Crow Wing County Property Tax

Property taxes are an essential aspect of local government funding, and they play a significant role in the development and maintenance of communities. In Crow Wing County, Minnesota, understanding the property tax system is crucial for both homeowners and businesses. This comprehensive guide aims to shed light on the intricacies of Crow Wing County's property tax landscape, providing an in-depth analysis of how it works, what factors influence tax assessments, and the impact it has on the local economy.

The Crow Wing County Property Tax System: An Overview

Crow Wing County, nestled in the heart of Minnesota’s beautiful northwoods, boasts a unique blend of vibrant communities, natural wonders, and recreational opportunities. As one of the state’s most desirable regions, it attracts residents and businesses alike, contributing to a thriving local economy. At the core of this economic ecosystem lies the property tax system, a critical funding mechanism for the county’s infrastructure, services, and overall development.

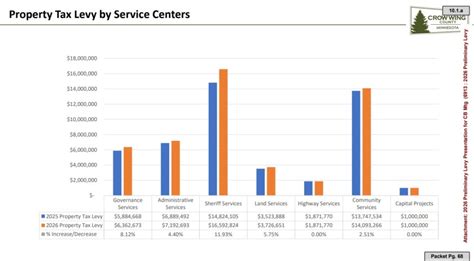

In Crow Wing County, property taxes are levied annually on real estate properties, including residential homes, commercial buildings, and agricultural lands. These taxes are a significant source of revenue for the county government, enabling it to fund essential services such as education, public safety, road maintenance, and more. The property tax system is designed to be fair and equitable, with assessments based on the property's value and the corresponding tax rate.

Tax Assessment Process

The assessment process in Crow Wing County is meticulous and follows a standardized procedure. The County Assessor’s Office is responsible for determining the value of each property within the county. This value, often referred to as the “assessed value,” is crucial as it forms the basis for calculating the property tax.

Assessments are conducted periodically, typically every few years, to ensure that property values remain up-to-date. The assessor considers various factors, including the property's location, size, condition, and any recent improvements or renovations. By comparing these attributes to similar properties, the assessor determines a fair market value, which is then used to calculate the property's assessed value.

Once the assessed value is established, it is multiplied by the applicable tax rate to arrive at the property tax liability. Tax rates in Crow Wing County are set by various taxing authorities, including the county government, school districts, cities, and townships. These rates are determined based on the budget requirements of each taxing jurisdiction and are subject to public approval through the budgeting process.

| Taxing Authority | 2023 Tax Rate (per $1,000) |

|---|---|

| Crow Wing County | $30.50 |

| School District | $120.75 |

| City of Brainerd | $35.25 |

| Township of Ideal | $18.00 |

In the table above, we provide a snapshot of the 2023 tax rates for some of the major taxing authorities in Crow Wing County. These rates can vary significantly depending on the location and type of property. For instance, school district tax rates tend to be higher to support educational facilities and programs.

Impact on the Local Economy

Property taxes in Crow Wing County have a profound impact on the local economy. They provide the financial backbone for critical public services, infrastructure development, and community initiatives. The revenue generated from property taxes funds schools, ensuring a quality education for the county’s youth. It also supports law enforcement agencies, fire departments, and emergency services, enhancing public safety and security.

Moreover, property taxes contribute to the maintenance and improvement of the county's road network, ensuring efficient transportation and connectivity. They also play a role in funding recreational facilities, parks, and cultural amenities, enhancing the quality of life for residents and attracting tourists, thereby boosting the local tourism industry.

Factors Influencing Property Tax Assessments

The assessed value of a property, and consequently the property tax liability, is influenced by several key factors. Understanding these factors can help property owners anticipate their tax obligations and make informed decisions.

Property Characteristics

The physical attributes of a property are a primary determinant of its value. These characteristics include the size of the land, the square footage of the building, the number of rooms, and the overall condition of the property. For instance, a larger property with more amenities is likely to have a higher assessed value than a smaller, more basic property.

Improvements or renovations made to a property can also impact its assessed value. Adding a garage, finishing a basement, or upgrading kitchen appliances can increase the property's value and, consequently, its tax liability. On the other hand, if a property falls into disrepair or suffers damage, its value may decrease, leading to a potential reduction in property taxes.

Market Conditions

The real estate market plays a crucial role in determining property values. In a thriving market, where demand for properties is high and supply is limited, property values tend to increase. This, in turn, leads to higher assessed values and, subsequently, higher property taxes.

Conversely, in a sluggish market with a surplus of properties and low demand, values may stagnate or even decline. This can result in lower assessed values and, potentially, a decrease in property taxes. However, it's important to note that market conditions are dynamic and can change rapidly, so property owners should stay informed about local real estate trends.

Assessor’s Methodology

The County Assessor’s Office employs various methods to determine property values. One common approach is the sales comparison method, which involves comparing the property to similar properties that have recently sold in the area. By analyzing these sales, the assessor can estimate the fair market value of the property in question.

Another method is the cost approach, which estimates the cost of replacing the property. This approach considers the current cost of land and construction, taking into account depreciation and other factors. The income approach, on the other hand, is primarily used for income-producing properties like rental properties or commercial buildings. It estimates the property's value based on the income it generates.

Understanding the assessor's methodology can help property owners anticipate how their property might be valued. It's important to note that assessors aim to be fair and accurate in their assessments, but property owners have the right to appeal if they believe their property has been unfairly valued.

