Tax Exemption Florida

Tax exemptions are an important aspect of financial planning, especially in states like Florida, which offer a range of tax breaks and incentives to its residents. Understanding the tax landscape and the available exemptions can help individuals and businesses make informed decisions to optimize their financial situations.

Unraveling the Tax Exemption Landscape in Florida

Florida, known for its sunny beaches and tax-friendly environment, provides a unique opportunity for individuals and businesses to reduce their tax burden. With a low tax rate and various exemptions, it is a haven for those seeking financial flexibility and growth.

Resident vs. Non-Resident Tax Exemption: A Key Distinction

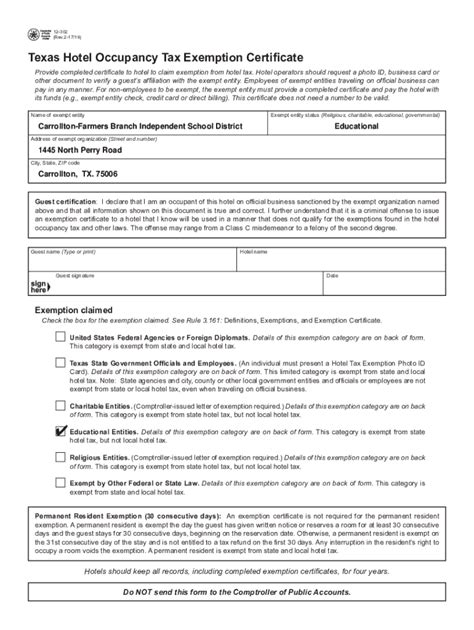

The tax exemption landscape in Florida differs significantly for residents and non-residents. Residents enjoy a wide range of tax benefits, including exemptions on certain income, property, and sales taxes. On the other hand, non-residents are subject to a different set of rules and may not qualify for the same exemptions.

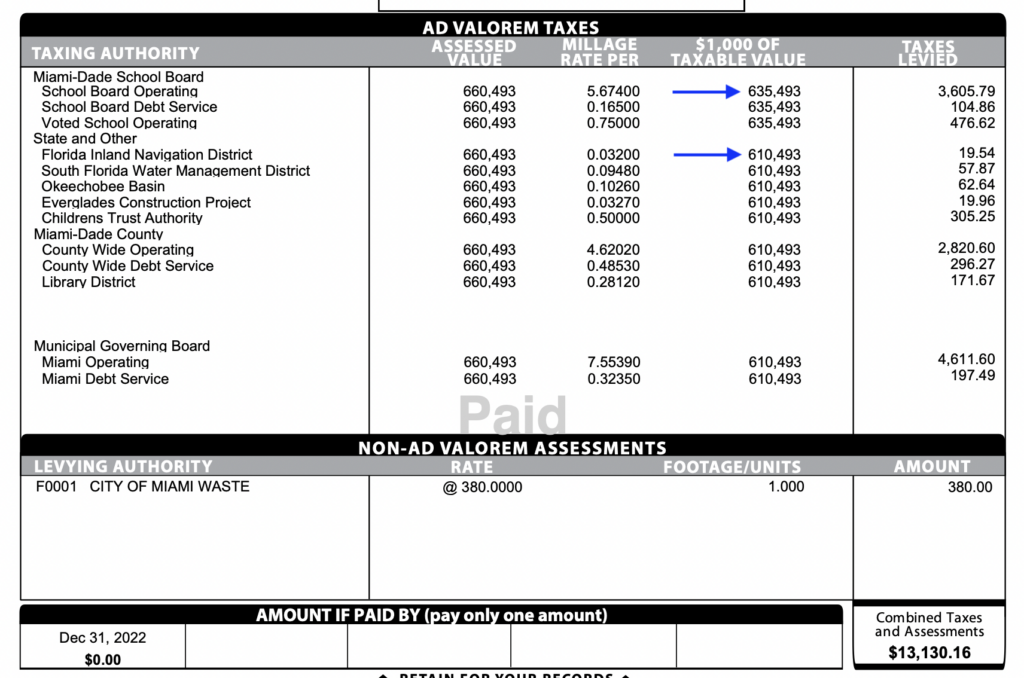

For instance, Florida offers a Resident's Property Tax Exemption, which provides a significant reduction in property taxes for individuals who own a homestead property in the state. This exemption can save residents thousands of dollars annually, making homeownership more affordable.

Income Tax Exemption: A Major Advantage

One of the most appealing aspects of Florida’s tax system is its lack of a state income tax. Unlike many other states, Florida does not impose a tax on personal income, providing a significant advantage for residents and businesses alike. This exemption allows individuals to keep more of their earnings and encourages businesses to thrive without the burden of high income taxes.

| State | Income Tax Rate |

|---|---|

| Florida | 0% |

| California | 13.3% |

| New York | 8.82% |

As the table illustrates, Florida's 0% income tax rate stands in stark contrast to states like California and New York, which impose double-digit income tax rates. This exemption not only attracts businesses and high-income earners but also contributes to a more competitive business environment within the state.

