Md Income Tax Calculator

Unveiling the MD Income Tax Calculator: Your Comprehensive Guide

Are you navigating the complex world of income tax in Maryland? Look no further! In this comprehensive guide, we'll explore the MD Income Tax Calculator, a powerful tool designed to simplify your tax obligations. With a user-friendly interface and precise calculations, this calculator ensures you stay compliant while optimizing your financial strategies. Get ready to unlock the secrets of Maryland's tax landscape and discover how this calculator can make your tax journey a breeze.

Understanding Maryland's Income Tax Landscape

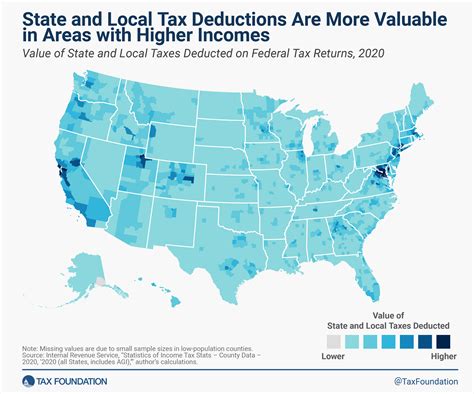

Before delving into the MD Income Tax Calculator, it's essential to grasp the unique characteristics of Maryland's tax system. Maryland imposes a progressive income tax, meaning the tax rate increases as your income rises. This progressive structure ensures fairness and contributes to the state's robust economy.

Maryland's tax brackets vary based on filing status, with rates ranging from 2% to 5.75%. Understanding these brackets is crucial for estimating your tax liability accurately. Additionally, Maryland offers various deductions and credits, such as the Maryland Resident Income Tax Credit, which can reduce your taxable income and provide significant savings.

The state also imposes a flat tax rate of 7% on business income, making it an attractive location for entrepreneurs and small businesses. By understanding these nuances, you can leverage the MD Income Tax Calculator to its fullest potential, ensuring accurate calculations and strategic financial planning.

Key Features of Maryland's Tax System

- Progressive Income Tax: Tax rates increase with income, promoting fairness.

- Variable Tax Brackets: Rates range from 2% to 5.75%, depending on filing status.

- Deductions and Credits: Opportunities to reduce taxable income, including the Maryland Resident Income Tax Credit.

- Business-Friendly Flat Tax: A 7% flat tax rate for business income.

Introducing the MD Income Tax Calculator: Precision and Simplicity

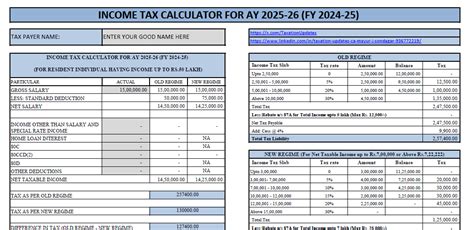

The MD Income Tax Calculator is a cutting-edge tool designed to revolutionize your tax calculations. Developed by a team of tax experts and tech enthusiasts, this calculator boasts a user-friendly interface and advanced algorithms to ensure accuracy. Whether you're a busy professional, a small business owner, or a tax-conscious individual, this calculator simplifies the complex process of estimating your tax liability.

By inputting your income, deductions, and relevant tax information, the calculator performs intricate calculations to provide a precise estimate of your tax obligation. It takes into account Maryland's progressive tax structure, tax brackets, and applicable deductions, delivering a tailored result based on your unique circumstances.

One of the standout features of the MD Income Tax Calculator is its ability to provide real-time updates. As tax laws and regulations evolve, the calculator stays abreast of the latest changes, ensuring you receive the most accurate and up-to-date information. This level of precision empowers you to make informed financial decisions and plan effectively for the future.

Benefits of Using the MD Income Tax Calculator

- Accuracy: Advanced algorithms ensure precise tax calculations.

- User-Friendly: Intuitive interface for easy navigation.

- Real-Time Updates: Stay informed with the latest tax law changes.

- Tailored Results: Calculations based on your unique financial situation.

Maximizing Your Tax Strategy with the Calculator

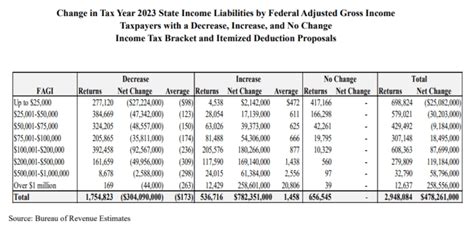

The MD Income Tax Calculator is not just a tool for estimation; it's a strategic companion on your financial journey. By utilizing this calculator effectively, you can uncover opportunities to optimize your tax liability and make informed decisions regarding your income, deductions, and credits.

For instance, the calculator can help you identify the most beneficial filing status for your situation. Whether you're single, married filing jointly, or head of household, the calculator provides tailored estimates to guide your choice. Additionally, it highlights deductions and credits you may be eligible for, ensuring you maximize your savings.

Moreover, the MD Income Tax Calculator offers a comprehensive overview of your tax liability over multiple years. This long-term perspective enables you to plan strategically, make informed investments, and optimize your financial growth. By understanding your tax obligations, you can allocate resources effectively and achieve your financial goals.

