Nyc Tax Return Status

The New York City (NYC) tax return status is a crucial aspect for both residents and businesses operating within the city. Understanding the tax obligations, deadlines, and the process of checking one's tax return status is essential for financial compliance and peace of mind. This comprehensive guide aims to provide an in-depth analysis of the NYC tax return status, offering valuable insights and practical tips for navigating the tax landscape of this vibrant metropolis.

Unraveling the Complexity of NYC Tax Returns

The tax system in New York City is intricate, reflecting the city’s diverse population and vibrant economy. Whether you’re a new resident filing your first tax return or a seasoned business owner managing multiple tax obligations, staying informed about the latest regulations and procedures is paramount.

Key Considerations for NYC Taxpayers

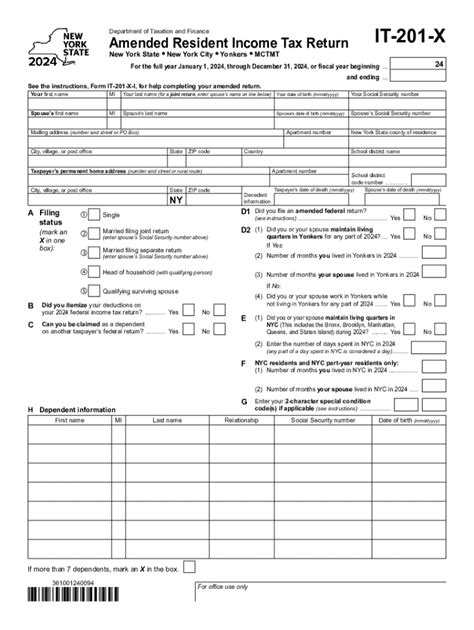

For individuals, the New York City Individual Income Tax is a progressive tax system, meaning the tax rate increases as income rises. This tax is in addition to the state and federal income taxes. Understanding the thresholds and brackets is crucial for accurate filing.

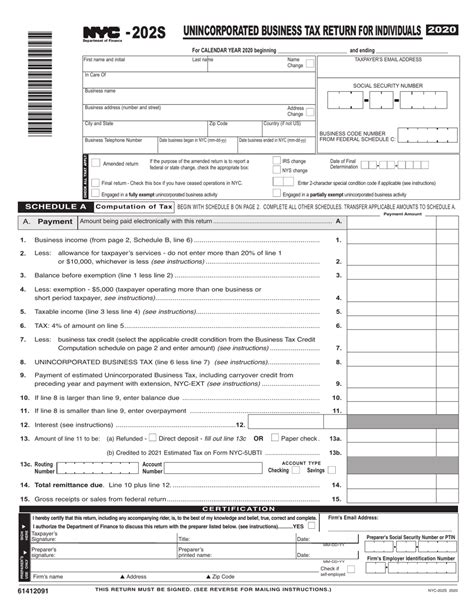

Businesses, on the other hand, face a myriad of tax obligations. The New York City General Corporation Tax applies to most corporations doing business in the city, with rates varying based on factors like revenue and industry. Additionally, Unincorporated Business Taxes, Commercial Rent Tax, and Hotel Room Occupancy Tax are just a few of the many taxes businesses must navigate.

The Importance of Timely Filing

Meeting tax deadlines is imperative to avoid penalties and interest charges. For individual income tax returns, the standard deadline is typically April 15th, but this can vary based on the year and specific circumstances. Businesses often have different filing deadlines, with some taxes due quarterly and others annually.

| Tax Type | Filing Deadline |

|---|---|

| Individual Income Tax | April 15th (may vary) |

| General Corporation Tax | Quarterly and Annual Deadlines |

| Unincorporated Business Tax | Varies based on business type |

| Commercial Rent Tax | Quarterly |

Checking Your NYC Tax Return Status: A Step-by-Step Guide

Knowing the status of your tax return provides clarity and allows for prompt action if any issues arise. Here’s a detailed guide on how to check your NYC tax return status, along with some common scenarios and their resolutions.

