San Antonio Tx Sales Tax

Welcome to the comprehensive guide on San Antonio, Texas's sales tax! In this article, we will delve into the intricacies of sales tax in the vibrant city of San Antonio, providing you with an in-depth understanding of the tax rates, exemptions, and the impact it has on businesses and consumers alike. As one of the most popular destinations in Texas, San Antonio boasts a thriving economy and a unique blend of culture and commerce, making it an essential topic for any business owner or consumer to grasp.

Understanding San Antonio’s Sales Tax Landscape

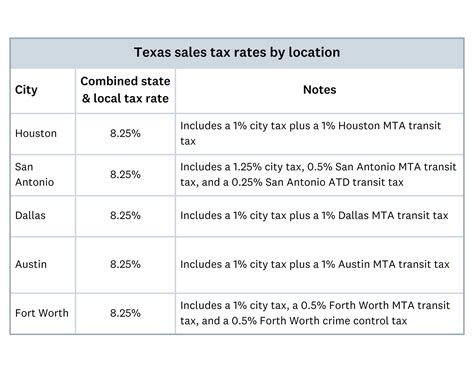

San Antonio, like many other cities in Texas, operates under a combined sales tax system, which includes both state and local tax rates. This means that when you make a purchase in San Antonio, you are subject to multiple layers of taxation, each serving a specific purpose.

As of 2023, the state sales tax rate in Texas stands at 6.25%, which is applied uniformly across the state. However, San Antonio, being a bustling metropolitan area, has its own local sales tax on top of the state rate. This local sales tax is set at 1.25%, bringing the total combined sales tax rate in San Antonio to 7.5%.

| Sales Tax Component | Rate |

|---|---|

| State Sales Tax | 6.25% |

| Local Sales Tax (San Antonio) | 1.25% |

| Total Combined Sales Tax Rate | 7.5% |

It's important to note that while the state sales tax rate remains constant, local sales tax rates can vary across different cities and counties within Texas. This variation allows local governments to raise funds for specific projects or services, such as infrastructure development or public transportation.

Impact on Businesses

For businesses operating in San Antonio, understanding the sales tax landscape is crucial for accurate financial planning and compliance. The sales tax rate directly affects the prices of goods and services offered to consumers, impacting revenue generation and profitability.

Businesses must ensure they are collecting the correct sales tax from customers and remitting it to the appropriate tax authorities. Failure to comply with sales tax regulations can result in penalties and legal consequences. To navigate this complex process, many businesses choose to utilize accounting software or consult tax professionals to streamline their sales tax obligations.

Consumer Perspective

From a consumer standpoint, being aware of the sales tax rate in San Antonio is essential for budgeting and understanding the true cost of purchases. While the sales tax may seem like a minor addition to the final bill, it can significantly impact the overall expenditure, especially for larger purchases or frequent shopping.

Consumers should also be aware of any applicable sales tax exemptions in San Antonio. Certain items, such as groceries, prescription drugs, and some types of clothing, may be exempt from sales tax, offering savings to consumers. Additionally, special sales tax holidays, like the Back-to-School Sales Tax Holiday, provide an opportunity for consumers to save on essential purchases without paying sales tax.

Sales Tax Exemptions and Special Cases

While the standard sales tax rate applies to most goods and services, Texas and San Antonio offer certain exemptions to alleviate the tax burden on specific items and promote economic growth.

Exemptions for Groceries and Necessities

One notable exemption in San Antonio is the tax-exempt status of most grocery items. This means that when you purchase groceries, including food staples and non-prepared food items, you won’t pay the standard sales tax. This exemption is a significant relief for households, especially those with tight budgets, as it reduces the cost of essential food purchases.

However, it's important to note that certain grocery items, such as soft drinks, candy, and prepared foods, are subject to sales tax. So, while your weekly grocery haul may not be taxed, that bottle of soda or your favorite snack might carry the standard sales tax rate.

Sales Tax Holidays

Texas, including San Antonio, occasionally offers sales tax holidays to encourage consumer spending and provide relief during specific times of the year. These holidays typically occur around major shopping events like back-to-school season or during holiday sales.

During a sales tax holiday, certain categories of items are exempt from sales tax for a limited time. For instance, the Back-to-School Sales Tax Holiday allows shoppers to purchase school supplies, clothing, and even computers without paying sales tax, making it an excellent opportunity to save on essential back-to-school items.

Online Sales and Remote Sellers

In today’s digital age, online sales have become a significant portion of the retail market. San Antonio, like other cities, has regulations in place for remote sellers, ensuring that sales tax is collected on online purchases as well.

