Oklahoma Tax Return Status

In today's digital age, managing our financial obligations and keeping track of tax-related matters has become more streamlined and efficient. This is particularly evident when it comes to checking the status of your Oklahoma tax return. With the right tools and knowledge, you can easily access the information you need and stay on top of your tax responsibilities. In this comprehensive guide, we will delve into the process of checking your Oklahoma tax return status, exploring the various methods and resources available to taxpayers. From online portals to helpful phone numbers, we will provide you with the insights and steps to navigate this process with ease. Whether you are a resident or a business owner, understanding how to monitor the status of your tax return is crucial for financial planning and compliance. So, let's dive in and explore the world of Oklahoma tax return status checks, ensuring you have the information you need at your fingertips.

Exploring the Process: How to Check Your Oklahoma Tax Return Status

When it comes to managing your taxes in Oklahoma, staying informed about the status of your tax return is essential. The Oklahoma Tax Commission (OTC) offers a range of resources and tools to help taxpayers like yourself track the progress of their returns. In this section, we will guide you through the process of checking your Oklahoma tax return status, providing you with step-by-step instructions and valuable insights.

Online Resources: Accessing Your Tax Return Information

One of the most convenient ways to check your Oklahoma tax return status is through the OTC’s online resources. The commission has developed user-friendly platforms to ensure taxpayers can access their information with ease. Here’s how you can leverage these online tools:

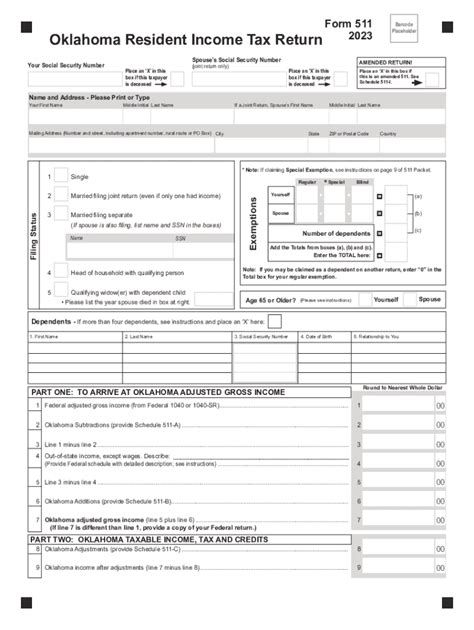

- Oklahoma Taxpayer Access Point (OTAP): OTAP is a secure online portal that allows registered users to view their tax return status, account balance, and other important tax-related information. To access OTAP, you’ll need to create an account and provide personal details such as your Social Security Number (SSN) or Employer Identification Number (EIN) for businesses. Once logged in, you can navigate to the “Tax Return Status” section to check the progress of your return.

- OTC Website: The OTC’s official website serves as a valuable resource for taxpayers. It provides a wealth of information, including updates on tax return processing, payment options, and frequently asked questions. While the website may not offer real-time status updates, it is a great starting point for understanding the tax filing process and obtaining general guidance.

Telephone Support: Connecting with Oklahoma Tax Experts

If you prefer a more personalized approach or have specific inquiries, the OTC offers telephone support to assist taxpayers. Connecting with a tax expert can provide valuable insights and answers to your questions. Here’s how you can utilize telephone support:

- Customer Service Hotline: The OTC maintains a dedicated customer service hotline to address taxpayer inquiries. By calling the hotline, you can speak directly with a tax representative who can provide information about your tax return status, payment options, and other relevant matters. Keep in mind that wait times may vary, especially during peak tax seasons.

- Individual Taxpayer Identification Number (ITIN) Hotline: For taxpayers with an ITIN, the OTC has established a separate hotline to assist with inquiries related to this specific identification number. ITIN holders can call this dedicated line to receive guidance on tax return status, filing requirements, and any other ITIN-related matters.

Mail and In-Person Assistance: Traditional Methods for Status Updates

While online resources and telephone support are convenient, some taxpayers may prefer more traditional methods of obtaining tax return status updates. The OTC acknowledges this preference and offers the following options:

- Mail Correspondence: Taxpayers can choose to receive updates and correspondence regarding their tax return status via mail. By providing a valid mailing address, the OTC will send letters or notices to inform you of the progress of your return. This method may take longer than digital alternatives, but it ensures a secure and reliable means of communication.

