Palm Beach County Property Tax

Palm Beach County, located in the southeastern region of Florida, is renowned for its beautiful beaches, vibrant culture, and luxurious lifestyle. However, one aspect that often sparks curiosity and raises questions among residents and prospective homeowners is the property tax system. In this comprehensive guide, we delve into the intricacies of Palm Beach County's property tax landscape, shedding light on the assessment process, rates, exemptions, and strategies to navigate this essential financial consideration.

Understanding the Property Tax Assessment Process

Palm Beach County’s property tax assessment is a systematic process overseen by the Property Appraiser’s Office. Each year, this office evaluates the value of properties within the county, ensuring a fair and equitable tax system. The assessment takes into account various factors, including:

- Market Value: The appraiser considers the current market conditions and comparable property sales to determine the fair market value of each property.

- Improvements: Any enhancements made to the property, such as renovations or additions, are factored into the assessment.

- Neighborhood Factors: The location, amenities, and overall desirability of the neighborhood play a role in the assessment.

- Historical Data: Previous assessments and any changes in the property’s characteristics are analyzed to ensure accuracy.

The Property Appraiser’s Office utilizes advanced tools and technology to conduct these assessments, ensuring a transparent and consistent evaluation process.

The Impact of Assessment on Property Taxes

The assessed value of a property forms the basis for calculating property taxes. Here’s a simplified breakdown of the tax calculation:

- Assessment: The appraised value is determined, considering the factors mentioned earlier.

- Tax Rate: Palm Beach County, like other counties in Florida, operates with a millage rate, which is a tax rate per thousand dollars of assessed value. This rate is set by local governments, including the county, municipalities, and special districts.

- Tax Calculation: The assessed value is multiplied by the millage rate to arrive at the property’s annual tax liability.

It’s important to note that the millage rate can vary from one jurisdiction to another within the county, impacting the final tax amount.

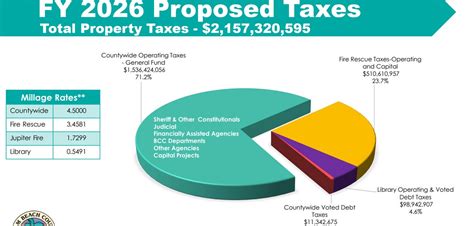

Palm Beach County Property Tax Rates

The property tax rates in Palm Beach County are influenced by several factors, including the location of the property and the services provided by local governments. As of the latest available data, the millage rates for various jurisdictions within the county are as follows:

| Jurisdiction | Millage Rate (per $1,000 of Assessed Value) |

|---|---|

| Palm Beach County | 6.5843 |

| West Palm Beach | 7.5238 |

| Boca Raton | 6.7572 |

| Delray Beach | 6.6975 |

| Jupiter | 7.4859 |

| Lake Worth Beach | 7.5736 |

| Palm Beach Gardens | 6.9263 |

Understanding the Variations

The differences in millage rates across jurisdictions within Palm Beach County can be attributed to the specific services and infrastructure provided by each local government. For instance, areas with higher millage rates may offer more extensive services, such as enhanced public safety, improved transportation infrastructure, or better recreational facilities.

Property Tax Exemptions and Relief Programs

Palm Beach County, in line with the state of Florida, offers several exemptions and relief programs to reduce the property tax burden on eligible homeowners. These initiatives aim to provide financial relief and promote homeownership.

Homestead Exemption

One of the most significant property tax exemptions in Florida is the Homestead Exemption. To qualify, a property must be:

- The primary residence of the homeowner.

- Owned and occupied by the homeowner as of January 1 of the tax year.

The Homestead Exemption provides a substantial reduction in the assessed value of the property, resulting in lower property taxes. The exemption amount varies based on the homeowner’s circumstances and the specific provisions of the Florida Constitution.

Additional Exemptions and Relief Programs

Beyond the Homestead Exemption, Palm Beach County and the state of Florida offer various other exemptions and relief programs, including:

- Senior Exemption: Eligible homeowners aged 65 or older may qualify for an additional exemption, further reducing their property taxes.

- Low-Income Senior Exemption: Seniors with limited income may be eligible for additional relief, ensuring their financial well-being.

- Disabled Veteran Exemption: Honorably discharged veterans with service-connected disabilities can receive an exemption, demonstrating the county’s support for its veterans.

- Widow/Widower Exemption: Spouses of deceased veterans may qualify for an exemption, providing continued support to military families.

- Special Assessment Reduction: Homeowners can apply for a reduction in assessments for certain improvements, such as solar energy systems or hurricane protection.

Strategies for Managing Property Taxes

Navigating the property tax landscape in Palm Beach County requires a strategic approach. Here are some tips to consider:

- Stay Informed: Keep yourself updated on the assessment process, tax rates, and any changes in legislation that may impact your property taxes. The Property Appraiser’s Office provides valuable resources and guidance.

- Understand Your Exemptions: Familiarize yourself with the exemptions and relief programs you may be eligible for. Consult with a tax professional or the Property Appraiser’s Office to ensure you’re maximizing your benefits.

- Review Your Assessment: Regularly review your property assessment for accuracy. If you believe the assessed value is incorrect, you can appeal the assessment through the Property Appraiser’s Office.

- Explore Tax Relief Options: Research and explore additional tax relief programs offered by the state or local governments. These programs can provide further financial relief, especially for low-income or special-needs homeowners.

- Plan for the Future: Consider the long-term implications of property taxes when making financial decisions. Whether it’s investing in home improvements or planning for retirement, understanding the tax landscape is crucial.

The Future of Property Taxes in Palm Beach County

As Palm Beach County continues to thrive and evolve, the property tax system is expected to adapt and change. Here are some key considerations for the future:

- Population Growth: The county’s population is projected to increase, bringing new residents and homeowners. This growth may impact the demand for services and, consequently, the millage rates.

- Infrastructure Development: As the county invests in infrastructure improvements, such as road expansions, public transportation, and green initiatives, the tax base may need to adapt to support these endeavors.

- Economic Shifts: Economic fluctuations and changes in the real estate market can influence property values and, by extension, property taxes. Staying vigilant about these shifts is essential for homeowners.

- Legislative Changes: The state and local governments may introduce new legislation or amendments to the tax system. Staying informed about these changes ensures homeowners can adapt their financial strategies accordingly.

Conclusion

Palm Beach County’s property tax system is a dynamic and essential aspect of homeownership in the region. By understanding the assessment process, tax rates, and available exemptions, homeowners can make informed decisions and navigate the financial landscape with confidence. As the county continues to thrive, staying updated on the evolving tax landscape will be crucial for long-term financial planning.

How often are property assessments conducted in Palm Beach County?

+Property assessments in Palm Beach County are conducted annually as part of the regular tax assessment cycle. The Property Appraiser’s Office evaluates properties each year to ensure accurate and up-to-date assessments.

Can I appeal my property assessment if I disagree with the value assigned to my property?

+Absolutely! If you believe your property’s assessed value is incorrect, you have the right to appeal. The Property Appraiser’s Office provides a formal appeals process, allowing homeowners to present their case and seek a fair assessment.

Are there any online resources available to estimate my property taxes in Palm Beach County?

+Yes, the Property Appraiser’s Office offers an online tax estimator tool. This user-friendly platform allows homeowners to input their property details and estimate their annual property taxes based on the current millage rates.

What happens if I miss the deadline to apply for a property tax exemption or relief program?

+Missing the deadline may result in the loss of exemption benefits for the current tax year. However, it’s essential to note that some exemptions and relief programs have grace periods or allow for late applications under specific circumstances. It’s advisable to consult with the Property Appraiser’s Office for guidance.