Tax Credit For Stay At Home Moms

In recent years, the topic of tax credits and financial support for stay-at-home parents, particularly mothers, has gained significant attention. As more women choose to prioritize family life and caregiving responsibilities, the need for recognition and support within the tax system has become increasingly evident. This article aims to delve into the concept of tax credits for stay-at-home moms, exploring the various initiatives, their impact, and the potential future implications.

Understanding Tax Credits for Stay-at-Home Moms

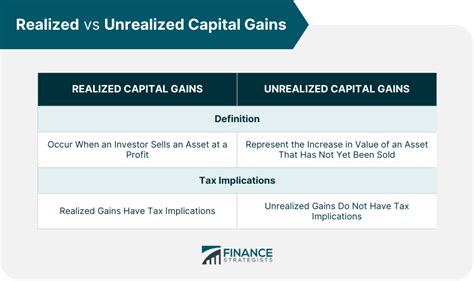

Tax credits are financial incentives offered by governments to reduce the tax burden on individuals or families who meet specific criteria. In the context of stay-at-home moms, these credits aim to acknowledge and support the valuable contributions made by caregivers who dedicate their time and energy to raising children and managing households.

The concept of providing tax credits for stay-at-home parents is grounded in the recognition that traditional childcare arrangements, such as formal daycare or nannies, often come with significant financial costs. By offering tax credits, governments aim to provide some form of financial relief and acknowledge the economic value of stay-at-home parenting.

The Benefits and Eligibility Criteria

Tax credits for stay-at-home moms can take various forms, depending on the jurisdiction and the specific program in place. Some common benefits include:

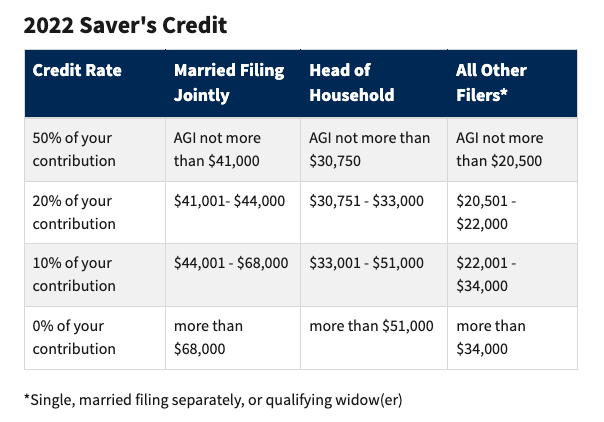

- Income Tax Credits: These credits directly reduce the amount of income tax owed by stay-at-home parents. For example, countries like the United States offer the Child and Dependent Care Credit, which provides a tax benefit for eligible childcare expenses.

- Dependent Care Assistance Programs: Some governments provide assistance programs that offer tax-free funds for childcare expenses. These programs often have eligibility criteria based on income levels and the number of children in the household.

- Child Tax Credits: In certain countries, tax credits are offered specifically for having and raising children. These credits can provide a significant financial boost to families, especially those with multiple children.

Eligibility criteria for these tax credits vary, but they typically consider factors such as income levels, the number of dependent children, and the primary caregiver's status as a stay-at-home parent. It is important for stay-at-home moms to understand these criteria and ensure they meet the requirements to access these benefits.

Real-World Examples and Case Studies

To better understand the impact of tax credits for stay-at-home moms, let’s explore some real-world examples and case studies:

The Canadian Experience: The Child Care Expense Deduction

In Canada, the federal government offers the Child Care Expense Deduction, which allows eligible individuals to claim a tax deduction for childcare expenses. This deduction is particularly beneficial for stay-at-home parents who may have previously paid for childcare services. The amount of the deduction depends on the income level and the age of the children.

| Income Level | Maximum Child Care Expense Deduction |

|---|---|

| Up to $15,000 | $8,000 |

| $15,001 - $25,000 | $7,000 |

| $25,001 - $50,000 | $6,000 |

This deduction has been instrumental in providing financial relief to Canadian stay-at-home moms, especially those with higher childcare expenses. It acknowledges the economic burden of childcare and encourages families to make informed decisions about their caregiving arrangements.

The United States: Child Tax Credit and Dependent Care Credit

The United States offers a range of tax credits to support families with dependent children. The Child Tax Credit provides a non-refundable credit for each qualifying child, up to a certain age limit. This credit can significantly reduce tax liability and provide much-needed financial support.

Additionally, the Dependent Care Credit offers a tax benefit for expenses related to the care of a qualifying individual, such as a child or an elderly dependent. This credit can be claimed for expenses incurred for childcare services, allowing stay-at-home moms to access funds for their caregiving responsibilities.

