California Auto Sales Tax

In the Golden State, understanding the intricacies of the California Auto Sales Tax is crucial for both car buyers and sellers. This tax, levied on the sale or lease of vehicles, is a significant aspect of the state's revenue system. It's essential to navigate this process with clarity and accuracy to ensure compliance and avoid potential pitfalls.

California Auto Sales Tax: A Comprehensive Guide

The California Auto Sales Tax is a critical component of the state’s revenue generation, contributing substantially to its fiscal health. For car buyers, this tax is an essential consideration in the overall cost of purchasing a vehicle. On the other hand, car dealers and sellers must be well-versed in the intricacies of this tax to ensure smooth transactions and compliance with state regulations.

This comprehensive guide aims to demystify the California Auto Sales Tax, providing a deep dive into its structure, calculation, and implications. By the end of this article, readers should have a clear understanding of this tax, enabling them to make informed decisions when buying or selling vehicles in California.

Understanding the Structure of California Auto Sales Tax

The California Auto Sales Tax is a state-level tax, meaning it is imposed by the state government and applies uniformly across California. This tax is levied on the sale or lease of both new and used vehicles, including cars, trucks, motorcycles, and even recreational vehicles (RVs). The tax is calculated as a percentage of the vehicle’s purchase price, making it a straightforward and transparent process for both buyers and sellers.

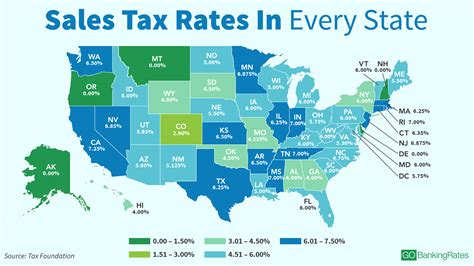

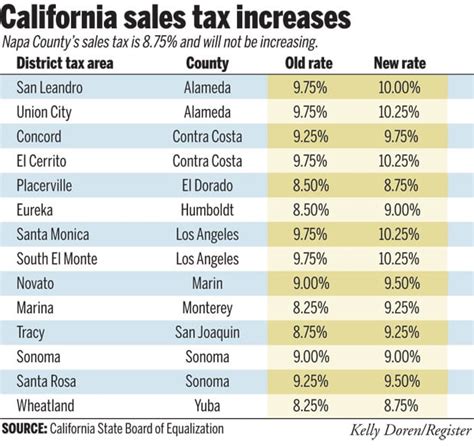

The current tax rate for the California Auto Sales Tax is set at 7.25% for most counties in the state. However, it's important to note that some counties in California have additional local sales taxes, which can increase the total sales tax rate for vehicle purchases. These local taxes can range from an additional 0.25% to 2.25%, bringing the total sales tax rate to between 7.50% and 9.50% in certain areas.

For instance, in the city of Los Angeles, the total sales tax rate for vehicle purchases is 10.25%, which includes the state tax rate of 7.25% and a local tax rate of 3%.

| County | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Los Angeles | 3% | 10.25% |

| Orange County | 1.25% | 8.5% |

| San Diego | 0.5% | 7.75% |

These local sales tax rates can significantly impact the overall cost of purchasing a vehicle, making it essential for buyers to be aware of these variations when budgeting for a new car.

Calculating California Auto Sales Tax: A Step-by-Step Guide

Calculating the California Auto Sales Tax is a straightforward process, thanks to its simple structure. Here’s a step-by-step guide to help you compute the sales tax on your vehicle purchase:

-

Determine the Purchase Price: Start by establishing the total purchase price of the vehicle. This should include the cost of the vehicle itself, as well as any additional fees or charges, such as dealer preparation fees or documentation fees.

-

Apply the State Sales Tax Rate: Multiply the purchase price by the state sales tax rate of 7.25%. This will give you the amount of state sales tax you owe.

-

Consider Local Sales Tax (if applicable): If you're purchasing the vehicle in a county with a local sales tax, you'll need to add this to the state sales tax. For instance, in Los Angeles, you would add an additional 3% to the state sales tax.

