Collin County Property Taxes

Collin County, located in the vibrant region of Texas, is renowned for its thriving communities, diverse economy, and, as a homeowner or prospective buyer, you'll undoubtedly encounter the topic of property taxes. These taxes are an essential part of the local economy and can significantly impact your financial planning. In this comprehensive guide, we will delve into the intricacies of Collin County property taxes, providing you with the knowledge to make informed decisions and navigate the tax landscape with confidence.

Understanding Collin County’s Property Tax System

Collin County, like many counties in Texas, operates on a robust property tax system that funds various essential services, including schools, emergency services, infrastructure, and local government operations. The property tax system is a crucial revenue source for the county, and it’s important to understand how it works to manage your financial obligations effectively.

Assessment and Valuation Process

The journey of property taxes in Collin County begins with the appraisal process. The Collin Central Appraisal District (CCAD) is responsible for determining the value of each property within the county. This value, known as the appraised value, serves as the basis for calculating property taxes.

The CCAD employs a systematic approach, considering factors such as location, size, improvements, and recent sales of similar properties. They perform a thorough assessment annually, ensuring that the appraised value reflects the current market conditions.

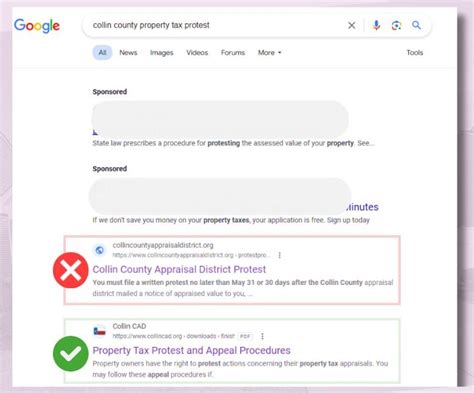

Homeowners have the right to appeal their property’s appraised value if they believe it is inaccurate or unfair. The CCAD provides guidelines and a clear process for such appeals, ensuring transparency and fairness in the valuation process.

Tax Rates and Calculations

Once the appraised value is established, the property tax rate comes into play. The tax rate is set by various taxing entities within the county, including the county government, school districts, cities, and special districts. These entities determine their tax rates based on their budget requirements and the need to fund specific services.

To calculate your property taxes, you multiply the appraised value of your property by the tax rate. For instance, if your property has an appraised value of 300,000 and the tax rate is 2%, your property taxes would amount to 6,000. This calculation provides a clear understanding of your financial obligation to the county.

| Taxing Entity | Tax Rate (per $100 of Value) |

|---|---|

| Collin County | 0.3795 |

| City of Plano | 0.6596 |

| Plano ISD | 1.5097 |

Payment Options and Deadlines

Collin County offers various options for property tax payments, providing flexibility to homeowners. The most common methods include online payment through secure platforms, mail-in payments, and in-person payments at designated locations. The county strives to make the payment process convenient and accessible.

Property taxes are due annually, typically by January 31st. However, if you miss the deadline, the county provides a grace period until February 1st, after which penalties and interest may apply. It’s crucial to stay informed about the payment schedule to avoid any financial repercussions.

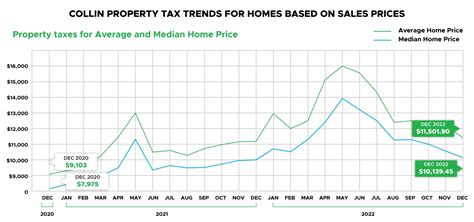

Exploring Property Tax Trends in Collin County

Understanding the historical and current trends in property taxes is essential for financial planning and investment decisions. Collin County has experienced significant growth and development over the years, which has influenced its property tax landscape.

Historical Perspective

Collin County has witnessed a steady increase in property values over the past decade. This appreciation has led to higher appraised values, resulting in increased property tax revenues for the county. The growth in the technology sector, coupled with the county’s attractive amenities and school districts, has attracted new residents and businesses, further fueling the real estate market.

While the rising property values benefit the county’s economy, they also impact homeowners’ tax obligations. It’s crucial to stay informed about the county’s economic trends to anticipate potential changes in property tax rates and values.

Current Market Conditions

As of the most recent data, the median home value in Collin County stands at $368,600, reflecting a robust real estate market. The county’s diverse economy, excellent schools, and high quality of life continue to attract homebuyers, driving property values upwards.

This trend has implications for property taxes, as higher values often result in increased tax obligations. Homeowners should stay updated on the county’s market conditions to understand how these changes may affect their financial plans.

Comparative Analysis

When comparing Collin County’s property taxes to other regions in Texas and beyond, it’s evident that the county offers a competitive tax landscape. While the tax rates may vary across different areas within the county, they generally align with or are slightly higher than the state average.

The county’s commitment to providing essential services and maintaining a high quality of life for its residents is reflected in these tax rates. Additionally, the county’s efficient tax collection processes and transparent valuation system contribute to a positive overall tax experience.

Strategies for Effective Property Tax Management

Navigating the property tax landscape can be challenging, but with the right strategies, you can optimize your financial planning and minimize potential burdens.

Stay Informed and Engage

Keeping yourself informed about Collin County’s property tax system is crucial. Attend local government meetings, stay updated on tax rate changes, and engage with the county’s tax offices. This active involvement ensures you’re aware of any upcoming changes and can plan accordingly.

Additionally, stay connected with your community and fellow homeowners. Sharing experiences and insights can provide valuable perspectives on tax-related matters and potential strategies for optimization.

Understand Exemptions and Deductions

Collin County offers various exemptions and deductions that can reduce your property tax obligations. These include exemptions for senior citizens, disabled veterans, and homeowners with certain income levels. Understanding these exemptions and ensuring you meet the eligibility criteria can provide significant financial relief.

Consult with the Collin County Tax Office or a tax professional to explore all available options and ensure you take advantage of any applicable deductions or exemptions.

Consider Payment Plans and Assistance Programs

If you anticipate difficulty in meeting your property tax obligations, Collin County provides payment plans and assistance programs to ease the financial burden. These programs offer flexible payment options and may include deferred payment plans or interest-free installments.

By taking advantage of these programs, you can manage your property taxes more effectively and avoid any potential penalties or interest charges.

Conclusion: A Comprehensive Approach to Property Taxes

Understanding and managing property taxes in Collin County is a critical aspect of financial planning and homeownership. By delving into the intricacies of the tax system, staying informed about trends, and employing effective strategies, you can navigate the property tax landscape with confidence.

As Collin County continues to thrive and develop, its property tax system remains a vital component of the local economy. By staying engaged and proactive, homeowners can ensure they meet their financial obligations while enjoying the benefits of living in this vibrant and dynamic county.

What is the average property tax rate in Collin County?

+The average effective property tax rate in Collin County is approximately 2.16%, which is slightly higher than the Texas state average of 1.86%.

Are there any ways to reduce my property taxes in Collin County?

+Yes, Collin County offers various exemptions and deductions that can reduce your property tax obligations. These include homestead exemptions, senior citizen exemptions, and disabled veteran exemptions. Consulting with the Collin County Tax Office or a tax professional can help you identify and apply for any applicable exemptions.

How can I stay updated on property tax changes in Collin County?

+Staying informed about property tax changes in Collin County is crucial. You can visit the official websites of the Collin County Tax Office and the Collin Central Appraisal District (CCAD) for the latest information. Additionally, local news outlets and community forums often provide updates on tax-related matters. Attending public meetings and engaging with local government representatives can also keep you informed about any upcoming changes.