Economic Nexus and Sales Tax Collection

Texas has adopted the concept of economic nexus, which means that out-of-state sellers with a certain level of sales or transactions in the state are required to collect and remit sales tax. This ensures that even online retailers with no physical presence in San Antonio contribute to the local tax revenue.

Remote sellers must register with the Texas Comptroller's office and collect sales tax based on the destination of the sale, which in this case would be San Antonio's sales tax rate. This process ensures a level playing field for local businesses and maintains fairness in the tax system.

Marketplace Facilitator Rules

San Antonio, along with Texas, also has regulations for marketplace facilitators, which are online platforms that facilitate the sale of goods by third-party sellers. These facilitators, such as popular e-commerce platforms, are responsible for collecting and remitting sales tax on behalf of the sellers.

By holding marketplace facilitators accountable, San Antonio ensures that sales tax is collected and paid on online purchases, even when the seller themselves may not have a physical presence in the city. This simplifies the tax collection process for both consumers and sellers, making online shopping more transparent and compliant.

Sales Tax Compliance and Enforcement

San Antonio, in collaboration with the Texas Comptroller’s office, takes sales tax compliance seriously. The city has robust systems in place to ensure businesses and remote sellers are meeting their sales tax obligations.

Audit Processes and Penalties

The Texas Comptroller’s office conducts regular audits to verify the accuracy of sales tax collections and remittances. These audits can be triggered by various factors, including random selection, tips or complaints, or suspected non-compliance.

If a business is found to be non-compliant, it may face penalties and interest charges on the outstanding sales tax. These penalties can be substantial and can have a significant impact on a business's financial health. Therefore, it's crucial for businesses to maintain accurate records and stay informed about their sales tax obligations.

Sales Tax Registration and Permits

To operate legally and collect sales tax in San Antonio, businesses must obtain the necessary permits and registrations. The Texas Comptroller’s office provides a streamlined process for businesses to register for sales tax permits online, making it convenient for new and existing businesses to comply with tax regulations.

Additionally, businesses must display their sales tax permit information visibly at their place of business, ensuring transparency and ease of access for customers and tax authorities.

The Future of Sales Tax in San Antonio

As San Antonio continues to thrive and grow, its sales tax landscape is likely to evolve as well. The city’s dynamic economy and diverse population create a unique environment for tax policies and regulations.

Potential Changes and Considerations

While it’s challenging to predict specific changes, there are a few trends and considerations that may influence the future of sales tax in San Antonio:

- The continued growth of e-commerce and online sales may lead to further refinement of economic nexus rules, ensuring fair tax collection for both online and brick-and-mortar businesses.

- The increasing focus on sustainability and environmental initiatives may result in the exploration of eco-friendly sales tax exemptions or incentives, encouraging consumers to make more environmentally conscious choices.

- As technology advances, San Antonio may leverage digital solutions for sales tax compliance, making the process more efficient and streamlined for businesses and consumers.

- The city's commitment to infrastructure development and public transportation may influence future sales tax allocations, with potential increases to fund specific projects.

Staying Informed

To navigate the ever-changing landscape of sales tax in San Antonio, it’s essential for businesses and consumers to stay informed about any updates or changes. The Texas Comptroller’s website is an invaluable resource, providing real-time information on tax rates, exemptions, and compliance guidelines.

Additionally, subscribing to newsletters or following relevant industry publications can keep you up-to-date with the latest tax news and ensure you're prepared for any upcoming changes.

Frequently Asked Questions (FAQ)

What is the sales tax rate for San Antonio, Texas in 2023?

+The total combined sales tax rate in San Antonio for 2023 is 7.5%, which includes a state sales tax rate of 6.25% and a local sales tax rate of 1.25%.

Are there any sales tax exemptions in San Antonio for specific items?

+Yes, San Antonio exempts most grocery items from sales tax. Additionally, there are sales tax holidays for certain categories of items, such as the Back-to-School Sales Tax Holiday.

How do online sales and remote sellers impact sales tax in San Antonio?

+Online sales are subject to sales tax in San Antonio. Remote sellers with economic nexus in the state must collect and remit sales tax based on the destination of the sale.

What happens if a business is found to be non-compliant with sales tax regulations in San Antonio?

+Non-compliant businesses may face penalties and interest charges on outstanding sales tax. Regular audits are conducted by the Texas Comptroller’s office to ensure compliance.

Where can I find the latest information on sales tax rates and regulations in San Antonio?

+The Texas Comptroller’s website is the official source for up-to-date information on sales tax rates, exemptions, and compliance guidelines in San Antonio and across Texas.