New Hampshire Tax

Taxes are an essential aspect of any state's economy, and New Hampshire is no exception. With its unique tax landscape, the Granite State has developed a system that sets it apart from many other states in the US. This article delves into the intricacies of New Hampshire's tax structure, providing an in-depth analysis of its various components and their impact on individuals and businesses.

The New Hampshire Tax System: A Comprehensive Overview

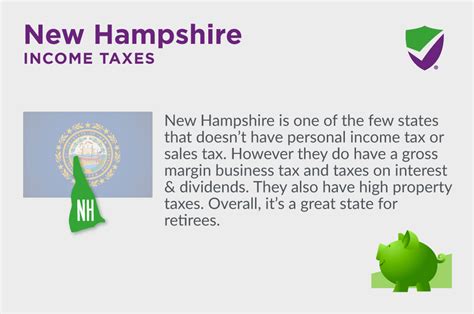

New Hampshire boasts a tax system that is often cited as one of the most business-friendly in the nation. The state’s approach to taxation is characterized by a lack of income tax, both for individuals and corporations, which makes it an attractive destination for businesses and high-income earners. However, this does not mean that the state operates without any taxes; rather, it has a carefully designed system to generate revenue and fund essential services.

Taxes in New Hampshire: A Breakdown

The absence of an income tax is one of the most notable features of New Hampshire’s tax system. This includes both personal income tax and corporate income tax. This absence has led to a significant influx of businesses and individuals seeking to benefit from this tax advantage.

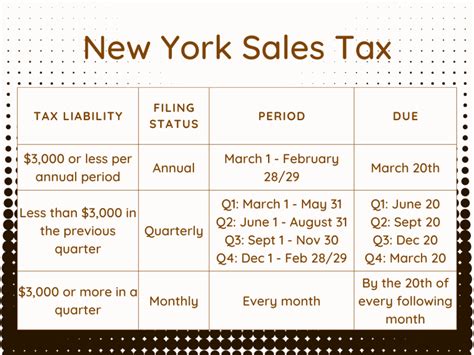

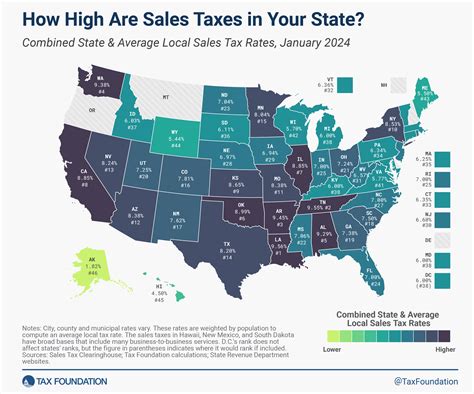

However, the state does levy a variety of other taxes to generate revenue. One of the primary sources of income is the state's sales and use tax, which is applied to the sale of tangible personal property and certain services. As of [date], the general sales tax rate in New Hampshire is [XX]%, with some exceptions and exemptions for specific goods and services.

New Hampshire also imposes a meals and rentals tax, which applies to food and beverages served in restaurants and certain short-term rentals. This tax rate stands at [XX]% and contributes significantly to the state's revenue.

| Tax Type | Rate |

|---|---|

| Sales and Use Tax | [XX]% |

| Meals and Rentals Tax | [XX]% |

| Real Estate Transfer Tax | Variable |

| Business Profits Tax | [XX]% |

| Business Enterprise Tax | [XX]% |

For property owners, New Hampshire has a property tax system. Unlike some states, New Hampshire does not have a statewide property tax; instead, property taxes are levied by local governments, such as cities and towns. The property tax rates vary widely across the state, depending on the municipality's needs and budget.

Businesses operating in New Hampshire are subject to a business profits tax, which is a tax on the net income of corporations, limited liability companies, and other business entities. The tax rate is [XX]%, making it a significant source of revenue for the state.

Additionally, New Hampshire imposes a business enterprise tax on businesses with a certain level of gross receipts. This tax, at a rate of [XX]%, is applied to businesses that exceed a specified revenue threshold, which varies depending on the type of business.

The Impact of New Hampshire’s Tax System

The absence of income tax in New Hampshire has had a significant impact on the state’s economy and its residents. It has attracted numerous businesses and individuals who are seeking to reduce their tax liabilities. This influx has led to a thriving business environment and has contributed to the state’s economic growth.

However, the benefits are not evenly distributed. The lack of income tax means that a large portion of the tax burden falls on sales and property taxes. This can disproportionately affect lower-income individuals and families, who may struggle to afford the higher cost of living that comes with these taxes.

Business Advantages and Disadvantages

From a business perspective, New Hampshire’s tax system offers several advantages. The absence of corporate income tax makes the state an attractive location for businesses looking to minimize their tax obligations. This has led to a significant number of corporations setting up operations in the state, contributing to job creation and economic development.

However, the reliance on sales tax can be a disadvantage for certain types of businesses. Retailers, for example, may find themselves at a disadvantage compared to online retailers, as the latter may not be required to collect sales tax from customers in New Hampshire. This can lead to a shift in consumer behavior and potentially impact the viability of brick-and-mortar stores.

Individual Taxpayers: A Two-Sided Coin

For individuals, the absence of income tax can be a significant benefit. It allows high-income earners to keep a larger portion of their earnings, making New Hampshire an appealing place to live and work. However, this benefit is not shared equally by all income levels.

Lower-income individuals often face a higher effective tax rate due to the sales and property taxes. These taxes can eat into their disposable income, making it more difficult to make ends meet. Additionally, the lack of income tax means that there is no progressive tax structure, which can further disadvantage those with lower incomes.

Future Considerations and Potential Changes

As with any tax system, New Hampshire’s approach is not without its critics and potential for change. The state’s reliance on sales tax and property tax leaves it vulnerable to economic downturns and changes in consumer behavior. If sales tax revenue were to decline significantly, the state would face a challenging fiscal situation.

There are also ongoing debates about the fairness of the current system. Critics argue that the lack of income tax results in a regressive tax structure, where those with lower incomes pay a larger proportion of their income in taxes. This has led to calls for the introduction of an income tax, particularly to fund essential services and infrastructure.

However, any change to the tax system is likely to be met with resistance from those who benefit from the current structure. The absence of income tax has become a defining feature of New Hampshire's economy, and any potential changes would require careful consideration and public support.

Conclusion: Navigating the Granite State’s Tax Landscape

New Hampshire’s tax system is a complex and intriguing part of its economic landscape. The absence of income tax makes it unique among US states, offering significant advantages to businesses and high-income individuals. However, this system also presents challenges, particularly for those with lower incomes, who bear a heavier tax burden.

As New Hampshire continues to navigate its fiscal future, the state's leaders will need to carefully consider the potential impacts of any tax reforms. The goal will be to maintain a competitive business environment while ensuring that the tax system remains fair and sustainable for all residents.

What are the primary sources of revenue for New Hampshire’s government?

+New Hampshire’s government primarily relies on sales tax, property tax, and business taxes for its revenue. The absence of income tax means these other forms of taxation play a crucial role in funding the state’s operations.

How does New Hampshire’s lack of income tax impact its economy?

+The absence of income tax has attracted businesses and high-income individuals to the state, contributing to economic growth. However, it also leads to a heavier reliance on other forms of taxation, which can disproportionately affect lower-income residents.

Are there any potential disadvantages for businesses operating in New Hampshire due to its tax system?

+Yes, the reliance on sales tax can be a disadvantage for certain businesses, especially retailers, as they may struggle to compete with online retailers who may not collect sales tax from customers in the state.