Sales Tax Car New York

When purchasing a new car in New York State, understanding the sales tax implications is crucial. This article aims to provide a comprehensive guide to sales tax for car buyers in New York, covering the tax rates, exemptions, and the entire process from start to finish. We'll explore the unique aspects of New York's tax system and offer expert insights to help you navigate the process smoothly.

Understanding New York’s Sales Tax Structure

New York State operates a complex sales tax system, with rates varying across different localities. The state sales tax rate is set at 4%, but counties and cities can add additional taxes, resulting in a combined rate that can reach up to 8.875% in some areas. This variability makes it essential for car buyers to understand the specific tax rate applicable to their location.

Tax Rates Across New York’s Counties

To illustrate the diversity of sales tax rates, let’s consider a few examples:

| County | Sales Tax Rate |

|---|---|

| New York County (Manhattan) | 8.875% |

| Kings County (Brooklyn) | 8.875% |

| Queens County | 8.875% |

| Erie County (Buffalo) | 8.75% |

| Monroe County (Rochester) | 8.75% |

As shown above, the sales tax rates can significantly impact the final cost of a new car. It's advisable to research the specific tax rate for your county before finalizing your purchase.

Exemptions and Special Considerations

New York offers certain exemptions and tax breaks for specific types of vehicles and buyers. For instance, vehicles used exclusively for agricultural purposes may be eligible for a reduced tax rate of 3.75%. Additionally, some counties, like Erie and Monroe, offer senior citizen exemptions, reducing the sales tax rate to 4.75% for eligible individuals.

It's important to note that these exemptions have specific criteria, and not all buyers will qualify. Consulting with a tax professional or the local Department of Motor Vehicles (DMV) can provide clarity on your eligibility.

The Sales Tax Process for New Car Purchases

Now that we understand the tax rates and exemptions, let’s delve into the step-by-step process of navigating sales tax when buying a new car in New York.

Step 1: Researching the Applicable Tax Rate

Before initiating the purchase, it’s crucial to determine the sales tax rate that will apply to your transaction. This involves understanding the state tax rate of 4% and then factoring in the local tax rate specific to your county. Online resources and local government websites can provide this information.

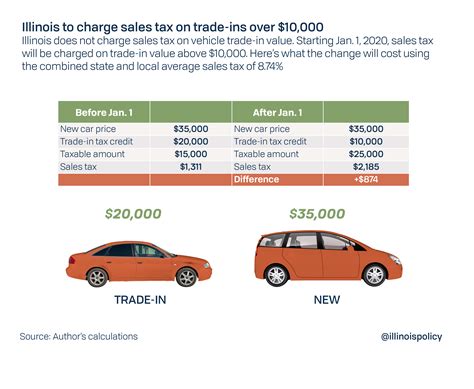

Step 2: Negotiating the Price

When negotiating the price of your new car, it’s important to consider the sales tax as part of the overall cost. Some dealerships may offer incentives or discounts that can reduce the taxable amount, potentially saving you a significant sum. Be sure to ask about any available deals or promotions that could lower your tax liability.

Step 3: Completing the Purchase

Once you’ve agreed on a price and are ready to complete the purchase, the dealership will calculate the sales tax based on the final cost of the vehicle. They will then add this tax to the purchase price, and you’ll be required to pay the total amount, including tax, to finalize the transaction.

Step 4: Registration and Title

After paying the sales tax, you’ll need to register your new vehicle with the New York DMV. This process involves providing proof of purchase, insurance, and paying any applicable registration fees. The DMV will then issue you a title for your vehicle, which serves as proof of ownership.

Expert Insights and Tips

Here are some valuable insights and tips to help you navigate the sales tax process more efficiently:

- Shop Around: Consider purchasing your new car from dealerships in counties with lower sales tax rates. This can result in significant savings, especially for higher-priced vehicles.

- Research Exemptions: If you believe you may qualify for an exemption or tax break, research the criteria thoroughly. Consult with tax professionals or the DMV to ensure you meet the requirements.

- Consider Leasing: Leasing a vehicle may offer tax advantages, as the sales tax is typically calculated based on monthly payments rather than the full purchase price. This can result in a lower overall tax liability.

- Negotiate Strategically: When negotiating the price, keep the sales tax in mind. Aim for a lower purchase price to reduce the taxable amount, which can lead to substantial savings.

- Seek Professional Advice: For complex transactions or unique circumstances, consulting a tax advisor or accountant can provide valuable guidance and ensure you're taking full advantage of any available tax benefits.

Conclusion: Navigating New York’s Sales Tax Landscape

Buying a new car in New York involves navigating a complex sales tax system. By understanding the applicable rates, researching exemptions, and employing strategic negotiation tactics, you can minimize your tax liability and make a more cost-effective purchase. Remember to consult experts and stay informed to ensure a smooth and financially beneficial transaction.

Frequently Asked Questions

Are there any sales tax breaks for hybrid or electric vehicles in New York?

+

Yes, New York offers a sales tax exemption for the purchase of plug-in electric vehicles (PEVs) and certain hybrid vehicles. This exemption applies to the first 60,000 of the vehicle's sales price, resulting in significant savings for buyers of these environmentally friendly cars.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>Can I claim a refund if I move out of state after purchasing a car in New York?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Yes, if you move out of New York within six months of purchasing a vehicle, you may be eligible for a sales tax refund. To claim this refund, you'll need to provide proof of the new state's residency and vehicle registration. It's advisable to consult the New York Department of Taxation and Finance for specific guidelines.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>Are there any sales tax exemptions for military personnel in New York?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Yes, New York offers a sales tax exemption for military personnel who are New York residents and purchase a vehicle while on active duty outside the state. This exemption applies to the first 18,000 of the vehicle’s sales price. It’s important to have the proper documentation to claim this exemption.