Step 1: Gather Your Information

Before you begin, ensure you have the following information readily available:

- Your Taxpayer Identification Number (TIN) or Social Security Number (SSN).

- The tax year for which you are checking the status.

- Any notice or correspondence you may have received from the NYC Department of Finance.

Step 2: Access the NYC Department of Finance Portal

The primary method to check your tax return status is through the NYC Department of Finance Online Services portal. This secure platform allows taxpayers to access their account information, view balances, and check the status of their returns.

Step 3: Log In or Create an Account

If you have an existing account, log in using your credentials. If not, creating an account is a straightforward process. You’ll need to provide your TIN or SSN, name, and other identifying information.

Step 4: Navigate to the Tax Return Status Section

Once logged in, locate the section dedicated to tax return status. This may be labeled as “Tax Return Status,” “Filing Status,” or something similar. Click on the appropriate link to proceed.

Step 5: Select the Tax Type and Year

The platform will typically allow you to choose the type of tax and the tax year for which you want to check the status. Select the appropriate options and click “Submit” or “Continue.”

Step 6: Review Your Tax Return Status

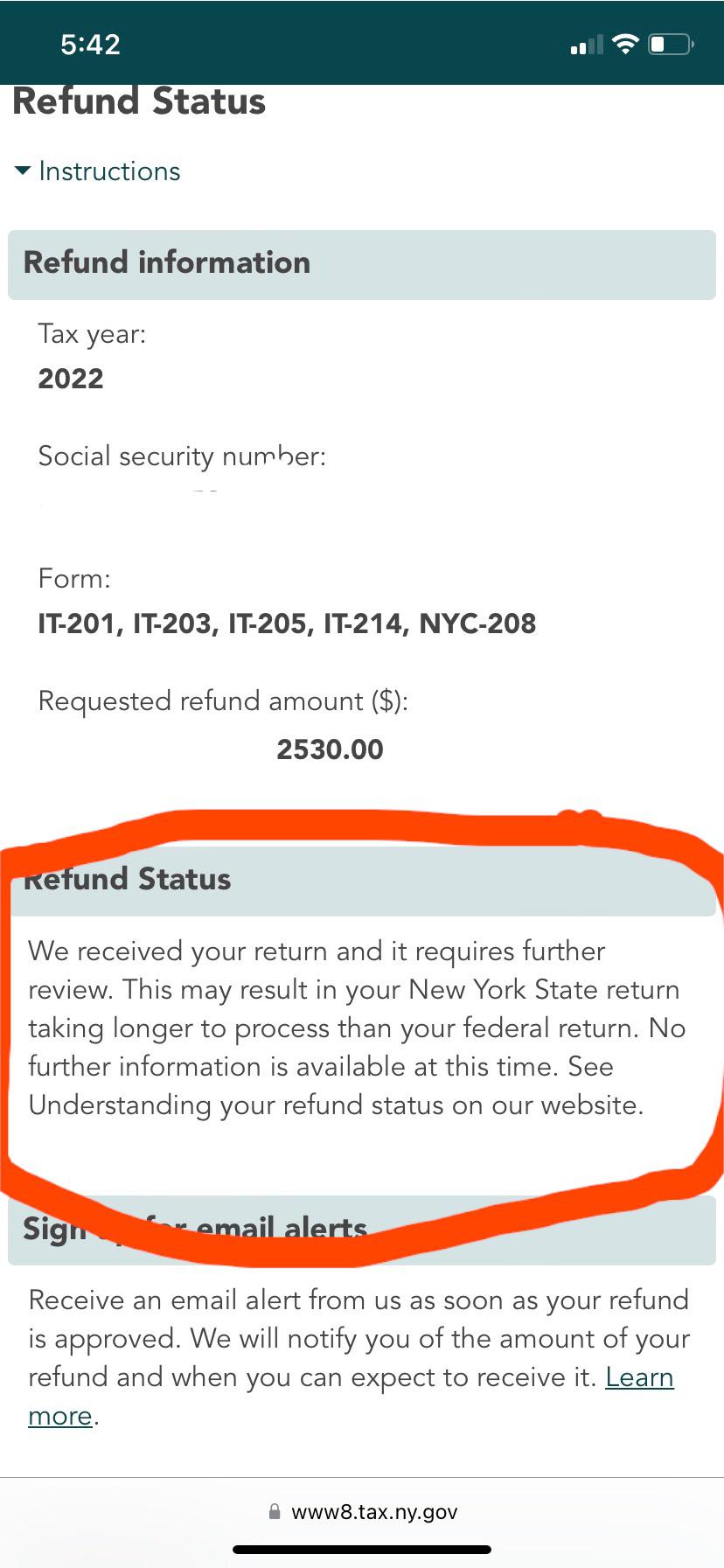

The system will display the status of your tax return. Common status messages include:

- Accepted: Your tax return has been successfully processed and accepted.

- Processing: Your tax return is currently being reviewed by the Department of Finance.

- Rejected: Your tax return has been rejected due to errors or missing information. You’ll need to correct and resubmit it.

- Pending: Your tax return is awaiting further action or additional information.

Common Scenarios and Solutions

If you encounter any of the following scenarios, here’s what you should do:

- Return Rejected: Carefully review the error message and make the necessary corrections. Resubmit your return once the issues are resolved.

- Return Pending: Contact the NYC Department of Finance to understand the reason for the pending status and provide any additional information they may require.

- Status Not Available: Ensure you have selected the correct tax type and year. If the issue persists, contact the Department of Finance for assistance.

Staying Informed: Resources for NYC Taxpayers

Navigating the NYC tax landscape can be challenging, but several resources are available to assist taxpayers.

NYC Department of Finance Website

The NYC Department of Finance website is a comprehensive resource for taxpayers. It offers detailed information on various taxes, filing requirements, and deadlines. The website also provides access to online services, forms, and publications.

