Is Car Insurance Tax Deductible

When it comes to personal finances and tax obligations, many individuals wonder whether car insurance costs can be deducted from their taxable income. This is a valid question, as understanding the deductibility of expenses is crucial for optimizing tax strategies. In this comprehensive guide, we will delve into the intricacies of car insurance and its tax implications, providing expert insights and real-world examples to clarify this important financial aspect.

Understanding Car Insurance and Tax Deductibility

Car insurance is a vital financial safeguard for vehicle owners, offering protection against various risks such as accidents, theft, and liability claims. While it is a necessary expense, the question of tax deductibility arises when considering personal tax obligations. Let’s explore the nuances of this topic and shed light on the factors that determine whether car insurance premiums can be claimed as tax deductions.

The Basics of Tax Deductibility

To comprehend the tax deductibility of car insurance, it’s essential to grasp the fundamental concept of tax deductions. Tax deductions are expenses that can be subtracted from an individual’s taxable income, thereby reducing the overall tax liability. These deductions are a means to provide financial relief and encourage certain activities or investments. However, not all expenses qualify for tax deductions, and specific criteria must be met for an expense to be considered deductible.

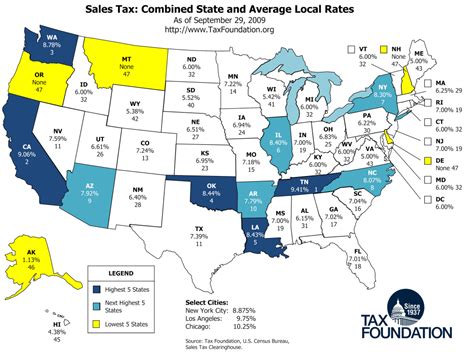

In the context of car insurance, the deductibility depends on several factors, including the purpose of the insurance coverage, the type of policy, and the individual's personal circumstances. It is important to note that tax laws and regulations vary across jurisdictions, so it's crucial to consult with a tax professional or refer to official guidelines specific to your region.

Business vs. Personal Use

One of the primary factors determining the tax deductibility of car insurance is the purpose for which the vehicle is used. If a vehicle is primarily used for business purposes, such as in the case of self-employed individuals, small business owners, or company-owned vehicles, the insurance premiums may be considered a legitimate business expense and, thus, tax-deductible.

For instance, imagine a freelance photographer who uses their car to travel to client locations and attend photoshoots. The insurance premiums for their vehicle can be claimed as a business expense, as it is directly related to their income-generating activities. This deduction can significantly reduce the photographer's taxable income, making it a valuable financial strategy.

On the other hand, if a vehicle is primarily used for personal purposes, such as commuting to work, running errands, or leisure travel, the insurance premiums are generally not tax-deductible. This is because personal expenses are typically not considered deductible unless specifically outlined in the tax code.

Vehicle Ownership and Registration

Another aspect to consider is the ownership and registration of the vehicle. In some cases, the deductibility of car insurance may be influenced by whether the vehicle is owned by the individual or leased. For instance, if a business owner leases a vehicle and includes insurance coverage in the lease agreement, the insurance premiums may be treated as a business expense and deducted accordingly.

Additionally, the registration status of the vehicle can impact deductibility. In certain jurisdictions, vehicles registered for business purposes may be eligible for specific tax benefits, including insurance deductions. It is crucial to review the applicable tax laws and regulations to determine the deductibility based on vehicle ownership and registration.

Specific Circumstances and Exceptions

While the general rule is that personal car insurance premiums are not tax-deductible, there are specific circumstances and exceptions that may apply. These exceptions often arise when the vehicle is used for charitable or volunteer work, or when it is directly related to certain tax-deductible activities.

For example, if an individual volunteers for a non-profit organization and uses their personal vehicle for transportation during volunteer activities, the insurance premiums for those specific trips may be considered tax-deductible. This exception is typically granted to encourage and support charitable endeavors.

Furthermore, if an individual is involved in an accident and incurs medical expenses, those expenses may be deductible, and in some cases, the insurance premiums related to the accident could also be considered as part of the deductible medical expenses. It is essential to consult with a tax professional to understand the specific circumstances and exceptions that may apply in your situation.

Navigating Tax Deductions for Car Insurance

Now that we have explored the fundamental aspects of car insurance tax deductibility, let’s delve deeper into the practical steps and considerations for maximizing potential deductions.

