Wa Capital Gains Tax

Welcome to an in-depth exploration of the Capital Gains Tax, a critical aspect of financial planning and investment strategies. In this comprehensive article, we will delve into the intricacies of Capital Gains Tax, providing you with a clear understanding of its implications, calculations, and strategies to optimize your financial decisions. With a focus on the Washington, D.C. (Wa) region, we'll navigate the specific rules and regulations that govern capital gains taxation in this jurisdiction, offering valuable insights for investors, business owners, and financial planners.

Understanding Capital Gains Tax: A Fundamental Overview

Capital Gains Tax, often abbreviated as CGT, is a tax levied on the profit realized from the sale of a capital asset, which can encompass a wide range of investments and properties. This tax is a critical component of an individual’s or entity’s tax liability, impacting their overall financial health and planning.

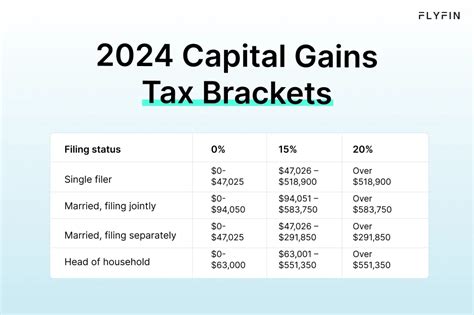

When an investor sells a capital asset for a price higher than their original purchase price, the resulting profit is subject to Capital Gains Tax. This tax is distinct from ordinary income tax and is calculated based on the asset's appreciation, or capital gain. The rate at which this tax is applied can vary based on several factors, including the type of asset, the holding period, and the taxpayer's income bracket.

Understanding Capital Gains Tax is crucial for investors and financial planners as it can significantly impact the net returns from an investment. By navigating the complexities of CGT, individuals can make informed decisions about asset sales, investment strategies, and tax planning, ultimately optimizing their financial outcomes.

Key Definitions and Concepts

- Capital Asset: This includes most possessions of value, such as real estate, stocks, bonds, precious metals, and even collectibles. However, it excludes inventory held for sale to customers, accounts or notes receivable acquired in the ordinary course of business, and depreciable property used in a trade or business.

- Capital Gain: The profit realized from the sale of a capital asset, calculated as the difference between the asset’s sale price and its original purchase price (also known as the cost basis). Capital gains can be either short-term (if the asset is held for one year or less) or long-term (if the asset is held for more than one year).

- Cost Basis: The original cost of an asset, adjusted for factors like improvements, depreciation, or fees, which forms the foundation for calculating capital gains or losses.

Capital Gains Tax in Washington, D.C.: Navigating the Local Landscape

Washington, D.C., often referred to as Wa, has its own unique set of rules and regulations governing Capital Gains Tax, which differ from federal guidelines. Understanding these local nuances is essential for individuals and businesses operating within the District.

Key Differences from Federal Capital Gains Tax

- The District of Columbia imposes a local income tax on capital gains, which is separate from the federal capital gains tax. This local tax is calculated at a rate different from the federal rate and can significantly impact the overall tax liability of residents.

- Wa’s capital gains tax is not progressive, unlike the federal system. Instead, it applies a flat rate to all capital gains, regardless of the taxpayer’s income bracket.

- The District offers specific tax incentives for certain types of capital gains, such as those derived from the sale of small business stock or real estate. These incentives can provide substantial tax savings for eligible taxpayers.

| Type of Capital Gain | Wa Tax Rate |

|---|---|

| Short-Term Capital Gain | 6.8% |

| Long-Term Capital Gain | 8.85% |

These rates are subject to change, and it's crucial for taxpayers to stay informed about any updates to the District's tax laws.

Calculating Capital Gains Tax: A Step-by-Step Guide

Calculating Capital Gains Tax involves a series of steps to determine the exact amount owed to the tax authority. This process can be complex, but understanding it is vital for accurate tax reporting and financial planning.

Step-by-Step Calculation Process

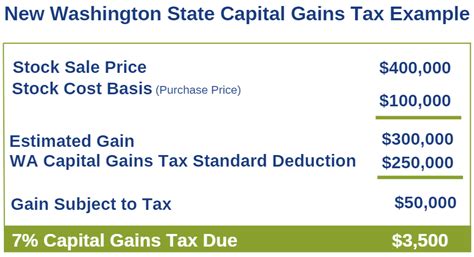

- Determine the Type of Capital Gain: Is it a short-term gain (held for one year or less) or a long-term gain (held for more than one year)? This distinction is crucial as it impacts the tax rate applied.

- Calculate the Cost Basis: Start by determining the original cost of the asset, including any additional costs like improvements or fees. This forms the basis for the calculation.

