Anchor Property Tax Relief Nj

The concept of property tax relief is of paramount importance for homeowners, as it can significantly impact their financial well-being and overall quality of life. In the state of New Jersey, the Anchor Property Tax Relief Program stands as a crucial initiative designed to ease the burden of property taxes for eligible residents. This comprehensive article will delve into the intricacies of this program, exploring its benefits, eligibility criteria, application process, and the overall impact it has on the lives of New Jersey residents.

Unveiling the Anchor Property Tax Relief Program

The Anchor Property Tax Relief Program, an initiative spearheaded by the New Jersey Department of Community Affairs (DCA), is a cornerstone of the state’s commitment to providing relief to its residents. This program, often referred to as the “Anchor Program”, is a testament to the state’s understanding of the financial strain that property taxes can impose on homeowners, especially those on fixed incomes or with limited financial resources.

At its core, the Anchor Program aims to reduce the property tax burden for eligible homeowners, offering them a much-needed financial respite. By providing direct assistance in the form of property tax credits or refunds, the program empowers residents to maintain their financial stability and invest in their communities with greater ease.

Key Features of the Anchor Program

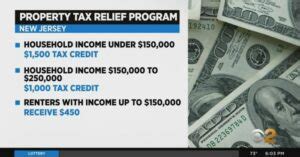

- Tax Relief Amounts: The program offers a maximum tax credit of $2,000 for eligible homeowners. This credit can be a significant relief, especially for those facing high property tax rates in New Jersey.

- Eligibility Criteria: To qualify for the Anchor Program, homeowners must meet specific requirements. These include being a resident of New Jersey, owning and occupying a single-family home, and having a total household income that falls within the program’s income limits.

- Application Process: The application process is designed to be straightforward and accessible. Homeowners can apply online or through paper applications, with the necessary documentation to support their eligibility. The DCA provides clear guidelines and assistance to ensure a smooth application journey.

One of the unique aspects of the Anchor Program is its focus on community-based initiatives. The program encourages eligible homeowners to reinvest their tax relief into local projects and initiatives that enhance their neighborhoods. This not only strengthens community bonds but also contributes to the overall development and improvement of the state.

Real-World Impact and Success Stories

The Anchor Property Tax Relief Program has had a tangible and positive impact on the lives of countless New Jersey residents. Take, for instance, the story of Mr. Johnson, a retired teacher living in Trenton. With a fixed income and rising property taxes, Mr. Johnson struggled to make ends meet. However, the Anchor Program provided him with a much-needed financial boost, allowing him to stay in his beloved home and contribute to local community projects.

Similarly, Ms. Smith, a single mother working multiple jobs in Newark, found the program to be a lifeline. The tax relief she received not only helped her stay current on her property taxes but also allowed her to invest in her children's education and future.

These success stories are a testament to the effectiveness and reach of the Anchor Program. By providing direct financial support, the program empowers residents to not only maintain their homes but also actively participate in the growth and development of their communities.

Eligibility and Application Process: A Comprehensive Guide

Understanding the eligibility criteria and application process is crucial for homeowners seeking to benefit from the Anchor Property Tax Relief Program. Here’s a detailed breakdown to guide you through the process.

Eligibility Criteria

To be eligible for the Anchor Program, homeowners must meet the following requirements:

- Residency: You must be a resident of the state of New Jersey and have owned and occupied your home for at least one year.

- Homeownership: The program is designed for single-family homeowners. This includes detached houses, townhomes, and condominiums.

- Income Limits: Your total household income, including all sources, must fall within the program’s income limits. These limits are determined based on family size and county of residence.

- Property Value: Your home’s assessed value must be at or below the median home value for your municipality.

It's important to note that the income and property value limits may vary annually, so it's advisable to refer to the DCA's official guidelines for the most up-to-date information.

Application Process

The application process for the Anchor Program is designed to be accessible and user-friendly. Here’s a step-by-step guide to help you navigate the process:

- Gather Necessary Documents: Before starting your application, ensure you have the following documents readily available:

- Proof of homeownership (e.g., deed, mortgage statement)

- Proof of residency (e.g., driver’s license, utility bill)

- Previous year’s federal income tax return

- Social Security numbers for all household members

- Choose Your Application Method: The DCA offers two application methods:

- Online Application: Visit the DCA’s official website and navigate to the Anchor Program application portal. Follow the instructions to complete and submit your application electronically.

