Tax Collector Harris County

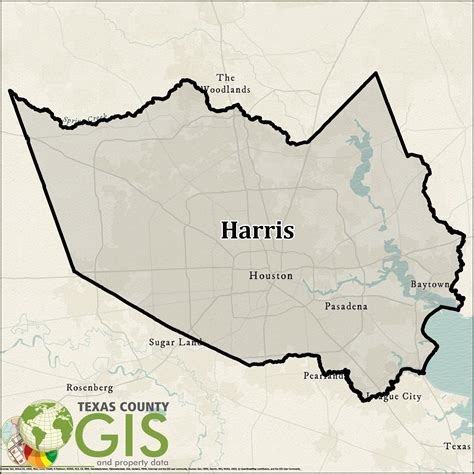

The Harris County Tax Office is an essential entity in the heart of Texas, playing a crucial role in the financial and administrative landscape of one of the largest counties in the United States. With a population exceeding 4.7 million people, Harris County stands as the third-most populous county in the nation, trailing only Cook County, Illinois, and Los Angeles County, California. The tax office, led by Tax Collector Annette N. Rodriguez, shoulders the responsibility of managing and collecting taxes for a diverse array of services and entities, including schools, cities, counties, and special districts.

As one of the primary sources of revenue for local governments, the Harris County Tax Office collects property taxes, a significant portion of which funds the county's public education system. The tax office's efficient and effective management of this complex system is vital to the smooth functioning of the county's vital services, infrastructure, and educational institutions.

Harris County Tax Office: A Comprehensive Overview

The Harris County Tax Office, under the leadership of Tax Collector Rodriguez, operates as an independent entity, free from political influence and interference. This autonomy ensures that the office can focus solely on its core responsibilities, which include property appraisal, tax collection, and the provision of essential services to the residents of Harris County.

One of the key functions of the tax office is the appraisal of property values. This process, conducted by a team of highly skilled professionals, involves assessing the market value of various types of properties, including residential, commercial, and industrial properties. The accuracy of these appraisals is critical, as they directly impact the tax liabilities of property owners in the county.

In addition to property appraisal, the Harris County Tax Office is responsible for the collection of taxes. This involves sending out tax bills, processing payments, and managing any delinquencies or disputes. The office offers a range of payment options to taxpayers, including online payments, mail-in payments, and in-person payments at their various locations across the county. The timely and efficient collection of taxes is vital to the financial stability and planning of local governments and the provision of public services.

Services and Support for Harris County Residents

The Harris County Tax Office is committed to providing exceptional service and support to the residents of the county. They offer a wide range of services, including:

- Property Tax Information: The office provides detailed information on property taxes, including tax rates, due dates, and payment options. Residents can access this information online or by visiting any of the tax office locations.

- Property Appraisal Services: Property owners can request an appraisal review or protest their property values if they believe the assessment is inaccurate. The tax office has a dedicated team to handle such requests and ensure a fair and transparent process.

- Payment Assistance: For residents facing financial difficulties, the tax office offers payment plans and other assistance programs to help them manage their tax liabilities.

- Online Services: The Harris County Tax Office website provides a user-friendly platform for residents to access their tax information, make payments, and obtain various forms and documents related to property taxes.

- Community Outreach: The office actively engages with the community through educational programs, workshops, and outreach events to ensure that residents understand their property tax obligations and the importance of timely payments.

In addition to these services, the tax office also collaborates with local governments, school districts, and other agencies to ensure the efficient allocation of tax revenues and the effective delivery of public services. This includes working closely with the Harris County Appraisal District to ensure accurate and fair property appraisals.

| Service Category | Description |

|---|---|

| Property Tax Payment Options | Online, Mail-in, In-Person |

| Appraisal Review | Process for protesting property values |

| Payment Plans | Assistance for taxpayers facing financial difficulties |

| Online Services | Access tax information, make payments, download forms |

The Role of Technology in Modern Tax Collection

In today's digital age, the Harris County Tax Office recognizes the importance of leveraging technology to enhance its operations and improve the taxpayer experience. The office has invested in modern systems and infrastructure to streamline tax collection processes, improve data security, and provide efficient services to taxpayers.

One of the key technological advancements is the implementation of an integrated tax collection software system. This system allows taxpayers to access their account information, view tax bills, and make payments online securely. It also enables the tax office to manage tax data more efficiently, reducing the risk of errors and improving overall operational efficiency.