-

Total Sales Tax: Add the state sales tax and any local sales tax to determine the total sales tax amount. This is the amount you'll need to pay along with the purchase price of the vehicle.

For example, if you're purchasing a vehicle with a total cost of $30,000 in Los Angeles, the calculation would be as follows:

- State Sales Tax: $30,000 x 7.25% = $2,175

- Local Sales Tax (Los Angeles): $30,000 x 3% = $900

- Total Sales Tax: $2,175 + $900 = $3,075

So, in this scenario, you would need to pay a total of $3,075 in sales tax for your vehicle purchase, in addition to the $30,000 purchase price.

Exemptions and Special Cases: Navigating the Complexity

While the California Auto Sales Tax is generally straightforward, there are certain exemptions and special cases that buyers and sellers should be aware of. These exceptions can significantly impact the tax liability, so it’s crucial to understand them to avoid potential issues.

Vehicle Exclusions

Certain types of vehicles are excluded from the California Auto Sales Tax, meaning they are not subject to this tax. These include:

- Vehicles purchased for resale (dealer-to-dealer sales)

- Certain government-owned vehicles

- Vehicles purchased by qualifying non-profit organizations

- Vehicles purchased by out-of-state residents who are not domiciled in California

Taxable Amount Adjustments

In some cases, the taxable amount of a vehicle may be adjusted, impacting the sales tax owed. This can occur in the following situations:

-

Trade-Ins: When trading in an old vehicle as part of a new vehicle purchase, the trade-in value is subtracted from the purchase price of the new vehicle. The sales tax is then calculated on the net amount.

-

Sales Price Adjustments: If there is a dispute over the sales price or if the seller voluntarily reduces the sales price after the transaction, the sales tax may need to be recalculated based on the adjusted price.

Special Cases: Out-of-State Purchases

Purchasing a vehicle out of state and then bringing it into California can present unique tax considerations. In such cases, the vehicle may be subject to the California Use Tax, which is essentially the same as the sales tax but applies to out-of-state purchases.

The use tax is calculated in the same way as the sales tax, with the difference being that it is applied to the purchase price of the vehicle, rather than the sales price. This ensures that all vehicles used in California are taxed, regardless of where they were purchased.

Implications and Best Practices for Buyers and Sellers

Understanding the California Auto Sales Tax is not just about compliance; it’s also about making informed decisions and ensuring a smooth transaction process. Here are some key implications and best practices for both buyers and sellers to consider:

Implications for Buyers

For buyers, the California Auto Sales Tax is an essential component of the overall cost of purchasing a vehicle. By understanding this tax and factoring it into their budget, buyers can make more informed decisions about their vehicle purchases.

Additionally, being aware of the sales tax rates in different counties can help buyers choose the most cost-effective place to purchase their vehicle, especially if they are flexible about the location of their purchase.

It's also important for buyers to understand their rights and responsibilities when it comes to sales tax. For instance, buyers have the right to receive a clear and accurate breakdown of the sales tax on their purchase, and they should be vigilant about ensuring this information is provided by the seller.

Implications for Sellers

For sellers, the California Auto Sales Tax is a critical aspect of their business operations. Sellers must be well-versed in the tax laws to ensure compliance and avoid potential penalties. This includes understanding the tax rates, exemptions, and special cases, as outlined above.

Sellers should also be transparent about the sales tax with their customers, providing clear and accurate information about the tax breakdown. This not only helps build trust with customers but also ensures a smooth and efficient transaction process.

Furthermore, sellers should stay up-to-date with any changes to the sales tax laws or regulations to ensure they are always operating within the legal framework.

Best Practices for All Parties

Both buyers and sellers can benefit from the following best practices when navigating the California Auto Sales Tax:

-

Research: Conduct thorough research on the sales tax rates and any applicable local taxes before making a purchase or sale. This ensures that all parties have a clear understanding of the tax implications.

-

Documentation: Keep detailed records and documentation of all transactions, including the sales price, trade-in values (if applicable), and any adjustments to the sales price. This documentation can be crucial in case of an audit or dispute.

-

Communication: Open and transparent communication between buyers and sellers is essential. Both parties should be clear about the sales tax and its implications, ensuring there are no misunderstandings or surprises.

