New York State Tax Return Refund

As tax season approaches, one of the most anticipated outcomes for many New York residents is the potential refund they may receive from their state tax returns. The process of filing taxes and understanding the refund system can be complex, but with the right information and guidance, it can be a straightforward and rewarding experience. This comprehensive guide aims to demystify the process of claiming a refund on your New York State tax return, providing valuable insights and practical tips to ensure a smooth and successful journey.

Understanding the New York State Tax Return Process

New York State imposes a progressive income tax on its residents, which means the tax rate increases as income levels rise. The state tax return process involves declaring your annual income, deductions, and credits to calculate the amount of tax owed or the refund due. The New York State Department of Taxation and Finance is responsible for collecting and processing tax returns, and they offer a range of resources to assist taxpayers in navigating the system.

One of the key advantages of filing your New York State tax return electronically is the potential for a faster refund. The state's e-filing system is designed to process returns more efficiently, and it often results in quicker refund deposits compared to traditional paper filing methods.

Key Tax Rates and Thresholds

The New York State income tax structure is divided into several brackets, each with its own tax rate. As of the 2023 tax year, these brackets and rates are as follows:

| Tax Rate | Income Range |

|---|---|

| 4% | Up to 8,900</td></tr> <tr><td>4.5%</td><td>8,900.01 to 11,950</td></tr> <tr><td>5.25%</td><td>11,950.01 to 13,900</td></tr> <tr><td>5.9%</td><td>13,900.01 to 22,000</td></tr> <tr><td>6.45%</td><td>22,000.01 to 161,550</td></tr> <tr><td>6.85%</td><td>Over 161,550 |

It's important to note that these tax rates are subject to change, so it's advisable to refer to the latest tax guidelines issued by the New York State Department of Taxation and Finance for the most accurate information.

Eligibility for Refunds

To be eligible for a refund on your New York State tax return, you must have overpaid your taxes throughout the year. This overpayment could occur due to various reasons, such as:

- Withholding too much tax from your wages or salaries.

- Making estimated tax payments that exceed your actual tax liability.

- Claiming deductions or credits that reduce your taxable income.

If you believe you may be eligible for a refund, it's crucial to ensure that you have all the necessary documentation and information to support your claim. This includes accurate records of your income, expenses, deductions, and any relevant tax forms.

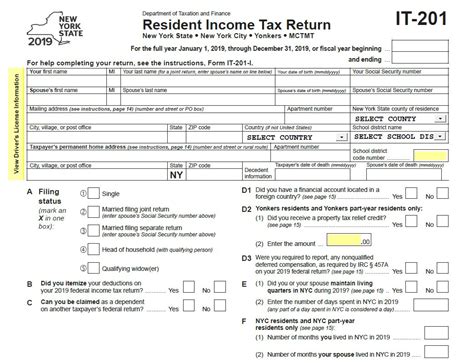

Filing Your New York State Tax Return

The process of filing your New York State tax return involves several key steps, each of which is crucial to ensuring an accurate and timely refund. Here’s a step-by-step guide to help you navigate this process:

Step 1: Gather Your Documents

Before you begin filing your tax return, it’s essential to collect all the necessary documents. These typically include:

- W-2 forms from all your employers, showing your wages, salaries, and withheld taxes.

- 1099 forms if you received any income from investments, dividends, or other sources.

- Records of any deductions or credits you plan to claim, such as medical expenses, charitable donations, or education-related expenses.

- Documentation of any other income or deductions not covered by the above, such as unemployment compensation or rental income.

Step 2: Choose Your Filing Method

New York State offers two primary methods for filing your tax return: electronic filing and paper filing. Here’s a brief overview of each:

- Electronic Filing: This method allows you to file your return online using approved software or through the state’s website. It’s generally faster and more secure, and you can often track the status of your refund easily. Most taxpayers opt for this method due to its convenience and efficiency.

