Will County Tax Records

Welcome to our comprehensive guide on accessing and understanding Will County tax records. This article aims to provide an in-depth exploration of the tax system within Will County, offering valuable insights for homeowners, investors, and anyone interested in the local property market.

Navigating the Will County Tax System

Will County, located in the vibrant state of Illinois, is known for its diverse communities and thriving real estate market. The tax system here plays a crucial role in the county’s operations and services, impacting homeowners and property owners alike. Understanding this system is essential for managing property-related finances effectively.

Key Aspects of Will County Tax Records

The tax records in Will County offer a wealth of information, from property assessments to tax rates and due dates. Let’s delve into some of the critical aspects:

- Property Assessment: The assessment process determines the value of each property, serving as the basis for tax calculations. It considers factors like location, size, and recent improvements.

- Tax Rates: These are set annually and vary depending on the municipality and the type of property. Understanding the tax rate structure is vital for accurate financial planning.

- Tax Due Dates: Staying informed about tax due dates is essential to avoid penalties. The county typically sends out tax bills with clear instructions on payment deadlines.

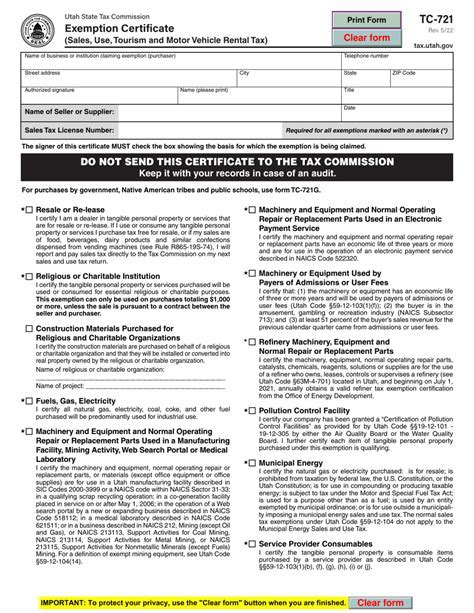

- Exemptions and Credits: Will County offers various exemptions and credits to eligible homeowners, such as the Homestead Exemption and Senior Citizens' Assessment Freeze. These can significantly reduce tax liabilities.

- Appeals Process: If you believe your property assessment is incorrect, the county provides an appeals process. Understanding this process is crucial for ensuring fair taxation.

Let's illustrate this with an example. Imagine you own a single-family home in Joliet, a bustling city within Will County. Your property assessment, which is conducted every three years, considers the home's recent improvements, such as a new kitchen renovation. The assessed value, along with the applicable tax rate, determines your annual property tax liability.

Accessing Will County Tax Records Online

Will County has made significant strides in digital accessibility, providing an online platform for taxpayers to access their records conveniently. Here’s a step-by-step guide:

- Visit the Official Website: Go to the Will County official website, which serves as the primary source for tax-related information.

- Navigate to the Tax Records Portal: Look for the "Tax Records" or "Property Taxes" section. This portal is designed to provide transparent access to tax data.

- Search by Property Address: Enter your property address to retrieve detailed tax information. This includes the current assessment, tax rate, and payment history.

- View and Download Documents: The portal allows you to view and download relevant tax documents, such as tax bills and assessment notices.

- Set Up Alerts: To stay updated on tax-related matters, you can set up email alerts for important notifications, ensuring you never miss a deadline.

