Denmark Taxes

The Danish tax system is a comprehensive and well-established structure that plays a crucial role in the country's economic and social policies. With a long history of progressive taxation and a high level of public trust, Denmark's tax system is designed to fund a wide range of public services and maintain a strong social safety net. In this article, we will delve into the intricacies of Danish taxes, exploring the various types, rates, and their impact on both individuals and businesses.

Understanding the Danish Tax System

The Danish tax system is characterized by its progressiveness, meaning that higher incomes are taxed at higher rates. This approach aims to promote social equality and ensure that the burden of taxation is distributed fairly across the population. The system is also known for its transparency and simplicity, with a strong emphasis on digital solutions and a user-friendly online platform for taxpayers.

One unique aspect of Danish taxation is the principle of personal responsibility, where individuals are primarily responsible for paying their own taxes. This differs from some other countries where employers may have a more significant role in tax withholding and administration. As a result, Danish citizens are well-informed about their tax obligations and actively engage in the process.

Key Features of the Danish Tax System

- Progressive Income Tax: Denmark applies a progressive tax rate structure, with higher income brackets facing higher tax rates. This encourages income redistribution and supports social welfare programs.

- Value Added Tax (VAT): VAT is a consumption tax applied to most goods and services in Denmark. It is an important source of revenue for the government and is often adjusted to fund specific initiatives.

- Capital Gains Tax: Capital gains from the sale of assets, such as stocks or property, are subject to taxation. The rate and treatment of capital gains can vary depending on the type of asset and the individual’s circumstances.

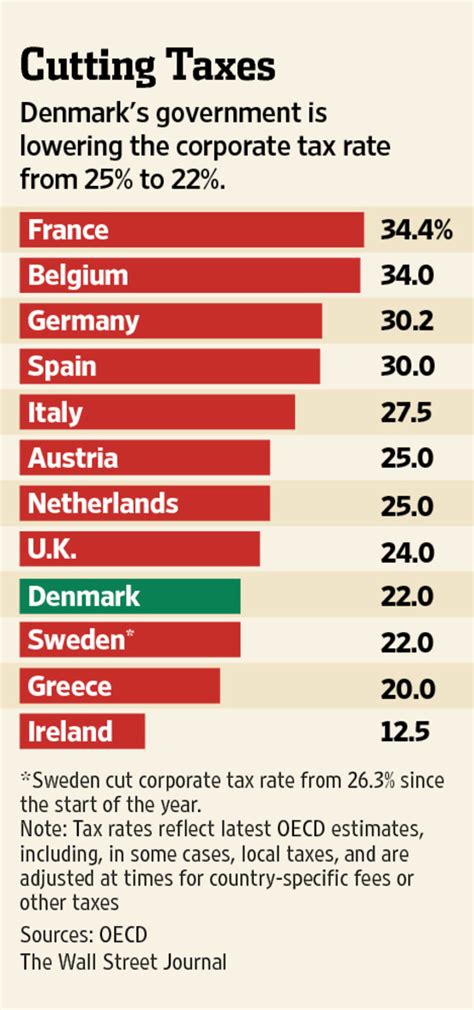

- Corporate Tax: Businesses in Denmark are subject to a corporate income tax, which is levied on their profits. The tax rate is relatively competitive compared to other European countries, making Denmark an attractive location for foreign investment.

- Municipal Taxes: In addition to national taxes, Danish residents also pay local taxes to their respective municipalities. These taxes fund local services and infrastructure, contributing to the overall efficiency of the public sector.