Strategic Insights from the Calculator

- Filing Status Optimization: Identify the most advantageous filing status.

- Deduction and Credit Opportunities: Uncover potential savings and maximize benefits.

- Long-Term Tax Planning: Gain insights for strategic financial growth.

Technical Specifications and Performance

Behind the user-friendly interface of the MD Income Tax Calculator lies a robust technical infrastructure. The calculator employs advanced algorithms and machine learning techniques to process vast amounts of data, ensuring accuracy and efficiency. It seamlessly integrates with Maryland's tax regulations, incorporating the latest changes and updates.

Performance-wise, the calculator boasts lightning-fast processing speeds, delivering results within seconds. Whether you're calculating a single income scenario or performing complex multi-year simulations, the calculator handles the task with ease. Its scalability ensures it can accommodate a wide range of users, from individuals to large enterprises.

Furthermore, the calculator's security measures are top-notch. All data is encrypted and stored securely, adhering to strict industry standards. Your privacy and the confidentiality of your financial information are guaranteed.

| Technical Specification | Details |

|---|---|

| Algorithms | Advanced, proprietary algorithms for precise calculations. |

| Machine Learning | Incorporates ML for dynamic tax regulation updates. |

| Processing Speed | Lightning-fast, delivering results within seconds. |

| Scalability | Handles a wide range of users and scenarios. |

| Security | Data encryption and strict privacy standards. |

User Experience and Testimonials

The MD Income Tax Calculator has garnered widespread acclaim for its intuitive design and seamless user experience. Users praise its simplicity, stating that even those with limited tax knowledge can navigate the calculator with ease. The clear and concise instructions guide users through the process, ensuring a stress-free experience.

"I was dreading the thought of calculating my taxes, but the MD Income Tax Calculator made it a breeze," said one satisfied user. "The step-by-step guidance and real-time results gave me confidence in my calculations. It's a game-changer for anyone wanting to simplify their tax journey."

Another user highlighted the calculator's ability to provide instant feedback, saying, "I could experiment with different scenarios and see the impact on my tax liability immediately. It helped me make informed decisions and optimize my financial strategy."

These testimonials reflect the calculator's success in empowering users to take control of their tax obligations. With its user-centric design and precise calculations, the MD Income Tax Calculator has become an indispensable tool for Maryland residents and businesses.

User Testimonials

- "The calculator's simplicity and accuracy made tax season less daunting. I highly recommend it for anyone seeking a hassle-free tax experience."

- "I was impressed by how the calculator tailored its calculations to my unique situation. It's a powerful tool for optimizing tax strategies."

Future Implications and Updates

As tax laws continue to evolve, the MD Income Tax Calculator remains committed to staying at the forefront of these changes. The development team is dedicated to providing regular updates to ensure the calculator remains accurate and aligned with the latest tax regulations.

In the coming years, the calculator is set to incorporate even more advanced features. These include expanded deduction and credit options, enhanced reporting capabilities, and improved integration with tax preparation software. These enhancements will further empower users to navigate the complex world of income tax with confidence and precision.

The future of the MD Income Tax Calculator is bright, with ongoing development and a focus on user feedback. By staying ahead of the curve, the calculator will continue to be a trusted companion for Maryland residents and businesses, ensuring compliance and strategic financial planning.

Future Enhancements

- Advanced Features: Expanded deductions, improved reporting, and software integration.

- User-Centric Development: Ongoing improvements based on user feedback.

Conclusion: Empowering Your Financial Journey

The MD Income Tax Calculator is more than just a tax estimation tool; it's a powerful ally on your financial journey. With its precision, simplicity, and strategic insights, the calculator empowers you to navigate Maryland's tax landscape with confidence. Whether you're a tax novice or a seasoned professional, this calculator ensures you stay compliant, optimize your tax obligations, and plan for a prosperous future.

As you embrace the capabilities of the MD Income Tax Calculator, you'll discover a new level of financial freedom and control. With accurate calculations and strategic guidance, you can make informed decisions, maximize your savings, and achieve your financial goals. So, why wait? Start using the calculator today and unlock the full potential of your financial journey.

FAQ

Is the MD Income Tax Calculator free to use?

+Yes, the MD Income Tax Calculator is available to use free of charge. Our mission is to provide accessible and accurate tax information to all Maryland residents.

How often is the calculator updated with new tax regulations?

+The calculator is updated regularly to reflect the latest tax laws and regulations. Our team stays abreast of any changes to ensure accurate calculations.

Can I save my calculations for future reference?

+Absolutely! The calculator allows you to save your calculations and access them at any time. This feature is especially useful for tracking your tax liability over multiple years.

What if I have complex tax scenarios or specific questions?

+For complex tax situations or specific queries, we recommend consulting a tax professional. While the calculator provides accurate estimates, a tax expert can offer personalized advice tailored to your unique circumstances.

Is my personal information secure when using the calculator?

+Absolutely! We take data security seriously. All information entered into the calculator is encrypted and stored securely. Your privacy is our top priority.