Sales Tax In Dade County Florida

Sales tax is an essential component of the revenue system in the United States, and understanding its intricacies is crucial for both businesses and consumers. In this comprehensive guide, we will delve into the specifics of sales tax in Dade County, Florida, exploring the rates, regulations, and impact on the local economy. By unraveling the complexities of this tax system, we aim to provide valuable insights and practical knowledge for all stakeholders involved.

Unraveling the Sales Tax Landscape in Dade County

Dade County, also known as Miami-Dade County, is a vibrant and diverse region in the state of Florida. With its thriving tourism industry, bustling urban centers, and vibrant cultural scene, the county plays a significant role in Florida’s economy. Sales tax, a crucial revenue source for local governments, holds immense importance in this context. Let’s explore the unique aspects of sales tax in Dade County and its implications.

Understanding the Sales Tax Rates

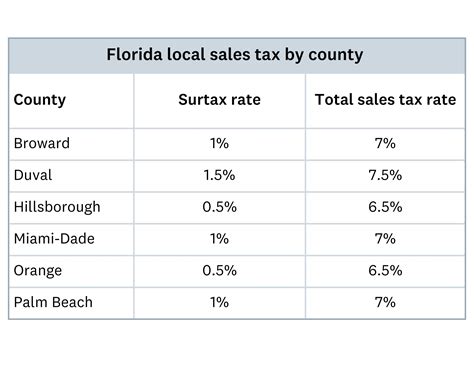

In Dade County, sales tax rates are comprised of various components, including state, county, and local taxes. The state of Florida imposes a general sales tax rate of 6%, which serves as the foundation for the county’s tax structure. However, Dade County, being a densely populated area with diverse needs, has additional taxes layered upon this base rate.

Dade County imposes a 1.5% county sales tax, bringing the total rate to 7.5% for most transactions. This additional tax is allocated to fund critical services and infrastructure projects within the county. Moreover, certain municipalities within Dade County may further augment the sales tax rate to address specific local requirements. For instance, the city of Miami has an extra 1% tax, resulting in a total sales tax rate of 8.5% within its boundaries.

It is essential to note that sales tax rates can vary across different jurisdictions within Dade County. Some cities and unincorporated areas may have unique tax structures, resulting in slightly different rates. This complexity underscores the importance of understanding the specific sales tax obligations for businesses operating within the county.

| Tax Component | Rate (%) |

|---|---|

| State Sales Tax | 6 |

| Dade County Sales Tax | 1.5 |

| Miami City Sales Tax | 1 |

Sales Tax Exemptions and Special Considerations

While sales tax is a ubiquitous part of consumer transactions, certain goods and services are exempt from taxation in Dade County. These exemptions are put in place to support specific industries, promote economic growth, and alleviate financial burdens on targeted sectors. Let’s explore some of the notable sales tax exemptions and special considerations in Dade County.

Grocery Exemptions: One of the most significant sales tax exemptions in Dade County, and Florida as a whole, pertains to groceries. Many staple food items, including fresh produce, dairy products, and non-alcoholic beverages, are exempt from sales tax. This exemption aims to reduce the financial burden on households and ensure essential groceries remain affordable.

Pharmaceuticals and Medical Devices: Sales tax is often waived for pharmaceuticals and medical devices, including prescription drugs, over-the-counter medications, and certain medical equipment. This exemption is designed to support the healthcare industry and provide essential healthcare items at more accessible prices.

Manufacturing and Industrial Machinery: In an effort to promote economic growth and attract businesses, sales tax exemptions are offered for the purchase of manufacturing and industrial machinery. This exemption encourages investment in infrastructure and technology, fostering a more robust industrial sector in Dade County.

Educational Materials: To support the education sector, sales tax is not levied on certain educational materials. This includes textbooks, school supplies, and educational software. By exempting these items, the county aims to reduce the financial burden on educational institutions and families.

Certain Services: Some services are exempt from sales tax in Dade County. These may include professional services like legal and accounting, as well as certain entertainment and cultural services. The specific exemptions can vary, so it's essential for businesses offering such services to stay updated on the latest regulations.

It's important to note that while these exemptions provide relief for specific industries and consumers, they also impact the revenue generated through sales tax. Local governments must carefully balance these exemptions with their fiscal responsibilities to ensure the continued provision of public services.

The Impact of Sales Tax on Local Businesses

Sales tax in Dade County has a profound impact on the local business landscape, influencing pricing strategies, consumer behavior, and overall economic dynamics. Let’s delve into some of the key ways in which sales tax affects businesses within the county.

Pricing Strategies: For businesses, especially those engaged in retail or e-commerce, understanding the sales tax rates is crucial for setting competitive prices. Businesses must factor in the applicable sales tax when determining their pricing, ensuring that their products remain attractive to consumers while maintaining profitability. The variability in sales tax rates across different jurisdictions within Dade County adds an additional layer of complexity to pricing strategies.

