Michigan Income Tax Refund

The Michigan income tax refund is a topic of interest for many residents and taxpayers in the state. Understanding how income tax refunds work and what factors influence them is crucial for financial planning and ensuring compliance with state tax regulations. In this comprehensive guide, we will delve into the intricacies of Michigan's income tax refund system, exploring the key factors, processes, and strategies to optimize your refund.

Understanding Michigan’s Income Tax Structure

Michigan, like many other states, imposes an income tax on its residents and businesses. The state’s income tax system is designed to generate revenue for various public services and infrastructure development. The Michigan Department of Treasury is responsible for administering and enforcing the state’s tax laws, including income tax.

The Michigan income tax is a progressive tax system, meaning that higher income earners pay a higher percentage of their income in taxes. This approach aims to ensure fairness and balance in the tax structure. The state tax rates are determined by tax brackets, and individuals' tax liabilities are calculated based on their taxable income and the applicable tax rates.

For the 2023 tax year, Michigan has six tax brackets with rates ranging from 4.25% to 4.60%. These rates apply to different income levels, and taxpayers are taxed at the corresponding rate for each bracket their income falls into. This progressive structure ensures that individuals with higher incomes contribute a larger proportion of their earnings to the state's revenue.

| Tax Bracket | Tax Rate |

|---|---|

| $0 - $21,350 | 4.25% |

| $21,351 - $50,000 | 4.35% |

| $50,001 - $97,500 | 4.40% |

| $97,501 - $200,000 | 4.50% |

| $200,001 - $500,000 | 4.55% |

| $500,001 and above | 4.60% |

It's important to note that Michigan's income tax system is separate from federal income taxes. Taxpayers must file both federal and state tax returns, and the state tax return is based on the federal adjusted gross income (AGI) reported on the federal tax return. This alignment simplifies the tax filing process and ensures consistency.

The Process of Obtaining an Income Tax Refund

An income tax refund occurs when an individual’s tax payments exceed their actual tax liability for the year. In other words, if you’ve paid more taxes throughout the year than you owe, the difference is refunded to you by the state. This refund can provide a financial boost, especially for those who have overpaid their taxes due to various reasons.

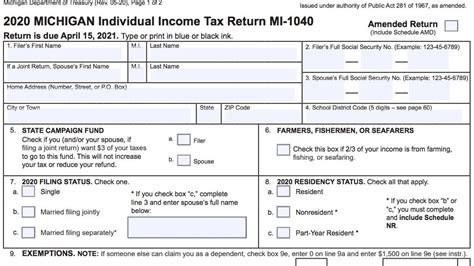

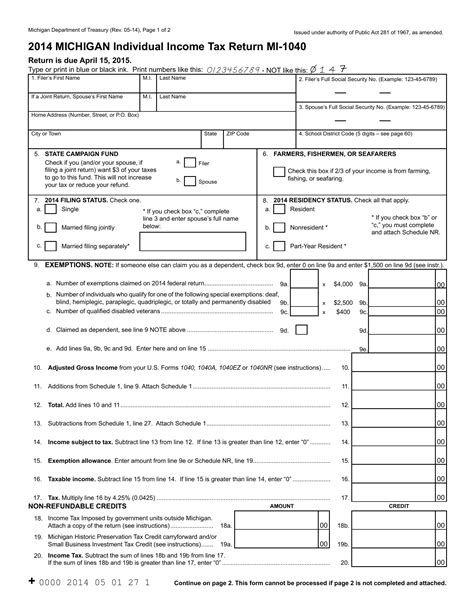

The process of obtaining an income tax refund in Michigan involves several key steps. First, individuals must ensure they have all the necessary documentation and records to accurately calculate their taxable income and tax liability. This includes W-2 forms, 1099 forms, and any other relevant income statements.

Next, taxpayers must file their state income tax return by the deadline. In Michigan, the tax filing deadline typically aligns with the federal deadline, which is usually around April 15th of the following year. It's crucial to meet this deadline to avoid penalties and interest charges.

When filing the state tax return, individuals must carefully review their income, deductions, and credits to ensure accuracy. The Michigan income tax form includes various sections to report different types of income, such as wages, business income, and investment gains. Taxpayers should also claim any applicable deductions and credits, as these can significantly reduce their tax liability and increase the likelihood of a refund.

