Sales Tax In Oakland California

Welcome to a comprehensive guide on the topic of sales tax in Oakland, California. This article aims to provide an in-depth understanding of the sales tax landscape in this vibrant city, covering its rates, exemptions, and implications for both consumers and businesses. Oakland, known for its diverse culture and thriving economy, has a unique sales tax structure that plays a significant role in its fiscal health and local development. As we delve into the specifics, we'll uncover the intricacies of how sales tax works in Oakland and its impact on the local community.

Understanding Sales Tax in Oakland

Sales tax in Oakland operates as a crucial component of the city’s revenue system, contributing to the funding of essential public services and infrastructure. The city of Oakland imposes its own sales tax rate in addition to the state and district taxes, creating a multi-tiered sales tax structure. This article will navigate through the various layers of this structure, providing a clear picture of the sales tax landscape in Oakland.

Oakland’s Sales Tax Rate

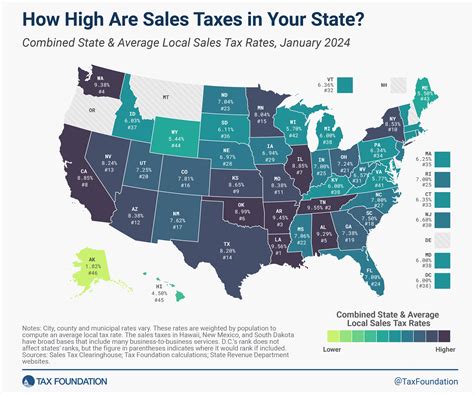

As of [insert current year], the sales tax rate in Oakland stands at 9.25%, which includes both the state and local taxes. This rate is applicable to most tangible personal property and certain services sold within the city limits. It’s important to note that sales tax in California is not a flat rate, and variations can occur based on the location of the sale and the type of goods or services being sold.

| Tax Component | Rate |

|---|---|

| California State Sales Tax | 7.25% |

| Alameda County Sales Tax | 0.875% |

| Oakland City Sales Tax | 1.125% |

The state sales tax rate is consistent across California, while county and city rates may vary. Oakland's city sales tax rate of 1.125% is specifically designated for funding city services and initiatives.

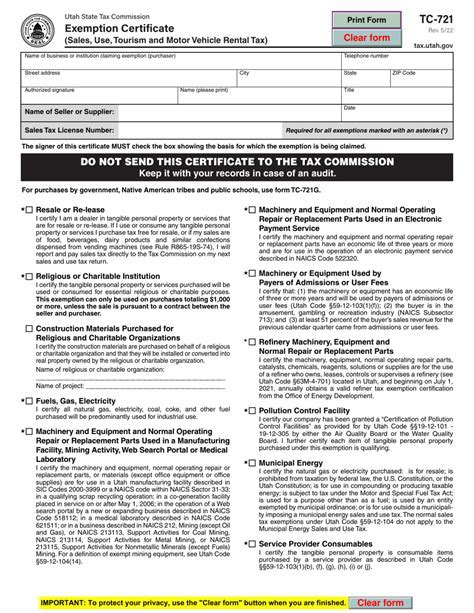

Exemptions and Special Considerations

While the general sales tax rate applies to a wide range of goods and services, there are certain exemptions and special cases to consider in Oakland. Some notable exemptions include:

- Groceries and Food: Sales tax is not applicable to most unprepared food items, such as fresh produce, meats, and dairy products. However, it’s important to note that prepared foods and beverages are taxable.

- Prescription Drugs: Medications purchased with a valid prescription are exempt from sales tax.

- Clothing and Shoes: In Oakland, sales tax does not apply to clothing and footwear items priced under $100.

- Certain Services: Some services, like medical services, educational services, and legal services, are generally not subject to sales tax.

It's crucial for businesses and consumers alike to be aware of these exemptions to ensure compliance with sales tax regulations.

Impact on Businesses and Consumers

The sales tax structure in Oakland has a direct impact on both businesses and consumers in the city. For businesses, especially those engaged in retail and e-commerce, understanding and managing sales tax obligations is essential for compliance and financial planning. Here’s a closer look at the implications:

Businesses

Sales tax compliance is a critical aspect of running a business in Oakland. Businesses must register with the California Department of Tax and Fee Administration (CDTFA) and obtain a seller’s permit. This permit allows them to collect and remit sales tax on taxable goods and services sold in Oakland. Non-compliance can result in penalties and interest charges, impacting a business’s financial health.

