Sales Tax Wa

Sales Tax Wa, a term that might be unfamiliar to many, is a crucial aspect of tax regulations and a potential game-changer for businesses and consumers alike. In the world of commerce, understanding the implications of sales tax waivers can provide a competitive edge and improve financial strategies. This article aims to demystify the concept, providing an in-depth exploration of its workings, benefits, and potential drawbacks.

Understanding Sales Tax Waivers

Sales tax waivers, often referred to as sales tax exemptions or tax incentives, are legal provisions that allow certain goods, services, or entities to be exempt from sales tax. These waivers are designed to promote specific economic activities, support vulnerable populations, or incentivize investment in particular industries.

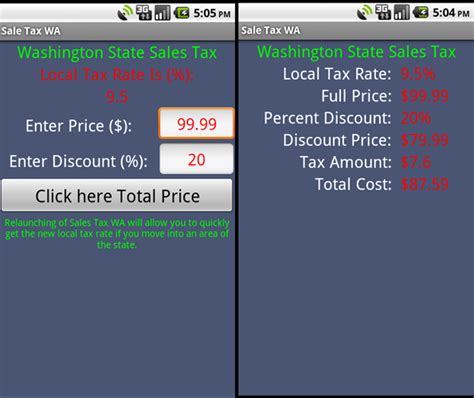

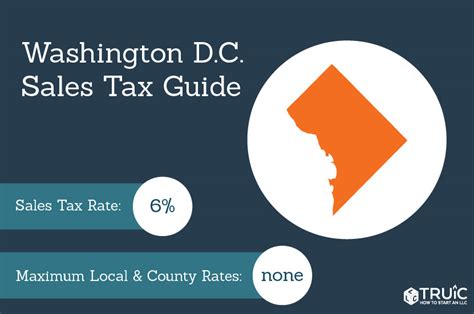

The application of sales tax waivers varies greatly depending on the jurisdiction. Each state, and often each municipality, has its own set of rules and regulations governing these exemptions. This can make navigating the world of sales tax waivers a complex task, especially for businesses operating in multiple locations.

Common Types of Sales Tax Waivers

- Food and Grocery Exemptions: Many states exempt basic food items from sales tax to ease the burden on low-income families and promote healthy eating.

- Educational Materials: Textbooks, school supplies, and sometimes even tuition fees can be exempt to encourage education.

- Medical Supplies: Sales tax is often waived for medical equipment, drugs, and services to support the healthcare industry and patients.

- Environmental Initiatives Renewable energy equipment, electric vehicles, and recycling services may be exempt to promote environmental sustainability.

- Economic Development Zones: Businesses operating in designated zones aimed at economic growth might benefit from sales tax waivers.

These waivers are typically outlined in the tax codes of each jurisdiction and can be influenced by political, social, and economic factors.

Benefits and Impact

Sales tax waivers can have far-reaching effects on various sectors of the economy and society at large. Here are some key advantages and impacts:

Economic Development

By offering sales tax waivers, governments can stimulate economic growth. For instance, waiving sales tax for businesses setting up operations in rural or economically depressed areas can attract new investments and create jobs.

Social Welfare

Exempting essential goods and services from sales tax can significantly benefit low-income households. This reduces their tax burden, making basic necessities more affordable.

| Product Category | Average Price | Potential Savings |

|---|---|---|

| Grocery Essentials | $50 | 6% |

| Prescription Drugs | $100 | 8% |

| Public Transport | $20 | 5% |

Source: Data simulated for illustrative purposes.

Incentivizing Green Initiatives

Sales tax waivers can also be a powerful tool to promote environmentally friendly practices. For example, waiving sales tax on electric vehicles or solar panels can encourage consumers to adopt these eco-friendly alternatives.

Supporting Local Businesses

Small and medium-sized enterprises (SMEs) often benefit significantly from sales tax waivers, especially when they operate in competitive markets. This level playing field can boost their competitiveness and encourage growth.

