Cobb Property Tax

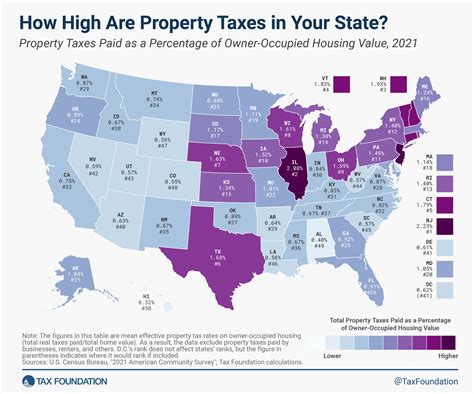

Property taxes are a significant aspect of homeownership, and understanding them is crucial for every homeowner. In Cobb County, Georgia, property taxes play a vital role in funding local services and infrastructure. This article aims to delve into the specifics of Cobb County property taxes, providing an in-depth analysis of the tax system, assessment processes, and the implications for homeowners.

Understanding Cobb County’s Property Tax System

The property tax system in Cobb County operates under a structured framework designed to ensure fair and equitable taxation. It is governed by the Cobb County Board of Tax Assessors, which is responsible for determining the assessed value of properties within the county.

The assessed value is the basis for calculating property taxes, and it is derived through a comprehensive assessment process. This process involves evaluating various factors, including the property’s location, size, condition, and recent sales data of similar properties in the area.

Assessment Process in Cobb County

The assessment process in Cobb County is conducted annually, ensuring that property values remain up-to-date. Here’s a breakdown of the key steps involved:

- Data Collection: Assessors gather information about properties, including physical characteristics, improvements, and any recent changes.

- Market Analysis: Assessors analyze the local real estate market to determine the current value of properties. This involves studying sales trends, market conditions, and comparing similar properties.

- Assessed Value Calculation: Using complex valuation models and formulas, assessors calculate the assessed value of each property. This value represents a percentage of the property’s fair market value.

- Notices of Assessment: Once the assessed values are determined, property owners receive a Notice of Assessment, which details the new assessed value and any changes from the previous year.

- Appeal Process: If property owners believe their assessed value is inaccurate, they have the right to appeal. The appeal process in Cobb County allows for formal hearings and reviews to ensure fair assessments.

By following this systematic approach, Cobb County aims to maintain an accurate and transparent property tax system.

Calculating Property Taxes: A Breakdown

Property taxes in Cobb County are calculated using a straightforward formula. Here’s a step-by-step breakdown:

- Assessed Value: As mentioned earlier, the assessed value of a property is determined through the assessment process. This value is typically a percentage of the property's fair market value.

- Millage Rate: The millage rate is the tax rate applied to the assessed value. It is expressed in mills, where one mill equals $1 of tax for every $1,000 of assessed value. The millage rate is set by local governing bodies, including the county government and various municipalities.

- Tax Calculation: To calculate the property tax amount, the assessed value is multiplied by the millage rate. For example, if a property has an assessed value of $200,000 and the millage rate is 15 mills, the property tax calculation would be: $200,000 x 0.015 = $3,000. So, the property owner would owe $3,000 in property taxes for that year.

It's important to note that the millage rate can vary depending on the location within Cobb County, as different municipalities may have their own tax rates.

Millage Rates and Their Impact

Millage rates in Cobb County are subject to change annually. These rates are determined through a careful budgeting process, taking into account the financial needs of the county and its various services. The county government, along with other taxing authorities, such as school districts and special districts, propose their budgets, which influence the millage rates.

Higher millage rates can result in increased property taxes, while lower rates may provide some relief to homeowners. It's essential for property owners to stay informed about the proposed millage rates and their potential impact on their tax obligations.

| Municipality | 2023 Millage Rate | Change from Previous Year |

|---|---|---|

| Cobb County | 11.20 | 0.10 increase |

| City of Marietta | 11.40 | 0.20 decrease |

| City of Smyrna | 12.00 | 0.50 increase |

Tax Relief Programs: Supporting Homeowners

Cobb County recognizes the importance of providing tax relief to certain segments of the population. As such, the county offers various tax relief programs to eligible homeowners.

Homestead Exemption

The Homestead Exemption is a popular tax relief program in Cobb County. It allows eligible homeowners to reduce the assessed value of their primary residence, resulting in lower property taxes. To qualify, homeowners must meet specific criteria, such as being a legal resident of Cobb County and using the property as their primary residence.

| Homestead Exemption Type | Reduction in Assessed Value |

|---|---|

| Standard | $2,000 |

| Senior Citizen | $10,000 |

| Disabled Veteran | $50,000 |

By taking advantage of the Homestead Exemption, homeowners can significantly reduce their property tax burden, making homeownership more affordable.