Taxpayer Assistance Centers

NYC operates Taxpayer Assistance Centers (TACs) across the city. These centers provide in-person assistance for taxpayers who need help with filing, payments, and other tax-related matters. To find the TAC nearest to you, visit the Contact Us page on the Department of Finance website.

NYC Tax Help for Low-Income Earners

The NYC Tax Help program offers free tax preparation assistance for low- and moderate-income New Yorkers. Volunteers provide help with federal, state, and city income tax returns. This service is especially beneficial for those who may struggle with the complexity of tax filing.

Stay Updated with Tax News and Alerts

Staying informed about tax news, updates, and alerts is crucial. The NYC Department of Finance often publishes important announcements and reminders on their website and through social media channels. Subscribing to their email newsletter or following them on Facebook and Twitter can ensure you receive timely information.

Conclusion: Empowering NYC Taxpayers with Knowledge

Understanding the NYC tax return status is an essential aspect of financial management for both individuals and businesses. By following the step-by-step guide provided and utilizing the available resources, taxpayers can efficiently check their return status and take prompt action if needed. Stay informed, leverage the available tools, and navigate the NYC tax landscape with confidence.

How often should I check my NYC tax return status?

+It’s recommended to check your tax return status periodically, especially if you’ve recently filed or are expecting a refund. Regular checks can help you stay informed and take action if any issues arise.

What should I do if my tax return is rejected?

+If your tax return is rejected, carefully review the error message provided. Common issues include missing or incorrect information. Correct the errors and resubmit your return as soon as possible to avoid penalties.

Can I check my tax return status by phone or email?

+While the primary method is through the online portal, you can also contact the NYC Department of Finance by phone or email for assistance. Their contact information can be found on the Contact Us page.

What happens if I miss the tax filing deadline?

+Missing a tax filing deadline can result in penalties and interest charges. It’s best to file your return as soon as possible to minimize these consequences. If you’re unable to file by the deadline, consider filing for an extension.

Are there any tax filing requirements for NYC residents who work remotely outside the city?

+The tax obligations for remote workers can be complex and depend on various factors, including the state where you reside and work. It’s advisable to consult a tax professional or refer to the NYC Department of Finance’s guidance for non-residents for more information.