- Compute the Capital Gain: Subtract the cost basis from the sale price of the asset. This results in the capital gain, which is the profit subject to tax.

- Apply the Appropriate Tax Rate: Depending on the type of capital gain and the taxpayer’s income bracket, apply the relevant tax rate. For Wa residents, this rate is 6.8% for short-term gains and 8.85% for long-term gains.

- Calculate the Tax Owed: Multiply the capital gain by the applicable tax rate to determine the tax liability. This amount is what the taxpayer owes to the tax authority.

For example, if an investor in Wa sells a stock held for more than one year (a long-term capital gain) for $10,000, and their original purchase price was $8,000, the capital gain is $2,000. Applying the long-term capital gains tax rate of 8.85%, the tax owed would be $177.

Strategies for Optimizing Capital Gains Tax

Navigating the complexities of Capital Gains Tax can be challenging, but with the right strategies, individuals can optimize their tax liability and potentially reduce their overall tax burden. Here are some key strategies to consider:

Tax-Efficient Investment Strategies

- Asset Allocation: Diversifying your investment portfolio can help spread out capital gains and losses, potentially reducing your overall tax liability. Consider allocating assets across different asset classes and investment vehicles.

- Tax-Loss Harvesting: This strategy involves selling losing investments to offset capital gains and reduce your tax bill. However, it’s essential to maintain a balanced portfolio and avoid potential pitfalls like the wash sale rule.

- Tax-Efficient Withdrawals: For retirement accounts, consider taking withdrawals in a way that minimizes your tax liability. For instance, drawing from tax-deferred accounts before tapping into taxable accounts can be a strategic move.

Utilizing Wa’s Tax Incentives

Washington, D.C., offers specific tax incentives that can provide significant savings for taxpayers. Understanding and utilizing these incentives is a strategic way to optimize your tax position.

- Small Business Stock Exemption: Wa exempts capital gains on the sale of qualified small business stock, encouraging investment in local businesses. This exemption can provide substantial tax savings for eligible taxpayers.

- Real Estate Incentives: The District provides tax incentives for certain real estate transactions, such as the sale of primary residences or investments in specific redevelopment areas. These incentives can significantly reduce the tax burden on real estate investors.

Future Implications and Trends in Capital Gains Tax

Staying informed about potential changes and trends in Capital Gains Tax is crucial for effective financial planning. Here’s a look at some key considerations for the future:

Potential Changes in Tax Rates

Tax rates are subject to change, and keeping abreast of proposed or enacted legislation is essential. For instance, there have been discussions about increasing capital gains tax rates to align with ordinary income tax rates, which could significantly impact taxpayers.

Impact of Economic Trends

Economic trends, such as market fluctuations or shifts in investment strategies, can influence the volume and nature of capital gains transactions. Being aware of these trends can help investors and financial planners adapt their strategies accordingly.

Long-Term Planning Considerations

For long-term investors, understanding the potential impact of Capital Gains Tax over time is crucial. This includes considering strategies like cost averaging, tax-loss harvesting, and optimizing the timing of asset sales to manage tax liability effectively.

Conclusion

Capital Gains Tax is a critical component of financial planning and investment strategies, and understanding its intricacies is essential for individuals and businesses alike. By navigating the specific rules and regulations in Washington, D.C., and implementing strategic tax planning, taxpayers can optimize their financial outcomes and navigate the complex world of capital gains taxation with confidence.

What is the difference between short-term and long-term capital gains?

+Short-term capital gains refer to profits from the sale of an asset held for one year or less, while long-term capital gains are profits from assets held for more than one year. The tax rates applied to these gains differ, with short-term gains typically taxed at a higher rate.

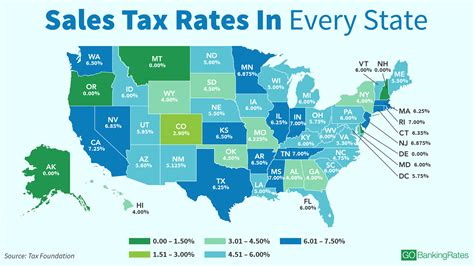

How does Washington, D.C.’s capital gains tax rate compare to other states or jurisdictions?

+Wa’s capital gains tax rates are relatively high compared to some other states. For instance, while some states have no capital gains tax, Wa’s rates of 6.8% for short-term gains and 8.85% for long-term gains are among the highest in the nation.

Are there any ways to defer or reduce capital gains tax liability?

+Yes, there are several strategies to consider. These include tax-loss harvesting, utilizing tax-deferred retirement accounts, and taking advantage of specific tax incentives like those offered in Wa for small business stock and real estate transactions.