Decoding the Truth About SC State Income Tax: What Every Resident Should Know

South Carolina's state income tax landscape has become a focal point in recent fiscal discourse, especially as debates surrounding tax fairness, economic competitiveness, and fiscal sustainability intensify. For residents and prospective movers alike, understanding the nuances of SC's income tax policies is not merely an academic exercise but a necessary component of financial literacy and strategic planning. This comprehensive analysis aims to decode the intricate layers of South Carolina's income taxation, unraveling misconceptions, revealing critical insights, and equipping every resident with the knowledge needed to navigate their fiscal environment confidently.

Unveiling the Structure of South Carolina’s State Income Tax: Mechanics and Trends

The foundation of South Carolina’s income tax system lies in its progressive tax brackets combined with unique deductions and credits tailored to bolster economic equity and retain residents. Over the past decade, South Carolina has undergone significant reforms—most notably, tax rate reductions and adjustments to exemption thresholds—that reflect a broader strategic aim to attract businesses and skilled labor while maintaining fiscal balance. As of 2023, the state’s top marginal rate is approximately 7%, a figure that positions South Carolina in the middle tier nationally but with specific nuances that influence its competitiveness and revenue stability.

Historical Context and Evolutionary Dynamics of SC Income Tax Policy

South Carolina’s tax policy evolution has been marked by periodic reforms driven by shifts in political leadership and economic imperatives. The early 2000s witnessed incremental hikes to address short-term budget deficits, coupled with efforts to expand the base via closing loopholes. In recent years, bipartisan support led to strategic rate cuts—most notably, a 1% reduction in 2017—aimed at fostering a more attractive environment for middle-income earners. This historical trajectory highlights how tax policy in South Carolina balances revenue needs with economic growth objectives, a balancing act that continues to evolve amid the state’s demographic and economic shifts.

| Relevant Category | Substantive Data |

|---|---|

| Top Marginal Income Tax Rate | 7.0% in 2023, down from 7.75% in prior years |

| Standard Deduction (2023) | $12,950 for single filers; $25,900 for married filing jointly |

| Tax Brackets | Four progressive brackets: up to $3,070 at 0%, $3,071–$15,410 at 3%, $15,411–$28,700 at 4%, over $28,701 at 7% |

Deciphering Residency and Tax Liability in South Carolina

Residency status remains the linchpin in determining taxable income. South Carolina employs a domicile-based approach, meaning if an individual maintains their permanent residence in the state, they are considered a resident and taxed on all income, regardless of where it accrues. Conversely, non-residents are taxed solely on income sourced within South Carolina. This distinction is vital, especially for dual residents, remote workers, and those with significant income streams from multiple states. Properly understanding and leveraging residency status can lead to substantial tax savings and compliance benefits.

Residency Tests and Their Implications

The state assesses domicile through various indicators—such as the location of primary residence, voting registration, and vehicle registration—over a 12-month period. For individuals where domicile is ambiguous, South Carolina provides a statutory test that considers physical presence, intent, and significant connections to the state. Strategic planning around these criteria can considerably influence one’s tax obligations. For example, establishing or withdrawing domicile should be based on a comprehensive understanding of both state law and individual circumstances, factoring in elements like employment location, family ties, and investment holdings.

| Relevant Category | Substantive Data |

|---|---|

| Residency Definition | Primary residence in South Carolina for >183 days or intent to remain indefinitely |

| Non-Resident Taxation | Taxed on SC-sourced income only, such as rental income from SC property or business income |

| Part-Year Resident | Taxed proportionally on income earned during residency period |

Key Deductions, Credits, and Their Strategic Use

South Carolina offers a variety of deductions and credits designed to incentivize certain behaviors and alleviate tax burdens for targeted groups. Among these, the standard deduction, personal exemptions, and specific credits—such as the Child and Dependent Care Credit—are noteworthy. Effective use of these can significantly reduce taxable income and overall tax bills. For instance, the child-related credits can offset a substantial portion of childcare expenses, which is particularly beneficial for working families. Meanwhile, itemized deductions, including mortgage interest and charitable contributions, remain relevant for higher-income filers, necessitating detailed record-keeping and strategic planning during tax season.

