Sales Tax New Jersey

Sales tax is an essential aspect of doing business in New Jersey, as it plays a crucial role in the state's revenue generation and impacts various industries and consumers alike. Understanding the intricacies of sales tax laws and regulations is vital for businesses operating within the state's borders. In this comprehensive guide, we will delve into the specifics of Sales Tax in New Jersey, covering everything from registration and collection processes to tax rates and compliance.

Navigating the Sales Tax Landscape in New Jersey

New Jersey’s sales tax system is governed by the Division of Taxation, which oversees the administration and enforcement of tax laws. The state’s sales tax regulations are designed to ensure a fair and efficient taxation process, benefiting both the government and businesses.

Sales Tax Registration

Any business entity engaging in taxable sales, leases, or rentals of tangible personal property or taxable services in New Jersey is required to register with the Division of Taxation. The registration process involves submitting the necessary forms and providing detailed information about the business’s activities and operations. Upon successful registration, the business will receive a Certificate of Authority, which serves as proof of their compliance with the state’s tax laws.

Taxable Transactions

New Jersey’s sales tax applies to a wide range of transactions, including the sale of goods, certain services, rentals, and leases. The state’s definition of taxable transactions is comprehensive and covers most commercial activities. However, it is crucial for businesses to understand the specific categories of taxable and exempt transactions to ensure proper tax compliance.

| Taxable Items | Examples |

|---|---|

| Tangible Personal Property | Clothing, electronics, vehicles, furniture |

| Services | Repairs, installations, legal services, consulting |

| Leases and Rentals | Real estate leases, equipment rentals, vehicle leases |

Certain items and services are exempt from sales tax, such as most groceries, prescription drugs, and certain medical devices. It is essential for businesses to stay updated with the latest tax regulations and exemptions to avoid any non-compliance issues.

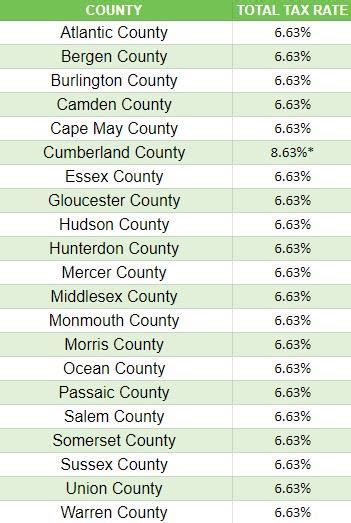

Sales Tax Rates

New Jersey operates with a single statewide sales tax rate, which is currently set at 6.625%. This rate applies uniformly across the state, making it easier for businesses to calculate and collect sales tax. However, it is important to note that certain jurisdictions within New Jersey may impose additional local taxes, resulting in a higher effective tax rate.

| Jurisdiction | Additional Tax Rate |

|---|---|

| Atlantic City | 3% |

| Atlantic County | 1% |

| Cape May County | 0.5% |

| Other Municipalities | Varies |

Businesses operating in multiple jurisdictions must be aware of these local tax rates and ensure accurate tax calculations for their customers. Failure to do so can result in penalties and negative customer experiences.

Sales Tax Collection and Remittance

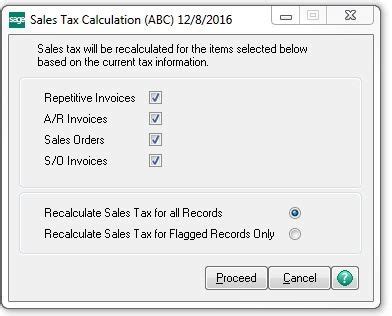

Businesses registered for sales tax in New Jersey are responsible for collecting the applicable tax from their customers at the point of sale. This includes both online and in-person transactions. The collected tax must then be remitted to the Division of Taxation on a regular basis, typically monthly or quarterly, depending on the business’s tax liability.

The remittance process involves submitting detailed tax returns, which provide a breakdown of the sales and tax collected during the specified period. Businesses must ensure accurate record-keeping and reporting to avoid discrepancies and potential audits.

Compliance and Penalties

Compliance with New Jersey’s sales tax regulations is critical for businesses to maintain their operational integrity and avoid legal consequences. The state’s tax authorities have robust enforcement mechanisms in place to ensure tax compliance.