- Paper Application: If you prefer a physical application, you can download and print the application form from the DCA’s website. Complete the form and mail it, along with the required supporting documents, to the designated address.

- Complete the Application: Whether you choose the online or paper method, ensure you provide accurate and complete information. Double-check your application for any errors or missing details.

- Submit Your Application: Once you’ve reviewed your application, submit it through the chosen method. For online applications, ensure you receive a confirmation of submission. For paper applications, make sure to use certified mail or trackable delivery services.

- Await Processing: After submitting your application, allow sufficient time for processing. The DCA typically takes several weeks to review applications. You will receive a notification once your application has been processed, and you will be informed of the outcome.

Tips for a Successful Application

To increase your chances of a successful application, consider the following tips:

- Read the program guidelines and eligibility criteria thoroughly before applying.

- Ensure all your supporting documents are up-to-date and accurately reflect your current financial situation.

- If you have any questions or need assistance, don’t hesitate to reach out to the DCA’s helpline or visit their website for additional resources.

By following these steps and guidelines, you can navigate the Anchor Program application process with confidence and increase your chances of receiving the tax relief you deserve.

Maximizing the Benefits: Strategies and Community Impact

The Anchor Property Tax Relief Program not only provides financial relief to eligible homeowners but also offers an opportunity to make a positive impact on their communities. By strategically utilizing the tax relief, residents can contribute to the growth and development of their neighborhoods, fostering a sense of pride and ownership.

Community Investment Strategies

One of the key advantages of the Anchor Program is the flexibility it offers in reinvesting tax relief funds. Homeowners can choose to allocate these funds to various community-focused initiatives, such as:

- Neighborhood Improvement Projects: Invest in beautification efforts, such as planting trees, improving parks, or enhancing public spaces. These projects not only enhance the visual appeal of the community but also create a more enjoyable living environment.

- Local Business Support: Support local businesses by patronizing them or even investing in their growth. This not only boosts the local economy but also strengthens the sense of community support.

- Community Organizations and Charities: Contribute to local charities or non-profit organizations that align with your values. Whether it’s supporting education, healthcare, or environmental initiatives, your contributions can make a meaningful difference.

- Home Improvement and Maintenance: Use the tax relief to maintain and improve your home. This not only enhances the value of your property but also contributes to the overall aesthetic and functionality of the neighborhood.

By actively participating in community projects and initiatives, homeowners can foster a sense of belonging and contribute to the overall well-being of their neighborhoods. The Anchor Program thus becomes a catalyst for positive change, empowering residents to take ownership of their community's future.

The Ripple Effect: Community Development and Engagement

The impact of the Anchor Program extends beyond individual financial relief. It creates a ripple effect that leads to broader community development and engagement. As homeowners reinvest their tax relief, they become active participants in shaping their neighborhoods.

Through community projects and initiatives, residents have the opportunity to build social connections, foster collaboration, and develop a sense of collective responsibility. This enhanced community engagement can lead to:

- Improved Neighborhood Aesthetics: Well-maintained and beautified neighborhoods attract new residents and businesses, boosting the local economy and creating a sense of pride.

- Enhanced Safety and Security: Active and engaged communities often experience lower crime rates and increased neighborhood watch initiatives, creating a safer environment for all residents.

- Increased Home Values: Neighborhood improvements and a sense of community can positively impact property values, providing long-term financial benefits to homeowners.

- Stronger Social Bonds: Participating in community projects allows residents to connect with their neighbors, build friendships, and create a supportive network.

The Anchor Property Tax Relief Program, therefore, serves as a powerful tool for community empowerment and transformation. By encouraging residents to invest in their communities, the program fosters a sense of ownership, pride, and collective action, leading to a brighter and more vibrant future for all New Jersey residents.