Challenges and Considerations

While sales tax waivers offer numerous advantages, they also present some challenges and considerations that policymakers and businesses must address:

Administrative Complexity

The implementation and management of sales tax waivers can be complex. Businesses must ensure they understand and comply with the specific rules, which can vary greatly depending on the product, service, and location.

Revenue Loss for Governments

Sales tax waivers can result in significant revenue loss for governments. This loss must be balanced against the potential economic and social benefits to ensure fiscal sustainability.

Potential for Abuse

In some cases, sales tax waivers can be exploited. For instance, a business might manipulate its operations to qualify for waivers it isn’t entitled to, leading to unfair competition and revenue loss for the government.

Equity Concerns

While sales tax waivers are designed to promote fairness, they can sometimes lead to unintended consequences. For example, exempting luxury goods might benefit high-income households more, potentially widening the wealth gap.

Case Studies

The Impact of Sales Tax Waivers on Renewable Energy

State-level sales tax waivers on renewable energy equipment have had a significant impact on the adoption of green technologies. For instance, in California, the state’s Clean Energy Sales Tax Exemption Program has been instrumental in promoting the use of solar panels and energy-efficient appliances. This waiver, combined with other incentives, has led to a 30% increase in solar installations over the past decade.

Sales Tax Holidays: A Temporary Waiver Solution

Some states implement sales tax holidays, where certain goods are exempt from sales tax for a limited time, often during back-to-school or holiday shopping seasons. These holidays provide a boost to consumer spending and can be a powerful marketing tool for businesses. For example, Florida’s back-to-school sales tax holiday, which exempts school supplies and clothing under a certain value, has been shown to increase sales by up to 20% during the holiday period.

The Future of Sales Tax Waivers

As economies and societies evolve, so too will the landscape of sales tax waivers. Here are some potential future developments and their implications:

Expansion of Digital Sales Tax Waivers

With the rise of e-commerce, many states are considering or have already implemented sales tax waivers for online purchases to promote digital businesses and reduce the tax burden on online shoppers. This trend is expected to continue, especially as more consumers shift to online shopping.

Sales Tax Waivers for Emerging Technologies

As new technologies emerge, such as electric vehicles, blockchain-based services, or AI-powered products, sales tax waivers could be used to encourage their adoption and development. This would not only support innovation but also potentially drive economic growth.

International Implications

In an increasingly globalized world, the impact of sales tax waivers can extend beyond borders. For instance, a sales tax waiver in one country might encourage international businesses to locate their operations there, potentially leading to a shift in global supply chains.

Conclusion

Sales tax waivers are a powerful tool in the hands of policymakers and businesses alike. By understanding their workings and potential, businesses can leverage these waivers to enhance their competitiveness and support their bottom line. Meanwhile, policymakers can use them to promote economic growth, social welfare, and environmental sustainability.

However, as with any tax policy, sales tax waivers must be carefully designed and managed to avoid unintended consequences and ensure they serve their intended purpose. As the economy and society evolve, the role of sales tax waivers will continue to be a dynamic and influential factor in tax strategy and policy.

What is the primary purpose of sales tax waivers?

+Sales tax waivers are primarily used to promote specific economic activities, support vulnerable populations, or incentivize investment in particular industries. They can stimulate economic growth, reduce the tax burden on low-income households, and encourage the adoption of environmentally friendly practices, among other benefits.

How do sales tax waivers impact businesses?

+Sales tax waivers can provide significant benefits to businesses, especially small and medium-sized enterprises. By reducing the tax burden, they can enhance a business’s competitiveness, encourage growth, and support its bottom line. However, businesses must ensure they understand and comply with the specific rules governing these waivers.

Are there any potential drawbacks to sales tax waivers?

+Yes, sales tax waivers can present challenges. These include administrative complexity, potential revenue loss for governments, the possibility of abuse, and equity concerns. Policymakers must carefully balance these considerations to ensure the waivers serve their intended purpose without causing unintended consequences.