Denver County Sales Tax

Welcome to the comprehensive guide on Denver County's sales tax! In this article, we will delve into the intricacies of the sales tax landscape in Denver County, Colorado. With a rich history dating back to the late 19th century, Denver has evolved into a vibrant urban center, and its sales tax structure plays a crucial role in the local economy. Let's explore the specifics of Denver County's sales tax, including rates, applicability, and its impact on businesses and consumers.

Understanding Denver County Sales Tax

Denver County, home to the vibrant city of Denver, imposes a sales tax that contributes significantly to the local government’s revenue. This tax is applicable to a wide range of goods and services purchased within the county boundaries. The revenue generated from this tax supports various public services and infrastructure projects, making it an essential component of Denver’s economic framework.

The sales tax in Denver County is composed of both state and local components. The state sales tax rate is a fixed percentage applied uniformly across Colorado, while local governments, including Denver County, have the authority to impose additional sales tax rates to meet their specific revenue needs. This combination of state and local taxes creates a unique sales tax structure for Denver County, making it distinct from other regions within the state.

Sales Tax Rates in Denver County

As of the latest data available, the total sales tax rate in Denver County stands at 7.62%. This rate includes the state sales tax of 2.9% and the additional local sales tax imposed by Denver County, which is 4.72%. It’s important to note that this rate can be subject to change, and it’s advisable to check with the Denver Department of Finance for the most current information.

| Tax Type | Rate |

|---|---|

| State Sales Tax | 2.9% |

| Denver County Sales Tax | 4.72% |

| Total Sales Tax | 7.62% |

The sales tax rate in Denver County is not a one-size-fits-all approach. Different jurisdictions within the county may have slightly varying rates due to additional taxes imposed by specific municipalities. For instance, the city of Denver itself has an extra 0.1% sales tax, bringing the total rate within the city limits to 7.72%. These nuances in sales tax rates can impact businesses and consumers, so staying informed about these variations is crucial.

Applicability and Exemptions

The sales tax in Denver County applies to a broad spectrum of goods and services. This includes retail sales, restaurant meals, hotel accommodations, and various other transactions. However, it’s essential to note that certain items and services are exempt from sales tax. These exemptions can vary based on state and local regulations and may include necessities like groceries, prescription medications, and certain medical services.

Additionally, certain entities, such as nonprofit organizations and government agencies, may also be exempt from sales tax. Understanding these exemptions is crucial for businesses to ensure compliance with the law and for consumers to know their rights when making purchases.

Impact on Businesses and Consumers

The sales tax in Denver County has a profound impact on both businesses and consumers. For businesses, especially those operating within the retail sector, the sales tax directly affects their bottom line. Businesses must collect and remit the appropriate sales tax to the government, which can influence their pricing strategies and overall profitability.

From a consumer perspective, the sales tax adds to the overall cost of goods and services. It's essential for consumers to be aware of the sales tax rate when budgeting for purchases. Additionally, understanding the sales tax structure can help consumers make informed decisions about where to shop, especially when considering the variations in rates between different jurisdictions within Denver County.

Compliance and Remittance

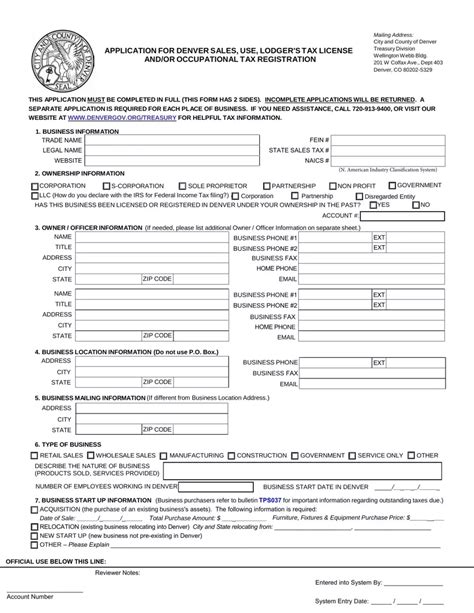

Compliance with sales tax regulations is a critical aspect for businesses operating in Denver County. Businesses are responsible for accurately calculating, collecting, and remitting the sales tax to the appropriate tax authorities. Failure to comply with these regulations can result in penalties and legal consequences.

