Sc State Sales Tax

Welcome to our comprehensive guide on South Carolina's sales tax, an essential aspect of the state's economy and tax system. In this article, we will delve into the intricacies of the South Carolina State Sales Tax, covering its history, current regulations, and its impact on businesses and consumers alike. With a focus on clarity and depth, we aim to provide you with valuable insights and a thorough understanding of this critical tax component.

The Evolution of Sales Tax in South Carolina

Sales tax in South Carolina has undergone a fascinating evolution since its inception. The state first introduced a general sales and use tax in 1951, with a rate of 3%. This marked the beginning of a system that has since become an integral part of South Carolina’s revenue generation and economic management.

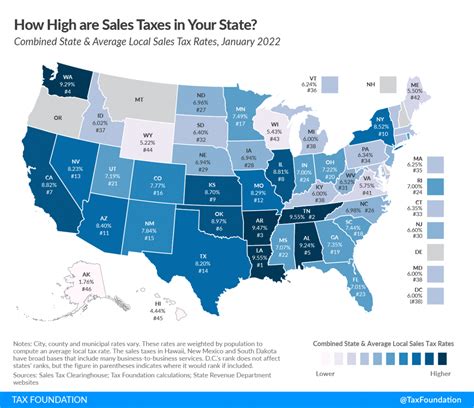

Over the years, the sales tax rate has seen several adjustments, reflecting the state's economic needs and priorities. As of my last update in January 2023, the state's general sales tax rate stands at 6%, with additional local sales taxes varying by jurisdiction. These local taxes, often referred to as local option taxes, can increase the total sales tax rate to as much as 8.5% in certain areas.

The evolution of South Carolina's sales tax system is not just about rate changes; it's also about the inclusion of various goods and services within the tax base. The state has continually expanded the scope of taxable items, ensuring a broader tax base and, subsequently, a more stable revenue stream. This expansion has included everything from traditional retail sales to services and even digital products, keeping pace with the changing nature of commerce.

Understanding the South Carolina Sales Tax System

The South Carolina Department of Revenue (SCDOR) is the governing body responsible for the administration and enforcement of the state’s sales tax laws. SCDOR provides comprehensive guidelines and resources to help businesses and consumers understand their sales tax obligations and rights.

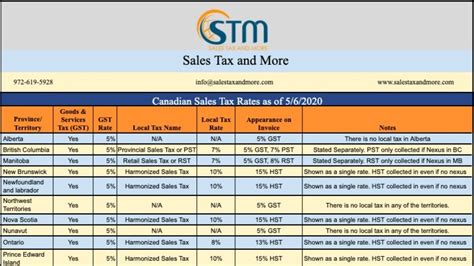

The state's sales tax is a destination-based tax, which means it is calculated based on the location where the goods are delivered or the services are provided, not the location of the seller. This destination-based approach ensures that the correct local tax rates are applied, making it essential for businesses to have accurate location-specific tax data.

South Carolina's sales tax is a transaction-based tax, applied to the retail sale or rental of tangible personal property, certain digitally provided products, and selected services. The tax is typically added to the purchase price, with the seller responsible for collecting and remitting the tax to the state. This transaction-based structure ensures that the tax burden is visible to consumers and provides a straightforward mechanism for revenue collection.

Taxable Items and Exemptions

South Carolina’s sales tax applies to a wide range of goods and services, including groceries, clothing, vehicles, and various personal and business services. However, it’s important to note that not all items are taxable. The state offers exemptions for certain essential items like prescription drugs, most non-prepared food items, and manufacturing equipment.

The state also has specific provisions for tax-free periods, such as the Back-to-School Sales Tax Holiday, which typically occurs in August. During this holiday, certain school supplies, clothing, and computers are exempt from sales tax, providing a boost to families and retailers alike.

| Taxable Items | Tax Rate |

|---|---|

| Groceries | 0% (exempt) |

| Clothing | 0% (exempt) |

| Vehicles | 6% (state) + Local Option Tax |

| Personal Services | 6% (state) + Local Option Tax |

The Impact on Businesses and Consumers

South Carolina’s sales tax has a significant impact on both businesses and consumers, shaping their economic behaviors and strategies.

