Nevada Income Tax Calculator

Welcome to our comprehensive guide on understanding and calculating income taxes in the state of Nevada. In this expert-written article, we will delve into the intricacies of Nevada's tax system, providing you with valuable insights and practical tools to navigate your tax obligations with ease. Whether you're a resident, a business owner, or simply curious about Nevada's tax landscape, this guide will equip you with the knowledge needed to make informed financial decisions.

Unraveling the Nevada Income Tax Structure

Nevada’s tax system stands out for its unique approach to income taxation. Unlike many other states, Nevada is known for its low tax rates and simplified tax structure, making it an attractive destination for individuals and businesses alike. However, understanding the nuances of this system is crucial to ensure compliance and optimize your financial strategies.

At the core of Nevada's income tax system is a progressive tax structure, which means that as your income increases, so does the tax rate applied to your earnings. This progressive approach ensures fairness and provides an incentive for individuals to strive for higher incomes while contributing proportionally to the state's revenue.

| Income Bracket | Tax Rate |

|---|---|

| First $25,000 | 0.925% |

| $25,001 - $50,000 | 1.175% |

| $50,001 - $75,000 | 1.425% |

| $75,001 - $100,000 | 1.675% |

| Over $100,000 | 2.425% |

As illustrated in the table above, Nevada's income tax rates are relatively competitive and reasonable, with the highest rate applicable only to the highest income brackets. This structure encourages economic growth and makes Nevada an attractive option for individuals seeking to minimize their tax liabilities.

Understanding Taxable Income in Nevada

When calculating your income tax liability in Nevada, it’s essential to grasp the concept of taxable income. Taxable income is the amount of your earnings that are subject to state income tax. In Nevada, the calculation of taxable income involves considering various factors, such as your residency status, income sources, and applicable deductions and credits.

Nevada, unlike many states, does not tax Social Security benefits, a significant advantage for retirees. Additionally, certain types of income, such as capital gains and dividends, are taxed at lower rates compared to regular income, making Nevada an attractive destination for investors.

Let's explore some key aspects of taxable income in Nevada:

- Wages and Salaries: Wages and salaries earned in Nevada are subject to income tax. If you work in Nevada, regardless of your residency status, your income from employment is taxable.

- Business Income: Nevada welcomes business owners with a low corporate income tax rate of 6.85%. This rate applies to net income from business activities conducted within the state.

- Rental Income: Rental income derived from properties in Nevada is taxable. However, you can claim deductions for expenses related to the rental property, such as maintenance and repairs.

- Investment Income: Capital gains and dividends from investments are taxed separately in Nevada. The state offers a favorable tax treatment for these types of income, with a maximum rate of 2.425% for capital gains and a flat rate of 1.25% for dividends.

Nevada’s Tax Credits and Deductions

Nevada provides various tax credits and deductions to help individuals and businesses reduce their tax liabilities. These incentives aim to promote economic development, support specific industries, and provide relief to taxpayers.

Here are some notable tax credits and deductions available in Nevada:

- Research and Development Tax Credit: Nevada offers a tax credit for businesses engaged in research and development activities. This credit can significantly reduce a company's tax liability, making it an attractive incentive for innovative enterprises.

- Low-Income Housing Tax Credit: To encourage the development of affordable housing, Nevada provides a tax credit for qualified low-income housing projects. This credit benefits both developers and individuals in need of affordable housing.

- Education Tax Credit: Nevada residents can claim a tax credit for qualified education expenses, including tuition and fees for higher education. This credit helps make education more accessible and affordable.

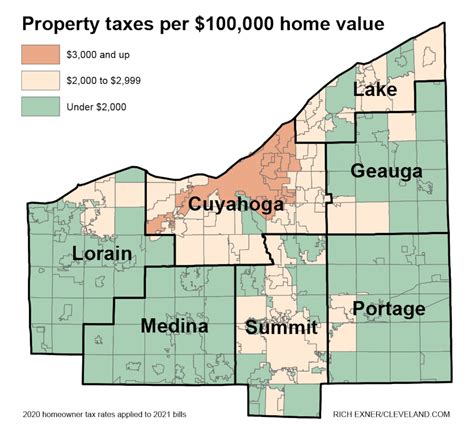

- Property Tax Deduction: Nevada allows homeowners to deduct a portion of their property taxes from their taxable income. This deduction provides relief to homeowners and helps reduce the overall tax burden.