The Denver Department of Finance provides resources and guidelines to assist businesses in understanding their sales tax obligations. This includes information on registration, tax rate changes, and reporting requirements. By staying informed and compliant, businesses can avoid unnecessary complications and maintain a positive relationship with the local tax authorities.

Consumer Awareness and Budgeting

For consumers, being aware of the sales tax rate and its impact on their purchases is essential for financial planning. Understanding the total cost of a product or service, including the sales tax, can help consumers make informed decisions and manage their budgets effectively. Especially when comparing prices between different retailers or jurisdictions within Denver County, consumers should factor in the sales tax to ensure a fair comparison.

Additionally, consumers should be mindful of any sales tax holidays or special promotions that may occur throughout the year. These periods can offer temporary relief from sales tax, making it an ideal time for significant purchases. Staying informed about these events can help consumers maximize their savings and make the most of their purchasing power.

Future Implications and Trends

The sales tax landscape in Denver County is subject to change and evolution. As the city and county continue to grow and develop, the sales tax structure may undergo adjustments to meet the evolving needs of the local government and its residents.

One potential trend is the increasing use of technology for sales tax compliance. Denver County, like many other regions, may explore digital solutions to streamline the tax collection and remittance process. This could include online platforms for tax registration, real-time tax calculation tools, and electronic filing systems, making it easier for businesses to stay compliant and for consumers to understand their tax obligations.

Additionally, with the rise of e-commerce, the sales tax structure may need to adapt to accommodate online sales. Denver County, like other jurisdictions, may need to address the challenge of collecting sales tax from out-of-state online retailers, ensuring a level playing field for local businesses.

Economic Impact and Development

The sales tax revenue generated in Denver County plays a significant role in the local economy and its development. This revenue supports essential public services, including education, healthcare, infrastructure, and public safety. As such, the sales tax structure and its rates can influence the quality of life and economic opportunities within the county.

As Denver County continues to thrive and attract businesses and residents, the sales tax revenue becomes increasingly crucial for funding vital services and initiatives. The effective management and allocation of this revenue can drive economic growth, enhance the local business environment, and improve the overall well-being of the community.

Conclusion

Denver County’s sales tax structure is a dynamic and integral part of the local economy. From understanding the varying rates to the impact on businesses and consumers, this guide provides a comprehensive overview of the sales tax landscape in Denver. As the city and county continue to evolve, staying informed about sales tax regulations and their implications will remain crucial for both businesses and consumers.

By navigating the intricacies of Denver County's sales tax, individuals and businesses can make informed decisions, contribute to the local economy, and ensure compliance with the law. As the city's economic hub, Denver's sales tax structure plays a vital role in shaping the future of the region, making it a key aspect for all residents and stakeholders to understand and engage with.

Frequently Asked Questions

What is the current sales tax rate in Denver County?

+As of our latest information, the total sales tax rate in Denver County is 7.62%. This includes the state sales tax of 2.9% and the additional local sales tax of 4.72% imposed by Denver County. However, it’s important to note that these rates can change, so it’s advisable to check with the Denver Department of Finance for the most current information.

Are there any sales tax exemptions in Denver County?

+Yes, certain items and services are exempt from sales tax in Denver County. These exemptions can vary based on state and local regulations. Common exemptions include groceries, prescription medications, and certain medical services. Nonprofit organizations and government agencies may also be exempt from sales tax. It’s essential to consult the specific regulations to understand the full list of exemptions.

How do businesses comply with sales tax regulations in Denver County?

+Businesses operating in Denver County must register with the appropriate tax authorities, accurately calculate and collect the sales tax on each transaction, and remit the collected tax to the government. The Denver Department of Finance provides resources and guidelines to assist businesses in understanding their sales tax obligations. Compliance with these regulations is crucial to avoid penalties and legal issues.

Are there any sales tax holidays in Denver County?

+Yes, Denver County, like many other regions, may have designated sales tax holidays. These periods typically occur during specific times of the year and offer temporary relief from sales tax on certain items, such as back-to-school supplies or energy-efficient appliances. These holidays can be an excellent opportunity for consumers to save money on essential purchases. Stay informed about these events to take advantage of the savings.

How does the sales tax revenue in Denver County benefit the community?

+The sales tax revenue generated in Denver County supports a wide range of public services and initiatives. This revenue funds essential services like education, healthcare, infrastructure development, and public safety. It also contributes to the enhancement of recreational facilities and cultural programs. By effectively managing and allocating this revenue, Denver County can drive economic growth and improve the overall quality of life for its residents.