Tax Rate Ma

Welcome to a comprehensive guide on the Tax Rates in the state of Massachusetts, commonly referred to as MA or Mass. This article aims to provide an in-depth analysis of the tax system in Massachusetts, covering various aspects that impact individuals, businesses, and investors. With its rich history and diverse economy, understanding the tax landscape of Massachusetts is crucial for making informed financial decisions.

Taxation in Massachusetts: A Comprehensive Overview

Massachusetts, known for its vibrant cities, educational institutions, and innovative industries, has a tax system that reflects its progressive nature. The state's tax policies play a significant role in shaping its economic landscape and contributing to its overall prosperity.

In this section, we will delve into the key components of the tax system in Massachusetts, exploring the various tax rates, types, and their implications. From income taxes to sales taxes and property taxes, we will provide a detailed breakdown to offer a clear understanding of the tax obligations within the state.

Income Tax: The Backbone of Massachusetts' Revenue

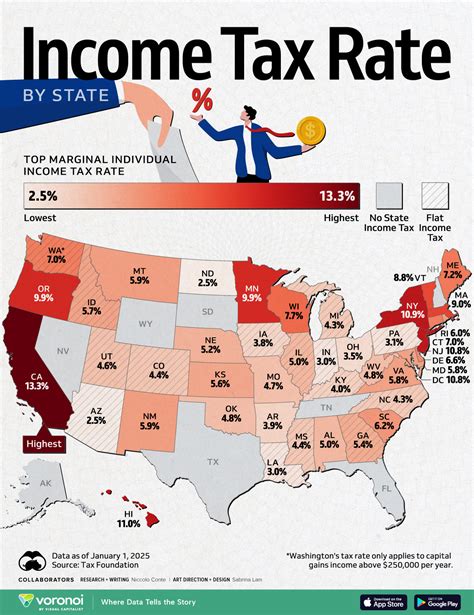

Massachusetts imposes an individual income tax on its residents and nonresidents earning income within the state. The income tax is a significant source of revenue for the state, contributing to its fiscal stability and the funding of essential services.

| Income Bracket | Tax Rate |

|---|---|

| Up to $15,000 | 5.05% |

| $15,001 - $25,000 | 5.05% |

| $25,001 - $49,999 | 5.05% |

| $50,000 - $99,999 | 5.05% |

| $100,000 - $150,000 | 5.10% |

| $150,001 and above | 5.10% |

It's important to note that Massachusetts also offers various tax credits and deductions to alleviate the tax burden on individuals. These incentives include the Personal Exemption Credit, Low-Income Tax Credit, and Property Tax Circuit Breaker, among others.

Sales and Use Tax: A Major Revenue Stream

Massachusetts imposes a sales and use tax on the sale or purchase of tangible personal property and certain services. This tax is a crucial revenue source for the state, covering a wide range of goods and services consumed within its borders.

As of my last update in 2023, the sales tax rate in Massachusetts is 6.25%, which is applicable to most retail sales, including clothing, electronics, and groceries (excluding most food items). However, it's essential to note that certain categories of goods and services are exempt from sales tax, such as prescription drugs and residential rents.

Additionally, Massachusetts has a use tax that applies to purchases made outside the state but used or consumed within Massachusetts. This tax ensures that individuals and businesses pay the appropriate tax on goods acquired from out-of-state vendors.

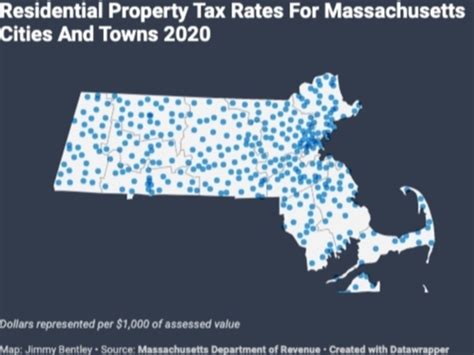

Property Tax: Local Assessments and Variations

Property taxes in Massachusetts are primarily assessed and collected at the local level, with rates varying across cities and towns. These taxes are a significant source of revenue for local governments, funding essential services such as education, public safety, and infrastructure maintenance.

The average property tax rate in Massachusetts is approximately 1.09% of a property's assessed value. However, it's crucial to understand that this rate can fluctuate significantly depending on the specific municipality. For instance, Boston, the state's largest city, has a property tax rate of 1.057%, while smaller towns like Belmont have a rate of 1.288%.