The UK’s Childcare Voucher Scheme

In the United Kingdom, the Childcare Voucher Scheme was introduced to provide financial support for working parents. While not specifically designed for stay-at-home moms, it has benefited many families. This scheme allows parents to receive childcare vouchers, which can be used to pay for registered childcare providers, reducing the overall cost of childcare.

Although the scheme was phased out for new entrants in 2018, existing users can still benefit from it. The vouchers provide a tax-efficient way to manage childcare expenses, making it easier for parents to balance work and caregiving responsibilities.

Performance Analysis and Impact

Tax credits for stay-at-home moms have shown promising results in terms of their impact on families and the overall economy. Let’s examine some key findings and analyses:

Financial Relief and Empowerment

Studies have indicated that tax credits for stay-at-home parents have a positive impact on household finances. By reducing the tax burden, these credits provide much-needed financial relief, allowing families to allocate resources towards other essential needs, such as education, healthcare, and savings.

Moreover, these credits empower stay-at-home moms by recognizing their contributions and providing a sense of financial security. It acknowledges the value of their work and ensures that they are not disadvantaged in the tax system compared to working parents.

Work-Life Balance and Well-Being

Tax credits for stay-at-home moms can also have a positive influence on work-life balance. By reducing the financial pressure associated with childcare, parents may feel more comfortable making choices that align with their personal and family goals. This could include opting for a more flexible work arrangement or choosing to stay at home for an extended period.

Furthermore, the availability of tax credits can contribute to improved well-being for both parents and children. With reduced financial stress, parents may have more time and energy to devote to their children's development, leading to stronger family bonds and overall well-being.

Economic Impact and Gender Equality

From an economic perspective, tax credits for stay-at-home moms can contribute to a more balanced labor market. By supporting caregivers, governments encourage more women to enter or remain in the workforce, which can lead to increased productivity and economic growth.

Additionally, these credits promote gender equality by recognizing the value of caregiving work, which is often undervalued and predominantly undertaken by women. By providing financial support, governments send a powerful message that caring for children and family members is a valuable contribution to society.

Future Implications and Potential Innovations

As the concept of tax credits for stay-at-home moms gains traction, there are exciting opportunities for further development and innovation:

Universal Childcare Benefits

One potential future direction is the implementation of universal childcare benefits, where governments provide direct financial support for childcare expenses, regardless of the parent’s employment status. This approach aims to ensure that all families, including stay-at-home parents, have access to affordable and high-quality childcare options.

Expanding Eligibility Criteria

Governments can consider expanding the eligibility criteria for tax credits to include a broader range of caregivers. This could involve recognizing the contributions of single parents, grandparents, or other family members who take on caregiving responsibilities.

Integration with Other Social Programs

Tax credits for stay-at-home moms can be integrated with other social programs, such as parental leave schemes or childcare subsidy programs. By creating a comprehensive support system, governments can provide a more holistic approach to supporting families and caregivers.

Advocacy and Awareness

Continued advocacy and awareness campaigns are crucial to ensuring that tax credits for stay-at-home moms remain a priority on the policy agenda. By highlighting the economic and social benefits, advocates can push for further developments and ensure that caregivers receive the recognition and support they deserve.

Conclusion

Tax credits for stay-at-home moms represent a significant step towards recognizing and supporting the invaluable contributions of caregivers. By offering financial incentives and acknowledging the economic value of stay-at-home parenting, governments can empower families and promote a more equitable society.

As we move forward, it is essential to continue exploring innovative approaches and expanding the reach of these tax credits. By doing so, we can create a more supportive environment for stay-at-home moms and ensure that their contributions are valued and rewarded.

Are tax credits for stay-at-home moms available in all countries?

+No, tax credits for stay-at-home moms are not universally available. These credits are typically implemented at the country or regional level, with variations in eligibility criteria and benefits. It is essential to research and understand the specific tax policies in your jurisdiction to determine the availability of such credits.

How do I claim tax credits for stay-at-home moms?

+The process of claiming tax credits for stay-at-home moms varies depending on the jurisdiction and the specific tax credit program. Generally, you will need to gather relevant documentation, such as proof of income, dependency status, and childcare expenses. It is recommended to consult a tax professional or refer to the official guidelines provided by your government’s tax agency for accurate instructions.

Are there any restrictions or limitations on these tax credits?

+Yes, tax credits for stay-at-home moms often have specific eligibility criteria and limitations. These may include income thresholds, age restrictions for dependent children, and requirements related to the primary caregiver’s status as a stay-at-home parent. It is crucial to review the guidelines carefully to understand any restrictions and ensure you meet the necessary criteria.

Can tax credits for stay-at-home moms be combined with other tax benefits?

+In some cases, tax credits for stay-at-home moms can be combined with other tax benefits, such as the Child Tax Credit or Dependent Care Credit. However, it is important to understand the interaction between these credits and any potential restrictions or limitations. Consulting a tax professional or seeking guidance from your government’s tax agency can help you navigate these combinations effectively.