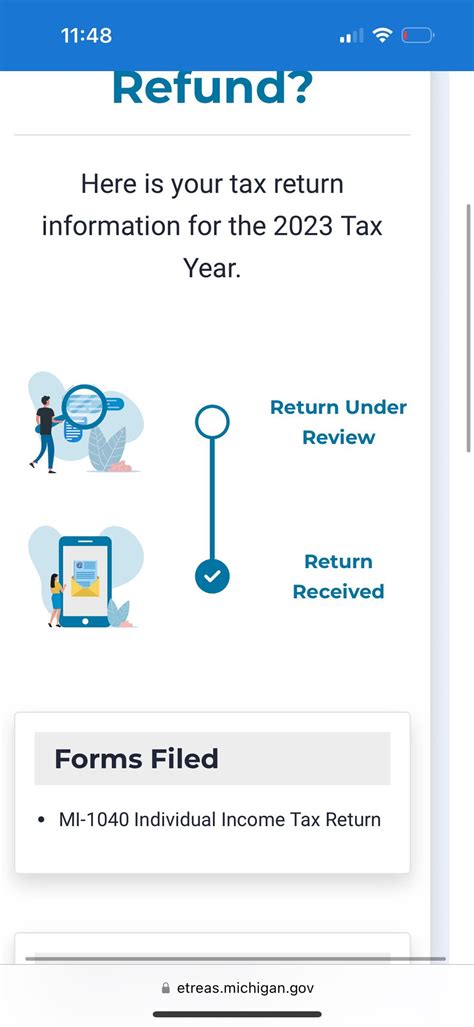

Once the tax return is filed, the Michigan Department of Treasury processes the return and calculates the taxpayer's actual tax liability. If the taxpayer has overpaid their taxes, the department will issue a refund. The refund amount is calculated by subtracting the taxpayer's total tax liability from the total taxes paid during the year.

Michigan offers multiple options for receiving tax refunds. Taxpayers can opt for direct deposit, which is a convenient and fast method. Alternatively, refunds can be issued as a check mailed to the taxpayer's address. It's essential to keep track of the refund status and ensure that the refund is received accurately and in a timely manner.

Common Factors Affecting Income Tax Refunds

Several factors can influence the size and timing of income tax refunds. Understanding these factors can help taxpayers optimize their financial planning and tax strategies.

One significant factor is the timing of tax payments. Throughout the year, individuals may make estimated tax payments or have taxes withheld from their paychecks. The amount and timing of these payments can impact the final refund amount. For instance, if an individual has more taxes withheld from their paycheck than necessary, they may receive a larger refund. Conversely, if they underpay their estimated taxes, they may owe additional taxes when filing their return.

Another crucial factor is the utilization of tax deductions and credits. Deductions reduce the taxable income, directly impacting the tax liability. Common deductions include those for mortgage interest, state and local taxes, charitable contributions, and certain business expenses. By claiming eligible deductions, taxpayers can lower their tax liability and increase their chances of a refund.

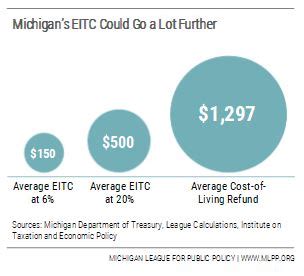

Additionally, taxpayers should be aware of various tax credits available. These credits provide a direct reduction in the tax liability and can be substantial. Examples of tax credits include the Child Tax Credit, Earned Income Tax Credit, and the Michigan Homestead Property Tax Credit. These credits can significantly boost the refund amount, especially for low- and moderate-income individuals and families.

Furthermore, the timing of major life events can affect tax refunds. Changes in employment, income levels, marital status, or having a new child can all impact tax liability and potential refunds. Taxpayers should be mindful of these changes and adjust their tax strategies accordingly.

Maximizing Your Michigan Income Tax Refund

Maximizing your income tax refund requires a strategic approach and an understanding of the tax system. Here are some practical tips and strategies to optimize your refund in Michigan:

-

Review Your Withholdings: Regularly review your tax withholdings throughout the year. Ensure that the correct amount is being withheld from your paychecks to avoid overpayment or underpayment. Use the IRS Withholding Calculator or consult a tax professional to adjust your withholdings if necessary.

-

Claim All Eligible Deductions: Take advantage of all the deductions you qualify for. Common deductions include those for medical expenses, state and local taxes, mortgage interest, charitable contributions, and education expenses. Keep track of these expenses throughout the year to maximize your deductions.

-

Explore Tax Credits: Research and understand the various tax credits available in Michigan. The Earned Income Tax Credit, Child Tax Credit, and other state-specific credits can provide significant savings. Make sure you meet the eligibility criteria and claim these credits on your tax return.

-

Consider Tax-Advantaged Accounts: Utilize tax-advantaged accounts such as Health Savings Accounts (HSAs), Flexible Spending Accounts (FSAs), and retirement accounts like 401(k)s or IRAs. These accounts offer tax benefits and can reduce your taxable income, potentially increasing your refund.

-

File Electronically and Timely: Filing your tax return electronically and early in the tax season can expedite the refund process. Electronic filing reduces errors and ensures a faster turnaround. Additionally, filing by the deadline avoids late fees and penalties.

-

Use Tax Preparation Software: Consider using tax preparation software or engaging a tax professional to ensure accuracy and maximize your refund. These tools can guide you through the process, identify potential deductions and credits, and help you navigate complex tax scenarios.