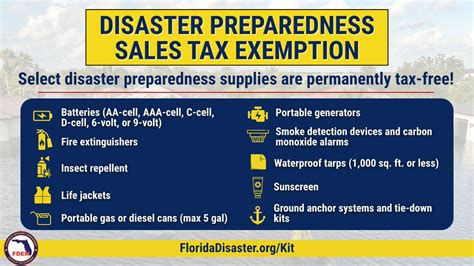

Sales Tax Exemption: A Strategic Move

Florida also offers a Sales Tax Exemption for certain purchases, which can be a strategic advantage for businesses. This exemption allows companies to avoid sales tax on specific items, reducing their operational costs and improving their bottom line. For instance, businesses can apply for a sales tax exemption on purchases of manufacturing equipment, a move that can significantly impact their long-term financial health.

Moreover, Florida's sales tax exemption extends to certain services, such as professional services and construction services. This exemption can be particularly beneficial for businesses in these sectors, as it allows them to pass on the savings to their clients, enhancing their competitiveness in the market.

Estate and Inheritance Tax: A Florida Advantage

Florida’s tax-friendly environment extends to estate and inheritance taxes as well. The state does not impose an inheritance tax, meaning that individuals who inherit property or assets in Florida are not subject to additional taxes. This exemption is a significant advantage for those planning their estates and can simplify the process of transferring wealth.

Additionally, Florida has one of the highest estate tax exemptions in the country. As of [insert year], the exemption threshold is set at $7 million, which means that estates valued below this amount are not subject to state estate tax. This exemption can provide significant peace of mind for individuals with substantial assets, knowing that their heirs will not face a large tax burden upon inheritance.

Maximizing Tax Exemptions: A Strategic Approach

Navigating the tax exemption landscape in Florida requires a strategic approach. Individuals and businesses must stay informed about the latest tax laws and regulations to ensure they are taking full advantage of the available exemptions.

Seeking Professional Guidance

Given the complexity of tax laws, seeking guidance from tax professionals is often a wise decision. These experts can help individuals and businesses understand the nuances of Florida’s tax system and develop strategies to maximize their exemptions. Whether it’s optimizing investment strategies, structuring business operations, or planning for retirement, tax professionals can provide valuable insights to ensure financial success.

Staying Updated with Tax Changes

Tax laws are subject to change, and it is crucial to stay updated with any modifications to Florida’s tax exemptions. Keeping abreast of these changes ensures that individuals and businesses can adjust their financial strategies accordingly. Regularly reviewing tax guides and resources, such as those provided by the Florida Department of Revenue, can help keep taxpayers informed and prepared.

Planning for the Future

Tax exemption planning is not just about the present; it’s also about the future. Individuals and businesses should consider the long-term implications of their tax strategies. For instance, when planning for retirement, understanding the tax exemptions available in Florida can be crucial. This includes considering the state’s favorable tax treatment of retirement accounts and planning investments accordingly.

Similarly, businesses should consider the impact of tax exemptions on their long-term growth and sustainability. Strategic planning that incorporates tax exemptions can help businesses thrive and adapt to changing economic landscapes.

Conclusion: A Tax-Friendly State

Florida’s tax exemption policies offer a unique opportunity for individuals and businesses to thrive financially. From income tax exemptions to property and sales tax breaks, the state provides a competitive advantage that attracts talent, investment, and growth. By understanding and maximizing these exemptions, residents and businesses can unlock significant financial benefits and contribute to Florida’s vibrant economy.

Frequently Asked Questions

How does Florida’s lack of state income tax impact its economy?

+

Florida’s absence of state income tax has a significant impact on its economy. It attracts businesses and high-income earners, fostering economic growth and creating a competitive business environment. This tax exemption encourages investment and contributes to the state’s thriving economy.

Are there any specific industries that benefit the most from Florida’s tax exemptions?

+

Several industries benefit significantly from Florida’s tax exemptions. For instance, the manufacturing sector can leverage the sales tax exemption on equipment purchases, reducing operational costs. Similarly, the real estate industry benefits from the Resident’s Property Tax Exemption, making homeownership more affordable.

How can individuals take advantage of Florida’s tax exemptions for retirement planning?

+

Individuals can maximize Florida’s tax exemptions for retirement planning by understanding the state’s favorable treatment of retirement accounts. This includes considering tax-efficient investment options and taking advantage of the state’s high estate tax exemption threshold to pass on wealth to heirs without a significant tax burden.