Understanding Your Tax Bill

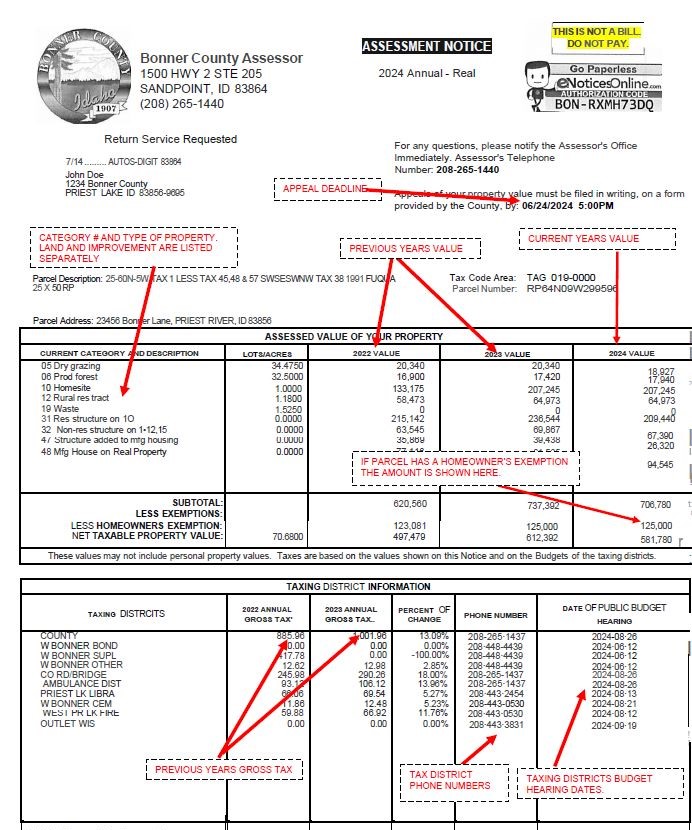

Your tax bill is a comprehensive document that provides crucial information about your property taxes. Here’s a breakdown of its key components:

| Section | Description |

|---|---|

| Property Address | The exact address of your property as recorded by the county. |

| Assessment Value | The assessed value of your property, which is the basis for tax calculations. |

| Tax Rate | The applicable tax rate for your property, determined by the municipality. |

| Tax Amount | The total amount of tax due, calculated based on the assessment value and tax rate. |

| Due Dates | Important deadlines for tax payments, typically split into two installments. |

| Exemptions and Credits | Details about any applicable exemptions or credits, reducing your tax liability. |

Understanding your tax bill is crucial for financial planning and ensuring timely payments. It provides transparency into how your tax dollars contribute to the county's services and operations.

The Impact of Tax Records on Property Transactions

Will County tax records play a significant role in property transactions. Buyers and investors rely on these records to evaluate the financial health of a property and make informed decisions. Here’s how:

- Due Diligence: Potential buyers use tax records to assess a property's value, tax history, and potential liabilities.

- Investment Decisions: Investors analyze tax records to determine the financial viability of a property and its potential for generating income.

- Market Analysis: Real estate professionals leverage tax data to conduct market research and compare properties based on tax liabilities.

- Negotiations: Tax records can be a valuable tool in negotiating the purchase price, especially if there are discrepancies or errors in the assessment.

For instance, when considering the purchase of a commercial property in Will County, investors would closely examine the tax records to understand the property's tax history and assess any potential risks or opportunities.

Future Outlook and Technological Advancements

Will County continues to invest in technological advancements to enhance the efficiency and accessibility of its tax system. Here are some potential future developments:

- Digital Payment Options: The county may introduce more secure and convenient digital payment methods, making it easier for taxpayers to pay their taxes online.

- AI-Assisted Assessments: Artificial Intelligence could be leveraged to improve the accuracy and efficiency of property assessments, reducing the risk of errors.

- Real-Time Data Updates: A more dynamic system could provide real-time updates on tax rates and assessments, ensuring taxpayers have the most current information.

- Integration with Property Databases: Integrating tax records with other property-related databases, such as zoning information and building permits, could provide a more comprehensive view of a property's status.

As Will County embraces technological advancements, the tax system is poised to become even more transparent and user-friendly, benefiting both taxpayers and county officials.

Conclusion

Will County tax records are a valuable resource for homeowners, investors, and anyone with an interest in the local real estate market. Understanding the tax system, accessing records online, and interpreting tax bills are essential skills for effective financial management. As the county continues to innovate, the tax system will likely become even more efficient and accessible, further benefiting the community.

How often are property assessments conducted in Will County?

+Property assessments in Will County are conducted every three years, ensuring an accurate valuation of properties for tax purposes.

Can I appeal my property assessment if I believe it’s inaccurate?

+Yes, Will County provides an appeals process for taxpayers who believe their property assessment is incorrect. The process typically involves submitting an appeal within a specified timeframe, followed by a review by the county’s assessment office.

What are the penalties for late tax payments in Will County?

+Late tax payments in Will County may incur penalties and interest charges. It’s important to stay informed about tax due dates to avoid these additional costs.

Are there any tax exemptions available for senior citizens in Will County?

+Yes, Will County offers the Senior Citizens’ Assessment Freeze, which can provide significant tax relief for eligible senior homeowners. This exemption freezes the assessed value of their property, preventing it from increasing due to inflation or improvements.