-

Compliance: Adhere to all state and local tax laws and regulations. This not only ensures legal compliance but also helps maintain a positive business reputation.

Future Implications and Potential Changes

The California Auto Sales Tax is subject to change, as tax laws and regulations can evolve over time. While it’s challenging to predict future changes with certainty, there are a few potential developments worth considering:

Potential Rate Adjustments

The state sales tax rate of 7.25% has been in effect since 1991, but it’s possible that this rate could be adjusted in the future. This could happen for a variety of reasons, such as changes in state revenue needs or shifts in the political landscape.

For instance, if the state faces a budget deficit, there could be pressure to increase the sales tax rate to generate more revenue. On the other hand, if the state is running a surplus, there may be calls to reduce the tax rate to stimulate economic growth.

Local Tax Variations

The local sales tax rates, which vary by county, are also subject to change. Local governments may choose to adjust these rates to meet their specific revenue needs or to align with local economic conditions.

For instance, a county experiencing rapid economic growth may choose to increase its local sales tax rate to fund infrastructure projects or other community initiatives. Conversely, a county facing economic challenges may opt to reduce its local sales tax rate to encourage economic activity.

Impact of Electric Vehicles (EVs)

The increasing popularity of electric vehicles (EVs) may also impact the California Auto Sales Tax in the future. Currently, EVs are subject to the same sales tax as traditional vehicles. However, as more people adopt EVs, there may be discussions around potential tax incentives or adjustments to encourage further EV adoption.

For instance, some states have implemented tax credits or rebates for EV purchases, which could potentially be adopted in California to promote the use of environmentally friendly vehicles.

Online Sales and Remote Transactions

With the rise of e-commerce and online marketplaces, there may be a need to address the tax implications of remote vehicle sales. Currently, the California Auto Sales Tax applies to in-state sales, but there could be discussions around extending this tax to online sales, particularly if a significant portion of vehicle purchases shift to online platforms.

Conclusion: Navigating the California Auto Sales Tax Landscape

The California Auto Sales Tax is a critical aspect of vehicle transactions in the state, impacting both buyers and sellers. By understanding the structure, calculation, and implications of this tax, individuals and businesses can make informed decisions and ensure compliance with state regulations.

As the tax landscape is subject to change, it's essential to stay informed about any potential adjustments or developments. By staying vigilant and proactive, buyers and sellers can navigate the California Auto Sales Tax landscape with confidence and ease.

What is the California Auto Sales Tax rate for my county?

+The California Auto Sales Tax rate can vary by county due to local sales taxes. To find the exact rate for your county, you can visit the California State Board of Equalization website, which provides a comprehensive list of sales tax rates by county.

Are there any exemptions or special cases for the California Auto Sales Tax?

+Yes, there are certain exemptions and special cases for the California Auto Sales Tax. These include vehicles purchased for resale (dealer-to-dealer sales), government-owned vehicles, vehicles purchased by qualifying non-profit organizations, and vehicles purchased by out-of-state residents who are not domiciled in California. It’s important to understand these exemptions to ensure compliance with the tax laws.

How does the California Auto Sales Tax work for online vehicle purchases?

+The California Auto Sales Tax applies to in-state sales, including online purchases. If you buy a vehicle online from a California-based seller, you are typically responsible for paying the sales tax to the seller. However, the exact process can vary depending on the online platform and the seller’s policies, so it’s important to clarify the tax implications before completing the purchase.

Can I negotiate the sales tax on my vehicle purchase?

+No, the California Auto Sales Tax is a legally mandated tax, and it cannot be negotiated. However, you can negotiate the sales price of the vehicle, which will directly impact the amount of sales tax you owe. Remember that the tax is calculated as a percentage of the sales price, so a lower sales price can result in a lower tax amount.

What happens if I don’t pay the California Auto Sales Tax on my vehicle purchase?

+Failing to pay the California Auto Sales Tax can have serious consequences. The state may impose penalties and interest on the unpaid tax, and you may also face legal repercussions. It’s important to pay the sales tax in a timely manner to avoid these issues and maintain compliance with state regulations.