Sales Tax In Ma For Cars

The state of Massachusetts, often referred to as "MA," has a unique sales tax system, including specific regulations for the purchase of vehicles. Understanding the intricacies of sales tax when buying a car in MA is crucial for both residents and potential visitors looking to make an informed purchase decision. This comprehensive guide aims to provide an in-depth analysis of the sales tax system in MA, specifically focusing on vehicle purchases, to ensure you are well-prepared and financially aware.

Understanding Sales Tax in MA: A Comprehensive Overview

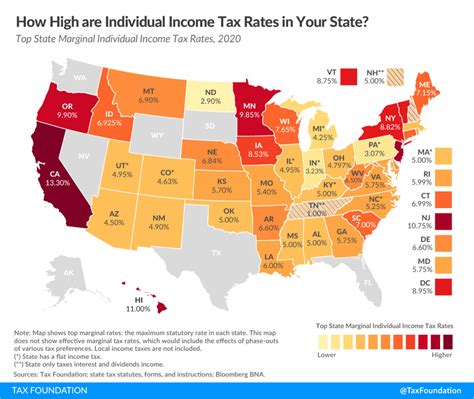

Massachusetts operates under a comprehensive sales and use tax system, which applies to various goods and services. The state sales tax rate is currently set at 6.25%, a standard rate applicable to most transactions. However, it’s important to note that certain jurisdictions within MA may impose additional local sales taxes, which can vary from one municipality to another. These local taxes can increase the overall sales tax rate, making it essential for consumers to be aware of the specific rates in their respective areas.

When it comes to vehicle purchases, MA introduces specific rules and regulations. The sales tax on cars is calculated based on the purchase price, including any applicable fees and charges. This means that when you buy a car in MA, the sales tax is applied to the total cost of the vehicle, which can include the manufacturer's suggested retail price (MSRP), additional dealer fees, and any optional features or add-ons you choose.

One notable aspect of MA's sales tax system is the First $1000 Exemption for vehicle purchases. This exemption applies to the first $1,000 of the vehicle's purchase price, effectively reducing the overall sales tax burden for buyers. For instance, if you purchase a car priced at $20,000, the sales tax will only be calculated on $19,000, as the first $1,000 is exempt. This exemption provides a significant savings opportunity for car buyers, especially those purchasing lower-priced vehicles.

Sales Tax Calculation for Vehicle Purchases in MA

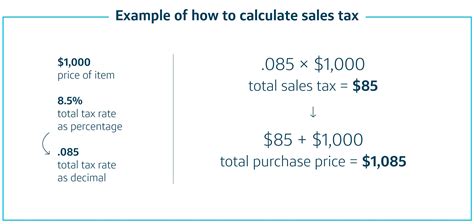

To calculate the sales tax on a vehicle purchase in MA, you can use the following formula:

Sales Tax Amount = (Vehicle Purchase Price - $1,000) * Sales Tax Rate

Let's consider an example to illustrate this calculation. If you purchase a car priced at $30,000 in a jurisdiction with a 6.25% sales tax rate, the sales tax amount would be calculated as follows:

Sales Tax Amount = ($30,000 - $1,000) * 0.0625 = $1,718.75

Therefore, in this scenario, the sales tax on the vehicle purchase would amount to $1,718.75.

It's important to note that this calculation is a simplified example and may not account for all potential factors. Additional fees, such as documentation fees, registration fees, or title transfer fees, may also be applicable and could impact the final sales tax amount. It's advisable to consult with the dealer or refer to official MA tax guidelines for a more accurate estimate of your specific vehicle purchase.

