Oregon Death Tax

The Oregon Death Tax, officially known as the Oregon Inheritance and Estate Tax, is a complex and often misunderstood aspect of the state's tax system. While some states have completely abolished inheritance taxes, Oregon maintains a unique approach to taxing estates, impacting both residents and non-residents with assets in the state. This article aims to provide a comprehensive guide to understanding the Oregon Death Tax, its implications, and how it fits into the broader estate planning landscape.

Understanding the Oregon Death Tax

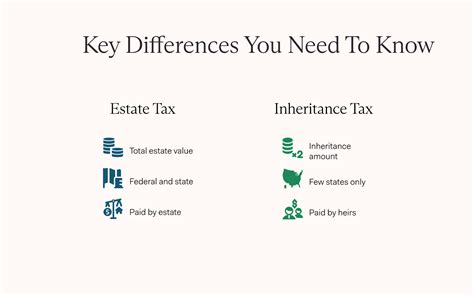

The Oregon Death Tax is a state-level tax levied on the transfer of assets upon an individual’s death. It is distinct from the federal estate tax, as each state has the autonomy to implement its own inheritance and estate tax laws. Unlike the federal system, which exempts estates valued below a certain threshold, Oregon’s tax applies to a broader range of estates, making it a critical consideration for comprehensive estate planning.

Taxable Estates

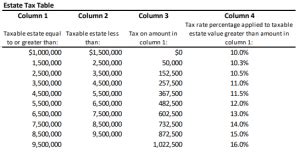

The Oregon Death Tax comes into play when an individual’s gross estate exceeds the state’s exemption amount, currently set at 1 million. This threshold is significantly lower than the federal estate tax exemption, which stands at 12.06 million for the 2022 tax year. As a result, many more estates in Oregon may be subject to taxation compared to other states.

The tax is calculated based on the value of the deceased individual's assets, including real estate, personal property, and financial assets, such as stocks, bonds, and life insurance proceeds. It's important to note that the tax is not applied to the entire estate but rather to the portion that exceeds the exemption amount.

| Tax Rate | Applicable Range |

|---|---|

| 1.8% - 16% | $1,000,001 - $5,000,000 |

| 16% | $5,000,001 and above |

For example, if an estate is valued at $2 million, the tax would be calculated as follows: $2 million - $1 million exemption = $1 million taxable estate. The tax rate for this range is 1.8%, so the tax owed would be $18,000.

Who Pays the Tax

The responsibility of paying the Oregon Death Tax typically falls on the beneficiaries of the estate. However, the tax is often deducted from the estate itself before distribution, ensuring that the beneficiaries receive the assets net of any applicable taxes.

Exemptions and Deductions

Oregon offers various exemptions and deductions to reduce the taxable amount of an estate. These include:

- Marital Deduction: Transfers of assets to a surviving spouse are generally exempt from the Oregon Death Tax.

- Charitable Contributions: Gifts to qualified charitable organizations are exempt from the tax.

- Family-Owned Business Deduction: A deduction is available for family-owned businesses, allowing a reduced tax rate for certain qualifying estates.

Impact on Estate Planning

The Oregon Death Tax significantly influences the estate planning strategies of individuals with substantial assets. Here’s how it can impact your planning:

Estate Tax Avoidance

To minimize the impact of the Oregon Death Tax, individuals may consider various estate planning techniques, such as:

- Gifting: Strategic gifting during one's lifetime can reduce the taxable estate and potentially avoid the tax altogether.

- Life Insurance Trusts: Establishing a life insurance trust can help protect the proceeds from being included in the taxable estate.

- Charitable Planning: Donating to charitable organizations not only provides a tax deduction but also reduces the taxable estate.

Trusts and Estate Administration

Trusts can be powerful tools for managing and transferring assets while minimizing tax liability. Oregon recognizes various types of trusts, including:

- Revocable Trusts: These trusts can be modified or revoked during the grantor's lifetime, offering flexibility in estate planning.

- Irrevocable Trusts: Once established, these trusts cannot be altered, providing asset protection and potential tax benefits.

- Dynasty Trusts: Designed to last for multiple generations, these trusts can protect assets from estate taxes for an extended period.

Legal and Tax Expertise

Given the complexity of the Oregon Death Tax and its interaction with federal tax laws, seeking advice from experienced estate planning attorneys and tax professionals is essential. They can help navigate the intricacies of the tax system and ensure that your estate plan aligns with your goals and minimizes tax liability.

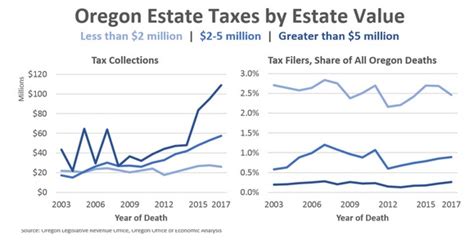

Oregon Death Tax vs. Federal Estate Tax

While the Oregon Death Tax and the federal estate tax share similarities, there are key differences to consider:

Thresholds and Rates

The federal estate tax has a significantly higher exemption amount than Oregon’s, currently set at $12.06 million for 2022. This means that fewer estates at the federal level are subject to taxation. However, the federal tax rates are generally higher than Oregon’s, ranging from 18% to 40% for estates valued above the exemption amount.

Portability

The federal estate tax allows for portability, which means that if one spouse dies without using their entire exemption, the remaining amount can be transferred to the surviving spouse. This portability feature is not available under Oregon’s estate tax laws.

Filing Requirements

The federal estate tax requires estates valued over the exemption amount to file Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return. In Oregon, estates must file Form OR-706, Oregon Inheritance and Estate Tax Return, if the gross estate exceeds the state’s exemption.

Conclusion

The Oregon Death Tax is a critical consideration for individuals with assets in the state, impacting both residents and non-residents. Understanding the tax’s implications and taking proactive estate planning measures can help minimize its impact. With careful planning and the guidance of legal and tax professionals, individuals can ensure that their assets are transferred efficiently and effectively, preserving their wealth for future generations.

Are there any exemptions for small estates in Oregon?

+Yes, Oregon provides an exemption for small estates. If the gross estate, excluding certain exempt property, is valued at $75,000 or less, the estate may qualify for a simplified administrative procedure, reducing the complexity and cost of the probate process.

Can the Oregon Death Tax be avoided by moving assets out of state before death?

+Transferring assets out of Oregon before death may reduce the state’s ability to tax those assets, but it’s important to consider the potential consequences. Moving assets may trigger capital gains taxes and could impact other aspects of estate planning, such as probate and estate administration. Consulting with a qualified professional is essential before taking such actions.

How often are the exemption amounts and tax rates adjusted in Oregon?

+The exemption amounts and tax rates in Oregon are subject to legislative changes. While there is no set schedule for adjustments, the Oregon Department of Revenue monitors federal estate tax laws and may make corresponding changes to state laws to maintain consistency. It’s crucial to stay updated with the latest tax laws to ensure accurate planning.