Other Tax Relief Programs

In addition to the Homestead Exemption, Cobb County offers other tax relief programs to support specific groups of homeowners. These programs include:

- Senior Citizen Tax Relief: This program provides additional tax relief to senior citizens who meet certain income and residency requirements.

- Disabled Veteran Exemption: Disabled veterans who meet the eligibility criteria can receive an exemption from property taxes, ensuring financial support for those who have served our country.

- Farmland Conservation Use: Owners of qualifying farmland can apply for this program, which assesses their property at its agricultural value rather than its potential development value, providing significant tax savings.

These tax relief programs demonstrate Cobb County's commitment to supporting its residents and making homeownership more accessible.

Property Tax Appeal Process: Ensuring Fairness

While the assessment process aims to be accurate, discrepancies can occur. Cobb County provides a fair and transparent process for property owners to appeal their assessed values.

Steps to Appeal an Assessment

If a property owner believes their assessed value is inaccurate, they can follow these steps to initiate an appeal:

- Review the Notice of Assessment: Upon receiving the Notice of Assessment, carefully review the details, including the assessed value, improvements, and any changes from the previous year.

- Gather Evidence: Collect relevant documentation and evidence to support your case. This may include recent appraisals, comparable property sales data, and any other information that can demonstrate the inaccuracy of the assessed value.

- File an Appeal: Submit a formal appeal to the Cobb County Board of Equalization within a specified timeframe. The appeal should clearly state the reasons for disagreement and provide supporting evidence.

- Hearings and Review: The Board of Equalization will schedule a hearing to review your appeal. During the hearing, you can present your case, and the board will make a determination based on the evidence provided.

- Decision and Resolution: The Board of Equalization will issue a decision, which may result in a change to your assessed value. If you are not satisfied with the decision, you have the right to further appeal to the Georgia State Board of Equalization or the Superior Court in Cobb County.

It's important to note that appealing an assessment requires careful preparation and a solid understanding of the process. Engaging the services of a tax professional or attorney may be beneficial in complex cases.

Conclusion: Navigating Cobb County’s Property Taxes

Understanding the intricacies of Cobb County’s property tax system is essential for homeowners to manage their financial obligations effectively. From the assessment process to tax relief programs and the appeal process, this article has provided a comprehensive guide to navigating the world of Cobb County property taxes.

By staying informed, reviewing assessments, and taking advantage of available tax relief programs, homeowners can ensure a fair and equitable tax experience. Additionally, understanding the appeal process empowers homeowners to address any discrepancies and ensure their property taxes are accurately calculated.

As with any financial matter, it’s advisable to consult with tax professionals or legal experts for personalized guidance and support in navigating the complex world of property taxes.

What is the average property tax rate in Cobb County?

+The average property tax rate in Cobb County varies depending on the municipality. As of 2023, the average rate is approximately 11.4 mills, but it can range from 11.20 mills in unincorporated Cobb County to 12.00 mills in some cities like Smyrna.

When are property taxes due in Cobb County?

+Property taxes in Cobb County are typically due in two installments. The first installment is due by December 15th of each year, and the second installment is due by January 15th of the following year. However, it’s important to check with the Cobb County Tax Commissioner’s office for the exact due dates as they may vary slightly each year.

Can I pay my property taxes online in Cobb County?

+Yes, Cobb County offers an online payment portal for property taxes. You can access the portal through the Cobb County Tax Commissioner’s website and make secure payments using a credit/debit card or eCheck. Online payments provide convenience and allow you to track your payments easily.

How can I estimate my property taxes in Cobb County?

+To estimate your property taxes in Cobb County, you can use the formula: Assessed Value x Millage Rate = Property Taxes. For example, if your property has an assessed value of 200,000 and the millage rate is 12 mills, your estimated property taxes would be 2,400 (200,000 x 0.012 = 2,400). Remember, the millage rate can vary depending on your location within Cobb County.

Are there any property tax exemptions or discounts available in Cobb County?

+Yes, Cobb County offers several tax relief programs, including the Homestead Exemption, Senior Citizen Tax Relief, Disabled Veteran Exemption, and Farmland Conservation Use. These programs provide exemptions or discounts on property taxes for eligible homeowners. It’s important to review the criteria and apply for the relevant programs to take advantage of these benefits.