Maximizing Tax Benefits Through Planning

Tax optimization involves timing income realization, leveraging available credits, and navigating phase-out thresholds. For example, income shifting strategies—such as deferring bonuses or business income—can keep taxpayers within lower brackets or preserve credits. Moreover, investment in South Carolina-specific savings programs, like the South Carolina College Tuition Savings Program, can offer state tax deductions as an added incentive for education planning. Staying abreast of legislative updates is crucial, as the state periodically adjusts these incentives to align with fiscal policies or economic shifts.

| Relevant Category | Substantive Data |

|---|---|

| Child and Dependent Care Credit | Up to 30% of qualified expenses, max $3,000 for one child/dependent, $6,000 for multiple |

| Standard Deduction (2023) | $12,950 single, $25,900 joint filers |

| Itemized Deduction Threshold | Applicable if total exceeds standard deduction; includes mortgage interest, charitable contributions, medical expenses |

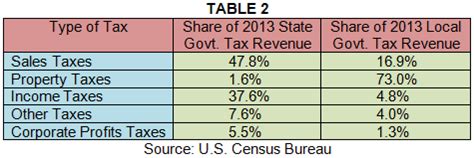

Impact of Federal Tax Policies and Their Interplay with South Carolina Taxation

The federal framework significantly influences state income tax calculations, often dictating how income is classified and which adjustments are permissible. Recent federal reforms—such as increased standard deduction, expanded tax credits, and alterations to itemized deduction caps—have a cascading effect on South Carolina’s tax filings. For instance, the federal SALT (State and Local Tax) deduction cap introduced by the 2017 Tax Cuts and Jobs Act prompted states, including South Carolina, to reconsider their tax incentives and deduction schemes to retain competitiveness.

Adjusting for Federal Policy Shifts

Taxpayers must be vigilant as federal policies evolve, particularly regarding the deductibility of state and local taxes, which directly impacts overall tax liability. South Carolina’s partial decoupling from certain federal provisions enables it to tailor its tax incentives—such as capping or expanding deductions—thus aligning state policy with both federal constraints and state-specific economic objectives. The interplay, therefore, demands sophisticated tax planning strategies that integrate compliance with maximizing benefits, particularly for high-net-worth individuals and complex business structures.

| Relevant Category | Substantive Data |

|---|---|

| SALT Deduction Cap (Federal) | $10,000 limit introduced in 2018, influencing state tax deduction strategies |

| Federal Standard Deduction (2023) | $13,850 single, $27,700 married filing jointly |

| South Carolina Conformity | Partially conforms—many federal provisions are decoupled, allowing SC-specific deductions |

Future Outlook: Trends and Policy Directions for South Carolina Income Tax

South Carolina’s fiscal policy trajectory suggests an ongoing pursuit of moderate tax rates balanced with fiscal prudence. Legislators are increasingly focused on digital and remote work economies, seeking to refine residency rules and broaden tax compliance net. Emerging initiatives, such as virtual residency verification systems and targeted tax incentives for green energy investments, hint at future policy directions that could reshape the state’s tax landscape.

Anticipated Reforms and Strategic Preparation

Policy analysts project continued adjustments in rates and credits, particularly aimed at luring high-income earners and tech companies. The adoption of digital tools for tax administration aims to improve compliance, reduce evasion, and enhance revenue collection. For residents, staying ahead of these shifts involves proactive engagement with legislative developments, participation in public consultations, and adaptation of financial planning strategies to benefit from upcoming incentives and avoid pitfalls of abrupt policy changes.

| Relevant Category | Substantive Data |

|---|---|

| Projected Rate Changes | Potential modest increases or reforms in frameworks to address fiscal deficits by 2025 |

| Tax Incentive Trends | Expansion in renewable energy credits and digital business incentives |

| Digital Tax Administration | Implementation of e-filing enhancements and residency verification systems by 2024 |

How can I determine my residency status for South Carolina tax purposes?

+Residency status hinges on domicile, which is based on intent and physical presence. Maintaining a primary residence, job location, voting registration, and other connections typically establish domicile, but specifics can vary. For nuanced cases, South Carolina law considers duration and intent, so consulting a tax professional for an assessment is advisable.

What strategies can I leverage to minimize my South Carolina income tax liability legally?

+Effective strategies include maximizing deductions and credits, timing income and expenses, investing in state-approved savings plans, and optimizing residency status where appropriate. Additionally, staying compliant with changing laws and utilizing professional advice can help to craft personalized, legal tax-saving approaches.

Will South Carolina’s income tax rates likely decrease further in the future?

+While recent trends point to stable or modestly reduced rates, future changes depend on fiscal needs, political priorities, and economic conditions. Proposals for further cuts or reforms are always under consideration, but they require legislative approval and alignment with the state’s budgetary strategies.

How do federal income tax reforms influence South Carolina’s state tax policies?

+Federal reforms, especially caps on deductions and adjustments in tax credits, influence state policy by shifting the tax burden. South Carolina often adjusts its deductions and credits to stay competitive and mitigate the impact of federal caps, thus ensuring residents retain some level of benefit.