Ca State Estate Tax

California, often hailed as the Golden State, is not only a haven for sunny beaches and Hollywood glamour but also a hub of economic activity and a significant contributor to the U.S. economy. However, the state's tax system, particularly its estate tax laws, can be complex and often a cause for concern among residents and businesses alike. This comprehensive guide aims to demystify the California estate tax, shedding light on its intricacies and implications.

Unraveling the California Estate Tax: A Comprehensive Overview

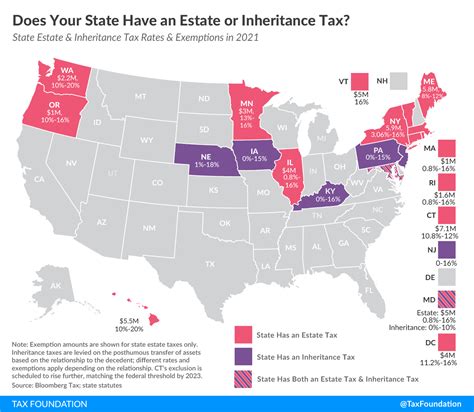

The estate tax, often referred to as the death tax, is a levy imposed on the transfer of an individual’s wealth upon their death. In the United States, this tax is primarily a federal matter, but several states, including California, have their own estate tax laws that complement the federal system. California’s estate tax is a crucial component of the state’s revenue stream, providing a significant source of income for state operations and services.

Historical Context and Legal Framework

California’s journey with estate taxes began in the early 20th century. The state initially adopted its own estate tax laws, but these were later abolished in the 1990s. However, in 2001, California reintroduced its estate tax, aligning it closely with the federal estate tax system. This move was a strategic decision to ensure the state could benefit from the revenue generated by high-net-worth individuals and large estates.

The legal foundation for California's estate tax is established under the California Revenue and Taxation Code, particularly in Division 8, Part 8.5. This code outlines the specific rules and regulations governing the assessment and collection of estate taxes in the state. It defines the parameters for taxable estates, the rates applicable, and the various deductions and exemptions that can be claimed.

Taxable Estates and Thresholds

Not all estates in California are subject to the state’s estate tax. The tax applies only to estates with a gross value exceeding a certain threshold. As of 2023, the California estate tax exemption is set at 5 million</strong>. This means that estates valued at 5 million or less are exempt from the state estate tax, but any value above this threshold becomes taxable.

| Year | California Estate Tax Exemption |

|---|---|

| 2023 | $5,000,000 |

| 2022 | $5,000,000 |

| 2021 | $5,000,000 |

It's important to note that this exemption amount is separate from the federal estate tax exemption, which stands at a much higher level. This means that even if an estate is exempt from federal estate tax, it might still be subject to California's estate tax if it exceeds the state's threshold.

Tax Rates and Calculations

California’s estate tax rates are progressive, meaning the tax burden increases as the estate’s value rises. The tax rates range from 0.8% to 16%, with different rates applicable to different portions of the taxable estate. The rates are structured in a way that ensures a higher tax burden for larger estates.

| Tax Rate | Applicable to Portion of Estate Exceeding |

|---|---|

| 0.8% | $5,000,001 - $10,000,000 |

| 1.2% | $10,000,001 - $25,000,000 |

| 1.6% | $25,000,001 - $50,000,000 |

| 2% | $50,000,001 - $100,000,000 |

| 2.4% | $100,000,001 - $250,000,000 |

| 2.8% | $250,000,001 - $500,000,000 |

| 3.2% | $500,000,001 - $1,000,000,000 |

| 3.6% | $1,000,000,001 - $1,500,000,000 |

| 4% | $1,500,000,001 - $2,000,000,000 |

| 4.4% | $2,000,000,001 - $5,000,000,000 |

| 4.8% | $5,000,000,001 - $10,000,000,000 |

| 5.1% | $10,000,000,001 - $25,000,000,000 |

| 5.5% | $25,000,000,001 - $100,000,000,000 |

| 5.8% | $100,000,000,001 - $250,000,000,000 |

| 6.1% | $250,000,000,001 - $500,000,000,000 |

| 6.4% | $500,000,000,001 - $1,000,000,000,000 |

| 6.7% | $1,000,000,000,001 - $1,500,000,000,000 |

| 7% | $1,500,000,000,001 - $2,000,000,000,000 |

| 7.3% | $2,000,000,000,001 - $5,000,000,000,000 |

| 7.6% | $5,000,000,000,001 and above |

For example, if an estate is valued at $15 million, the tax calculation would involve applying different rates to different portions of the estate. The first $5 million would be exempt, the next $5 million would be taxed at 0.8%, the following $5 million at 1.2%, and so on.

Deductions, Exemptions, and Credits

California’s estate tax system offers various deductions, exemptions, and credits to reduce the tax burden. These provisions are designed to alleviate the financial strain on estates and encourage certain types of charitable giving and business activities.