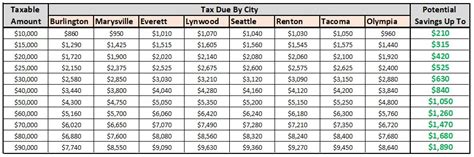

Vehicle Sales Tax Rates in Different Jurisdictions

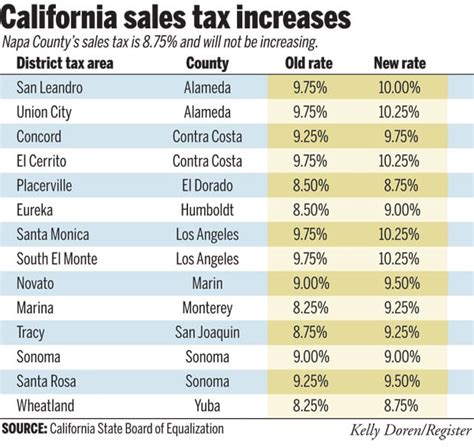

While the state sales tax rate in MA is uniform at 6.25%, it’s essential to recognize that local governments have the authority to impose additional taxes. These local sales tax rates can vary significantly, ranging from 0% in certain areas to upwards of 7% in others. As a result, the total sales tax rate on vehicle purchases can differ substantially depending on the specific jurisdiction where the purchase is made.

| Jurisdiction | Sales Tax Rate |

|---|---|

| Boston | 6.65% |

| Springfield | 6.25% |

| Worcester | 7.0% |

| Cambridge | 6.75% |

| Brockton | 6.25% |

The table above provides a glimpse of the varying local sales tax rates in different cities within MA. It's crucial for buyers to be aware of these variations and consider the potential impact on their vehicle purchase. When comparing prices and considering different dealerships, it's advisable to factor in the local sales tax rates to make an informed decision.

Exemptions and Special Considerations for Vehicle Sales Tax in MA

Massachusetts offers certain exemptions and special considerations regarding sales tax on vehicle purchases. These provisions are designed to accommodate specific circumstances and provide relief to eligible individuals or entities. It’s crucial to understand these exemptions to determine if they apply to your situation and to ensure compliance with MA tax regulations.

Sales Tax Exemptions for Specific Vehicles

MA provides sales tax exemptions for specific types of vehicles, including:

- Electric Vehicles (EVs): MA promotes the adoption of environmentally friendly vehicles by offering a 100% sales tax exemption on the purchase of new electric vehicles. This exemption applies to both battery-electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). By incentivizing the purchase of EVs, MA aims to reduce carbon emissions and promote sustainable transportation.

- Alternative Fuel Vehicles: In addition to EVs, MA offers a partial sales tax exemption for vehicles that run on alternative fuels. This includes vehicles powered by natural gas, propane, or hydrogen. The exemption rate varies depending on the type of alternative fuel used. For instance, vehicles fueled by compressed natural gas (CNG) or liquefied petroleum gas (LPG) may be eligible for a 50% sales tax exemption, while hydrogen fuel cell vehicles could qualify for a 75% sales tax exemption.

- Adaptive Vehicles for Disabled Individuals: MA recognizes the importance of mobility for individuals with disabilities by providing a 100% sales tax exemption on the purchase of adaptive vehicles. This exemption applies to vehicles equipped with adaptive devices or modifications that enhance accessibility and mobility for disabled drivers or passengers. By eliminating the sales tax burden, MA aims to ensure equal access to transportation for individuals with disabilities.

It's crucial to note that these exemptions are subject to specific criteria and documentation requirements. To qualify for the EV or alternative fuel vehicle exemptions, for example, you may need to provide proof of the vehicle's eligibility, such as a certificate of compliance or a manufacturer's statement. Similarly, for adaptive vehicles, you may need to submit documentation confirming the disability and the need for adaptive equipment.

Special Considerations for Vehicle Sales Tax in MA

In addition to the exemptions mentioned above, MA offers special considerations for specific circumstances related to vehicle sales tax:

- Trade-Ins: When trading in your old vehicle as part of a new vehicle purchase, the sales tax calculation in MA takes into account the trade-in value. The trade-in value is subtracted from the purchase price of the new vehicle before applying the sales tax rate. This approach ensures that you are only taxed on the net purchase price, providing a financial advantage when trading in your old vehicle.

