Gas Tax California

The topic of the gas tax in California has been a significant discussion point in recent years, especially as the state grapples with rising fuel costs and the need for infrastructure improvements. The California gas tax is a complex issue, with various factors influencing its implementation and impact on residents and the economy. This comprehensive article aims to delve into the intricacies of the gas tax, exploring its history, purpose, and the challenges it presents to Californians.

Understanding the California Gas Tax

The gas tax in California is a consumption tax levied on the purchase of gasoline and other motor fuels. It is a critical revenue source for the state, primarily allocated towards funding transportation infrastructure projects, such as road repairs, bridge maintenance, and public transit improvements. The tax rate is determined by the California State Legislature and is subject to periodic adjustments to keep up with inflation and the rising costs of transportation projects.

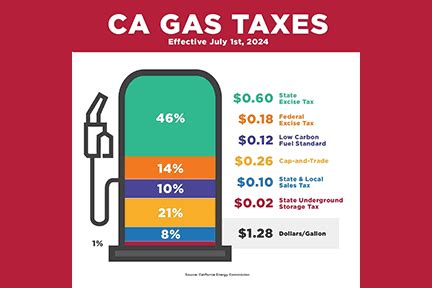

The current gas tax in California is comprised of both state and federal components. The state portion is set at $0.41 per gallon, while the federal tax stands at $0.184 per gallon. These rates have been adjusted over the years to meet the evolving needs of the state's transportation network. However, it is the state's gas tax that often sparks debate and controversy, especially during periods of economic hardship or when fuel prices surge.

A Historical Perspective

The gas tax in California has a rich history, dating back to the early 20th century when the automobile was becoming an integral part of American life. In 1923, California became one of the first states to impose a gas tax, with the revenue initially dedicated to constructing and maintaining the state’s growing road network. Over the decades, the gas tax has played a pivotal role in funding some of California’s most iconic transportation projects, including the construction of the famous Pacific Coast Highway and the expansion of the state’s freeway system.

Despite its long-standing presence, the gas tax has not been without its share of controversies. In the 1980s, the state experienced a surge in fuel prices, leading to public outcry and a call for a rollback of the gas tax. This resulted in a temporary reduction in the tax rate, but it also sparked a debate on the state's reliance on volatile fuel prices to fund infrastructure projects. Since then, the gas tax has been a subject of frequent discussions and proposals for reform, with varying degrees of success.

Revenue Allocation and Spending

The revenue generated from the gas tax is a crucial component of California’s transportation funding. It is deposited into the State Transportation Improvement Fund (STIF), which is then allocated to various transportation projects across the state. The STIF ensures that the gas tax revenue is directed towards critical areas such as road maintenance, bridge repairs, and the improvement of public transit systems.

| Allocation Category | Percentage of STIF Funds |

|---|---|

| State Highways and Freeways | 40% |

| Local Roads and Streets | 30% |

| Public Transit Projects | 20% |

| Pedestrian and Bicycle Infrastructure | 10% |

The STIF allocation process is designed to ensure a balanced approach to transportation funding, addressing the needs of various modes of transport and prioritizing projects based on their impact and importance.

Impact on Consumers

The gas tax has a direct impact on California residents and businesses, as it increases the cost of gasoline and diesel fuel. This can be particularly burdensome for those who rely heavily on their vehicles for daily commutes or business operations. The tax, when combined with rising fuel prices, can lead to significant financial strain, especially for low-income households and small businesses.

However, it is important to note that the gas tax is not solely a consumer burden. The revenue generated helps maintain and improve the state's transportation infrastructure, which benefits all residents and businesses in the long run. Well-maintained roads and efficient public transit systems contribute to a more sustainable and economically vibrant California.

The Challenges of the California Gas Tax

While the gas tax serves an essential purpose, it also presents several challenges that California must navigate to ensure a fair and effective tax system.

Volatility of Fuel Prices

One of the primary challenges associated with the gas tax is the volatility of fuel prices. As the cost of gasoline and diesel fluctuates, the tax’s impact on consumers can vary significantly. During periods of high fuel prices, the tax can become a substantial burden, leading to public discontent and calls for tax relief. On the other hand, when fuel prices are lower, the tax may be less noticeable, but it still plays a crucial role in funding transportation projects.

To address this challenge, some states have implemented mechanisms to stabilize the gas tax rate, such as indexing it to inflation or fuel price fluctuations. This ensures that the tax remains consistent and predictable, reducing the impact of volatile fuel prices on consumers.

