greenburgh.

How does Greenburgh’s property tax rate compare to other towns in Westchester County?

+Greenburgh’s property tax rate is generally lower compared to some neighboring towns in Westchester County. However, it’s important to note that property values and assessment practices can vary, so a thorough analysis of individual circumstances is essential.

Are there any tax incentives for businesses in Greenburgh?

+Yes, Greenburgh offers a range of tax incentives and programs to attract and support businesses. These incentives include tax abatements, economic development grants, and expedited permitting processes, making it an attractive location for businesses to thrive.

How can residents stay informed about tax-related matters in Greenburgh?

+Greenburgh provides various resources to keep residents informed. The town’s official website offers detailed tax information, including assessment data, tax rates, and payment options. Additionally, the town holds public meetings and workshops to discuss tax-related topics, ensuring transparency and resident engagement.