Scc Property Tax Payment

Property taxes are an essential component of a well-functioning society, as they contribute significantly to the funding of various public services and infrastructure. In this comprehensive guide, we will delve into the world of property tax payments, focusing specifically on the Scc Property Tax system. Understanding how to navigate and manage property taxes efficiently is crucial for both homeowners and businesses. By the end of this article, you will have a thorough understanding of the Scc Property Tax Payment process, including its history, calculation methods, payment options, and strategies for effective management.

Understanding the Scc Property Tax System

The Scc Property Tax system is a robust and comprehensive framework designed to assess and collect taxes on real estate properties within a specific jurisdiction. It plays a vital role in generating revenue for local governments, which in turn use these funds to provide essential services such as education, healthcare, public safety, and infrastructure development. The system is carefully structured to ensure fairness and transparency, taking into account various factors that influence property values.

The history of the Scc Property Tax system dates back to [year], when it was first implemented to replace the previous tax assessment methodology. This transition aimed to introduce a more modern and accurate approach to property valuation, considering not only the physical characteristics of the property but also its location, market trends, and potential for development. Over the years, the system has evolved to keep pace with changing market dynamics and technological advancements.

Key Components of the Scc Property Tax System

The Scc Property Tax system consists of several critical components that work together to ensure a fair and efficient tax assessment and collection process. These components include:

- Assessment Process: This is the first step, where professional assessors evaluate the properties within the jurisdiction. They consider factors such as size, location, improvements, and recent sales data to determine the property’s assessed value.

- Tax Rate Calculation: Once the assessed value is determined, it is subjected to a specific tax rate, which is set by the local government. This rate is usually expressed as a percentage and varies depending on the jurisdiction and the type of property.

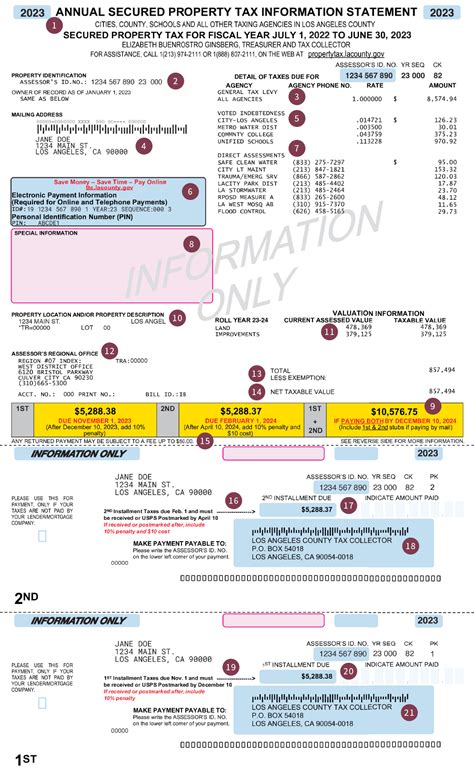

- Tax Bills: After the assessment and tax rate calculation, property owners receive tax bills detailing the amount they owe for the current tax year. These bills include important information such as the assessed value, tax rate, and the due date for payment.

- Payment Options: Scc Property Tax offers various payment options to cater to different preferences and circumstances. Property owners can choose to pay their taxes in full by the due date or opt for installment plans, which allow them to spread the payment over multiple months.

- Penalty and Interest: Late payments often incur penalties and interest charges, which are designed to encourage timely payments and ensure a steady revenue stream for the local government.

Calculating Scc Property Taxes

Understanding how Scc Property Taxes are calculated is essential for property owners to accurately assess their financial obligations and plan their budgets accordingly. The calculation process involves a series of steps, each contributing to the final tax amount.

Assessing Property Value

The first step in calculating property taxes is to determine the assessed value of the property. This value is influenced by various factors, including:

- Market Value: The current market value of the property is a significant determinant of its assessed value. Assessors consider recent sales of similar properties in the area to establish a fair market value.

- Physical Characteristics: The size, age, condition, and any improvements made to the property also play a role in its valuation. For instance, a newly renovated property with modern amenities may have a higher assessed value than a similar-sized property in need of repairs.

- Location: The property’s location is crucial, as properties in desirable neighborhoods or areas with better infrastructure and amenities tend to have higher assessed values.