Michigan’s Taxpayer Assistance Programs

The Michigan Department of Treasury recognizes that taxpayers may face challenges or have questions regarding their tax obligations. To assist taxpayers, the department offers various taxpayer assistance programs and resources.

One notable program is the Michigan Tax Amnesty Program. This program provides an opportunity for taxpayers with outstanding tax liabilities to settle their debts with reduced penalties and interest. It encourages voluntary compliance and offers a window of time for taxpayers to come forward and resolve their tax issues.

Additionally, the department provides tax assistance centers and help lines for taxpayers seeking guidance. These resources offer personalized support and help taxpayers navigate complex tax situations. Taxpayers can receive assistance with filing their tax returns, understanding tax laws, and resolving issues related to refunds, payments, or audits.

For taxpayers facing financial hardship, the department also offers payment plans and relief options. These programs allow taxpayers to pay their tax liabilities over time, making it more manageable and avoiding potential penalties and interest charges. The department works with taxpayers to find suitable payment arrangements based on their individual circumstances.

Furthermore, the Michigan Department of Treasury actively promotes taxpayer education and awareness. They provide online resources, publications, and workshops to help taxpayers understand their rights and responsibilities. By empowering taxpayers with knowledge, the department aims to foster a culture of compliance and responsible tax behavior.

Future Implications and Tax Reform

The landscape of income taxes is subject to change and reform. Michigan, like many states, periodically reviews its tax structure and considers adjustments to promote fairness, economic growth, and fiscal sustainability.

In recent years, there have been discussions and proposals for tax reform in Michigan. These initiatives aim to simplify the tax code, reduce complexity, and provide tax relief to individuals and businesses. Potential reforms include adjustments to tax brackets, the introduction of new credits or deductions, and modifications to the tax filing process.

Staying informed about tax reform initiatives is crucial for taxpayers. These changes can impact tax liabilities, refund amounts, and the overall tax landscape. By staying updated, taxpayers can adapt their financial planning and tax strategies accordingly.

Furthermore, tax reform efforts often involve public engagement and feedback. Taxpayers have the opportunity to participate in discussions, provide input, and influence the direction of tax policy. Engaging in these conversations allows individuals to have a say in the tax system that affects their financial well-being.

As Michigan continues to evaluate and refine its tax system, taxpayers can expect ongoing efforts to improve fairness, efficiency, and compliance. The state's commitment to tax reform and taxpayer assistance ensures that the tax system remains responsive to the needs and challenges faced by its residents.

Conclusion: Navigating Michigan’s Income Tax Refunds

Understanding Michigan’s income tax refund system is essential for taxpayers to navigate their financial obligations effectively. By grasping the state’s tax structure, filing process, and factors influencing refunds, individuals can optimize their tax strategies and maximize their refunds.

Throughout this guide, we've explored the progressive nature of Michigan's income tax, the key steps in obtaining a refund, and the various factors impacting refund amounts. We've also provided practical tips for maximizing refunds and highlighted the taxpayer assistance programs offered by the Michigan Department of Treasury.

As taxpayers, staying informed and proactive is crucial. By reviewing withholdings, claiming eligible deductions and credits, and exploring tax-advantaged accounts, individuals can make the most of their financial situation and potentially increase their refund. Additionally, staying updated on tax reform initiatives and engaging in taxpayer assistance programs ensures a smooth tax experience and compliance with state regulations.

Michigan's income tax refund system, while complex, provides an opportunity for taxpayers to receive financial relief and plan their finances strategically. By leveraging the knowledge and strategies outlined in this guide, individuals can navigate the tax landscape with confidence and make informed decisions to optimize their financial well-being.

How do I calculate my Michigan income tax refund?

+To calculate your Michigan income tax refund, you’ll need to determine your total taxable income for the year and apply the appropriate tax rates based on your income bracket. Subtract your total tax liability from the total taxes paid during the year. The difference is your refund amount.

What is the deadline for filing Michigan state tax returns?

+The deadline for filing Michigan state tax returns typically aligns with the federal deadline, which is usually around April 15th of the following year. However, it’s important to check the official Michigan Department of Treasury website for any updates or changes to the filing deadline.

Can I receive my Michigan income tax refund as a direct deposit?

+Yes, Michigan offers the option of receiving your income tax refund through direct deposit. When filing your tax return, you’ll have the opportunity to provide your banking information for direct deposit. This method is fast and convenient, ensuring you receive your refund promptly.

Are there any tax credits available in Michigan that can increase my refund?

+Yes, Michigan offers several tax credits that can increase your refund. Some examples include the Earned Income Tax Credit (EITC), Child Tax Credit, and the Michigan Homestead Property Tax Credit. These credits provide direct reductions in your tax liability, potentially boosting your refund amount.

What should I do if I have questions or need assistance with my Michigan income tax refund?

+If you have questions or need assistance with your Michigan income tax refund, you can reach out to the Michigan Department of Treasury’s Taxpayer Assistance Center. They provide guidance and support to taxpayers. You can find their contact information and resources on the official Michigan government website.