From a strategic perspective, businesses may need to consider the impact of sales tax on pricing and consumer behavior. Higher sales tax rates can influence purchasing decisions, potentially leading to shifts in consumer preferences and spending patterns. Additionally, businesses may explore strategies to optimize their sales tax obligations, such as implementing efficient point-of-sale systems and staying updated on tax law changes.

Consumers

For consumers, understanding sales tax is essential for making informed purchasing decisions. The sales tax rate in Oakland adds a significant cost to the final price of taxable goods and services. Consumers should be aware of the tax implications when budgeting for purchases, especially for higher-value items.

Moreover, consumers can benefit from being knowledgeable about sales tax exemptions and special cases. For instance, taking advantage of the exemption on clothing and footwear under $100 can result in significant savings. Similarly, understanding the taxability of prepared foods versus unprepared foods can help consumers make more cost-effective choices.

Compliance and Enforcement

Ensuring compliance with sales tax regulations is a shared responsibility between businesses and the government. The California Department of Tax and Fee Administration (CDTFA) is responsible for enforcing sales tax laws and ensuring that businesses collect and remit the appropriate taxes.

Compliance with sales tax regulations is crucial for businesses to avoid penalties and maintain a positive relationship with tax authorities. Businesses must accurately calculate and collect sales tax, issue proper receipts, and remit the collected taxes to the CDTFA on a regular basis. Failure to comply can result in audits, fines, and legal consequences.

On the enforcement side, the CDTFA employs various strategies to ensure compliance, including audits, data analytics, and outreach programs. Businesses are encouraged to seek guidance and stay updated on sales tax regulations to avoid unintentional non-compliance.

Future Implications and Trends

The sales tax landscape in Oakland is subject to change, influenced by various factors such as economic trends, political decisions, and technological advancements. Here are some key future implications and trends to consider:

Economic Impact

The sales tax revenue generated in Oakland plays a vital role in funding essential public services and infrastructure projects. As the city continues to grow and evolve, the revenue generated from sales tax becomes increasingly important for maintaining and improving the city’s quality of life. However, economic fluctuations can impact sales tax revenue, making it essential for the city to adapt its financial strategies accordingly.

Technological Advancements

The rise of e-commerce and online sales presents unique challenges and opportunities for sales tax compliance. As more businesses operate online, the traditional brick-and-mortar sales tax collection methods may need to be adapted. This could involve exploring new technologies and systems to accurately track and collect sales tax for online transactions.

Policy Changes

Sales tax rates and regulations are subject to change based on political decisions and legislative actions. Businesses and consumers should stay informed about any proposed or enacted changes to sales tax laws, as these changes can significantly impact their financial obligations and purchasing decisions.

Consumer Behavior

Shifts in consumer behavior, such as preferences for online shopping or an increased focus on tax-exempt items, can influence the sales tax landscape. Businesses may need to adapt their strategies to cater to these changing consumer preferences while ensuring compliance with sales tax regulations.

Conclusion

Sales tax in Oakland, California, is a complex yet essential aspect of the city’s economic landscape. Understanding the rates, exemptions, and implications of sales tax is crucial for both businesses and consumers. By navigating the sales tax structure effectively, businesses can ensure compliance and optimize their financial strategies, while consumers can make informed purchasing decisions.

As Oakland continues to thrive and evolve, staying informed about sales tax regulations and their potential future changes will be key for all stakeholders involved. Whether you're a business owner, a consumer, or simply interested in the economic dynamics of Oakland, a clear understanding of sales tax is a valuable asset.

How often do sales tax rates change in Oakland?

+

Sales tax rates in Oakland can change periodically due to various factors. While major changes are relatively rare, they can occur in response to economic conditions, legislative decisions, or voter-approved initiatives. It’s important for businesses and consumers to stay updated on any potential rate changes through official government sources.

Are there any online tools to calculate sales tax in Oakland?

+

Yes, there are several online calculators and tools available that can help you calculate the sales tax for a specific purchase in Oakland. These tools consider the state, county, and city tax rates to provide an accurate estimate. It’s always a good idea to double-check the calculations with official sources for the most up-to-date information.

What happens if a business fails to collect and remit sales tax in Oakland?

+

Failure to collect and remit sales tax can result in significant penalties and interest charges for businesses. The California Department of Tax and Fee Administration (CDTFA) has the authority to audit businesses and impose fines for non-compliance. It’s crucial for businesses to understand their sales tax obligations and stay compliant to avoid these consequences.