- Assessor’s Discretion: Assessors have the authority to make adjustments based on their professional judgment, taking into account unique features or circumstances that may impact the property’s value.

To ensure fairness and accuracy, the assessment process often involves a combination of automated valuation models, on-site inspections, and comparisons with similar properties. Property owners have the right to appeal their assessed value if they believe it is inaccurate or unfair.

Applying the Tax Rate

Once the assessed value is determined, the tax rate comes into play. The tax rate is set by the local government and is typically expressed as a percentage of the assessed value. For instance, if the tax rate is 1.5%, a property with an assessed value of 500,000 would owe 7,500 in property taxes.

It's important to note that the tax rate may vary depending on the type of property. For example, residential properties might have a different tax rate than commercial or industrial properties. Additionally, some jurisdictions may offer tax incentives or exemptions for certain properties, such as those used for agricultural purposes or owned by non-profit organizations.

Calculating Additional Fees and Charges

In addition to the basic property tax, there may be other fees and charges included in the final tax bill. These can include:

- Special Assessments: These are charges imposed by local governments to fund specific projects or improvements, such as road construction or sewer system upgrades. Special assessments are typically tied to the property and may be paid over multiple years.

- Milling Rates: Milling rates are adjustments made to the tax rate to account for changes in property values over time. They ensure that the tax burden is distributed fairly among property owners, preventing sudden increases in taxes for some while others remain relatively unaffected.

- Penalty and Interest: As mentioned earlier, late payments can result in additional charges. Penalties are often calculated as a percentage of the unpaid tax amount, while interest accumulates over time until the payment is made.

Payment Options and Strategies

Scc Property Tax offers a range of payment options to accommodate different financial situations and preferences. Understanding these options can help property owners choose the most suitable method for their circumstances.

Full Payment

The most straightforward payment option is to pay the full amount of the property tax by the due date specified on the tax bill. This option is often preferred by those who have the financial means and want to avoid the administrative burden of installment plans or potential late fees.

To facilitate full payment, Scc Property Tax provides various payment methods, including online payments through secure platforms, in-person payments at designated tax offices, and payment by mail using a provided remittance slip. Property owners should ensure they have the correct tax bill and follow the instructions carefully to avoid any processing delays.

Installment Plans

For property owners who prefer to spread their tax payments over a longer period, installment plans are a convenient option. These plans allow taxpayers to divide their total tax liability into multiple payments, typically due at regular intervals throughout the year. The number of installments and the payment schedule may vary depending on the jurisdiction and the taxpayer’s preference.

Installment plans are especially beneficial for individuals or businesses with limited cash flow or those who want to align their tax payments with their income streams. By paying in installments, taxpayers can avoid the burden of a large, one-time payment and manage their finances more effectively.

Electronic Payment Options

Scc Property Tax offers a range of electronic payment options to provide convenience and flexibility to taxpayers. These options include:

- Online Payments: Property owners can make secure online payments using their credit or debit cards. This method is often preferred for its speed and ease of use, as it eliminates the need for physical visits to tax offices or the risk of lost mail.

- Automated Clearing House (ACH) Transfers: ACH transfers allow taxpayers to authorize their bank to transfer funds directly to the tax authority. This option is convenient for those who prefer automatic payments and want to avoid potential delays associated with manual transactions.

- Mobile Apps: Scc Property Tax has developed user-friendly mobile applications that enable taxpayers to access their tax information, view payment history, and make payments directly from their smartphones. These apps often provide real-time updates and notifications, ensuring taxpayers stay informed about their tax obligations.

Payment Strategies for Tax Management

Effective tax management requires careful planning and strategic decision-making. Here are some strategies property owners can employ to optimize their tax payments:

- Budgeting: Create a detailed budget that accounts for your property tax obligations. This helps you allocate funds accordingly and ensures you have sufficient financial resources to make timely payments.

- Explore Tax Relief Programs: Research and take advantage of any tax relief programs or incentives offered by the local government. These programs may provide reductions in property taxes for eligible individuals, such as senior citizens, veterans, or low-income households.

- Monitor Market Trends: Stay informed about the real estate market in your area. Understanding market trends can help you anticipate potential changes in property values, which may impact your future tax obligations. This knowledge can assist in financial planning and budgeting.

- Seek Professional Advice: If you have complex financial circumstances or require personalized tax advice, consider consulting a tax professional or financial advisor. They can provide expert guidance tailored to your specific situation, ensuring you make the most suitable tax-related decisions.