Income Tax in Denmark: A Comprehensive Overview

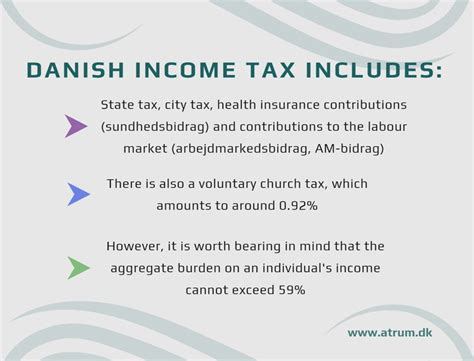

Income tax is the cornerstone of the Danish tax system, with rates varying based on individual circumstances and income levels. The progressive nature of the tax system means that as income increases, so does the tax rate, ensuring a more equitable distribution of wealth.

The income tax in Denmark is divided into two main components: the state income tax and the municipal income tax. The state income tax is a national tax that funds various public services, while the municipal income tax supports local services and infrastructure. Both taxes are calculated separately and are based on the individual's income and personal circumstances.

| Income Level (DKK) | State Income Tax Rate | Municipal Income Tax Rate |

|---|---|---|

| Up to 51,200 | 0% | 25.5% |

| 51,201 - 263,700 | 15% | 25.5% |

| 263,701 - 639,700 | 27% | 25.5% |

| 639,701 - 1,218,500 | 36% | 25.5% |

| Above 1,218,500 | 42% | 25.5% |

It's important to note that these tax rates are subject to change, and individuals may be eligible for various deductions and tax credits that can reduce their overall tax liability. The Danish tax authority, Skattestyrelsen, provides detailed guidelines and tools to help taxpayers calculate their income tax obligations accurately.

Tax Deductions and Exemptions

Denmark offers a range of tax deductions and exemptions to support certain activities and promote social welfare. Some common deductions include:

- Pension Contributions: Individuals can deduct a portion of their pension contributions from their taxable income, encouraging long-term savings.

- Childcare Costs: Parents can claim deductions for childcare expenses, helping to offset the cost of raising children.

- Health Insurance: Premiums paid for private health insurance are often deductible, promoting access to healthcare services.

- Education Expenses: Certain education-related expenses, such as tuition fees and books, may be deductible, supporting lifelong learning.

Value Added Tax (VAT) in Denmark: A Detailed Analysis

Value Added Tax, or VAT, is a crucial component of Denmark’s tax system, contributing significantly to government revenue. VAT is applied to most goods and services, with certain exemptions for essential items like groceries and healthcare services. The standard VAT rate in Denmark is 25%, one of the highest in the European Union.

However, Denmark also employs a range of reduced VAT rates for specific sectors and products. These reduced rates aim to support certain industries and promote social inclusion. For example, the VAT rate for restaurant services is 12%, while books and magazines are subject to a 0% VAT rate, encouraging cultural participation.

| Product/Service | VAT Rate |

|---|---|

| Standard Rate | 25% |

| Restaurant Services | 12% |

| Hotel Accommodation | 8% |

| Books, Magazines, and Newspapers | 0% |

| Pharmaceuticals | 0% |

VAT registration in Denmark is mandatory for businesses that exceed a certain turnover threshold. Registered businesses are responsible for collecting and remitting VAT to the tax authority. The Danish tax authority provides comprehensive guidelines and support to help businesses navigate the VAT registration and compliance process.

VAT Compliance and Penalties

To ensure compliance with VAT regulations, the Danish tax authority conducts regular audits and inspections. Non-compliance with VAT obligations can result in significant penalties, including fines and even criminal charges in severe cases. It is crucial for businesses to maintain accurate records and file VAT returns accurately and on time.

Corporate Tax in Denmark: Attracting Foreign Investment

Denmark’s corporate tax structure is designed to attract foreign investment and support business growth. The corporate income tax rate in Denmark is currently set at 22%, which is relatively competitive compared to other European countries. This rate applies to both domestic and foreign-owned companies, creating a level playing field for businesses operating in Denmark.

In addition to the standard corporate income tax, Denmark offers a range of tax incentives and schemes to support specific industries and promote innovation. For example, the Innovation Fund Denmark provides funding and tax benefits to companies engaged in research and development activities. These incentives aim to foster a vibrant business environment and encourage long-term investment.

