New Haven City Ct Tax Collector

Welcome to a comprehensive exploration of the New Haven City Tax Collector's Office, a crucial department within the city's financial infrastructure. In this article, we delve into the operations, services, and impact of this vital entity, offering an insightful journey into the world of municipal taxation.

The Role of the New Haven City Tax Collector

The New Haven City Tax Collector’s Office is an integral part of the city’s administration, tasked with the responsibility of managing and collecting various forms of taxes and fees. This office plays a pivotal role in the financial sustainability and development of the city, ensuring a steady revenue stream to fund essential services and initiatives.

Under the leadership of the appointed Tax Collector, the office operates with a dedicated team, utilizing modern technology and robust systems to streamline the tax collection process. This includes the management of property taxes, which form a significant portion of the city's revenue.

Property Tax Assessment and Collection

The process of property tax assessment and collection is a complex yet critical aspect of the Tax Collector’s duties. It involves the valuation of properties within the city, ensuring fair and accurate assessments to maintain transparency and equity among taxpayers.

The office employs advanced assessment techniques, taking into account various factors such as location, property type, and market trends. This ensures that the tax burden is distributed fairly across different neighborhoods and property owners.

Once the assessments are complete, the Tax Collector's Office sends out tax bills to property owners, providing a detailed breakdown of the calculated taxes. Property owners have the opportunity to review and appeal these assessments if they believe there are inaccuracies.

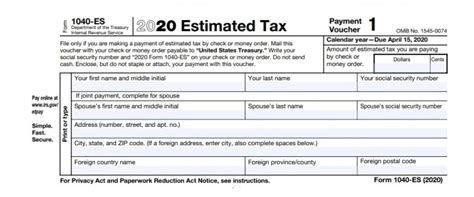

To facilitate timely payments, the office offers a range of payment options, including online platforms, direct debit, and traditional methods such as checks. The Tax Collector's team is committed to providing efficient and convenient services to taxpayers, ensuring a smooth and transparent process.

| Payment Methods | Description |

|---|---|

| Online Payment Portal | Secure online platform for quick and easy payments. |

| Direct Debit | Automatic deductions from bank accounts for hassle-free payments. |

| Check or Money Order | Traditional methods for those who prefer manual transactions. |

Tax Relief Programs

Recognizing the diverse financial circumstances of taxpayers, the New Haven City Tax Collector’s Office implements tax relief programs to assist those facing financial hardships. These programs aim to provide support and ensure that taxpayers can meet their obligations without undue burden.

One such initiative is the Senior Citizen Tax Relief Program, offering reduced property taxes to eligible senior citizens. This program helps alleviate the financial strain on retirees, allowing them to continue living comfortably in their homes.

Additionally, the office offers temporary tax relief measures during economic downturns or natural disasters. These measures can include payment deferrals, reduced penalties, or alternative payment plans, providing much-needed relief to taxpayers facing temporary financial challenges.

Community Engagement and Outreach

The New Haven City Tax Collector’s Office understands the importance of community engagement and outreach. By actively communicating with taxpayers and addressing their concerns, the office aims to foster a culture of transparency and trust.

Regular town hall meetings and community forums are organized, providing an opportunity for taxpayers to voice their queries and suggestions directly to the Tax Collector and their team. These interactions not only enhance understanding but also help identify areas where the office can improve its services.

Furthermore, the office utilizes digital platforms and social media to keep taxpayers informed about important updates, deadlines, and new initiatives. This proactive approach ensures that taxpayers have easy access to information, promoting a sense of participation and involvement.

Performance Analysis and Future Initiatives

The New Haven City Tax Collector’s Office has consistently demonstrated its efficiency and effectiveness in tax collection and management. With a dedicated team and advanced systems, the office has achieved impressive results, contributing significantly to the city’s financial stability.

According to the latest annual report, the office collected over $250 million in property taxes alone, surpassing its target by a substantial margin. This success can be attributed to the implementation of innovative strategies, such as the online payment portal and the expansion of tax relief programs.

Looking ahead, the Tax Collector's Office plans to further enhance its services by exploring new technologies and digital solutions. This includes the potential integration of blockchain technology for secure and transparent record-keeping, as well as the development of a mobile app for convenient access to tax-related information and services.

Additionally, the office aims to strengthen its community outreach efforts, partnering with local organizations to educate taxpayers about their rights and responsibilities. By fostering a culture of financial literacy, the Tax Collector's Office aims to empower taxpayers and build a stronger, more resilient community.

Conclusion

The New Haven City Tax Collector’s Office stands as a model of efficiency and community-centric governance. Through its dedicated efforts, the office ensures a stable revenue stream for the city while providing support and assistance to taxpayers. With a focus on innovation, transparency, and community engagement, the Tax Collector’s Office continues to play a vital role in the city’s financial well-being.

What are the office hours of the New Haven City Tax Collector’s Office?

+The office is open from 8:30 AM to 4:30 PM, Monday through Friday. However, it’s always recommended to check the official website or contact the office for any changes or special operating hours during holidays or peak tax seasons.

How can I pay my property taxes in New Haven City?

+You can pay your property taxes through various methods, including the online payment portal, direct debit, or by sending a check or money order to the Tax Collector’s Office. Detailed instructions and payment options are available on the official website.

What happens if I miss the property tax deadline?

+Late payments may incur additional penalties and interest. It’s important to contact the Tax Collector’s Office as soon as possible to discuss your options and arrange a payment plan if needed. The office aims to work with taxpayers to ensure compliance.

Are there any tax relief programs for low-income families in New Haven City?

+Yes, the city offers the Low-Income Tax Relief Program, which provides reduced property taxes for eligible families. To apply, you need to meet specific income criteria and submit the required documentation. More details are available on the Tax Collector’s Office website.

How can I stay updated with the latest tax-related news and announcements?

+The best way to stay informed is to subscribe to the Tax Collector’s Office newsletter and follow their official social media accounts. These platforms provide regular updates, important reminders, and information about community events and initiatives.