For Businesses

Businesses operating in South Carolina face the challenge of navigating a complex sales tax system. They must accurately calculate and collect sales tax, ensuring compliance with the state’s regulations. This often involves the use of sophisticated tax software and the establishment of robust internal processes.

The sales tax also influences businesses' pricing strategies. While the tax is typically added to the retail price, businesses may choose to absorb part or all of the tax to make their products more competitive. This can impact their profit margins and require careful financial planning.

Moreover, businesses must consider the administrative burden of sales tax compliance. This includes registering with the state, filing regular tax returns, and managing tax collection and remittance processes. The complexity of these tasks often varies based on the size and nature of the business.

For Consumers

Consumers in South Carolina bear the direct impact of sales tax at the point of purchase. The tax adds to the cost of goods and services, influencing buying decisions and overall spending patterns. Consumers must factor in the sales tax when budgeting and making purchasing choices, especially during periods of economic uncertainty.

The varying local sales tax rates across the state can also create a sense of complexity for consumers. When traveling or shopping in different areas, they must be aware of the local tax rates to understand the true cost of their purchases. This can be particularly challenging for online shoppers, who may not always have immediate access to accurate tax information.

However, sales tax also benefits consumers by funding essential state and local services. These include public education, infrastructure development, and social services, which contribute to the overall well-being and quality of life in the state.

Sales Tax and Economic Development

South Carolina’s sales tax plays a crucial role in the state’s economic development and fiscal planning. The revenue generated from sales tax contributes significantly to the state’s overall budget, funding various public services and infrastructure projects.

The sales tax is particularly beneficial in promoting economic growth and stability. By taxing a broad base of goods and services, the state ensures a steady revenue stream, which is vital for long-term planning and investment. This stability is attractive to businesses and can influence their decision to invest in or relocate to South Carolina.

Additionally, the sales tax system, with its local option taxes, allows for a degree of local control and flexibility. This enables local governments to address specific community needs and invest in local projects, fostering a sense of economic empowerment at the grassroots level.

The Future of Sales Tax in South Carolina

As South Carolina continues to evolve economically and technologically, the sales tax system will likely face new challenges and opportunities. The rise of e-commerce and digital services has already prompted discussions about updating tax regulations to capture revenue from these emerging sectors.

The state may also explore ways to simplify the sales tax system, making it more accessible and less burdensome for businesses and consumers. This could involve streamlining tax rates, enhancing tax collection technologies, or implementing tax reform initiatives.

Moreover, the state's commitment to economic development and fiscal responsibility will continue to shape the future of its sales tax system. As South Carolina strives to attract businesses and maintain a competitive edge, the sales tax will remain a critical tool in its economic toolkit.

Conclusion

In conclusion, South Carolina’s sales tax is a vital component of the state’s economy, impacting businesses, consumers, and the overall fiscal health of the state. Its evolution over the years reflects the state’s commitment to economic growth and stability, while also adapting to the changing landscape of commerce.

As we've explored in this guide, the sales tax system in South Carolina is intricate, with various rates, exemptions, and considerations. Understanding these nuances is essential for both businesses and consumers to navigate the system effectively and contribute to the state's economic vitality.

Frequently Asked Questions

What is the current sales tax rate in South Carolina?

+As of my last update, the state sales tax rate in South Carolina is 6%. However, local option taxes can increase this rate to a maximum of 8.5% in certain areas.

Are there any tax-free periods in South Carolina?

+Yes, South Carolina offers a Back-to-School Sales Tax Holiday in August. During this period, certain school supplies, clothing, and computers are exempt from sales tax.

How often do sales tax rates change in South Carolina?

+Sales tax rates can change periodically, usually as a result of legislative actions or budget considerations. It’s important for businesses and consumers to stay updated with the latest rates to ensure compliance.