- Charitable Deductions: Estates can deduct gifts made to qualified charities. These deductions can significantly reduce the taxable value of the estate.

- Spousal Exemption: Transfers of property to a surviving spouse are generally exempt from estate tax, allowing couples to pass on their wealth to each other without incurring tax liability.

- Business Deductions: Estates that include certain types of business interests may be eligible for deductions, particularly if the business is actively engaged in trade or business operations.

- Mortgage and Debt Payments: Estates can deduct certain debts and mortgages owed by the decedent, reducing the taxable value of the estate.

- Credit for Prior Transfers: California offers a credit for taxes paid on prior transfers, ensuring that estates are not taxed multiple times on the same assets.

Filing and Payment Requirements

Estate executors or personal representatives are responsible for filing the California estate tax return, known as Form 521. This form must be filed within nine months of the decedent’s death, and any taxes due must be paid by the same deadline. Late filings and payments can result in penalties and interest.

It's important to note that even if an estate is not subject to California's estate tax, it might still need to file a federal estate tax return if it exceeds the federal exemption threshold. In such cases, the executor must also file Form 706 with the IRS.

Impact on Estate Planning

California’s estate tax has significant implications for estate planning. High-net-worth individuals and families residing in the state often work closely with estate planning attorneys and tax professionals to structure their estates in a way that minimizes tax liability. Common strategies include:

- Gift Giving: Making strategic gifts during one's lifetime can reduce the taxable value of the estate upon death.

- Trusts: Establishing certain types of trusts, such as bypass trusts or irrevocable trusts, can help manage the estate's tax liability.

- Business Planning: Structuring business interests in a way that maximizes deductions and exemptions can be a crucial aspect of estate planning for business owners.

- Charitable Giving: Encouraging charitable donations not only supports worthy causes but also provides tax benefits to the estate.

Comparison with Federal Estate Tax

California’s estate tax is often compared to the federal estate tax, which has a much higher exemption threshold and applies to a larger number of estates. While the federal estate tax exemption is currently set at 12.4 million</strong> for individuals and <strong>24.8 million for married couples, California’s exemption is significantly lower. This means that some estates that are exempt from federal estate tax might still be subject to California’s estate tax.

| Year | Federal Estate Tax Exemption (Individual) | Federal Estate Tax Exemption (Married Couple) |

|---|---|---|

| 2023 | $12,400,000 | $24,800,000 |

| 2022 | $12,060,000 | $24,120,000 |

| 2021 | $11,700,000 | $23,400,000 |

However, it's worth noting that California offers a credit for taxes paid to other states. This means that if an estate is subject to both California's and another state's estate tax, the credit can offset some of the California tax liability.

Future Outlook and Potential Changes

The landscape of estate taxes in California, as in many other states, is subject to change. Political and economic factors can influence the state’s tax policies, leading to potential modifications in the estate tax laws. Some experts predict that the exemption threshold might be adjusted over time, either increasing or decreasing, based on economic conditions and state revenue needs.

Additionally, there have been discussions and proposals for the federal government to eliminate the estate tax altogether, which could have a significant impact on states like California that rely on this tax for revenue. However, as of the latest available information, these proposals have not been enacted, and the federal estate tax remains in effect.

Conclusion

California’s estate tax is a complex but crucial component of the state’s tax system. It plays a vital role in funding state operations and services while also impacting the financial planning of high-net-worth individuals and families. Understanding the intricacies of this tax, including the thresholds, rates, deductions, and exemptions, is essential for effective estate planning.

As the state's tax laws continue to evolve, it is imperative for residents and businesses to stay informed and consult with tax professionals to ensure compliance and minimize tax liability. The estate tax landscape in California is a dynamic one, and staying abreast of the latest developments is key to effective financial and estate planning.

What is the current California estate tax exemption amount for 2023?

+As of 2023, the California estate tax exemption is set at $5 million.

How does California’s estate tax compare to the federal estate tax?

+California’s estate tax has a lower exemption threshold compared to the federal estate tax. While the federal exemption is much higher, some estates that are exempt from federal tax might still be subject to California’s estate tax.

Are there any deductions or exemptions available to reduce California estate tax liability?

+Yes, California’s estate tax system offers various deductions and exemptions, including charitable deductions, spousal exemptions, business deductions, and credits for prior transfers. These provisions can significantly reduce the tax burden on estates.

When is the deadline for filing California estate tax returns and making payments?

+Estate tax returns (Form 521) must be filed within nine months of the decedent’s death, and any taxes due must be paid by the same deadline. Late filings and payments can result in penalties and interest.

What impact does California’s estate tax have on estate planning strategies?

+California’s estate tax influences estate planning strategies, prompting high-net-worth individuals to explore options like gift-giving, establishing trusts, structuring business interests, and charitable giving to minimize tax liability and maximize wealth transfer.