- Paper Filing: If you prefer a more traditional approach, you can file your tax return by mail using the appropriate forms. This method may take longer, and you’ll need to ensure that your return is complete and accurate to avoid processing delays.

Regardless of the method you choose, it's important to carefully review your return before submitting it to ensure its accuracy. This can help prevent potential delays or audits in the future.

Step 3: Calculate Your Refund

Once you’ve gathered your documents and chosen your filing method, it’s time to calculate your refund. This process involves:

- Determining your taxable income by subtracting any deductions and credits from your total income.

- Applying the appropriate tax rates to your taxable income to calculate the total tax owed.

- Subtracting the total tax owed from the amount of tax you’ve already paid (through withholding or estimated payments) to determine your refund amount.

Various online tax calculators and software can assist you in this process, ensuring accuracy and ease of use. It's advisable to double-check your calculations to avoid any errors that could impact your refund.

Step 4: Submit Your Return

After calculating your refund, it’s time to submit your tax return. If you’re filing electronically, simply follow the prompts on the software or website to complete the process. If you’re filing by paper, carefully fill out the appropriate forms and ensure that all required information is included. Double-check your return for accuracy before mailing it to the designated address.

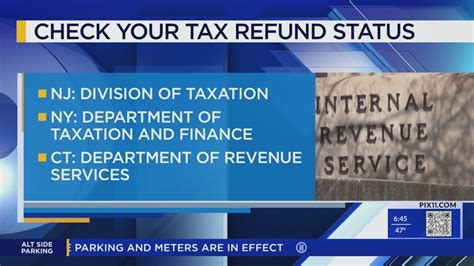

Step 5: Track Your Refund

Once you’ve submitted your tax return, you can track the status of your refund using the New York State Department of Taxation and Finance’s online refund tracker. This tool provides real-time updates on the progress of your refund, allowing you to stay informed and plan your finances accordingly.

If you haven't received your refund within the expected timeframe, it's advisable to contact the Department of Taxation and Finance to inquire about the status. They can provide further guidance and assistance if your refund is delayed or if there are any issues with your return.

Maximizing Your New York State Tax Refund

While the process of filing your tax return and claiming a refund is straightforward, there are several strategies you can employ to maximize your refund and ensure you’re taking advantage of all available deductions and credits.

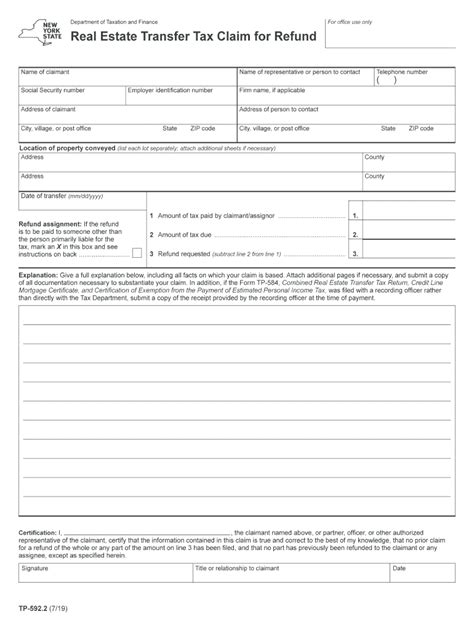

Claiming Deductions and Credits

New York State offers a range of deductions and credits that can reduce your taxable income and increase your refund. Some of the most common deductions and credits include:

- Standard Deduction: This is a fixed amount that reduces your taxable income. The standard deduction amount varies based on your filing status and is adjusted annually for inflation.

- Personal Exemptions: New York State allows you to claim personal exemptions for yourself and your dependents, further reducing your taxable income.

- Itemized Deductions: If your eligible expenses exceed the standard deduction, you may choose to itemize your deductions. This includes expenses such as medical costs, state and local taxes, mortgage interest, and charitable contributions.