- In-Person Assistance: For those who prefer face-to-face interactions, the OTC has physical offices located throughout Oklahoma. Taxpayers can visit these offices to receive assistance with their tax return status inquiries. Appointments may be necessary, so it’s advisable to call ahead to ensure availability and receive any necessary instructions.

| OTC Office Locations | Contact Information |

|---|---|

| Oklahoma City Office | Phone: (405) 521-3160 Address: 2501 N Lincoln Blvd, Oklahoma City, OK 73105 |

| Tulsa Office | Phone: (918) 295-1000 Address: 451 S Boulder Ave, Suite 1000, Tulsa, OK 74103 |

| Lawton Office | Phone: (580) 357-5111 Address: 420 SW 38th St, Lawton, OK 73501 |

Understanding Your Oklahoma Tax Return Status: A Comprehensive Overview

Now that you are familiar with the various methods to check your Oklahoma tax return status, let’s delve deeper into the different stages and potential outcomes you may encounter during the tax return processing journey. Understanding these statuses will help you interpret the information provided by the OTC and make informed decisions regarding your tax obligations.

Accepted and Processing: The Initial Steps

When you submit your Oklahoma tax return, the first status you will likely encounter is “Accepted.” This indicates that the OTC has successfully received and accepted your return for processing. At this stage, your return has entered the initial processing phase, where the OTC’s systems validate the information provided and begin the assessment process.

It’s important to note that the “Accepted” status does not necessarily mean your return has been fully processed or that you will receive a refund or owe any additional taxes. It is merely an acknowledgment that your return has been received and is undergoing initial scrutiny.

Processing: The In-Depth Review

Once your return has been accepted, it moves into the “Processing” stage. This is where the OTC’s systems and tax experts thoroughly review your tax return to ensure accuracy and compliance with Oklahoma tax laws. During this phase, the OTC may request additional information or documentation to verify the accuracy of your return.

The processing stage can vary in duration depending on the complexity of your return and the volume of tax returns being processed by the OTC. It’s crucial to remain patient during this period, as thorough review and verification are essential to ensure accurate tax calculations and compliance.

Completed: The Final Verdict

After your tax return has successfully undergone the acceptance and processing stages, it will reach the “Completed” status. This is the final stage of the tax return processing journey, indicating that the OTC has finished reviewing and assessing your return.

The “Completed” status can have different outcomes depending on your tax situation:

- Refund: If you are due a refund, the OTC will issue a refund payment to you. The method of refund disbursement may vary, including direct deposit, check, or other preferred payment methods. Keep an eye on your chosen payment method to ensure you receive your refund promptly.

- Balance Due: If your tax return indicates that you owe additional taxes, the “Completed” status will be accompanied by a notice of the amount owed. You will need to make arrangements to pay this balance to fulfill your tax obligations. The OTC provides various payment options, including online payments, mail-in payments, or in-person payments at authorized locations.

- No Refund/Balance Due: In some cases, your tax return may result in neither a refund nor a balance due. This means that your tax obligations are considered satisfied, and no further action is required.

Potential Delays and Challenges: Navigating the Unexpected

While the OTC strives to process tax returns efficiently, there may be instances where unexpected delays or challenges arise. It’s important to be aware of these potential issues and understand how to navigate them effectively:

- Missing Information: If the OTC identifies missing or incomplete information on your tax return, they may request additional documentation or clarification. Responding promptly to such requests is crucial to avoid further delays in processing your return.

- Errors or Discrepancies: In some cases, the OTC may discover errors or discrepancies in your tax return. These may include mathematical errors, incorrect tax calculations, or mismatched information. Addressing these issues promptly is essential to resolve any potential tax liabilities or refund adjustments.

- Complex Returns: Certain tax returns, such as those involving business income, investments, or multiple streams of income, may require additional scrutiny and review. Complex returns may take longer to process, so it’s advisable to plan accordingly and allow for extended processing times.

Maximizing Your Tax Experience: Tips and Insights for Oklahoma Taxpayers

Now that you have a comprehensive understanding of the Oklahoma tax return status process and potential outcomes, it’s time to explore some valuable tips and insights to enhance your tax experience. By implementing these strategies, you can streamline your tax obligations, optimize your refunds, and ensure compliance with Oklahoma tax laws.

Filing Early: The Benefits of Prompt Action

One of the most effective ways to maximize your tax experience is to file your Oklahoma tax return early. Here’s why filing early can be advantageous:

- Avoid Processing Delays: Filing early allows your tax return to be processed promptly, reducing the likelihood of delays caused by high tax season volume. By submitting your return early, you can ensure your return is processed within a reasonable timeframe.

- Receive Refunds Faster: If you are due a refund, filing early increases the chances of receiving your refund sooner. The OTC processes refunds on a first-come, first-served basis, so early filers often receive their refunds more quickly.

