Nyc Tax Refund

The New York City tax refund process can be a complex and often confusing journey for many residents and businesses alike. Understanding the ins and outs of this process is crucial, as it can significantly impact your financial situation. In this comprehensive guide, we will delve into the intricacies of the NYC tax refund system, providing you with valuable insights and practical steps to navigate it successfully.

Unraveling the NYC Tax Refund System

The New York City Department of Finance is responsible for administering the city’s tax refund program, which covers various types of taxes, including income tax, property tax, and business-related taxes. The process of claiming a refund involves several steps, each with its own set of requirements and considerations.

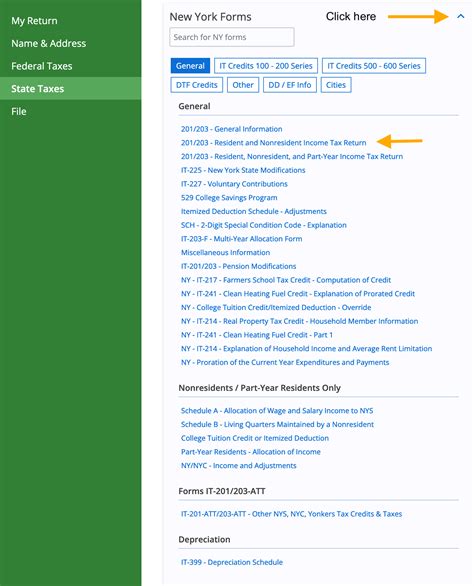

Income Tax Refunds

For individuals and businesses, income tax refunds are a common occurrence. These refunds arise when the amount of tax paid exceeds the actual tax liability for the year. The NYC income tax refund process typically begins with filing your tax return, which must be done within the designated deadlines to avoid penalties.

Key considerations for income tax refunds include:

- Ensuring accurate reporting of income and deductions.

- Understanding the city’s tax brackets and rates to calculate your liability correctly.

- Keeping track of any tax credits and incentives you may be eligible for.

- Considering the impact of state and federal tax laws on your NYC tax refund.

It’s important to note that income tax refunds can vary significantly based on individual circumstances. Factors such as employment status, investment income, and family composition can all influence the amount of your refund.

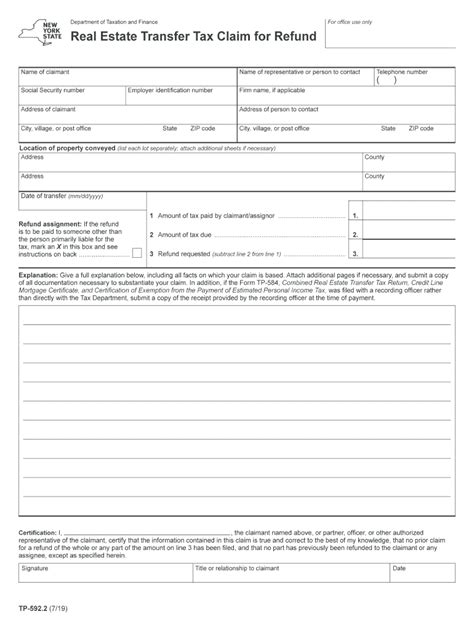

Property Tax Refunds

Property owners in New York City may be eligible for property tax refunds, especially if they have overpaid their taxes or if their property’s assessment has been reduced. The process for claiming a property tax refund involves submitting an application to the Department of Finance, along with supporting documentation.

Key aspects of property tax refunds include:

- Understanding the assessment process and your property’s value.

- Reviewing your tax bill carefully to identify any overpayments.

- Being aware of the appeal process if you believe your property has been overassessed.

- Knowing the deadlines for filing property tax refund claims to avoid missing out on potential refunds.

Business Tax Refunds

Businesses operating in New York City may also be entitled to tax refunds, particularly if they have overpaid their business taxes or if they qualify for certain tax incentives. The process for claiming business tax refunds can be more intricate, often requiring detailed financial records and compliance with specific regulations.

Considerations for business tax refunds include:

- Maintaining accurate and organized financial records to support your refund claim.

- Understanding the various business tax categories, such as sales tax, corporate tax, and payroll tax.

- Researching and applying for applicable tax incentives and credits to reduce your tax liability.

- Seeking professional advice to navigate the complex world of business tax refunds.

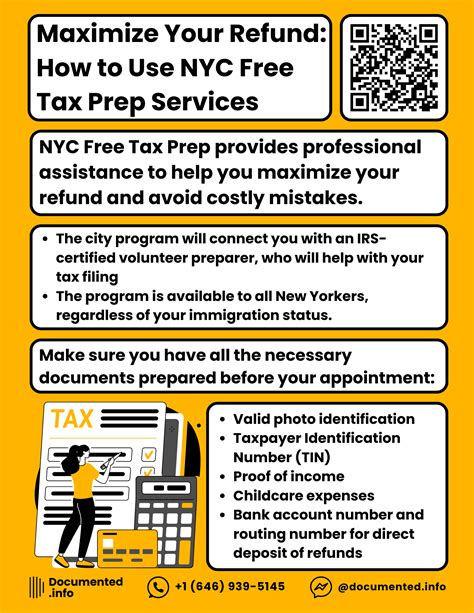

Maximizing Your NYC Tax Refund

To ensure you receive the maximum refund you’re entitled to, it’s crucial to familiarize yourself with the available tax credits and incentives offered by the city. These can significantly reduce your tax liability and increase your refund amount.