Appealing Property Tax Assessments

Property owners in Crow Wing County have the right to appeal their property tax assessments if they believe the assessed value is inaccurate or unfair. The appeals process is designed to provide a fair and transparent mechanism for resolving disputes and ensuring that property taxes are assessed equitably.

The Appeals Process

The first step in the appeals process is to carefully review the assessment notice received from the County Assessor’s Office. This notice provides detailed information about the property’s assessed value, the basis for the assessment, and the deadline for filing an appeal. It’s crucial to understand the information provided and identify any potential discrepancies or errors.

If a property owner believes there is a valid reason to challenge the assessment, they can initiate the appeal process by submitting a formal request to the County Board of Equalization. This board, composed of local officials, is responsible for reviewing and adjusting property assessments. The request should include a clear and concise explanation of why the assessment is believed to be incorrect, along with any supporting documentation or evidence.

The Board of Equalization will carefully review the appeal, considering the property owner's arguments and the assessor's assessment. If the board determines that the assessment is indeed inaccurate, they have the authority to adjust the assessed value accordingly. This adjustment can lead to a reduction in the property tax liability for the current year and potentially for future years as well.

Gathering Evidence for an Appeal

To strengthen the case for an appeal, property owners should gather relevant evidence that supports their claim. This may include recent sales data of similar properties in the area, professional appraisals, or documentation of any significant changes to the property that could impact its value.

It's important to note that the appeals process is not a forum for arguing about the tax rate or the services provided by the county. The focus should be solely on the accuracy of the assessed value. Property owners should aim to provide clear and compelling evidence to demonstrate that the assessed value is unreasonable or inconsistent with market values.

Property Tax Relief Programs

Crow Wing County recognizes that property taxes can be a financial burden, especially for certain segments of the population. To alleviate this burden, the county offers various property tax relief programs designed to assist eligible homeowners and businesses.

Homestead Credit Refund

The Homestead Credit Refund program provides a refund of a portion of the property taxes paid by eligible homeowners. To qualify, homeowners must meet certain income criteria and must occupy the property as their primary residence. The refund amount is calculated based on the homeowner’s income and the amount of property taxes paid during the year.

For instance, in 2022, eligible homeowners with an annual income of less than $65,000 received a refund of up to $1,050. The refund amount decreases as income increases, with a maximum income limit of $96,000 for single filers and $144,000 for joint filers.

Senior Citizen Property Tax Deferral

The Senior Citizen Property Tax Deferral program allows eligible senior citizens to defer a portion of their property taxes. To qualify, seniors must be at least 65 years old, own and occupy the property as their primary residence, and meet certain income and asset limits. The deferred taxes, along with a small interest charge, become a lien on the property and are due upon the sale of the property or the owner’s death.

This program provides seniors with a financial cushion, allowing them to maintain their homes without the immediate burden of high property tax payments. It ensures that seniors can age in place comfortably, knowing that their property taxes are deferred until a later date.

Other Relief Programs

In addition to the Homestead Credit Refund and Senior Citizen Property Tax Deferral programs, Crow Wing County offers several other property tax relief initiatives. These include:

- Military Service Tax Exemption: Provides a property tax exemption for eligible military personnel and their families.

- Disabled Veteran Property Tax Exemption: Offers a partial or full property tax exemption for qualifying disabled veterans.

- Agricultural Property Tax Relief: Provides relief for agricultural lands used for farming or agricultural purposes.

- Renter's Property Tax Refund: Aims to provide property tax relief to eligible renters who meet certain income criteria.

Each of these programs has specific eligibility criteria and application processes. Property owners and renters are encouraged to explore these options to determine if they qualify for any form of property tax relief.

Conclusion

Understanding the Crow Wing County property tax system is crucial for both homeowners and businesses. From the assessment process to the appeals process, and from tax relief programs to the economic impact, every aspect of the property tax landscape plays a vital role in the county’s development and sustainability.

By staying informed about property tax assessments, rates, and relief programs, property owners can effectively manage their tax obligations and contribute to the vibrant community of Crow Wing County. The county's commitment to transparency and fairness in its property tax system ensures that residents and businesses can thrive, knowing their tax dollars are invested in the community's growth and prosperity.

How often are property assessments conducted in Crow Wing County?

+Property assessments in Crow Wing County are conducted every year. The County Assessor’s Office evaluates properties annually to ensure that assessed values remain up-to-date and accurate.

What happens if I disagree with my property tax assessment?

+If you believe your property tax assessment is incorrect, you have the right to appeal. The appeals process involves submitting a formal request to the County Board of Equalization, providing evidence to support your claim, and attending a hearing if necessary. The Board will review your case and make a decision regarding any adjustments to your assessed value.

Are there any tax relief programs for low-income homeowners in Crow Wing County?

+Yes, Crow Wing County offers the Homestead Credit Refund program, which provides a refund of a portion of property taxes paid by eligible low-income homeowners. To qualify, homeowners must meet certain income criteria and occupy the property as their primary residence. The refund amount varies based on income and property tax payments.

Can I pay my property taxes online in Crow Wing County?

+Yes, Crow Wing County offers an online payment portal for property taxes. You can access the portal through the County Treasurer’s website and make payments using a credit card, debit card, or electronic check. Online payments are processed securely and provide a convenient option for taxpayers.