- Education Credits: New York State offers several education credits, including the Tuition Credit and the New York State Tax Credit for College Tuition and Fees, which can significantly reduce your tax liability if you or your dependents are enrolled in higher education.

- Child and Dependent Care Credit: If you incur expenses for childcare or dependent care, you may be eligible for this credit, which can help offset the cost of these services.

It's important to carefully review your eligibility for these deductions and credits and ensure that you claim them accurately on your tax return. This can often make a significant difference in the size of your refund.

Optimizing Your Withholding

Another strategy to maximize your refund is to ensure that your tax withholding throughout the year aligns with your actual tax liability. If you’ve had too much tax withheld from your wages or salaries, you may be entitled to a larger refund. Conversely, if you’ve had too little withheld, you may owe additional taxes when you file your return.

To optimize your withholding, you can use the IRS Withholding Calculator or consult with a tax professional to ensure that the right amount of tax is being withheld from your paychecks. This can help prevent surprises at tax time and ensure that you're not overpaying or underpaying your taxes.

Exploring Tax Credits

In addition to deductions, New York State offers a range of tax credits that can further reduce your tax liability. Some of the most notable credits include:

- Child and Dependent Care Credit: This credit, as mentioned earlier, can help offset the cost of childcare or dependent care expenses, making it easier to manage the financial burden of these services.

- Property Tax Credit: If you own a home in New York State, you may be eligible for a property tax credit, which can reduce the amount of tax you owe based on the property taxes you’ve paid.

- Veterans’ Credits: New York State offers several tax credits for veterans, including the Veterans’ Exemption, which provides a reduction in property taxes for eligible veterans.

- Elderly and Disabled Homeowners’ Exemption: This credit provides a reduction in property taxes for elderly or disabled homeowners who meet certain income and residency requirements.

By claiming these credits on your tax return, you can further reduce your tax liability and potentially increase your refund. It's important to carefully review your eligibility for these credits and ensure that you have the necessary documentation to support your claims.

Common Issues and Solutions

While the process of filing your New York State tax return and claiming a refund is generally straightforward, there are some common issues that taxpayers may encounter. Here’s a look at some of these issues and potential solutions:

Filing Status Confusion

One of the most common issues taxpayers face is determining their correct filing status. Your filing status can significantly impact your tax liability and the deductions and credits you’re eligible for. The primary filing statuses in New York State are:

- Single: This status applies to unmarried individuals who don’t qualify for another status.

- Married Filing Jointly: This status is for married couples filing a joint return.

- Married Filing Separately: Married couples who choose to file separate returns fall under this status.

- Head of Household: This status is for unmarried individuals who maintain a household for a qualifying person, such as a dependent parent or child.

- Qualifying Widow(er): This status is for individuals who are widowed and have a dependent child or other qualifying person.

If you're unsure of your filing status, it's advisable to consult with a tax professional or use online tools provided by the IRS or the New York State Department of Taxation and Finance to help you determine the correct status.

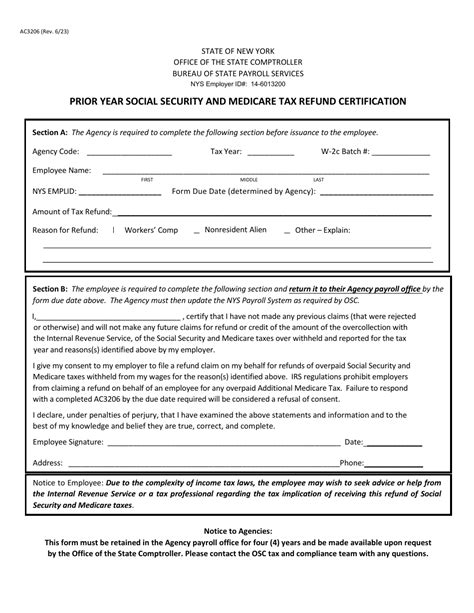

Overpayment and Underpayment

Overpaying or underpaying your taxes can lead to issues when it comes time to file your return. If you’ve overpaid your taxes, you’re entitled to a refund, but if you’ve underpaid, you may owe additional taxes.