Equity and Fairness Concerns

The gas tax also raises questions of equity and fairness. As it is a consumption tax, it affects all drivers equally, regardless of their income level or the distance they travel. This can be particularly unfair to low-income individuals who may have no choice but to drive long distances for work or essential services. Additionally, the tax may disproportionately impact rural communities where public transit options are limited, forcing residents to rely heavily on their vehicles.

To address these concerns, some states have explored alternative funding mechanisms, such as vehicle miles traveled (VMT) fees or road usage charges. These approaches aim to shift the burden away from a consumption tax to a usage-based system, ensuring that those who drive more contribute more to transportation funding.

Maintaining Infrastructure with Evolving Transportation Trends

The California gas tax was initially designed to fund a traditional transportation network, primarily focused on roads and highways. However, with the rise of alternative transportation options, such as electric vehicles (EVs) and ride-sharing services, the tax’s effectiveness in funding these new infrastructure needs is being questioned.

As more Californians adopt electric vehicles, the revenue generated from the gas tax will decline, potentially impacting the state's ability to maintain and expand its transportation network. This challenge requires a forward-thinking approach, exploring new funding sources and innovative strategies to ensure that California's transportation infrastructure remains sustainable and adaptable to changing trends.

Future Outlook and Potential Solutions

Looking ahead, California must address the evolving challenges presented by the gas tax while ensuring the continued funding of its transportation infrastructure. Several potential solutions and strategies are being discussed and implemented to navigate these complexities.

Exploring Alternative Funding Sources

As the state’s transportation landscape changes, California is exploring alternative funding sources to complement the gas tax. One promising approach is the implementation of a Vehicle Miles Traveled (VMT) fee, which charges drivers based on the number of miles they drive. This system ensures that those who use the roads more frequently contribute proportionally more to transportation funding.

Additionally, the state is considering revenue from other sources, such as congestion pricing, which charges drivers a fee for using certain high-traffic roads or entering congested areas. This approach not only generates revenue but also encourages more efficient use of the road network.

Investing in Renewable Energy and Electric Vehicles

With the rise of electric vehicles, California is strategically investing in renewable energy infrastructure and EV charging stations. By encouraging the adoption of EVs, the state aims to reduce its reliance on traditional fuel sources, which will ultimately lead to a decrease in gas tax revenue. However, by diversifying its energy sources and promoting sustainable transportation, California can ensure a more resilient and environmentally friendly transportation system.

Public-Private Partnerships

California is exploring partnerships with private entities to leverage their expertise and resources in transportation infrastructure development. These partnerships can bring much-needed investment and innovative solutions to the table, helping to bridge the funding gap and accelerate infrastructure projects.

For instance, public-private partnerships can lead to the development of innovative toll road systems, where private companies manage and maintain certain sections of the road network, providing a steady stream of revenue for transportation projects.

Long-Term Planning and Transparency

To address concerns about equity and fairness, California is committed to long-term planning and transparency in its transportation funding strategies. By engaging with communities and stakeholders, the state can better understand the needs and challenges of its residents, ensuring that transportation funding is allocated equitably and efficiently.

Furthermore, increased transparency in the allocation of gas tax revenue can build trust and confidence among Californians, demonstrating that their tax dollars are being used effectively to improve the state's transportation infrastructure.

Conclusion

The California gas tax is a critical component of the state’s transportation funding, but it is not without its complexities and challenges. As California navigates the evolving transportation landscape, the state must find innovative solutions to ensure a sustainable and fair system. By embracing alternative funding models, investing in renewable energy, and fostering collaboration, California can secure a bright and sustainable future for its transportation infrastructure.

What is the current gas tax rate in California?

+As of my last update in January 2023, the gas tax rate in California is 0.41 per gallon for gasoline and 0.475 per gallon for diesel fuel. This rate is subject to change and is determined by the California State Legislature.

How is the gas tax revenue used in California?

+The revenue generated from the gas tax is primarily allocated to fund transportation infrastructure projects, including road repairs, bridge maintenance, public transit improvements, and pedestrian and bicycle infrastructure. It is deposited into the State Transportation Improvement Fund (STIF) for this purpose.

How does the gas tax impact consumers in California?

+The gas tax increases the cost of gasoline and diesel fuel for consumers, which can be a financial burden, especially during periods of high fuel prices. However, the tax revenue is crucial for maintaining and improving the state’s transportation infrastructure, which benefits all residents in the long run.

Are there any alternatives to the gas tax being considered in California?

+Yes, California is exploring alternative funding sources to complement the gas tax. This includes the implementation of a Vehicle Miles Traveled (VMT) fee, congestion pricing, and public-private partnerships to leverage private investment in transportation infrastructure.