Az Property Taxes

In the world of real estate, property taxes are an essential aspect that homeowners and investors must navigate. These taxes, often a significant expense, play a crucial role in shaping the financial landscape of property ownership. Understanding how property taxes work, their calculation, and their impact on the overall investment is vital for making informed decisions. This article aims to delve into the intricacies of property taxes, specifically focusing on the case of Arizona, a state with its unique tax regulations and practices.

Unraveling Arizona’s Property Tax System

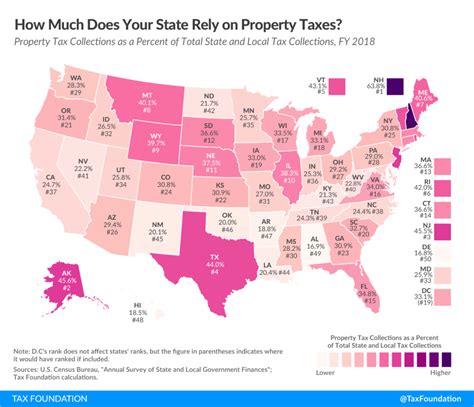

Arizona’s property tax system operates on a foundation of several key principles and regulations. Unlike some states, Arizona does not levy a state-level property tax. Instead, the responsibility for property taxation falls on the shoulders of local governments, primarily counties and municipalities.

The tax rate in Arizona varies from one jurisdiction to another, influenced by factors such as the type of property, its location, and the specific services provided by the local government. This localized approach allows for a more tailored tax system, ensuring that property owners contribute to the funding of local services and infrastructure they directly benefit from.

Assessment and Valuation: The First Step

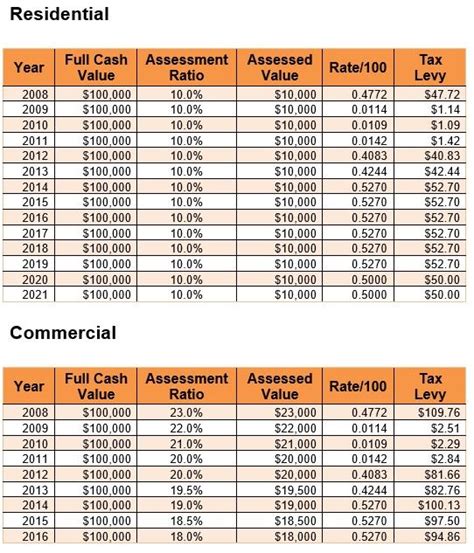

The journey towards understanding property taxes in Arizona begins with the assessment and valuation process. Each county in Arizona has an elected county assessor, responsible for establishing the assessed value of all taxable properties within their jurisdiction. This value is determined through various methods, including physical inspections, sales data analysis, and market research.

The assessed value serves as the basis for calculating the property taxes. However, it is not the actual tax amount. To determine the taxes, the assessed value is multiplied by the tax rate, which is set by the local government.

For instance, consider the city of Phoenix. The tax rate in Phoenix might be 1.15%, which means that for every $100 of assessed value, the property owner would owe $1.15 in taxes. So, a property with an assessed value of $200,000 would incur a property tax of $2,300.

| City | Tax Rate | Example Calculation |

|---|---|---|

| Phoenix | 1.15% | $200,000 x 1.15% = $2,300 |

| Tucson | 1.2% | $150,000 x 1.2% = $1,800 |

| Mesa | 1.05% | $300,000 x 1.05% = $3,150 |

It's important to note that Arizona offers several exemptions and reductions for property taxes. These include:

- Homestead Exemption: A reduction in assessed value for homeowners who use their property as their primary residence.

- Senior Citizen Exemption: A tax reduction for homeowners aged 65 and older.

- Veteran's Exemption: A tax exemption for certain qualifying veterans.

The Impact of Property Taxes on Real Estate Decisions

Property taxes in Arizona have a significant influence on real estate decisions, especially for investors. High property taxes can eat into an investor’s profits, making certain areas less attractive for investment. On the other hand, lower taxes can make an area more appealing, leading to increased competition and potentially higher property values.

For instance, consider the case of two identical properties, one in Phoenix and the other in Tucson. Assuming both properties have the same assessed value of $200,000, the property tax in Phoenix would be $2,300 (as calculated earlier), while in Tucson, with a slightly higher tax rate of 1.2%, the tax would be $2,400. This difference of $100 per year might not seem significant, but over the long term, it can add up, impacting the overall profitability of the investment.

Strategies for Navigating Arizona’s Property Tax Landscape

Understanding Arizona’s property tax system is the first step towards making informed real estate decisions. Here are some strategies to consider when navigating this landscape:

Research Local Tax Rates

Before investing in a property, research the tax rates in the specific area. Local government websites often provide this information, and understanding the tax rate can help in budgeting and financial planning.

Explore Exemptions and Reductions

Familiarize yourself with the various exemptions and reductions available in Arizona. These can significantly reduce the tax burden, especially for long-term homeowners.

Consider Property Value Trends

Property values in Arizona can fluctuate over time. Understanding the historical and projected value trends can help in assessing the potential impact of property taxes on your investment. If property values are expected to rise significantly, the increased assessed value could lead to higher taxes, affecting your overall returns.

Stay Informed on Legislative Changes

Arizona’s property tax regulations can evolve over time, influenced by legislative decisions. Staying informed about any changes in tax laws or assessment practices can help you adapt your investment strategies accordingly.

The Future of Property Taxes in Arizona

As Arizona continues to grow and evolve, its property tax system will likely undergo changes and adaptations. The state’s population growth and increasing demand for housing will put pressure on local governments to fund essential services and infrastructure, potentially leading to adjustments in tax rates.

Additionally, the state's focus on economic development and attracting businesses could lead to incentives and tax breaks for commercial properties. These changes would further impact the real estate market and the strategies employed by investors.

While it is challenging to predict the exact future of property taxes in Arizona, staying informed and adaptable is key. Real estate professionals and investors should keep a close eye on legislative updates and market trends to ensure they are making the most informed decisions.

How often are property taxes assessed in Arizona?

+Property taxes in Arizona are assessed annually. County assessors determine the assessed value of properties each year, which forms the basis for calculating the property taxes for that year.

Are there any ways to appeal property tax assessments in Arizona?

+Yes, Arizona offers a formal process for appealing property tax assessments. If a homeowner or property owner believes their assessed value is incorrect, they can file an appeal with the county assessor’s office. The appeal process typically involves submitting evidence and attending a hearing to present their case.

How do property taxes impact the overall real estate market in Arizona?

+Property taxes play a significant role in the real estate market in Arizona. Higher taxes can make certain areas less attractive for investment, potentially slowing down growth in those regions. Conversely, lower taxes can stimulate the market, attracting buyers and investors.