Shelby County Land Tax

The Shelby County Land Tax is a crucial aspect of property ownership and local governance in the United States, particularly within the vibrant community of Shelby County, Tennessee. This tax, levied on real estate properties, plays a significant role in funding essential public services and infrastructure development, impacting both residents and businesses alike. Understanding the intricacies of the Shelby County Land Tax is vital for property owners and investors, as it influences financial planning, tax strategies, and overall economic growth in the region.

Understanding the Shelby County Land Tax

The Shelby County Land Tax, often referred to as the property tax, is an ad valorem tax, meaning it is calculated based on the assessed value of the property. This tax is an essential revenue source for Shelby County, contributing to the maintenance and improvement of various public facilities and services, such as schools, roads, public safety, and recreational areas.

Tax Assessment Process

The assessment of land and property values in Shelby County is conducted by the Shelby County Assessor’s Office. This office employs certified assessors who determine the fair market value of each property through a systematic evaluation process. The assessment takes into account various factors, including the property’s location, size, improvements, and recent sales data of comparable properties.

| Assessment Factors | Description |

|---|---|

| Location | The property's address and neighborhood influence its value. |

| Size | Land and building square footage impact the overall valuation. |

| Improvements | Upgrades, renovations, and additions affect the property's assessed value. |

| Comparable Sales | Recent sales of similar properties provide valuable market data. |

Property owners in Shelby County receive a notice of assessment each year, detailing the estimated fair market value of their property. This assessment is a critical step in the tax calculation process, as it forms the basis for determining the land tax liability.

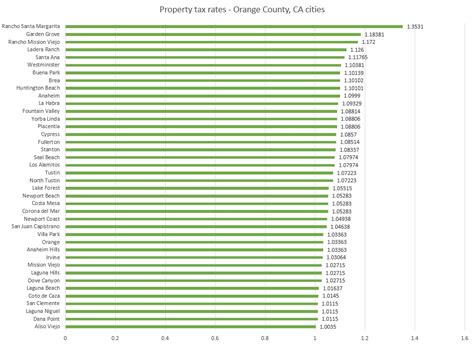

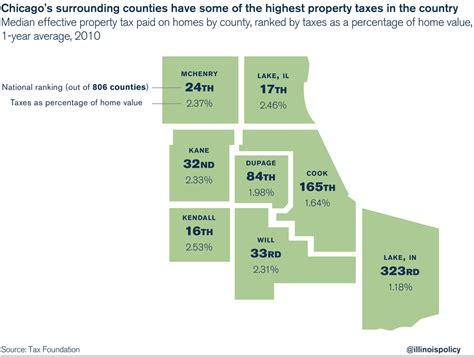

Tax Rate Structure

The Shelby County Land Tax is levied at a certain rate per $100 of assessed property value. This rate, known as the tax rate or millage rate, is set annually by the Shelby County Commission, taking into account the county’s budget requirements and the need to fund various public services. The tax rate can vary across different areas of the county, reflecting the unique needs and characteristics of each region.

| Tax Rate Structure | Rate per $100 of Assessed Value |

|---|---|

| Countywide Tax Rate | Varies annually |

| City-Specific Tax Rates | May differ for incorporated cities within Shelby County |

The tax rate structure ensures that property owners contribute proportionally to the county's financial obligations, with higher-valued properties bearing a greater tax burden. This progressive approach to taxation aims to maintain fairness and balance in the distribution of tax responsibilities.

The Impact on Property Owners

The Shelby County Land Tax has a direct and significant impact on property owners, influencing their financial decisions and long-term planning. Here are some key aspects to consider:

Tax Liability and Payment

Property owners in Shelby County are responsible for paying the land tax based on the assessed value of their property and the applicable tax rate. The tax liability is typically due annually, and failure to pay on time can result in penalties and interest charges. It is essential for property owners to budget for this expense and ensure timely payment to avoid any legal consequences.

Strategies for Tax Optimization

Property owners can employ various strategies to optimize their tax liability. One effective approach is to review the annual assessment notice carefully and identify any discrepancies or errors in the property’s valuation. By disputing inaccurate assessments, property owners can potentially lower their tax burden. Additionally, understanding the tax rate structure and comparing it with other counties can provide insights into the competitiveness of Shelby County’s tax rates.

Another strategy is to explore tax incentives and exemptions offered by Shelby County. These incentives, such as the homestead exemption for primary residences or tax abatements for certain types of properties, can reduce the overall tax liability. Property owners should stay informed about these opportunities and take advantage of them to minimize their tax obligations.

The Role of Real Estate Professionals

Real estate professionals, including agents and brokers, play a crucial role in helping property owners navigate the complexities of the Shelby County Land Tax. They can provide valuable insights into the local real estate market, property values, and potential tax implications. Working with experienced professionals can assist property owners in making informed decisions, whether it’s buying, selling, or managing properties in Shelby County.

Performance Analysis and Future Outlook

The Shelby County Land Tax system has demonstrated effectiveness in funding essential public services and infrastructure development. Over the years, the county has successfully allocated tax revenues to support various initiatives, including:

- Improving the county's road network and transportation infrastructure.

- Enhancing public safety measures and emergency response capabilities.

- Upgrading educational facilities and supporting quality education.

- Developing recreational spaces and promoting community well-being.

Looking ahead, the future of the Shelby County Land Tax system appears promising. The county's commitment to fiscal responsibility and efficient tax administration ensures that the tax revenue is utilized effectively to address the evolving needs of the community. With a focus on sustainable development and community engagement, Shelby County is well-positioned to continue providing high-quality public services while maintaining a competitive tax environment.

Conclusion

The Shelby County Land Tax is a vital component of the local economy, supporting the growth and development of the community. Property owners, investors, and residents alike have a vested interest in understanding this tax system, as it directly impacts their financial planning and the overall well-being of the region. By staying informed, engaging with real estate professionals, and actively participating in community initiatives, individuals can contribute to the continued success and prosperity of Shelby County.

How often is the Shelby County Land Tax assessed and paid?

+The Shelby County Land Tax is typically assessed and paid annually. Property owners receive an assessment notice, and the tax liability is due within a specified timeframe, usually with the option to pay in installments.

Are there any tax incentives or exemptions available in Shelby County?

+Yes, Shelby County offers various tax incentives and exemptions. These include the homestead exemption for primary residences, tax abatements for certain commercial properties, and incentives for renewable energy installations. It’s beneficial to explore these options to potentially reduce tax liability.

How can property owners dispute their land tax assessment?

+Property owners can dispute their land tax assessment if they believe it is inaccurate or unfair. The process typically involves submitting a formal appeal to the Shelby County Assessor’s Office, providing evidence to support their claim. It is advisable to seek professional guidance during the appeal process.

What happens if a property owner fails to pay the land tax on time?

+Late payment of the Shelby County Land Tax can result in penalties and interest charges. In severe cases, the county may place a lien on the property, which could eventually lead to foreclosure if the tax liability remains unresolved. It is crucial to prioritize timely tax payments to avoid these consequences.

How does the Shelby County Land Tax compare to other counties in Tennessee?

+The Shelby County Land Tax varies compared to other counties in Tennessee. Some counties may have lower tax rates, while others may have higher rates depending on their budgetary needs and the services they provide. It is essential to research and compare tax rates when considering property ownership in different counties.