Property taxes in Massachusetts are based on the full and fair cash value of a property, which is determined through a comprehensive assessment process. This value is then multiplied by the local tax rate to calculate the annual property tax bill.

| City/Town | Property Tax Rate |

|---|---|

| Boston | 1.057% |

| Cambridge | 1.155% |

| Worcester | 1.13% |

| Springfield | 1.82% |

| Belmont | 1.288% |

| Newton | 1.17% |

Massachusetts also offers various property tax abatements and exemptions to eligible homeowners, such as the Homestead Exemption, which provides a reduction in property taxes for primary residences.

The Impact of Massachusetts' Tax System on Businesses and Investors

Massachusetts' tax policies have a significant influence on the business environment and investment opportunities within the state. Understanding these tax implications is crucial for entrepreneurs, investors, and businesses considering their options in the region.

Corporate Income Tax: Attracting and Supporting Businesses

Massachusetts imposes a corporate income tax on the net income of businesses operating within the state. This tax is a vital source of revenue for the state, contributing to its economic development and the funding of essential infrastructure projects.

The corporate income tax rate in Massachusetts is 8.8%, which applies to all taxable income of corporations. However, there are various tax incentives and credits available to businesses, such as the Research and Development Tax Credit and the High Technology Job Creation Incentive Program, aimed at encouraging innovation and job creation.

Massachusetts also offers a Business Enterprise Tax (BET) credit, which provides a credit against the BET for eligible businesses that meet specific criteria. This credit aims to support small businesses and promote economic growth.

Estate and Inheritance Taxes: Implications for Investors

Massachusetts imposes both estate taxes and inheritance taxes, which can have significant implications for investors and individuals with substantial assets within the state.

The Massachusetts estate tax is imposed on the transfer of property at the time of death. The tax is applicable to estates exceeding a certain threshold, which is subject to change based on federal and state regulations.

As of my last update, the Massachusetts estate tax exemption amount is $1 million, meaning estates valued below this threshold are not subject to the state's estate tax. However, it's crucial to note that this exemption amount is lower than the federal exemption, which stands at $11.7 million (as of 2022). This means that estates with a value between $1 million and $11.7 million may be subject to the Massachusetts estate tax but not the federal estate tax.

Additionally, Massachusetts imposes an inheritance tax, which is a tax on the transfer of property from a deceased individual to their beneficiaries. The tax rate for inheritance varies depending on the relationship between the decedent and the beneficiary.

| Relationship | Tax Rate |

|---|---|

| Spouse | 0% |

| Lineal Descendants (Children, Grandchildren) | 0% - 15% |

| Siblings | 12% |

| Other Relatives | 15% |

| Non-Relatives | 16% |

Investors and individuals with substantial assets in Massachusetts should carefully consider the impact of these taxes on their estate planning and financial strategies.

Tax Incentives and Strategies in Massachusetts

Massachusetts offers a range of tax incentives and strategies to promote economic growth, support businesses, and encourage investment. These incentives are designed to attract businesses, create jobs, and stimulate the state's economy.

Research and Development Tax Credits

Massachusetts provides Research and Development (R&D) tax credits to encourage businesses to invest in innovation and technological advancements. These credits can offset a portion of the corporate income tax liability for businesses engaged in qualifying R&D activities.

To be eligible for the R&D tax credit, businesses must meet specific criteria, such as conducting research that is technologically innovative, designed to eliminate uncertainty, and has a high probability of success.

The R&D tax credit in Massachusetts is a valuable incentive for businesses engaged in cutting-edge research, as it provides a financial boost to support their innovative endeavors.

Film and Digital Media Tax Credits

Massachusetts has implemented a Film and Digital Media Tax Credit program to attract film and media production to the state. This credit aims to boost the state's economy, create jobs, and promote Massachusetts as a vibrant media hub.

Eligible productions can receive a tax credit of up to 25% of their qualified production expenses incurred within Massachusetts. This credit is designed to offset a portion of the costs associated with film and media production, making the state an attractive destination for filmmakers and media companies.

Historic Rehabilitation Tax Credit

The Historic Rehabilitation Tax Credit in Massachusetts provides a financial incentive for the rehabilitation and restoration of historic properties. This credit aims to preserve the state's rich historical heritage while stimulating economic development.

Eligible projects can receive a 20% tax credit for qualified rehabilitation expenses incurred on historic buildings. This credit is applicable to both commercial and residential properties, encouraging the preservation and revitalization of Massachusetts' historic architecture.