Online Income Tax Calculators: A Valuable Tool

Navigating the complexities of income tax calculations can be challenging, especially when dealing with multiple income sources and tax considerations. To simplify this process, online income tax calculators have become an invaluable resource for taxpayers.

These calculators are designed to provide accurate estimates of your tax liability based on your unique circumstances. By inputting your income, deductions, and credits, you can quickly determine your potential tax obligation and make informed decisions regarding your financial planning.

Here are some key advantages of using online income tax calculators for Nevada residents:

- Accuracy and Precision: Online calculators use up-to-date tax rates and regulations, ensuring that your calculations are accurate and reliable.

- Ease of Use: These calculators are user-friendly and require minimal technical knowledge. Simply input your information, and the calculator does the rest.

- Scenario Analysis: By adjusting variables, such as income or deductions, you can explore different scenarios and understand how changes impact your tax liability.

- Time Efficiency: Online calculators save you time by automating complex calculations, allowing you to focus on other aspects of your financial planning.

Nevada’s Online Tax Resources

To assist taxpayers in navigating the state’s tax system, Nevada offers a wealth of online resources. The Nevada Department of Taxation provides comprehensive information, forms, and guidance to ensure compliance and simplify the tax filing process.

Key online resources include:

- Nevada Tax Portal: The official website of the Nevada Department of Taxation offers a wealth of information, including tax forms, publications, and news updates. It serves as a one-stop shop for all your tax-related needs.

- Taxpayer Guides: Nevada provides detailed guides and instructional materials to help taxpayers understand their obligations and rights. These guides cover topics such as filing requirements, payment options, and common tax scenarios.

- Online Filing and Payment Options: Nevada offers convenient online filing and payment options, allowing taxpayers to complete their tax obligations from the comfort of their homes. This streamlines the process and reduces the need for physical paperwork.

- Taxpayer Assistance: If you have questions or need assistance, Nevada's taxpayer assistance programs provide support through various channels, including online chats, emails, and phone calls.

Conclusion: Embracing Nevada’s Tax Landscape

Nevada’s income tax system, with its progressive rates and simplified structure, presents a unique and advantageous environment for individuals and businesses. By understanding the tax rates, taxable income considerations, and available credits and deductions, you can optimize your financial strategies and ensure compliance with state regulations.

Utilizing online income tax calculators and taking advantage of Nevada's online tax resources can further enhance your tax planning experience. With the right tools and knowledge, you can navigate Nevada's tax landscape with confidence and make informed decisions that benefit your financial well-being.

How often does Nevada update its tax rates and regulations?

+Nevada’s tax rates and regulations are subject to periodic updates, typically on an annual basis. These updates align with changes in the state’s fiscal policies and economic conditions. It is essential to stay informed about any modifications to ensure compliance with the latest tax laws.

Are there any tax incentives for renewable energy projects in Nevada?

+Absolutely! Nevada offers a range of tax incentives for renewable energy projects, including tax credits and exemptions. These incentives aim to promote sustainable practices and encourage the development of renewable energy sources within the state.

Can I claim a tax deduction for charitable donations in Nevada?

+Yes, Nevada allows taxpayers to claim a deduction for qualified charitable contributions. This deduction provides an opportunity for individuals to support their favorite causes while reducing their tax liability. It’s a win-win situation for both taxpayers and charitable organizations.

How does Nevada’s tax system impact remote workers who reside in the state?

+Remote workers who reside in Nevada are subject to the state’s income tax laws. Their taxable income includes earnings from their remote employment, regardless of where the work is performed. However, Nevada’s competitive tax rates make it an attractive option for remote workers looking to minimize their tax obligations.

What is the deadline for filing Nevada income tax returns?

+The deadline for filing Nevada income tax returns is typically aligned with the federal tax deadline, which is April 15th of the following year. However, it’s essential to check the official Nevada Department of Taxation website for any updates or extensions, as deadlines may vary based on specific circumstances.