Transfer Pricing and International Taxation

Denmark, like many other countries, has regulations in place to prevent tax avoidance through transfer pricing. Transfer pricing refers to the prices charged for goods and services between related companies, often across international borders. The Danish tax authority closely monitors transfer pricing practices to ensure that companies pay the appropriate level of tax on their profits.

For international businesses operating in Denmark, the tax system provides clarity and transparency. Denmark has a network of double taxation agreements with numerous countries, ensuring that income is not taxed twice and facilitating cross-border trade and investment. These agreements also help to prevent tax evasion and promote fair taxation practices.

Municipal Taxes: Funding Local Services

In addition to the national taxes, Danish residents also contribute to municipal taxes, which fund local services and infrastructure. These taxes are determined by each municipality and can vary based on factors such as property value and personal income. Municipal taxes are an essential component of the Danish tax system, ensuring that local communities have the resources to provide efficient and effective services to their residents.

Municipal taxes in Denmark typically consist of two main components: the property tax and the church tax. The property tax is based on the value of an individual's property and is used to fund local infrastructure and services. The church tax, on the other hand, is a voluntary contribution to support religious institutions and is often set at a lower rate.

| Municipal Tax Type | Average Rate |

|---|---|

| Property Tax | 1.5% - 2.5% of property value |

| Church Tax | 0.4% - 0.8% of taxable income |

The revenue generated from municipal taxes is used to support a wide range of services, including education, healthcare, social services, and local infrastructure projects. This decentralized approach to taxation ensures that local communities have the autonomy to prioritize and allocate resources based on their specific needs.

Efficient Public Sector

The Danish tax system, including both national and municipal taxes, is designed to support an efficient and well-funded public sector. The high level of taxation in Denmark contributes to a robust social safety net, excellent public services, and a high quality of life for its residents. The transparent and user-friendly nature of the tax system further enhances public trust and engagement in the process.

Future Implications and Potential Reforms

The Danish tax system, while highly regarded, is not immune to potential reforms and adjustments. As economic conditions and societal needs evolve, the tax system must adapt to ensure its continued effectiveness and fairness.

One area of focus for potential reforms is the digitalization of tax processes. While Denmark already has a strong emphasis on digital solutions, further advancements in this area could enhance efficiency and reduce administrative burdens for taxpayers and businesses. This could include the development of more sophisticated online platforms and the implementation of automated processes for tax filing and compliance.

Another area of consideration is the balance between taxation and social welfare spending. As the population ages and societal needs change, the government may need to carefully manage the distribution of tax revenue to ensure the sustainability of the welfare state. This could involve adjusting tax rates, exploring new sources of revenue, or prioritizing spending in specific areas.

Conclusion

Denmark’s tax system is a complex and well-established framework that plays a vital role in funding public services and maintaining social equality. With its progressive income tax, competitive corporate tax rates, and efficient municipal taxation, Denmark has created a strong foundation for economic growth and social welfare. As the country continues to adapt to changing circumstances, the tax system will remain a key focus for policymakers, ensuring that it remains fair, efficient, and responsive to the needs of its citizens.

What is the overall tax burden in Denmark compared to other countries?

+Denmark has one of the highest overall tax burdens in the world, with a combination of income, consumption, and corporate taxes. This high tax burden funds an extensive social welfare system and high-quality public services.

How does Denmark’s tax system support social equality and welfare?

+The progressive nature of Denmark’s income tax system ensures that higher incomes are taxed at higher rates, promoting income redistribution. Additionally, the tax revenue funds a robust social safety net, including universal healthcare, education, and social benefits, contributing to social equality.

What are the key advantages of Denmark’s corporate tax structure for businesses?

+Denmark’s corporate tax rate of 22% is relatively competitive, making it an attractive location for businesses. The tax system also offers various tax incentives and schemes to support specific industries and promote innovation, fostering a business-friendly environment.