Record-Keeping and Documentation

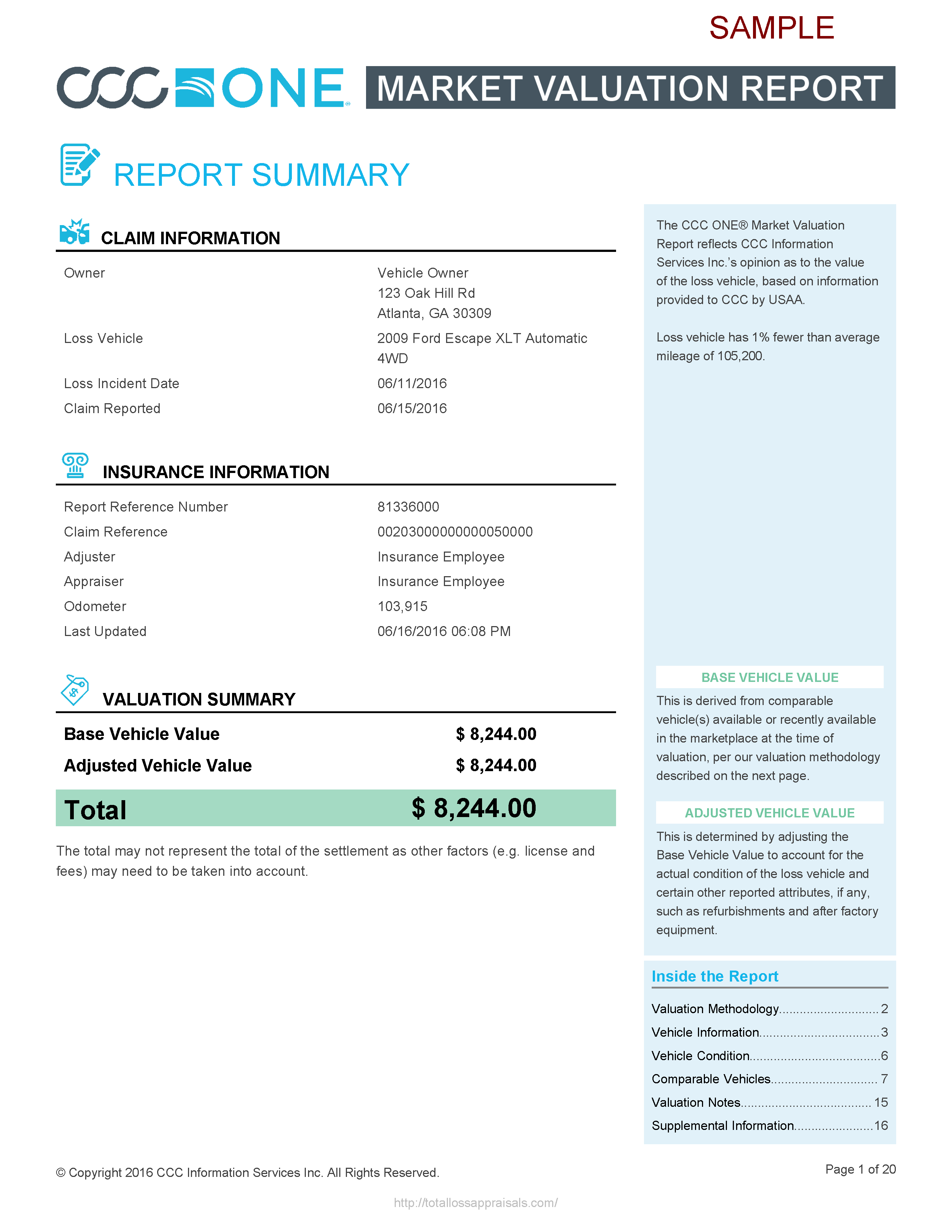

Maintaining thorough records and documentation is crucial when claiming tax deductions for car insurance. This includes keeping track of insurance premium payments, policy details, and any relevant receipts or statements. Proper record-keeping ensures that you have the necessary evidence to support your deductions during tax filing.

It is advisable to create a dedicated folder or digital storage system for all insurance-related documents. This practice not only simplifies the process of retrieving information but also helps in organizing your financial records for future reference. Additionally, consider using accounting software or spreadsheets to track your insurance expenses throughout the year.