Future Outlook and Program Evolution

As the Anchor Property Tax Relief Program continues to make a positive impact on the lives of New Jersey residents, its future trajectory holds promise and potential for further enhancement. The program’s success has sparked discussions and initiatives aimed at expanding its reach and effectiveness, ensuring that more homeowners can benefit from the financial relief it provides.

Expanding Eligibility Criteria

One of the key areas of focus for the future of the Anchor Program is the expansion of eligibility criteria. Recognizing that property taxes can be a burden for a broader range of homeowners, efforts are underway to explore ways to include more residents within the program’s parameters.

Potential strategies include:

- Adjusting Income Limits: By increasing the income thresholds, the program can accommodate a larger number of middle-income households, providing them with much-needed tax relief.

- Expanding Homeownership Types: Currently, the program is limited to single-family homeowners. Exploring ways to include other types of homeownership, such as multi-family dwellings or mobile homes, could broaden the program's reach and impact.

- Addressing Geographic Disparities: Some municipalities in New Jersey face higher property tax rates than others. Adjusting the program's criteria to take into account these disparities could ensure that residents in high-tax areas receive adequate relief.

Enhancing Community Engagement

The success of the Anchor Program lies not only in providing financial relief but also in fostering a sense of community and engagement. To further strengthen this aspect, future iterations of the program may focus on:

- Community Grant Programs: Developing grant opportunities specifically for community-based initiatives could encourage more residents to participate in projects that enhance their neighborhoods. These grants could be awarded based on the impact and sustainability of proposed projects.

- Collaborative Partnerships: Forming partnerships with local organizations, non-profits, and community leaders could amplify the program's reach and impact. These partnerships could facilitate the sharing of resources, expertise, and best practices, leading to more effective community development.

- Educational Initiatives: Providing educational resources and workshops on financial literacy, homeownership, and community engagement could empower residents to make informed decisions and actively participate in their communities.

Leveraging Technology for Efficiency

In today's digital age, leveraging technology can greatly enhance the efficiency and accessibility of the Anchor Program. Potential technological advancements include:

- Online Application Enhancements: Upgrading the online application process to make it more user-friendly and accessible could encourage more residents to apply. This could include features like progress trackers, application status updates, and interactive guides.

- Digital Community Platforms: Creating online platforms or apps where residents can connect, share ideas, and collaborate on community projects could foster a sense of virtual community and engagement.

- Data-Driven Insights: Utilizing data analytics to track the program's impact and identify areas for improvement could lead to more targeted and effective strategies, ensuring that the program remains relevant and beneficial to New Jersey residents.

As the Anchor Property Tax Relief Program evolves, it has the potential to become an even more powerful tool for financial relief, community development, and resident empowerment. By embracing these future outlooks and adapting to the changing needs of New Jersey residents, the program can continue to make a positive and lasting impact on the state's communities.

How often can I apply for the Anchor Property Tax Relief Program?

+The Anchor Program is an annual program, so you can apply each year as long as you continue to meet the eligibility criteria. However, it’s important to note that the program’s guidelines and requirements may change annually, so it’s advisable to review the official guidelines each year before applying.

What happens if my application is denied?

+If your application is denied, you will receive a notification from the DCA explaining the reason for the denial. In such cases, you can reach out to the DCA for further guidance and clarification. They may provide additional information or suggest alternative programs you could consider.

Can I apply for the Anchor Program if I rent my home?

+No, the Anchor Program is specifically designed for homeowners. However, if you are a renter, there may be other programs or initiatives available to assist with rental costs or provide financial support. It’s recommended to explore these options or reach out to the DCA for guidance on renter-specific programs.

How long does it take to receive the tax relief after my application is approved?

+Once your application is approved, the timing for receiving the tax relief can vary. The DCA typically processes approved applications within a few weeks, but the actual disbursement of funds may depend on various factors, including the method of payment chosen (e.g., direct deposit, check) and the timing of the program’s funding cycle.

Can I use the tax relief for any purpose, or are there restrictions?

+While the Anchor Program does not restrict the use of tax relief funds, it encourages homeowners to reinvest them in their communities. The program promotes the idea of using the funds for community-focused initiatives or projects that enhance the neighborhood. However, homeowners have the flexibility to use the funds as they see fit, as long as they comply with any applicable tax regulations.