The Future of Scc Property Tax Payments

As technology continues to advance and digital transformation shapes various industries, the future of Scc Property Tax Payments looks set to become even more streamlined and efficient. Here are some potential developments and trends to watch out for:

Digital Transformation

The integration of digital technologies into the property tax payment process is already underway, and this trend is expected to accelerate. Online platforms and mobile apps will likely become the primary channels for taxpayers to access their tax information, make payments, and interact with tax authorities.

Digital transformation offers numerous benefits, including improved efficiency, reduced administrative burdens, and enhanced transparency. Taxpayers can expect faster processing times, real-time updates, and more secure transactions. Additionally, digital platforms can provide personalized dashboards and tools to help taxpayers track their payments, view tax history, and receive timely reminders.

Data Analytics and AI

Advanced data analytics and artificial intelligence (AI) technologies are poised to play a significant role in the future of property tax assessments and payments. AI-powered systems can analyze vast amounts of data, including historical property sales, market trends, and demographic information, to make more accurate and efficient assessments.

By leveraging AI, tax authorities can identify patterns, detect anomalies, and ensure fair and consistent tax assessments. This technology can also assist in identifying potential tax evasion or underreporting, leading to more effective tax collection and revenue generation.

Blockchain Technology

Blockchain, the technology behind cryptocurrencies like Bitcoin, has the potential to revolutionize the property tax payment process. Blockchain offers enhanced security, transparency, and immutability, making it an attractive solution for secure and tamper-proof transactions.

In the future, property tax payments could be made using blockchain-based digital currencies, ensuring faster and more secure transactions. Additionally, blockchain technology can facilitate smart contracts, which can automatically trigger tax payments based on predefined conditions, reducing the risk of late payments and associated penalties.

Improved Taxpayer Experience

As technology advances, the focus on enhancing the taxpayer experience will become increasingly important. Tax authorities will prioritize user-friendly interfaces, intuitive navigation, and seamless integration of various payment methods. The goal will be to make the tax payment process as simple and convenient as possible, minimizing the time and effort required from taxpayers.

Additionally, tax authorities may explore innovative ways to provide personalized support and assistance to taxpayers. This could include chatbots, virtual assistants, or dedicated customer service teams equipped with advanced tools to resolve queries and provide guidance quickly and efficiently.

Conclusion

The Scc Property Tax Payment system is a critical component of local government revenue generation, funding essential public services and infrastructure. Understanding the assessment process, tax calculation methods, and payment options is crucial for property owners to manage their tax obligations effectively.

As technology continues to shape the future of property tax payments, we can expect increased efficiency, transparency, and convenience. Digital transformation, data analytics, and blockchain technology will play significant roles in streamlining the process, ensuring fair assessments, and providing an improved taxpayer experience.

By staying informed about the latest developments and employing strategic tax management techniques, property owners can navigate the Scc Property Tax system with confidence, ensuring timely payments and contributing to the well-being of their communities.

What happens if I miss the property tax payment deadline?

+Missing the property tax payment deadline can result in penalties and interest charges. It is essential to stay informed about the due dates and make timely payments to avoid additional costs. If you anticipate difficulties in meeting the deadline, it is advisable to contact the tax authority and explore available options, such as installment plans or payment extensions.

Are there any tax relief programs available for property owners?

+Yes, many jurisdictions offer tax relief programs to support specific groups of taxpayers. These programs may include property tax exemptions or reductions for senior citizens, veterans, low-income households, or properties used for certain purposes, such as agriculture or non-profit organizations. It is recommended to research and explore these programs to determine your eligibility.

Can I appeal my property’s assessed value if I believe it is incorrect?

+Absolutely! If you believe that your property’s assessed value is inaccurate or unfair, you have the right to appeal the assessment. The process typically involves submitting an appeal application, providing supporting documentation, and potentially attending a hearing. It is important to gather evidence and seek professional advice to strengthen your case.

How can I stay informed about changes to the Scc Property Tax system and upcoming deadlines?

+Staying informed is crucial for effective tax management. You can subscribe to official newsletters or notifications from the tax authority, follow their social media accounts, or visit their website regularly for updates. Additionally, consider signing up for tax-related news alerts or joining local community forums where taxpayers share relevant information.