To avoid these issues, it's crucial to carefully calculate your tax liability throughout the year and adjust your withholding or estimated payments accordingly. This can help ensure that you're not left with a large tax bill at the end of the year or that you don't overpay and miss out on a potential refund.

Errors in Documentation

Errors in your tax documentation can lead to delays in processing your return or even trigger an audit. Common errors include:

- Incorrect social security numbers.

- Mismatched names and social security numbers.

- Math errors in calculating taxable income or tax liability.

- Missing or incomplete forms.

- Incorrectly claiming deductions or credits.

To avoid these errors, it's essential to carefully review your tax return before submitting it. Double-check all your personal information, social security numbers, and calculations to ensure accuracy. If you're unsure about any aspect of your return, consult with a tax professional or use online resources to verify your calculations and claims.

Future Implications and Planning

Understanding the process of claiming a refund on your New York State tax return is not only beneficial for the current tax year but can also help you plan for the future. By familiarizing yourself with the system and strategies for maximizing your refund, you can make more informed financial decisions and optimize your tax liability in the years to come.

Long-Term Financial Planning

The strategies you employ to maximize your refund can also be applied to your long-term financial planning. For instance, if you consistently claim certain deductions or credits, you can plan your financial activities around these to optimize your tax liability year after year. This could involve strategic contributions to retirement accounts, careful management of medical expenses, or planning for education-related expenses to take advantage of available credits.

Additionally, by understanding the impact of your filing status and tax rates, you can make more informed decisions about your career, family, and lifestyle. For example, if you're considering marriage or having children, understanding the tax implications of these life events can help you plan your finances more effectively.

Preparing for Future Tax Years

The process of filing your tax return and claiming a refund can also provide valuable insights into your financial situation. By analyzing your tax return and the factors that contribute to your refund, you can identify areas where you may be overpaying taxes and make adjustments to reduce your tax liability in future years.

For instance, if you consistently receive a large refund, it may indicate that you're having too much tax withheld from your paychecks. By adjusting your withholding, you can ensure that you're not giving the government an interest-free loan and can instead use that money throughout the year for other financial goals.

On the other hand, if you consistently owe taxes when you file your return, it may be a sign that you need to increase your withholding or make estimated tax payments to avoid penalties and interest. Understanding these dynamics can help you better manage your finances and ensure that you're not caught off guard at tax time.

Staying Informed on Tax Changes

The tax landscape is constantly evolving, with new laws, regulations, and deductions being introduced or phased out. Staying informed on these changes is crucial to ensuring that you’re taking advantage of all available opportunities and not missing out on potential savings.

The New York State Department of Taxation and Finance and the IRS regularly publish updates and guides on tax changes. By staying informed on these changes, you can adjust your financial strategies accordingly and ensure that you're compliant with the latest tax laws.

Additionally, consulting with a tax professional or using online resources can help you stay abreast of tax changes and understand how they may impact your specific financial situation. This can help you make informed decisions and plan your finances more effectively.

Conclusion

Claiming a refund on your New York State tax return can be a rewarding process, providing you with a financial boost and insights into your tax liability. By understanding the process, maximizing your deductions and credits, and staying informed on tax changes, you can ensure a smooth and successful journey through the tax season.

Remember, the key to a successful tax refund is preparation, accuracy, and staying informed. By following the steps outlined in this guide and seeking professional advice when needed, you can navigate the New York State tax system with confidence and optimize your financial outcomes.

When is the deadline for filing my New York State tax return?

+The deadline for filing your New York State tax return is typically aligned with the federal tax deadline, which is typically April 15th of each year. However, this deadline may be extended in certain circumstances, such as during a natural disaster or other emergencies. It’s advisable to check the official website of the New York State Department of Taxation and