Additionally, the tax office has embraced digital communication channels to stay connected with taxpayers. They utilize email, text messages, and social media platforms to provide updates, reminders, and important notifications. This digital outreach ensures that taxpayers receive timely information and can easily access the services they need.

Benefits of Technology in Tax Collection

- Enhanced Efficiency: Technology streamlines tax collection processes, reducing manual errors and increasing overall operational efficiency.

- Improved Data Security: Modern systems and infrastructure provide robust data security measures, protecting taxpayer information from potential breaches.

- Convenience for Taxpayers: Online platforms and digital communication channels offer taxpayers a convenient and accessible way to manage their tax obligations.

- Cost Savings: By automating certain processes and reducing the need for manual intervention, the tax office can achieve significant cost savings, which can be passed on to taxpayers in the form of lower tax rates.

The Harris County Tax Office's embrace of technology not only improves its own operations but also enhances the taxpayer experience. By providing a seamless and user-friendly digital interface, the office ensures that taxpayers can efficiently manage their tax obligations, saving time and reducing the stress often associated with tax-related tasks.

| Technology Implementation | Benefits |

|---|---|

| Integrated Tax Collection Software | Streamlined processes, improved data management |

| Digital Communication Channels | Timely notifications, improved taxpayer engagement |

| Online Payment Platforms | Convenience, security, and efficiency for taxpayers |

The Future of Tax Collection in Harris County

As technology continues to advance, the Harris County Tax Office is committed to staying at the forefront of innovation in tax collection. The office is exploring new avenues to further enhance its services and improve the taxpayer experience.

One area of focus is the integration of artificial intelligence (AI) and machine learning technologies. These advanced technologies can analyze vast amounts of data, identify patterns, and automate certain tasks, further streamlining tax collection processes. For example, AI can be used to automatically identify potential errors in tax returns, flag suspicious activities, and improve the accuracy of tax assessments.

Additionally, the tax office is working towards implementing a more comprehensive online platform. This platform will offer an even wider range of services, including the ability to file tax returns, track the status of refunds, and access personalized tax information. The goal is to create a one-stop-shop for taxpayers, where they can manage all their tax-related needs conveniently and securely.

Key Initiatives for the Future

- AI and Machine Learning Integration: Enhancing accuracy and efficiency in tax collection processes.

- Comprehensive Online Platform: Providing a centralized hub for all taxpayer needs, including filing returns and tracking refunds.

- Data Analytics: Utilizing advanced data analytics to identify trends, improve tax administration, and enhance taxpayer services.

- Mobile App Development: Developing a mobile application to offer taxpayers a convenient and accessible way to manage their tax obligations on the go.

The Harris County Tax Office's dedication to innovation and technological advancement ensures that the tax collection process remains efficient, secure, and taxpayer-friendly. By embracing these future initiatives, the office aims to further improve its services, reduce taxpayer burden, and contribute to the overall financial health and well-being of the county.

How can I pay my property taxes in Harris County?

+You can pay your property taxes in Harris County through various methods, including online payment, mail-in payment, and in-person payment at designated tax office locations. The Harris County Tax Office provides a user-friendly online platform for taxpayers to access their account, view tax bills, and make payments securely.

What happens if I miss the tax payment deadline?

+If you miss the tax payment deadline, you may be subject to penalties and interest. It’s important to note that the tax office offers payment plans and other assistance programs for taxpayers facing financial difficulties. Contact the Harris County Tax Office for more information on late payment options and potential penalties.

How can I protest my property value assessment?

+If you believe your property value assessment is inaccurate, you can request an appraisal review. The Harris County Tax Office provides a process for taxpayers to protest their property values. You can find detailed information and instructions on their website or by contacting the office directly.

Are there any tax exemptions or discounts available for senior citizens or veterans?

+Yes, Harris County offers various tax exemptions and discounts for eligible senior citizens and veterans. These exemptions can reduce the taxable value of your property, resulting in lower tax liabilities. Contact the Harris County Tax Office or visit their website for more information on the specific exemptions and the eligibility criteria.

How often does the Harris County Tax Office update property values?

+The Harris County Tax Office conducts regular property appraisals to ensure that property values are accurate and up-to-date. Property values are typically updated annually, but the exact schedule may vary depending on various factors. The office provides information on the appraisal process and the timeline for updates on their website.