Business Mileage and Expense Tracking

If your vehicle is used for business purposes, accurately tracking mileage and expenses is essential for maximizing tax deductions. Many jurisdictions allow deductions based on the percentage of miles driven for business versus personal use. To take advantage of these deductions, it is crucial to maintain a detailed log of business miles traveled.

Consider using a mileage tracking app or a simple notebook to record the dates, locations, and purposes of your business trips. This information will not only help in claiming insurance deductions but also in calculating other potential business expense deductions, such as fuel costs and vehicle maintenance.

Consulting with Tax Professionals

Given the complexity of tax laws and the potential variations across different jurisdictions, consulting with a tax professional is highly recommended when navigating the world of tax deductions for car insurance. Tax professionals, such as certified public accountants (CPAs) or enrolled agents, have the expertise to provide personalized guidance based on your specific circumstances.

A tax professional can help you understand the applicable tax laws, identify any relevant deductions or credits, and ensure that you are maximizing your tax benefits while remaining compliant with the law. They can also assist in preparing and filing your tax returns, providing peace of mind and minimizing the risk of errors or omissions.

Staying Updated on Tax Regulations

Tax laws and regulations are subject to change, and staying updated is crucial to ensure you are taking advantage of the most current tax deductions and incentives. Governments and tax authorities often introduce new legislation or make amendments to existing laws to reflect economic changes or promote specific initiatives.

Make it a habit to periodically review official tax websites, publications, or reputable online resources to stay informed about any updates or clarifications related to tax deductibility. Additionally, subscribe to newsletters or follow reputable tax blogs to receive timely notifications about relevant changes. By staying abreast of the latest tax regulations, you can ensure that your tax strategies remain effective and compliant.

Real-World Examples and Case Studies

To illustrate the practical application of car insurance tax deductions, let’s explore some real-world examples and case studies. These scenarios will provide a clearer understanding of how tax deductions can be claimed and the potential financial benefits they offer.

Case Study: Freelance Graphic Designer

Meet Emma, a freelance graphic designer who operates her business from home. She uses her personal vehicle to meet clients, attend networking events, and deliver printed materials. Emma’s car insurance premiums are approximately $1,200 annually.

By tracking her business mileage and maintaining detailed records, Emma determines that she drives her vehicle for business purposes approximately 15,000 miles per year. Based on the standard mileage rate allowed by the tax authorities, Emma can deduct a significant portion of her insurance premiums as a business expense. This deduction not only reduces her taxable income but also helps offset other business-related expenses.

Case Study: Self-Employed Real Estate Agent

John is a self-employed real estate agent who frequently travels to show properties to clients. He owns a personal vehicle that he uses exclusively for business purposes, and his annual car insurance premiums amount to $1,500.

John understands the importance of proper record-keeping and maintains a meticulous log of his business mileage. By calculating the percentage of miles driven for business, he determines that he can claim a substantial portion of his insurance premiums as a legitimate business expense. This deduction not only reduces his tax liability but also provides him with a financial advantage over competitors who may not be aware of these tax-saving strategies.

Case Study: Non-Profit Organization Volunteer

Sarah is an active volunteer for a local non-profit organization that provides support to underprivileged youth. She uses her personal vehicle to transport children to various activities and events. Sarah’s car insurance premiums are $1,000 annually.

Recognizing the charitable nature of her work, Sarah consults with a tax professional to understand the potential tax benefits. The tax expert advises her that, due to the volunteer nature of her activities, she may be eligible to deduct a portion of her insurance premiums as a charitable contribution. This deduction not only supports the non-profit organization but also provides Sarah with a personal tax benefit, making her volunteering efforts even more rewarding.

Maximizing Tax Benefits: Strategies and Tips

To optimize your tax position and maximize the potential benefits from car insurance deductions, consider implementing the following strategies and tips.

Bundling Insurance Policies

Bundling your insurance policies with the same provider can often result in significant savings. Many insurance companies offer discounts when you combine multiple policies, such as car insurance, home insurance, and life insurance. By bundling your policies, you not only enjoy reduced premiums but also simplify your insurance management and potentially increase your tax deductions.

Utilizing Tax Software

Tax software can be a valuable tool for individuals seeking to maximize their tax deductions. These programs are designed to guide users through the tax filing process, including identifying potential deductions and credits. By inputting your insurance-related expenses and other relevant financial information, tax software can help you calculate your deductions accurately and ensure you are taking advantage of all available tax benefits.

