Pay Iowa Property Taxes

Iowa is a state known for its vibrant agriculture, rich history, and a tax system that offers a unique blend of property tax structures. Understanding how to navigate the process of paying property taxes in Iowa is essential for homeowners, investors, and anyone with a stake in the state's real estate market. This guide aims to provide an in-depth look at the intricacies of paying Iowa property taxes, offering valuable insights for anyone seeking to manage their financial obligations efficiently.

The Landscape of Iowa Property Taxes

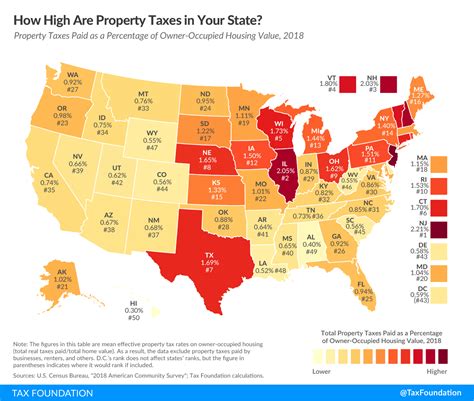

Iowa’s property tax system is a vital component of the state’s revenue stream, accounting for a significant portion of the funds used to support local governments, schools, and various public services. The process of assessing and collecting property taxes is a complex one, influenced by a range of factors, including the type of property, its location, and its assessed value.

One of the distinctive features of Iowa's property tax system is its reliance on a property's assessed value, which is determined by the county assessor's office. This value is crucial as it forms the basis for calculating the property tax liability. In Iowa, property taxes are typically due twice a year, with due dates falling in March and September. However, this schedule can vary slightly based on the county, so it's essential to be aware of the specific deadlines in your area.

For homeowners, understanding the assessment process is key. Assessors typically value properties based on their market value, taking into account recent sales of similar properties in the area. This means that if property values rise, so too will the assessed value and, consequently, the property taxes. Conversely, if property values decline, tax liabilities may decrease as well.

Understanding the Assessment Process

The assessment process in Iowa is a comprehensive undertaking, with county assessors playing a crucial role. They are responsible for evaluating the value of each property in their jurisdiction, ensuring that the assessments are fair and equitable. This process involves analyzing various factors, including the property’s physical characteristics, such as size, age, and condition, as well as its market value.

One of the key tools used in the assessment process is the comparable sales approach, where assessors look at recent sales of similar properties to determine the fair market value of a given property. This approach ensures that properties with similar characteristics are assessed similarly, promoting fairness in the tax system. However, it's important to note that this method may not always capture unique features of a property, which could potentially impact its market value.

| Property Type | Assessment Ratio |

|---|---|

| Residential Property | 100% |

| Agricultural Land | 100% |

| Commercial Property | 100% |

In Iowa, the assessment ratio is set at 100% for all property types, meaning that the assessed value is equal to the property's fair market value. This simplifies the tax calculation process, as there are no additional conversion factors to consider. However, it's important for property owners to review their assessments to ensure accuracy, as errors or omissions can lead to unfair tax liabilities.

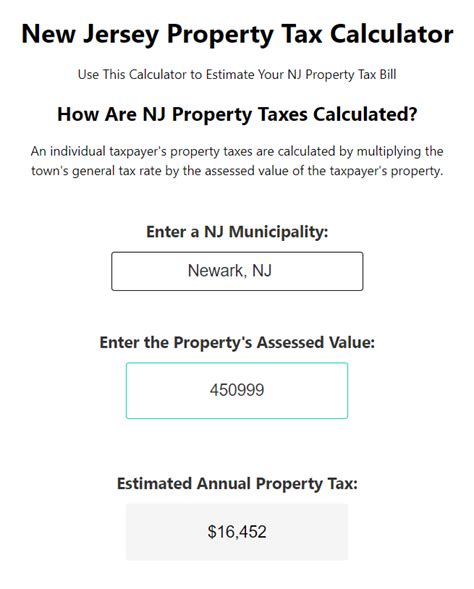

Calculating Your Property Tax Liability

Calculating your property tax liability in Iowa involves a straightforward process. Once you know your property’s assessed value, you can use the following formula to estimate your tax bill:

Property Tax = Assessed Value x Tax Rate

The tax rate in Iowa varies depending on the location of the property and the services it receives. These services can include school districts, cities, counties, and special assessment districts. Each of these entities has the authority to set its own tax rate, which can lead to significant variations in property tax rates across the state.

Breaking Down the Tax Rate

The tax rate in Iowa is not a uniform percentage but rather a complex combination of millage rates set by various taxing authorities. A mill is a term used in property taxation, representing a rate of 1 for every 1,000 of assessed value. Therefore, a tax rate of 20 mills would equate to 20 for every 1,000 of assessed value.

For instance, if your property has an assessed value of $200,000 and the combined millage rate for your area is 50 mills, your property tax liability would be calculated as follows:

Property Tax = $200,000 x 0.050 = $10,000

It's important to note that the millage rate can change annually, as taxing authorities may adjust their rates to meet budgetary needs or to maintain consistent services. Therefore, it's crucial to stay informed about the millage rates in your area to accurately estimate your property tax liability.

Methods of Paying Iowa Property Taxes

Iowa offers several convenient methods for property owners to pay their taxes. Understanding these options can help you choose the method that best suits your preferences and needs.