Some key tax credits and incentives to consider include:

- Low-Income Tax Credit: This credit aims to provide relief for low-income individuals and families by reducing their tax burden.

- Property Tax Credit: Designed to assist property owners, this credit can offset a portion of their property tax liability.

- Business Incentive Programs: NYC offers various programs to encourage business growth and investment, often resulting in tax savings.

- Energy Efficiency Credits: Tax credits are available for businesses and individuals who invest in energy-efficient upgrades.

Researching and applying for these credits can be a strategic way to increase your tax refund. However, it’s essential to ensure you meet all the eligibility criteria and understand the specific requirements for each credit or incentive program.

The Role of Professional Tax Advisors

Navigating the complexities of the NYC tax refund system can be challenging, especially for those who are not well-versed in tax laws and regulations. Engaging the services of a professional tax advisor or accountant can be a wise decision to ensure accuracy and maximize your refund.

Benefits of working with a tax professional include:

- Expert guidance on tax planning and strategy to minimize your tax liability.

- Assistance with identifying applicable tax credits and incentives.

- Help with preparing and filing your tax returns accurately and on time.

- Peace of mind knowing your tax affairs are being handled by an expert.

When selecting a tax advisor, it’s important to choose someone with experience in NYC tax matters and a proven track record of successful refund claims.

The Impact of Technology on Tax Refunds

In recent years, technology has played a significant role in simplifying the tax refund process. Online platforms and tax preparation software have made it easier for individuals and businesses to file their tax returns and track their refunds.

Key advantages of utilizing technology for tax refunds include:

- Enhanced accuracy through automated calculations and error-checking.

- Convenience of filing taxes from the comfort of your home or office.

- Real-time tracking of your tax refund status.

- Access to a wealth of tax-related resources and guides online.

However, it’s important to exercise caution when using online tools, ensuring that the platform you choose is secure and reputable. Additionally, while technology can streamline the process, it’s still crucial to understand the underlying tax principles to make informed decisions.

Common Pitfalls to Avoid

When navigating the NYC tax refund system, it’s essential to be aware of common pitfalls that could hinder your refund process.

Pitfalls to avoid include:

- Missing filing deadlines, which can result in penalties and interest charges.

- Failing to report all income sources accurately, leading to potential audits.

- Overlooking applicable tax credits and incentives, which could reduce your refund.

- Not keeping adequate records to support your refund claim, especially for business taxes.

Being proactive and staying informed about tax laws and regulations can help you steer clear of these pitfalls and ensure a smoother refund process.

The Future of NYC Tax Refunds

As technology continues to advance and tax laws evolve, the future of NYC tax refunds looks promising. The city is constantly exploring ways to improve the tax refund process, making it more efficient and accessible to residents and businesses.

Potential future developments include:

- Further integration of technology to streamline the filing and refund process.

- Enhanced taxpayer education and outreach programs to ensure better understanding of tax obligations and refunds.

- Implementation of more generous tax credits and incentives to stimulate economic growth.

- Continued collaboration between the city and tax professionals to provide better support to taxpayers.

Staying informed about these developments can help you stay ahead of the curve and make the most of your NYC tax refund opportunities.

Conclusion

Understanding the NYC tax refund system is an essential step towards optimizing your financial situation. By familiarizing yourself with the process, staying informed about tax laws, and utilizing available resources, you can maximize your refund and minimize your tax liability. Whether you’re an individual, a business owner, or a property owner, there are strategies and incentives available to help you navigate the complex world of NYC taxes.

| Tax Type | Key Considerations |

|---|---|

| Income Tax | Accurate reporting, tax bracket awareness, credits and incentives |

| Property Tax | Assessment understanding, appeal process, overpayment identification |

| Business Tax | Detailed record-keeping, tax category awareness, incentive programs |

What is the average time it takes to receive an NYC tax refund?

+The time it takes to receive an NYC tax refund can vary depending on several factors. Generally, it can take anywhere from a few weeks to several months. Factors influencing the timeframe include the complexity of your tax return, the accuracy of your filing, and the volume of refund claims being processed by the Department of Finance.

Are there any penalties for missing the tax refund filing deadline?

+Yes, missing the tax refund filing deadline can result in penalties and interest charges. The exact amount of the penalty will depend on the specific tax type and the extent of the delay. It’s crucial to be aware of the deadlines and plan your tax affairs accordingly to avoid these penalties.

Can I file for a tax refund if I’m a non-resident of NYC?

+Non-residents of NYC may be eligible for certain tax refunds, particularly if they have overpaid their taxes or have specific income sources tied to the city. However, the process and requirements for non-residents can be more complex. It’s advisable to consult a tax professional to determine your eligibility and navigate the process effectively.