Consumer Behavior: Sales tax can influence consumer purchasing decisions, particularly when shopping across county lines. Consumers may be inclined to make purchases in areas with lower sales tax rates, impacting the revenue generated by businesses in high-tax areas. Additionally, the sales tax rate can factor into a consumer's overall perception of value, influencing their brand loyalty and spending habits.

Compliance and Administration: Sales tax compliance is a critical responsibility for businesses operating in Dade County. Businesses must accurately collect, report, and remit sales tax to the appropriate authorities. This involves maintaining detailed records, understanding the applicable tax rates, and ensuring timely submissions. The complexity of the sales tax system, with its varying rates and exemptions, can present challenges for businesses, particularly those with multiple locations or online sales.

Economic Development: Sales tax revenue plays a vital role in funding critical infrastructure projects, public services, and economic development initiatives within Dade County. By generating revenue through sales tax, the county can invest in projects that enhance the quality of life for residents and create a more attractive business environment. This, in turn, can foster economic growth and attract new businesses to the region.

Sales Tax and the Tourism Industry

Dade County is renowned for its vibrant tourism industry, with attractions like Miami Beach, South Beach, and the Art Deco District drawing visitors from around the world. The sales tax system plays a unique role in this context, influencing the visitor experience and contributing to the county’s economic prosperity.

For tourists, the sales tax rate can impact their overall spending habits and budget considerations. While Florida's reputation as a tax-friendly state may attract visitors, the varying sales tax rates within Dade County can present surprises for those unfamiliar with the system. Businesses catering to tourists must navigate these nuances to ensure a positive visitor experience.

Hotels and accommodations are subject to unique sales tax considerations. In addition to the standard sales tax rate, a separate tax known as the "tourist development tax" is often levied on accommodations. This tax is typically used to fund tourism-related infrastructure and marketing initiatives, further supporting the industry's growth.

The tourism industry's reliance on sales tax revenue is a double-edged sword. While it provides a significant source of funding for tourism development and marketing, economic downturns or reduced visitor numbers can have a direct impact on the county's revenue stream. As such, effective tourism management and marketing strategies are crucial to ensuring a steady flow of visitors and, consequently, sales tax revenue.

Future Outlook and Potential Changes

As with any tax system, the sales tax landscape in Dade County is subject to change and evolution. Economic trends, political decisions, and technological advancements can all influence the future of sales tax in the county. Let’s explore some potential developments that could shape the sales tax system in the coming years.

Online Sales and Remote Transactions: The rise of e-commerce and remote transactions presents unique challenges for sales tax collection. As more businesses operate online, the question of jurisdiction and tax liability becomes increasingly complex. Dade County, along with other localities, may need to adapt their tax systems to address these changing dynamics, potentially implementing new regulations or partnerships with online marketplaces.

Economic Factors and Revenue Needs: Economic conditions can significantly impact the sales tax system. During economic downturns, sales tax revenue may decline, prompting local governments to consider adjustments to tax rates or exemptions to stimulate economic activity. Conversely, periods of economic growth may provide an opportunity to reevaluate the tax structure, potentially leading to rate changes or the introduction of new exemptions.

Technological Innovations: Technological advancements can streamline the sales tax collection and reporting process, making it more efficient and accurate. Dade County may explore implementing innovative solutions, such as digital tax reporting systems or point-of-sale integration, to enhance compliance and reduce administrative burdens for businesses.

In conclusion, the sales tax system in Dade County is a dynamic and complex framework that plays a crucial role in the local economy. From its impact on businesses and consumers to its role in funding public services and infrastructure, sales tax is an essential component of the county's fiscal landscape. By understanding the rates, exemptions, and potential future developments, stakeholders can navigate the sales tax system with confidence and contribute to the continued prosperity of Dade County.

What is the state sales tax rate in Florida?

+The state sales tax rate in Florida is currently set at 6%.

Are there any sales tax exemptions for specific industries in Dade County?

+Yes, Dade County offers sales tax exemptions for various industries, including grocery items, pharmaceuticals, and manufacturing machinery. These exemptions are designed to support specific sectors and reduce financial burdens on targeted industries.

How do sales tax rates vary across different jurisdictions within Dade County?

+Sales tax rates can vary depending on the specific jurisdiction within Dade County. While the state sales tax rate remains consistent at 6%, the county and municipal sales tax rates may differ. For example, Miami imposes an additional 1% tax, resulting in a total sales tax rate of 8.5% within the city limits.

What are the implications of sales tax for businesses operating in Dade County?

+Sales tax has a significant impact on businesses in Dade County, influencing pricing strategies, consumer behavior, and compliance obligations. Businesses must carefully consider the applicable sales tax rates when setting prices and ensure accurate collection and remittance of sales tax to avoid legal and financial consequences.

How does the sales tax system affect the tourism industry in Dade County?

+The sales tax system plays a crucial role in the tourism industry of Dade County. It can influence visitor spending habits, particularly when shopping across county lines. Additionally, hotels and accommodations are subject to a separate “tourist development tax” to fund tourism-related initiatives.