Online Payment Options

One of the most popular and convenient ways to pay Iowa property taxes is through online payment portals. Many counties in Iowa provide secure online platforms where property owners can access their tax information, view their bills, and make payments. These portals often offer the option to schedule payments, providing flexibility for taxpayers.

To use the online payment system, you'll typically need your property's unique identification number, which can be found on your tax bill or assessment notice. This ensures that your payment is correctly allocated to your property.

Online payment portals also provide a convenient way to track your payment history, view past due amounts, and receive email notifications about upcoming deadlines. Some portals even offer the option to set up automatic payments, ensuring that you never miss a due date.

Traditional Payment Methods

In addition to online payment options, Iowa also accommodates traditional payment methods. If you prefer to pay by check or money order, you can typically mail your payment to the county treasurer’s office, ensuring that it reaches them before the due date. It’s important to include your property’s unique identification number with your payment to avoid any processing delays.

Some counties in Iowa also offer the option to pay in person. You can visit the county treasurer's office during business hours and make your payment over the counter. This method provides an immediate receipt, offering peace of mind that your payment has been received.

Payment Plans and Options

Iowa understands that paying property taxes can be a significant financial burden, especially for those facing financial challenges. To provide relief, the state offers various payment plans and options to help taxpayers manage their obligations.

One such option is the Installment Payment Plan, which allows taxpayers to divide their annual tax liability into equal monthly payments. This plan can help spread out the cost, making it more manageable. To qualify for this plan, you typically need to meet certain income criteria and demonstrate a financial need.

Additionally, Iowa offers a Deferred Tax Program for eligible taxpayers, primarily designed for senior citizens and disabled individuals. This program allows qualified individuals to defer their property taxes until the property is sold or the owner's circumstances change. This can provide significant financial relief for those on fixed incomes.

Staying Informed and Avoiding Penalties

Staying informed about your property tax obligations is crucial to avoid late payments and associated penalties. Iowa imposes late payment penalties, which can accumulate over time, making it essential to stay on top of your tax payments.

Late Payment Penalties and Interest

Iowa imposes a late payment penalty of 1% per month on any unpaid property taxes. This penalty can accrue for up to 12 months, after which additional legal actions may be taken to collect the outstanding amount. It’s important to note that this penalty applies to the entire tax amount, not just the late portion.

In addition to the late payment penalty, Iowa also assesses interest on overdue property taxes. The interest rate is typically set at a rate determined by the State Treasurer and is charged on the unpaid balance, including any penalties that have accrued. This interest continues to accumulate until the balance is paid in full.

To avoid these penalties and interest charges, it's crucial to stay informed about your payment deadlines. Many counties in Iowa provide reminder notices before the due date, but it's always a good practice to mark your calendar with the payment deadlines to ensure you don't miss them.

Tips for Staying Organized

Managing your property tax obligations can be simplified by staying organized. Here are some tips to help you stay on top of your payments:

- Set reminders for payment due dates on your calendar or use reminder apps.

- Keep a record of your property's unique identification number and other important tax-related documents in a secure location.

- Consider using a tax preparation software or app to help you estimate and track your tax obligations.

- Stay informed about any changes in tax rates or assessment values in your area.

- If you're facing financial challenges, explore the payment plans and options available to you to manage your tax obligations effectively.

Conclusion: Navigating Iowa’s Property Tax Landscape

Paying Iowa property taxes involves a comprehensive understanding of the assessment process, tax calculation, and payment methods. From determining your property’s assessed value to choosing the most convenient payment option, the process can seem daunting at first.

However, with the right knowledge and tools, managing your property tax obligations can become a straightforward and manageable task. Remember to stay informed, utilize the resources available to you, and take advantage of the payment plans and options offered by Iowa to ensure a smooth and stress-free tax payment experience.

What is the deadline for paying Iowa property taxes?

+The deadlines for paying Iowa property taxes typically fall in March and September each year. However, these dates can vary slightly based on the county, so it’s important to check with your local county treasurer’s office or tax collector for the exact due dates.

Can I appeal my property’s assessed value in Iowa?

+Yes, Iowa provides an Annual Appeal Process that allows property owners to challenge their assessments if they believe they are inaccurate or unfair. This process typically involves submitting an appeal to the county assessor’s office, providing evidence to support your claim, and potentially attending a hearing to present your case.

Are there any tax relief programs available in Iowa for senior citizens or low-income individuals?

+Yes, Iowa offers several tax relief programs to assist senior citizens and low-income individuals with their property tax obligations. These programs include the Deferred Tax Program and the Property Tax Credit Program. Eligibility criteria and application processes vary, so it’s recommended to contact your county assessor’s office or tax collector for more information.

What happens if I don’t pay my Iowa property taxes on time?

+Late payment of Iowa property taxes can result in penalties and interest charges. The state imposes a late payment penalty of 1% per month on the unpaid balance, up to a maximum of 12 months. Additionally, interest is charged on the unpaid balance, including any accrued penalties. If taxes remain unpaid, the county may initiate legal actions to collect the debt, including the potential for a tax sale.

How can I estimate my property tax liability in Iowa?

+To estimate your property tax liability in Iowa, you can use the formula: Property Tax = Assessed Value x Tax Rate. You can find your property’s assessed value on your assessment notice or by contacting the county assessor’s office. The tax rate is determined by the taxing authorities in your area, so you’ll need to obtain this information from your local tax collector or assessor’s office.