- Vehicle Donations: If you plan to donate your vehicle to a qualified charitable organization, you may be eligible for a sales tax exemption. MA allows donors to claim a sales tax exemption on the fair market value of the donated vehicle, provided the donation is made to a registered charity. This exemption provides a tax benefit to donors while supporting charitable causes.

- Vehicle Leases: For individuals or businesses leasing a vehicle, the sales tax in MA is calculated based on the lease payment rather than the full purchase price. The sales tax is applied to each lease payment, which can provide a more manageable tax burden compared to purchasing the vehicle outright. It's important to review the lease agreement and consult with a tax professional to understand the specific sales tax implications of a vehicle lease.

These special considerations demonstrate MA's commitment to supporting various transportation needs and promoting sustainable practices. By offering exemptions and tailored tax calculations, the state aims to encourage environmentally friendly vehicle choices, support individuals with disabilities, and facilitate vehicle ownership and donations for charitable purposes.

Future Implications and Conclusion

The sales tax system in MA, particularly concerning vehicle purchases, is a dynamic and evolving landscape. While the state’s current sales tax rate and exemptions provide a solid framework, it’s important to recognize the potential for future changes and developments. As MA continues to prioritize sustainable transportation and support for individuals with disabilities, we can expect further refinements and incentives within the sales tax framework.

Looking ahead, MA may explore additional measures to promote the adoption of electric and alternative fuel vehicles, such as expanding the existing sales tax exemptions or introducing new incentives. The state's commitment to environmental sustainability and accessibility is likely to shape future tax policies, creating a more favorable environment for these vehicles. Additionally, as technology advances and new transportation options emerge, MA may consider adapting its sales tax system to accommodate innovative mobility solutions.

Furthermore, MA's sales tax regulations are subject to ongoing review and potential amendments. It's crucial for buyers, dealers, and industry professionals to stay informed about any changes to sales tax rates, exemptions, or special considerations. By staying abreast of these developments, stakeholders can ensure compliance, optimize financial strategies, and make informed decisions regarding vehicle purchases and sales.

In conclusion, understanding the sales tax system in MA, especially when it comes to vehicle purchases, is essential for both residents and visitors. The current sales tax rate, coupled with the First $1000 Exemption and specific exemptions for electric, alternative fuel, and adaptive vehicles, provides a comprehensive framework for consumers. By being aware of these regulations and considering the varying local sales tax rates, buyers can make well-informed decisions and navigate the vehicle purchasing process with confidence.

As MA continues to evolve its sales tax policies, staying informed about future developments will be crucial for all stakeholders. By embracing the state's commitment to sustainability and accessibility, we can expect a more supportive and progressive sales tax environment for vehicle purchases in the years to come. Ultimately, a deep understanding of MA's sales tax system empowers buyers to make financially sound choices and contributes to a thriving automotive market within the state.

How often does MA update its sales tax rates and regulations?

+

MA reviews and updates its sales tax rates and regulations periodically. While there is no fixed schedule for these updates, they are typically announced in advance to allow businesses and consumers to adapt. It’s advisable to stay informed by monitoring official government websites and tax publications for any changes.

Are there any sales tax holidays in MA for vehicle purchases?

+

Currently, MA does not observe specific sales tax holidays for vehicle purchases. However, the state may offer sales tax holidays for certain items or during designated periods. It’s worth checking the official MA Department of Revenue website for any updates or announcements regarding sales tax holidays.

Can I apply for a refund if I overpay sales tax on a vehicle purchase in MA?

+

Yes, if you believe you have overpaid sales tax on a vehicle purchase in MA, you can apply for a refund. The process typically involves completing a sales tax refund application and providing supporting documentation. It’s advisable to consult with a tax professional or refer to the MA Department of Revenue guidelines for specific instructions and requirements.

Are there any online resources to estimate sales tax on vehicle purchases in MA?

+

Yes, several online tools and calculators are available to estimate sales tax on vehicle purchases in MA. These resources can provide a rough estimate based on the vehicle’s purchase price and the applicable sales tax rate. However, it’s important to note that these estimates may not account for all factors and should be used as a guide rather than a definitive calculation.