Exploring Alternative Insurance Options

In some cases, exploring alternative insurance options may lead to cost savings and increased tax deductions. For example, if you own multiple vehicles, considering a multi-car insurance policy can often result in lower premiums and potential tax advantages. Additionally, reviewing your insurance coverage periodically and comparing quotes from different providers can help you identify the most cost-effective options, allowing you to maximize your tax deductions.

Leveraging Tax Credits and Incentives

Tax credits and incentives are another avenue to explore when maximizing your tax benefits. Depending on your jurisdiction and specific circumstances, you may be eligible for various tax credits related to energy-efficient vehicles, electric cars, or hybrid vehicles. These credits can significantly reduce your tax liability and provide additional financial incentives for environmentally conscious choices.

The Future of Car Insurance and Tax Deductibility

As the landscape of personal finance and tax regulations evolves, it is essential to stay informed about potential changes that may impact the deductibility of car insurance. While the current tax deductibility rules provide certain advantages, it is crucial to anticipate future developments and adapt your financial strategies accordingly.

Emerging Trends and Innovations

The insurance industry is experiencing significant technological advancements and innovations that may influence the future of tax deductibility. The rise of telematics and usage-based insurance policies, for instance, offers new opportunities for cost savings and tax advantages. These policies, which monitor driving behavior and offer discounts based on safe driving practices, could potentially impact the deductibility of car insurance premiums.

Potential Policy Changes and Adjustments

Tax policies and regulations are subject to change, and governments may introduce new measures or adjust existing ones to address evolving economic conditions or promote specific objectives. It is crucial to stay vigilant and aware of any proposed changes or amendments that could impact the deductibility of car insurance. Monitoring official announcements, tax websites, and industry publications can help you stay informed and adapt your tax strategies accordingly.

The Impact of Electric and Autonomous Vehicles

The transition to electric and autonomous vehicles is expected to bring about significant changes in the automotive industry, and these advancements may also influence tax policies. As governments encourage the adoption of environmentally friendly technologies, there may be increased incentives and tax benefits for electric vehicle owners. Additionally, the emergence of autonomous vehicles could lead to new insurance models and potentially impact the deductibility of insurance premiums.

Conclusion: Navigating the Complexities of Tax Deductibility

Understanding the tax deductibility of car insurance is a crucial aspect of financial planning and tax optimization. By exploring the factors that influence deductibility, such as business use, vehicle ownership, and specific circumstances, individuals can make informed decisions to maximize their tax benefits. Proper record-keeping, consultation with tax professionals, and staying updated on tax regulations are essential practices to ensure compliance and take advantage of potential deductions.

Through real-world examples and case studies, we have seen how tax deductions for car insurance can provide significant financial advantages, especially for business owners and individuals engaged in charitable activities. By implementing strategic approaches, such as bundling insurance policies, utilizing tax software, and exploring alternative insurance options, individuals can further optimize their tax positions and make the most of available deductions.

As the future of car insurance and tax deductibility evolves, staying informed about emerging trends, potential policy changes, and technological advancements is crucial. By adapting to these changes and staying proactive in managing our finances, we can continue to navigate the complexities of tax deductibility with confidence and maximize our financial well-being.

Can I deduct car insurance if I use my vehicle for both business and personal purposes?

+Yes, you can deduct a portion of your car insurance premiums based on the percentage of miles driven for business purposes. Proper record-keeping of business mileage is crucial for claiming these deductions.

Are there any tax benefits for owning an electric or hybrid vehicle?

+Yes, many jurisdictions offer tax credits and incentives for electric and hybrid vehicle owners. These credits can significantly reduce your tax liability and encourage environmentally friendly choices.

How often should I review my insurance policies to optimize tax deductions?

+It is advisable to review your insurance policies annually to ensure you are taking advantage of any available discounts or tax benefits. Regularly comparing quotes from different providers can also help you identify cost-effective options.

Can I deduct car insurance premiums if I am an employee driving a company-owned vehicle?

+No, as an employee, you cannot deduct car insurance premiums for a company-owned vehicle. However, your employer may provide you with a tax-free mileage allowance or reimburse your expenses, which can reduce your overall tax liability.

What records should I keep to support my car insurance tax deductions?

+Keep records of insurance premium payments, policy details, and any relevant receipts or statements. Additionally, maintain a log of business mileage and purposes to support your deductions.