Tax Increment Financing (TIF)

Massachusetts offers Tax Increment Financing (TIF) to support economic development projects in specific areas. TIF is a financing tool that allows municipalities to direct a portion of the increased property taxes generated by a development project back to the project's developer to offset their costs.

TIF can be a powerful incentive for developers, as it helps reduce the financial burden of development and encourages investment in targeted areas. This strategy has been successful in revitalizing urban centers and promoting economic growth in Massachusetts.

Future Outlook and Implications

The tax landscape in Massachusetts is subject to ongoing changes and developments, influenced by economic trends, political decisions, and societal needs. Understanding the future outlook and potential implications is crucial for individuals, businesses, and investors navigating the state's tax system.

Potential Tax Reforms and Their Impact

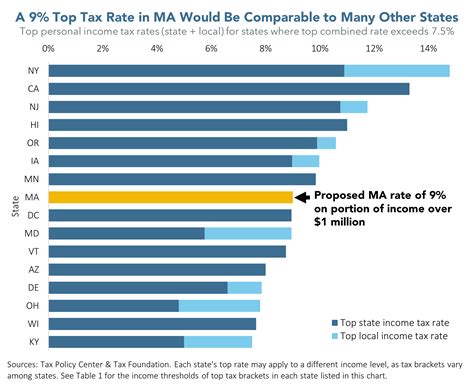

Massachusetts, like many states, is continuously evaluating its tax policies to ensure they align with the evolving needs of its residents and businesses. Proposed tax reforms often emerge from legislative discussions, aiming to address budgetary concerns, promote fairness, or stimulate economic growth.

For instance, there have been discussions about potential reforms to the personal income tax rates, with proposals to adjust the brackets and rates to provide tax relief to certain income levels. Additionally, proposals to expand or modify the tax base, such as including certain services or digital products under the sales tax, are also under consideration.

These potential reforms can have significant implications for individuals and businesses, affecting their tax liabilities and financial planning strategies. Staying informed about these discussions and their progress is essential for adapting to any future changes.

Economic Growth and Tax Revenue

The economic growth of Massachusetts plays a pivotal role in shaping its tax landscape. As the state's economy expands, tax revenues tend to increase, providing additional resources for essential services, infrastructure development, and social programs.

A robust economy attracts businesses and investors, leading to increased tax collections from corporate and personal income taxes, sales taxes, and property taxes. This influx of revenue allows the state to invest in education, healthcare, and other public services, ultimately contributing to the overall well-being of its residents.

However, economic downturns can present challenges, potentially impacting tax revenues and the state's ability to fund its obligations. Understanding the relationship between economic growth and tax revenue is crucial for forecasting and planning, ensuring the state's fiscal stability and sustainability.

Impact on Residents and Businesses

The tax policies in Massachusetts have a direct impact on its residents and businesses. For individuals, the tax system influences their disposable income, savings, and overall financial well-being. Higher taxes can reduce disposable income, while tax incentives and credits can provide relief and encourage specific behaviors, such as homeownership or investment.

Businesses, on the other hand, are influenced by the tax environment in their decision-making processes. Tax rates and incentives can impact their profitability, expansion plans, and choice of location. A favorable tax climate can attract businesses and encourage economic growth, while an unfavorable one may drive businesses to seek more tax-friendly jurisdictions.

Massachusetts' tax system, with its various rates, credits, and incentives, plays a crucial role in shaping the state's economic landscape and the lives of its residents. Understanding these dynamics is essential for individuals and businesses to make informed decisions and adapt to the ever-evolving tax landscape.

What is the sales tax rate in Massachusetts for 2024?

+As of my last update, the sales tax rate in Massachusetts is 6.25%. However, it’s important to note that tax rates and regulations can change, so it’s recommended to check with the Massachusetts Department of Revenue for the most current information.

Are there any tax incentives for renewable energy projects in Massachusetts?

+Yes, Massachusetts offers various tax incentives for renewable energy projects. These include the Renewable Energy Credit (REC) program, which provides financial incentives for the development and use of renewable energy sources. Additionally, there are tax exemptions and credits available for solar energy systems and other clean energy initiatives.

How often are property tax assessments conducted in Massachusetts?

+Property tax assessments in Massachusetts are typically conducted every three years. However, some cities and towns may have different assessment cycles. It’s recommended to check with your local assessor’s office for specific details regarding your property’s assessment schedule.

Are there any tax breaks for first-time homebuyers in Massachusetts?

+Yes, Massachusetts offers tax breaks for first-time homebuyers through the Homeowners