Penalties for Non-Compliance

Businesses found to be non-compliant with sales tax regulations may face severe penalties, including fines, interest charges, and even criminal prosecution in extreme cases. The penalties are designed to deter tax evasion and encourage businesses to adhere to the state’s tax laws.

| Penalty Type | Description |

|---|---|

| Late Payment Penalty | A penalty of 5% of the unpaid tax for each month or part of a month that the tax remains unpaid, up to a maximum of 25%. |

| Failure to File Penalty | A penalty of $50 or 5% of the unpaid tax, whichever is greater, for each month or part of a month that a required tax return is not filed. |

| Interest Charges | Interest accrues on unpaid tax at a rate of 1% per month or fraction thereof. |

In addition to financial penalties, businesses may also face administrative actions, such as the suspension of their business licenses or the revocation of their sales tax registration.

Voluntary Disclosure Program

New Jersey offers a Voluntary Disclosure Program, which allows businesses to come forward and disclose any past non-compliance issues. By participating in this program, businesses can resolve their tax liabilities and avoid penalties. This program is particularly beneficial for businesses that have inadvertently made errors in their tax calculations or reporting.

Future Implications and Considerations

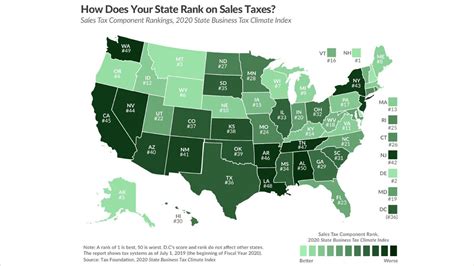

As the landscape of e-commerce and remote selling continues to evolve, New Jersey, like many other states, is navigating the challenges of taxing online transactions. The state’s tax authorities are actively exploring ways to ensure that online businesses, particularly those with a significant presence in the state, contribute to the tax base.

Remote Seller Nexus

New Jersey has established economic nexus standards, which determine when out-of-state sellers are required to register for and collect sales tax within the state. The current economic nexus threshold is $100,000 in annual sales or 200 separate transactions. This means that online sellers who meet these criteria must register for sales tax and comply with the state’s tax regulations.

Marketplace Facilitator Rules

The state has also implemented marketplace facilitator rules, which hold online marketplaces responsible for collecting and remitting sales tax on behalf of their third-party sellers. This ensures that even sellers who do not have a physical presence in New Jersey but sell through these marketplaces are subject to sales tax.

Online Sales Tax Compliance

For businesses engaging in online sales, it is crucial to have robust systems in place to accurately calculate and collect sales tax. This includes integrating tax calculation software into their e-commerce platforms and ensuring compliance with the state’s tax laws. Failure to do so may result in non-compliance issues and potential penalties.

Conclusion

Navigating the complexities of sales tax in New Jersey requires a thorough understanding of the state’s regulations and a commitment to compliance. By staying informed about the latest tax laws, registering for sales tax, and accurately collecting and remitting taxes, businesses can ensure a smooth and efficient tax process. Additionally, staying abreast of the evolving landscape of online sales tax compliance is essential for businesses to maintain their competitive edge and avoid any legal pitfalls.

Frequently Asked Questions

What are the current sales tax rates in New Jersey?

+

The statewide sales tax rate in New Jersey is 6.625%. However, certain jurisdictions may impose additional local taxes, resulting in a higher effective tax rate. It is essential for businesses to be aware of these local rates to ensure accurate tax calculations.

Are there any sales tax exemptions in New Jersey?

+

Yes, New Jersey offers sales tax exemptions for certain items and services. Exempt items include most groceries, prescription drugs, and certain medical devices. Businesses should stay updated with the latest exemptions to ensure proper tax compliance.

How often do businesses need to remit sales tax in New Jersey?

+

The frequency of sales tax remittance depends on the business’s tax liability. Typically, businesses with a higher tax liability are required to remit taxes monthly, while those with lower liabilities may remit taxes quarterly. It is important to consult the Division of Taxation for specific guidelines.

What are the consequences of non-compliance with sales tax regulations in New Jersey?

+

Non-compliance with sales tax regulations can result in severe penalties, including fines, interest charges, and potential criminal prosecution. Businesses may also face administrative actions, such as license suspensions or sales tax registration revocations. Compliance is crucial to avoid these consequences.

How can businesses stay updated with the latest sales tax regulations in New Jersey?

+

Businesses can stay informed by regularly visiting the official website of the New Jersey Division of Taxation. They should also subscribe to tax newsletters, follow industry associations, and consult tax professionals to ensure they are up-to-date with any changes in tax laws and regulations.