- Minimize Stress and Anxiety: Tax season can be a stressful time for many individuals and businesses. By filing early, you can alleviate some of the stress associated with last-minute filings and potential complications. This allows you to focus on other important matters without the added pressure.

Accurate Record-Keeping: The Foundation of Tax Compliance

Maintaining accurate and organized records is essential for tax compliance and accurate return preparation. Here’s why proper record-keeping is crucial:

- Avoid Errors and Discrepancies: Accurate record-keeping minimizes the risk of errors or discrepancies in your tax return. By keeping track of income, expenses, deductions, and other relevant information, you can ensure your return reflects your actual financial situation.

- Simplify the Audit Process: In the event of an audit, having well-organized records can greatly simplify the process. Audits can be intimidating, but with comprehensive records, you can provide the necessary documentation to support your tax return and resolve any issues efficiently.

- Make Amending Returns Easier: Accurate record-keeping facilitates the process of amending tax returns if necessary. If you discover errors or need to make adjustments, having clear and organized records will streamline the amendment process, saving you time and effort.

Exploring Tax Credits and Deductions: Maximizing Your Refund

Oklahoma, like many other states, offers various tax credits and deductions to eligible taxpayers. Understanding these incentives can help you maximize your refund and minimize your tax liability. Here are some key considerations:

- Research Available Credits and Deductions: Familiarize yourself with the tax credits and deductions offered by the state of Oklahoma. These may include incentives for education expenses, child care costs, energy-efficient home improvements, and more. By understanding these incentives, you can determine if you qualify and maximize your refund potential.

- Consult a Tax Professional: If you are unsure about which tax credits or deductions apply to your situation, consider consulting a tax professional. Certified Public Accountants (CPAs) or tax attorneys can provide expert guidance and ensure you take advantage of all eligible credits and deductions.

- Keep Track of Eligible Expenses: To claim certain tax credits or deductions, you may need to maintain records of eligible expenses. This could include receipts, invoices, or other documentation. By keeping these records organized, you can easily claim the credits and deductions you qualify for.

Stay Informed: Keep Up with Oklahoma Tax Updates

Tax laws and regulations can change from year to year, so it’s essential to stay informed about any updates or changes that may impact your tax obligations. Here are some tips to ensure you remain up-to-date:

- Follow the OTC’s Website and News: The Oklahoma Tax Commission regularly publishes updates, announcements, and important tax-related information on their website. By regularly visiting the OTC’s website and subscribing to their news feed, you can stay informed about any changes to tax laws, deadlines, or new initiatives.

- Utilize Tax Software or Online Tools: Many reputable tax software providers and online resources offer updates and guides specific to Oklahoma tax laws. These tools can help you navigate any changes and ensure your tax return is prepared accurately and in compliance with the latest regulations.

- Attend Tax Seminars or Workshops: The OTC and other tax-related organizations often host seminars, workshops, or webinars to educate taxpayers about changes in tax laws and regulations. Attending these events can provide valuable insights and help you stay ahead of any tax-related developments.

Frequently Asked Questions (FAQ)

What should I do if I receive a notice from the OTC regarding errors in my tax return?

+If you receive a notice from the Oklahoma Tax Commission (OTC) regarding errors or discrepancies in your tax return, it’s important to respond promptly. Review the notice carefully and identify the specific issues highlighted by the OTC. Gather the necessary documentation or information to address these concerns. Contact the OTC’s customer service hotline or seek assistance from a tax professional to guide you through the process of correcting the errors and ensuring compliance.

How long does it typically take to receive my Oklahoma tax refund after filing my return?

+The processing time for Oklahoma tax refunds can vary depending on several factors, including the volume of tax returns being processed and the method of refund disbursement chosen. On average, it may take several weeks to receive your refund. However, if you file your return electronically and opt for direct deposit, you may receive your refund within 10-14 business days. It’s important to note that the OTC processes refunds on a first-come, first-served basis, so early filers often receive their refunds sooner.

Can I check my Oklahoma tax return status if I filed my return through a tax preparer or software?

+Yes, you can still check your Oklahoma tax return status even if you filed your return through a tax preparer or tax software. The OTC’s online resources, such as the Oklahoma Taxpayer Access Point (OTAP), provide access to your tax return information regardless of how you filed. By creating an OTAP account and providing the necessary details, you can log in and view the status of your return, whether it was filed through a preparer or software.

What if I owe additional taxes after filing my Oklahoma tax return?

+If you receive a notice from the OTC indicating that you owe additional taxes, it’s important to take prompt action. Review the notice carefully to understand the amount owed and the due date. The OTC provides various payment options, including online payments, mail-in payments, or in-person payments at authorized